Attention

We will soon be sunsetting the Revenue Recognition Reports. Checkout Chargebee RevRec, a more comprehensive solution with a suite of revenue recognition features. Reach out to [email protected] for more information.

Revenue recognition is an accounting methodology which helps determining the revenue to be recognized over the period of time the service is consumed.

Most SaaS companies recognize revenue over a period of time when the services are rendered or earned. Though payments are collected upfront to sell subscription plans, the revenue is reflected as recognized only when the service is rendered. Most GAAPs across the globe recommend following this principle for better reporting.

Let's say a customer subscribes to a Monthly plan, on Jan 1, 2017

On the other hand, when a customer signs up for a Quarterly ($299) plan, Jan 1, 2017

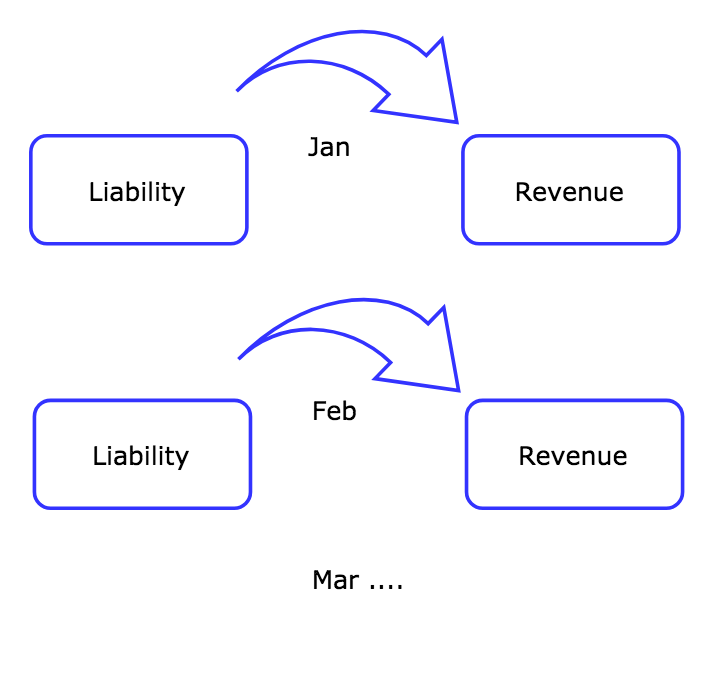

Since there is a liability to serve the customer(s) for the rest of the subscription period, the revenue cannot be entirely recognized in the first month when the payment is received.

Hence, the revenue needs to be recorded as a liability on the balance sheet and should be recognized as the service is delivered over time and recognized as revenue on the income statement.

Caution

Accounting practices vary across different organisations and across different industry verticals. The details are shared as recommendations. Please speak to your accounting advisor before processing your books.

