The European Union Value Added Tax (EU VAT) is type of a tax which is levied on most goods and services that are traded for consumption within the EU. It is applied when a VAT registered business sells goods or services to buyers based in EU. "Value added" in VAT refers to the amount by which the value of a product is increased at each stage of production and distribution.

The necessary changes related to Brexit are available for you to update in your Chargebee site as applicable. They require your action to take effect, and will not be automatically updated on your behalf.

It is mandatory that you register for VAT in the EU state where your business is incorporated. Depending on the products/services you sell in an EU member state, you may have to register for VAT in that member state. You can choose between two options for registering in member states:

If you had Member State of Identification(MSI) as the United Kingdom (UK), your VAT MOSS becomes invalid during Brexit. Make sure you obtain your new VAT MOSS number and update it under EU region for it to reflect in your Chargebee invoices. If you were using VATMOSS for UK as well, you would need to update the newly obtained local UK VAT number in the UK tax region.

If your buyer is from the EU member state where your business is domiciled then the VAT rate of your member state is applied, irrespective of the buyer being a consumer or a business.

If your buyer is from a different EU member state, the VAT rates depend on the type of service you are providing:

However, irrespective of the type of service provided, if your buyer has a valid VAT number and is from a different member state, VAT is not applied. This is in keeping with the reverse charge mechanism which puts the tax liability on the business buying from you.

Here is the list of rates per EU Member state:

The rates are subject to change based on EU VAT Notice/ announcements. Rates last updated on 29th May 2019. We recommend that you review the rates while configuring taxes to stay updated.

If you sell digital products, you will have to collect and store proof of your customers' location. Apart from helping calculate an accurate VAT rate, this information will help prevent fraud. The following non-conflicting pieces of evidence are accepted as valid proof of location:

Chargebee collects the Billing Address country and IP Address of the buyer and will store this information for a minimum of 10 years in compliance with regulation.

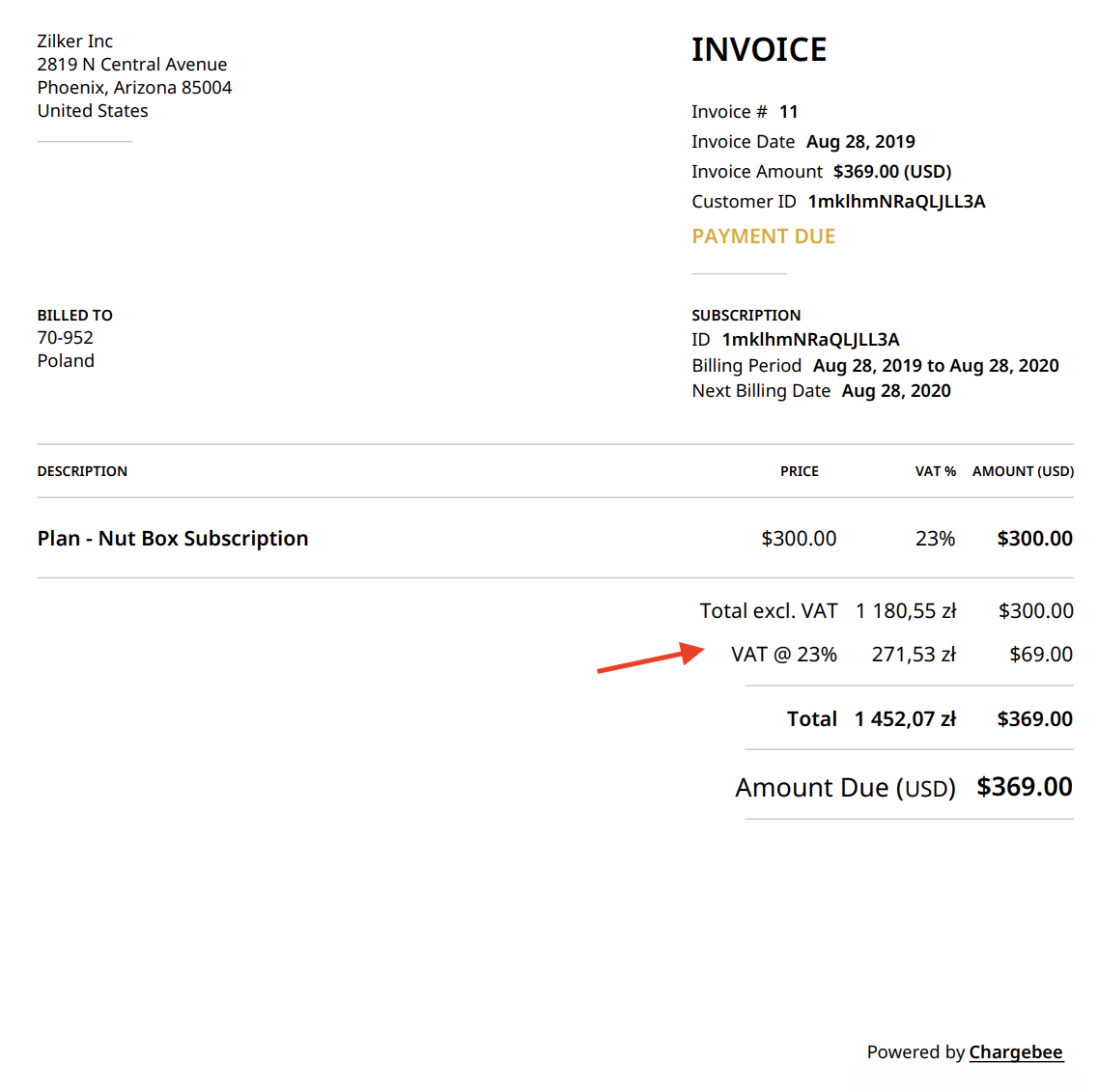

An EU VAT Invoice sent to a consumer must contain the following information:

The invoice contains the applicable VAT rate for each line item and a subtotal amount before applying VAT and a final invoice amount after VAT is added.

You can configure EU VAT invoices on the Invoice Customization page. Navigate to Settings > Configure Chargebee > Invoices, credit notes and quotes.

Step 1: Provide your Organization Address

Make sure you've added your organization address at Settings > Configure Chargebee > Business Profile. You cannot configure taxes in Chargebee without an organization address.

Step 2: Enable Tax

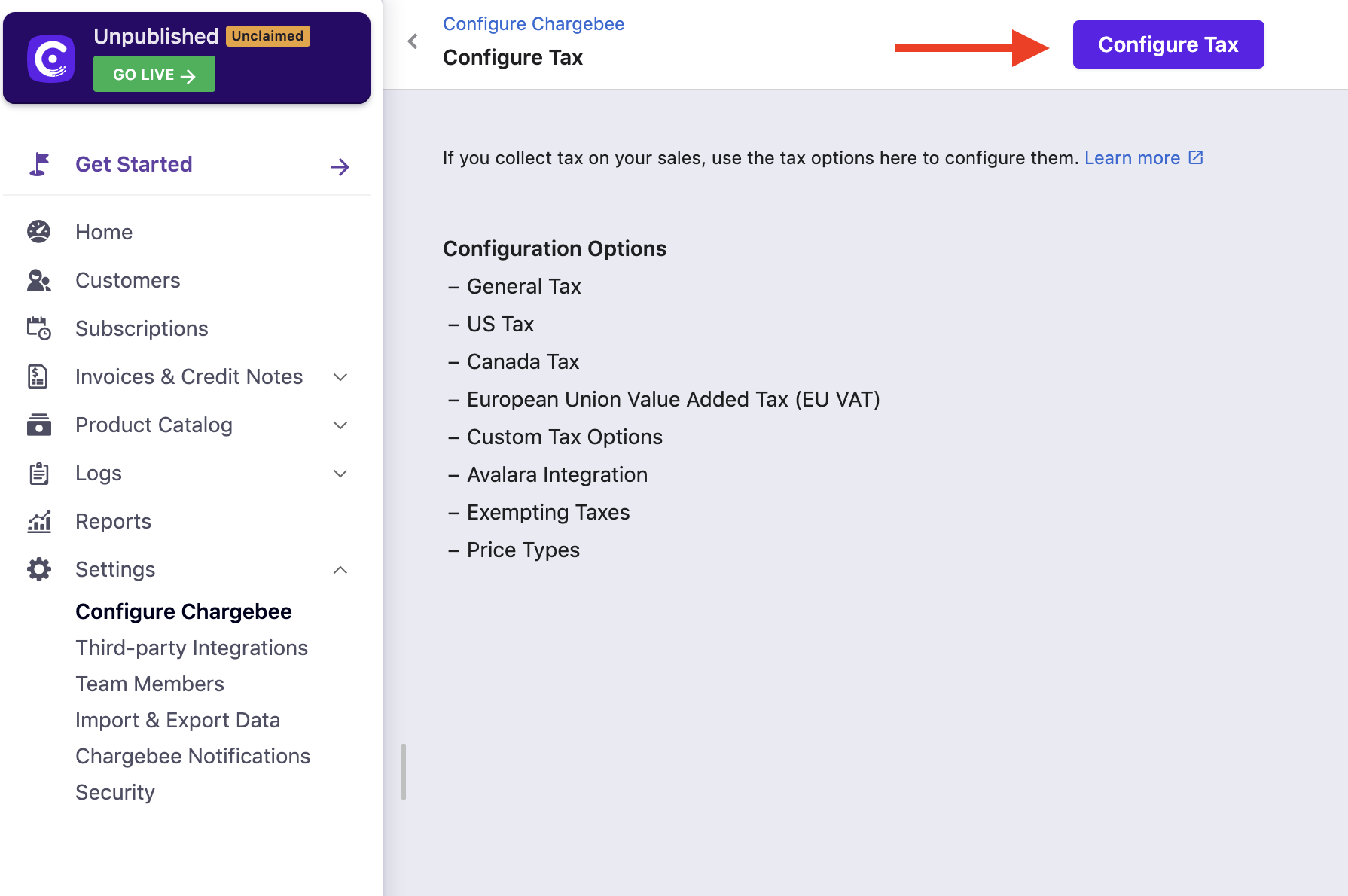

Go to Settings > Configure Chargebee > Taxes and click the Configure Tax option.

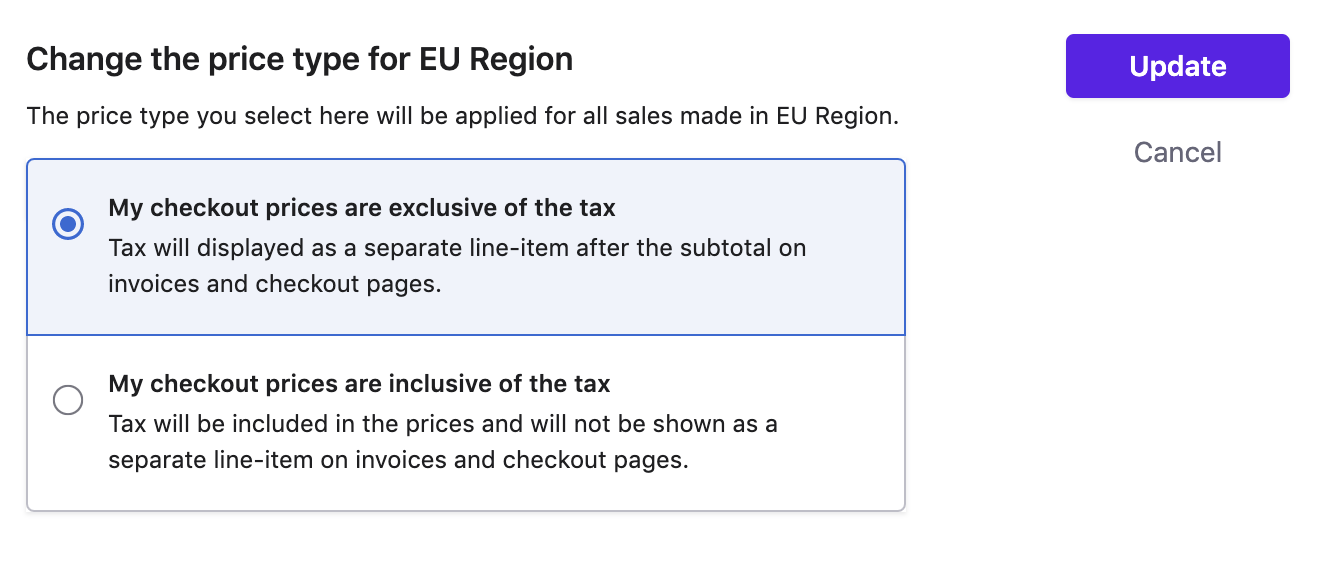

Step 3: Choose a Price Type (Tax exclusive or inclusive)

Once taxes are enabled, you will be redirected to a page containing all the currencies that you have enabled for your site.

This step is about configuring a price type for each currency.

This decides whether the price that you quote for your product/service/addon can be either inclusive of tax, where tax is included in the price, or exclusive of tax, where tax is added to the price.

VAT invoicing rules call for your invoices to reflect the VAT rate that you are applying. This means that you will have to set your Price Type to Tax Exclusive if you are selling to customers residing in the EU.

Once you are done, click I've Reviewed my Price Types button.

Step 4: Configure list of Countries (as a part of Tax jurisdiction)

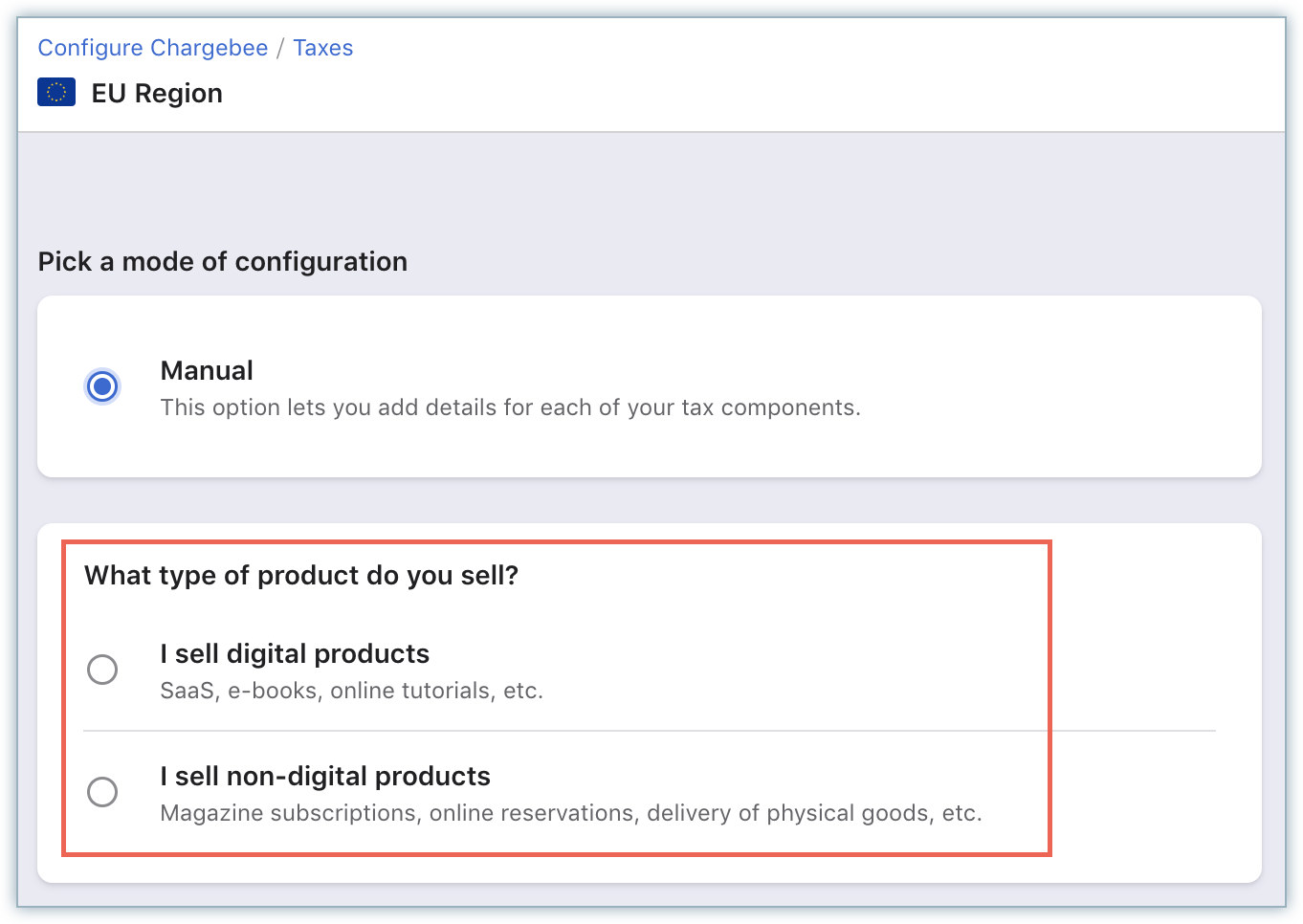

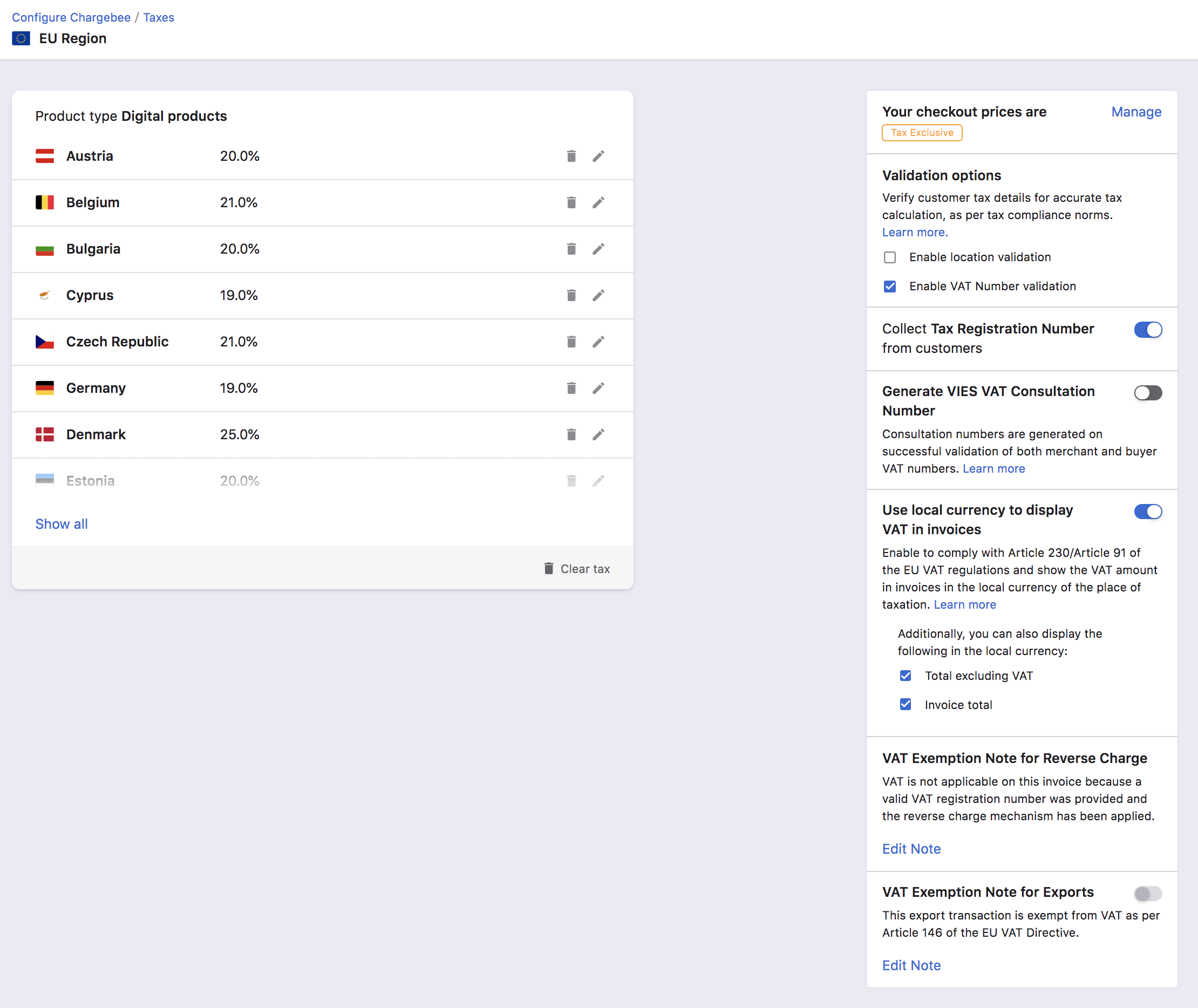

Choosing EU Region option in the Add Region dropdown menu will redirect you to a page where you select what type of product you sell. Choose between the I sell digital products and the I sell Non-Digital products options in the EU VAT configuration page. This will help Chargebee apply an appropriate tax rate to your invoices, as EU VAT regulations specify different tax rates for digital and physical products.

Step 4a: If you sell Digital Products

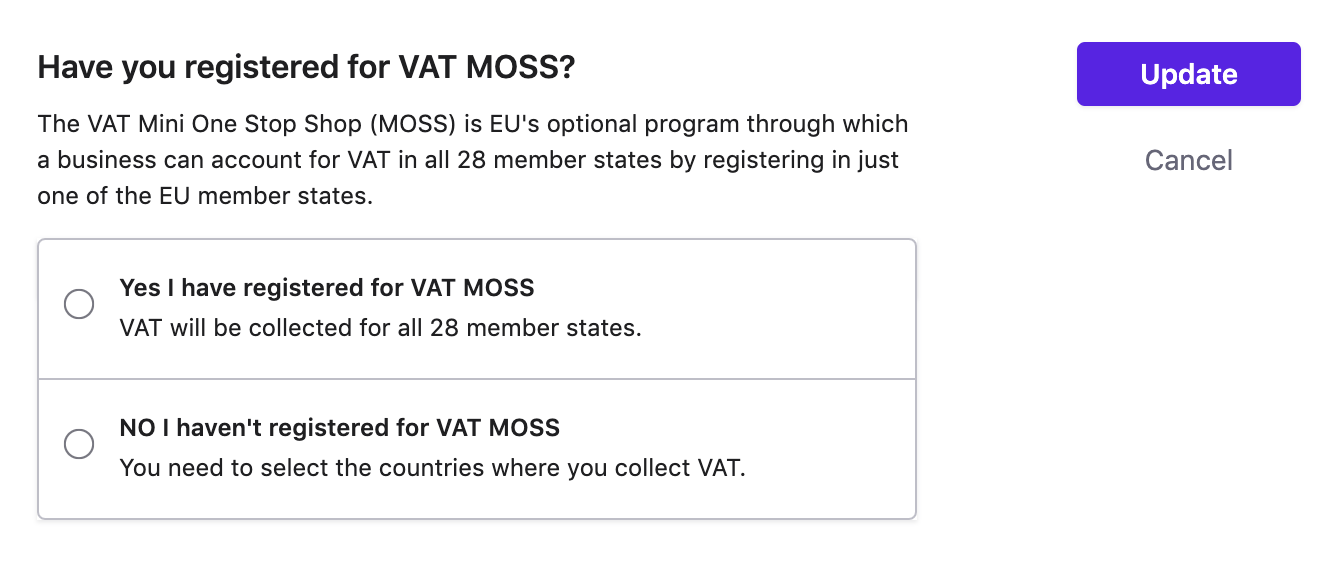

If you are selling digital products to a large number of countries in the EU, registering for VAT in individual member states could be a difficult task, with 28 countries and a total of 27 different VAT rates. Instead you can register for the EU's optional program to simplify the VAT process called the Mini One Stop Shop (MOSS), which enables businesses to register in one country and pay their dues with a single payment. The country mentioned in the billing address will be considered for tax calculation. Learn more about VAT MOSS.

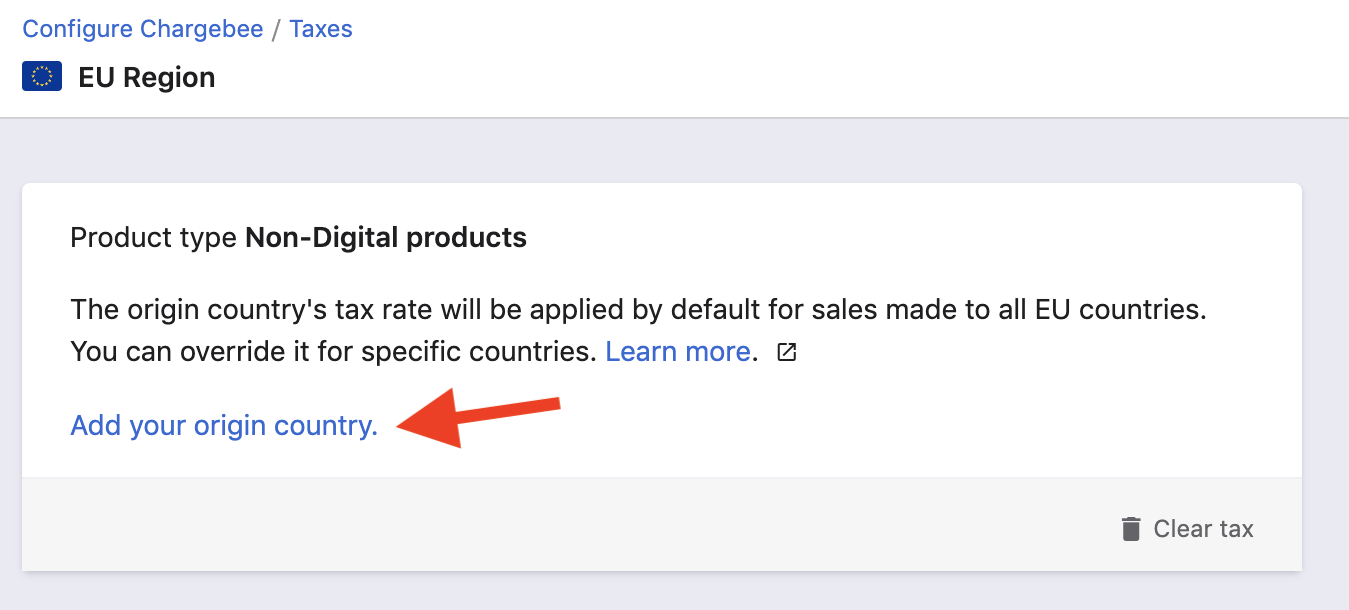

Step 4b: If you sell Physical/Other Products

If you are selling physical products to a number of countries within the EU, the VAT rate of your country is applied. Simply enter the country where you are domiciled and your VAT Number here and Chargebee will calculate what rates are applicable to your invoices.

For tax calculation, Chargebee will consider the country mentioned in the shipping address. However, in case of absence of shipping address, the country in the billing address will be taken into account.

If you cross a certain threshold of sales per annum (the threshold figure differs from country to country) you will have to register for VAT in the member states where you have a commercial presence.

You can select and add the countries where you are liable to pay taxes.

Step 5: Configure taxes

You can configure the validation options you want to enable, and the details you want to capture when your users checkout:

If you sell to businesses, it is recommended that you collect the VAT Number of your Business customers and ensure that it is valid. Chargebee verifies the validity of a VAT number entered against VIES.

The exchange rate applied for this purpose is as per the rates listed in the European Central Bank(ECB) website. In cases where a currency's exchange rate is not listed with the ECB, Chargebee uses the exchange rates available with currencylayer and Open Exchange Rates.

VAT Exemption Note:

Enter the VAT Exemption note to be displayed in the invoices when sale is made to other Businesses (reverse charge scenario). The VAT Exemption Note will be displayed at the bottom of the invoice.

VAT Exemption Note for Exports:

Export of goods from an EU country to a place outside the EU is not subject to VAT as per Article 146 of the EU VAT Directive. If you export goods to other countries from EU as part of your business, enabling this option will add a note in the respective invoices that refers to the VAT exemption for export transactions. You can edit the note to add/edit the text.

Chargebee collects the following address/location information as evidence of a customer's place of residence in adherence to the EU VAT location requirements. If you disable this feature, you have to collect the following evidence by yourself, to ensure that your customer is from the EU.

Customer's IP Address:

Hosted Pages: If you have integrated with Chargebee using the hosted pages, the IP Address of the customer is collected automatically.

API: If you use the Chargebee API, you have to pass the IP Address of the customer to Chargebee using the User Details Header API.

Card BIN of the Customer:

The first six digits of a card carries the Bank Identification Number (BIN). BIN gives us the information about the card-issuing bank and hence can be used as a way to determine the customer's location.

Hosted Pages: If you have integrated with Chargebee using the hosted pages, the BIN of the customer is collected automatically.

API: If you use the Chargebee API, you have to pass the BIN of the customer using the card [number] parameter in the Create a customer API.

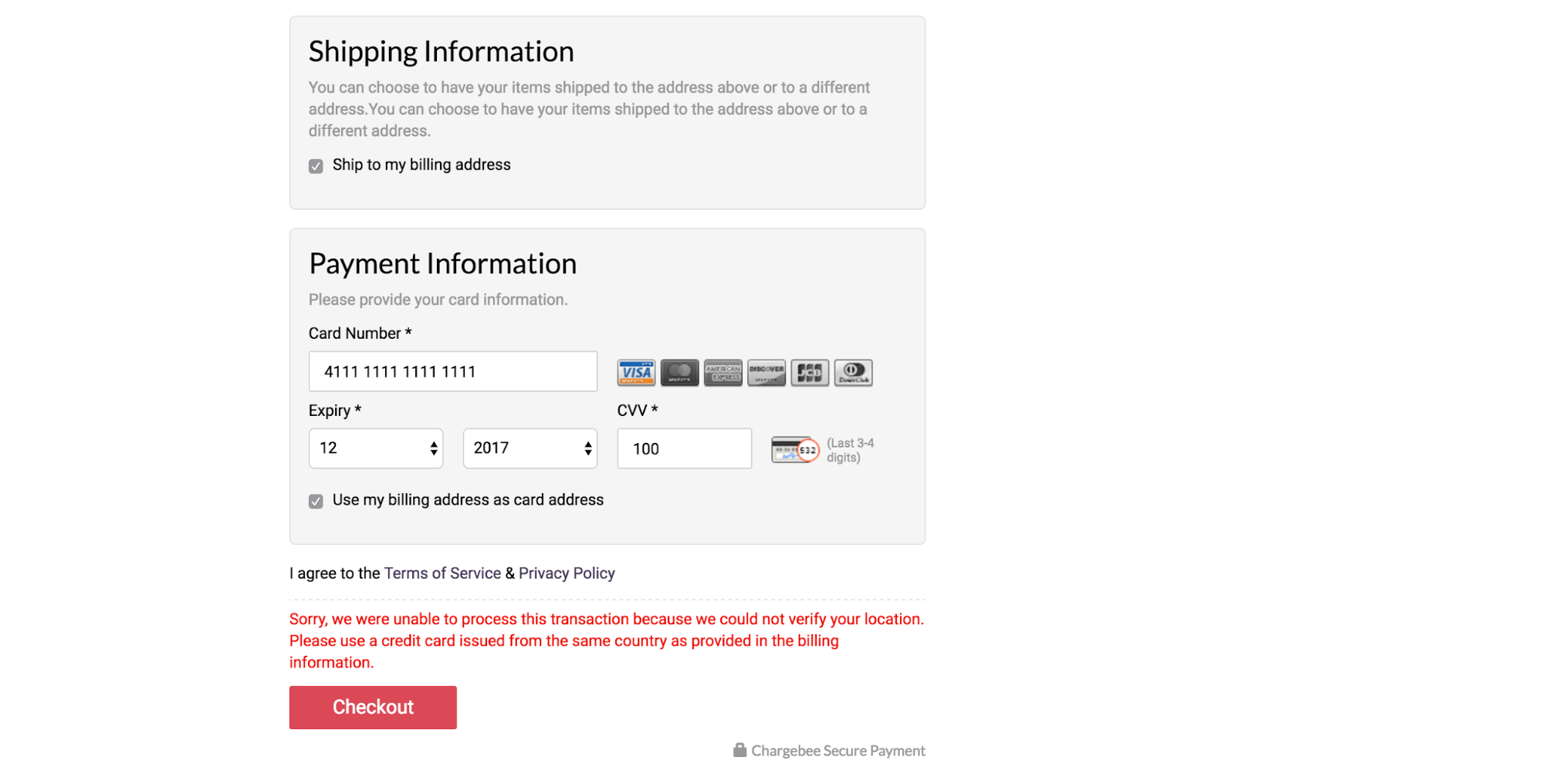

Once the above evidence is collected, Chargebee attempts to match the customer's billing country with either their IP address or their card issuing country(from the card BIN). Only when either of these evidence matches with their billing country, location validation is successful and the customer can complete their purchase.

If the Location Validation option is enabled and the validation fails, the customer can not complete the order.

Location Validation Failure

If your customer's location validation fails, they can not complete the order. They will receive the following error message:

If a customer signs up for a trial plan which involves no immediate payment, the subscription is created irrespective of whether the location validation was successful or not. The details of the customer are marked with a warning indicating that the location validation failed.

The policy updates are applicable from August 22nd, 2017 onward.

Chargebee validates VAT Number by sending a validation request to VAT Information Exchange System (VIES), a search engine owned by the European Commission

You as a merchant may have a tax registration number in different EU member countries. Alternatively, for providing digital services more conveniently across the EU region, you may have registered for VAT MOSS.

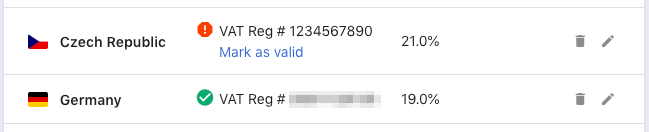

Validation Status

As soon as you add/update one of your VAT numbers on the above screen, it is validated using VIES and results are shown. The result of the validation can be one of the following:

| Validation Status |

Description |

| Valid |

VAT Number validation was successful and the number is valid |

| Invalid |

VAT Number validation failed You can click on Mark as valid to ignore and override the VIES validation result. |

| Undetermined |

No response from VIES, or other errors. Chargebee retries validation attempts periodically for such VAT numbers. |

Your customers can enter their VAT Number when you enable the Collect Tax Registration Number option. You can mandate VAT Number validation by enabling the Enable VAT Number Validation option.

VIES can help you prove to the Tax Administration Department that you have successfully validated your customer's VAT number at a certain time. This involves using a special VIES validation enquiry that on successful validation, generates a unique VAT Consultation Number. When you enable this feature in Chargebee, this number is requested for and stored for your convenience. (You can view/export this information under Settings > Import & Export Data > Export Data > VIES VAT Validation History.) This advanced VAT validation service in fact, checks your own VAT number along with your customer's, and both must be valid for the consultation number to be generated.

If this validation fails on any attempt, then as a fallback, Chargebee performs the basic VIES validation of your customer VAT number.

During VAT validation, if Chargebee finds your previously valid VAT number to be invalid, the site admins and the site owner are immediately notified via email.

The Consultation Number and VAT Validation attempt related details will be available starting 30th Nov, 2018.

If you are using multiple tax profiles, only the VAT numbers in your primary profile will be used for generating the Consultation Number.

When the VIES service is down due to a VIES internal error, Chargebee will not be able to know if the VAT Number was VALID or INVALID. In absence of a status, you can configure one of the options:

Based on your choice, Chargebee creates subscriptions (or not).

If you have chosen to allow to collect and save the VAT numbers without validation, when VIES service is down, Chargebee will check for VAT number status later, every 24hrs. Based on the response from VIES, following actions will be taken

During subscription renewals, Chargebee will validate your customer's VAT Number, if it was not validated in the last 3 months. If a VAT number is found to be INVALID, VAT will be applied on the upcoming invoices.

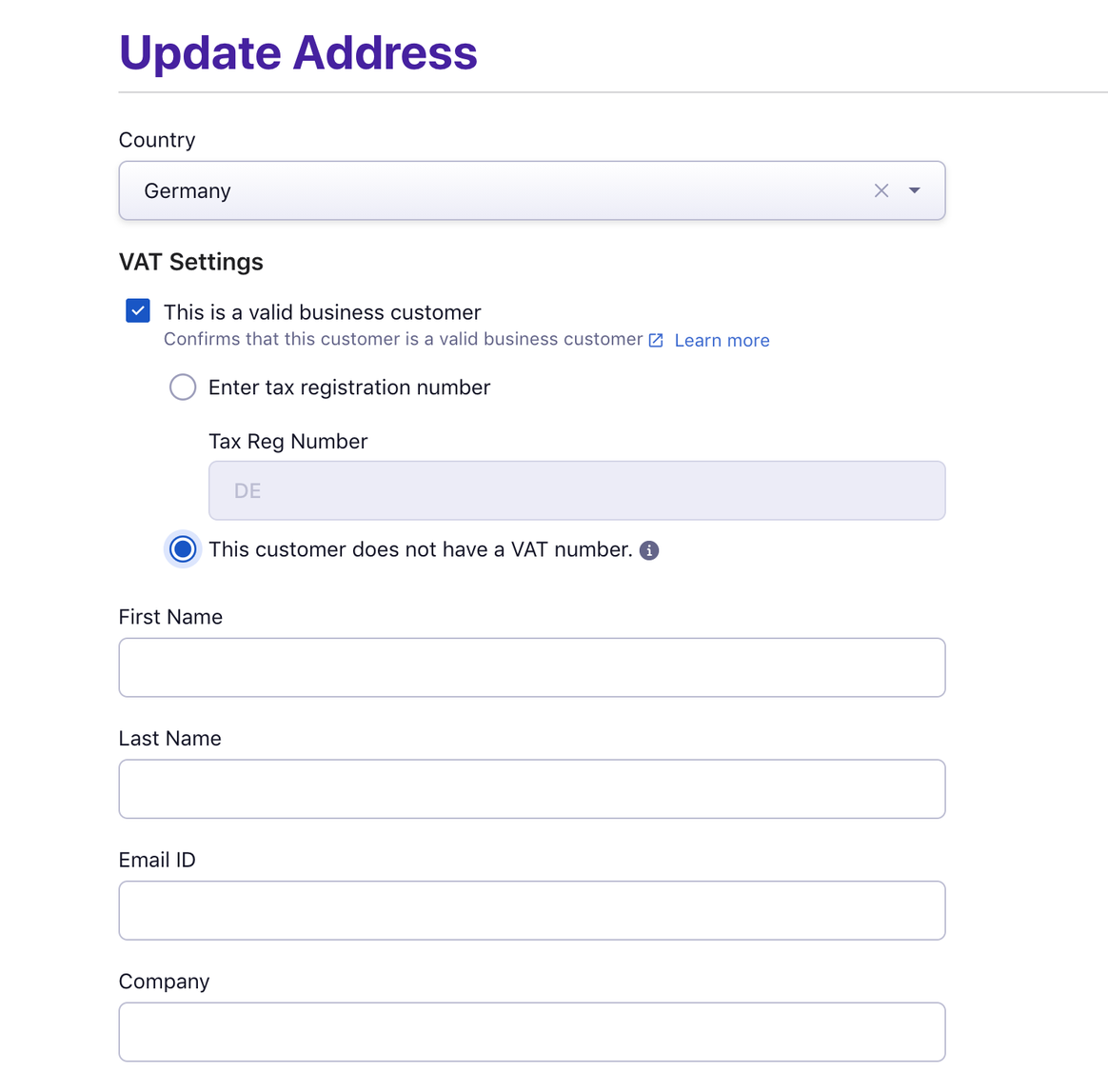

There could be instances where a business customer does not have a valid VAT number, say when their sale is below the VAT threshold or their VAT validation status is found to be INVALID when VIES database is yet to be updated. In such cases, if you validate the customer as a legitimate business, Chargebee allows you to intervene manually and apply reverse charge - with or without a valid VAT number. You can do so while creating/editing the customer record, in the customer details page under Billing Address, or using the Update Billing Info option on the Action panel.

Under VAT settings, enable This is a business customer and select Enter the VAT Reg Number to specify the VAT number or select This customer does not have a VAT number.

In either case, your customers from a different member state other than yours will be exempted from VAT. This is in keeping with the reverse charge mechanism and the appropriate note will be displayed in the invoice.

1. How to enable VAT Number to be displayed in the Hosted Pages?

For a transaction to be considered B2B, a valid VAT number has to be provided by the customer. If you use Chargebee's hosted pages, enabling the VAT number option will display the VAT Number field in the checkout pages.

To enable VAT Number in the hosted pages, if you're using:

2. How does Chargebee apply taxes when Shipping & Billing addresses are present?

For tax calculation, Chargebee will consider the country mentioned in the shipping address linked to the Subscription.

in absence of a shipping address, the country in the billing address will be taken into account for tax calculation.

If both are not available, tax will not be calculated/ applied.

3. Can I change the Tax Exclusive/Inclusive settings?

Yes, you can change the Price type, i.e., whether the prices shown during Checkout should be Tax Exclusive or Inclusive.

4. What is the difference between VAT MOSS and non-MOSS registered merchants?

VAT MOSS Registered Merchants: If you have registered for VAT MOSS you will need to enter the VAT MOSS registration number.

Chargebee will apply destination based tax for VAT MOSS registered businesses, i.e., the VAT rate of the EU Member State where the sale is made to, irrespective of the country you are registered in.

Non-VAT MOSS Registered Merchants: If you have not registered for VAT MOSS you will be given options to select the countries in which you have a presence and manually enter the VAT registration number for each country where you sell.

5. When is the Reverse Charge Mechanism applied?

In order to comply with VAT regulations, Chargebee applies the reverse charge mechanism only when:

6. How does Chargebee differentiate between a B2B and B2C transaction?

VAT numbers are used to distinguish between your individual customers and your business customers.

7. How to view customers whose VAT Number is invalid?

Chargebee will mark the customer's VAT Number status as valid/invalid based on the response from VIES. You will be able to filter the customers with an invalid VAT number and get in touch with them, asking them to update a valid VAT number.

Filtering based on VAT number can be done as follows,

If the customer has confirmed that the provided VAT number is valid and VIES shows that it is invalid, as per the following European Commission FAQ the customer will be required to contact their fiscal administration.

8. What is the significance of enabling location validation for Country of Business?

For certain countries such as Italy and Spain, the VAT numbers of businesses that trade within the country are not automatically available in the VIES database. Such businesses need to explicitly register their numbers in VIES if they trade with EU countries outside of their country of business. In such cases, Chargebee will not allow subscriptions to pass through since the VAT number status will be unverified and, therefore, invalid. Use this option to disable VAT Number validation for your country of business, and Chargebee will allow subscriptions to pass through.

9. How does Chargebee handle location validation when there are multiple payment methods for a customer?

If there are multiple payment methods present against a customer, Chargebee will follow this protocol:

Chargebee will use the customer's IP address to retrieve the physical address of the customer. It will then attempt to verify the physical address with the customer's billing address.

If the country of the physical address (retrieved via the IP addresses) matches the country in billing address that the customer has provided, the customer's location will be marked as VALID.

If the IP addresses of the customer cannot be captured, Chargebee will attempt to verify the location of the customer by matching the issuing country (of the payment methods added) with the billing address.

If the issuing country of any of the customer's payment methods match the billing address, the customer's location will be marked as VALID.

If the above fail, the customer's location will be marked as INVALID.