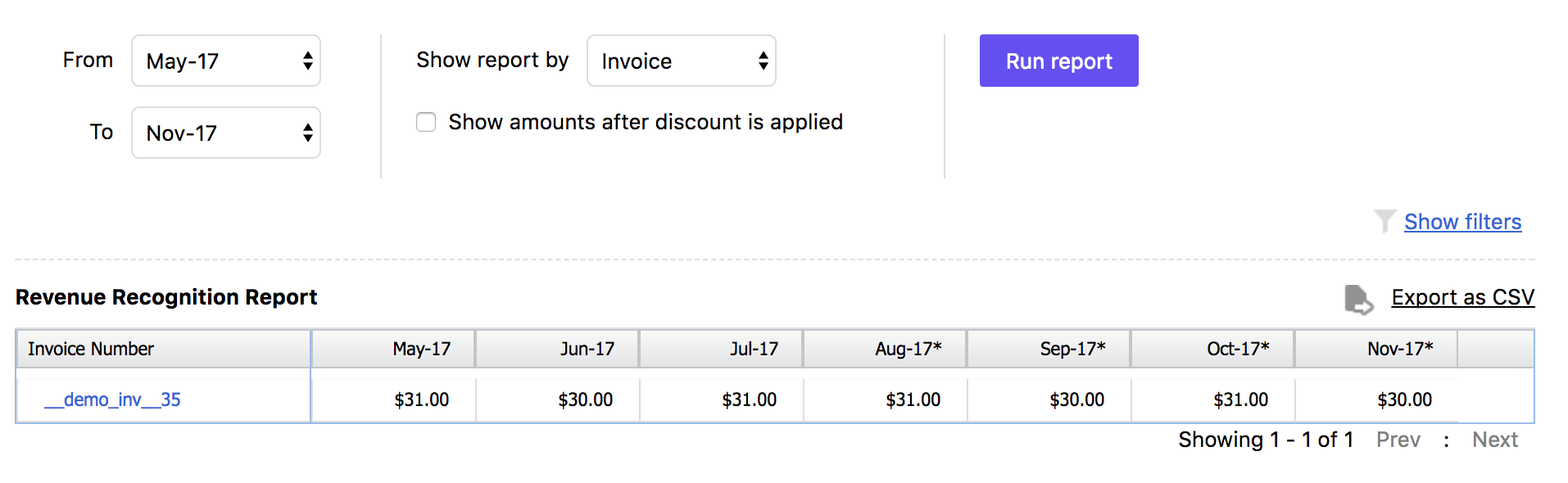

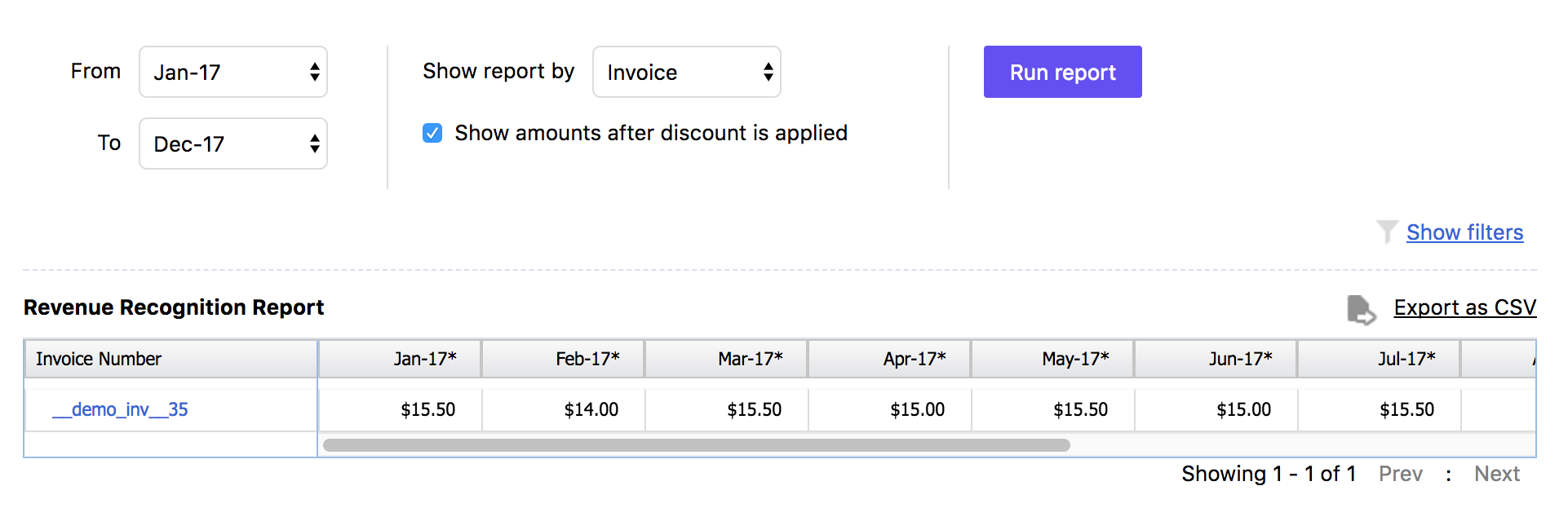

The Revenue Recognition Report provides the actual amount to be recognized for each month. This report will also show the projected revenue for the upcoming months.

Let's assume an Annual Subscription is sold for $365 on Jan 1, 2017

An invoice for $365 is created for the period Jan 1, 2017 to Dec 31, 2017

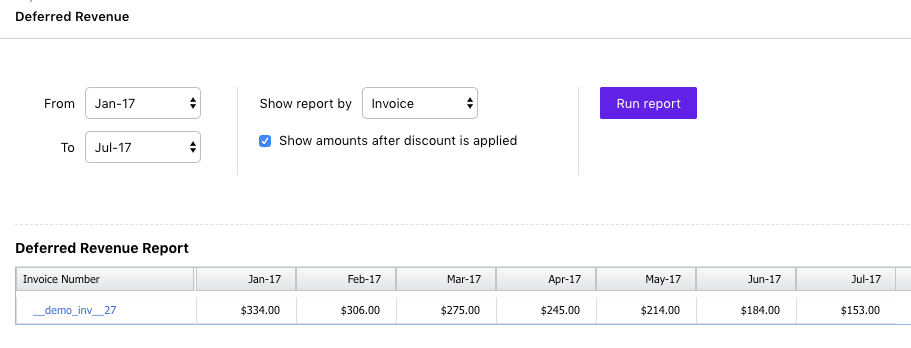

The Deferred Revenue Report calculates the pending revenue to be recognized for the rest of the subscription period.

Let's assume an Annual Subscription is sold for $365 on Jan 1, 2017.

An invoice for $365 is created for the period Jan 1, 2017 to Dec 31, 2017.

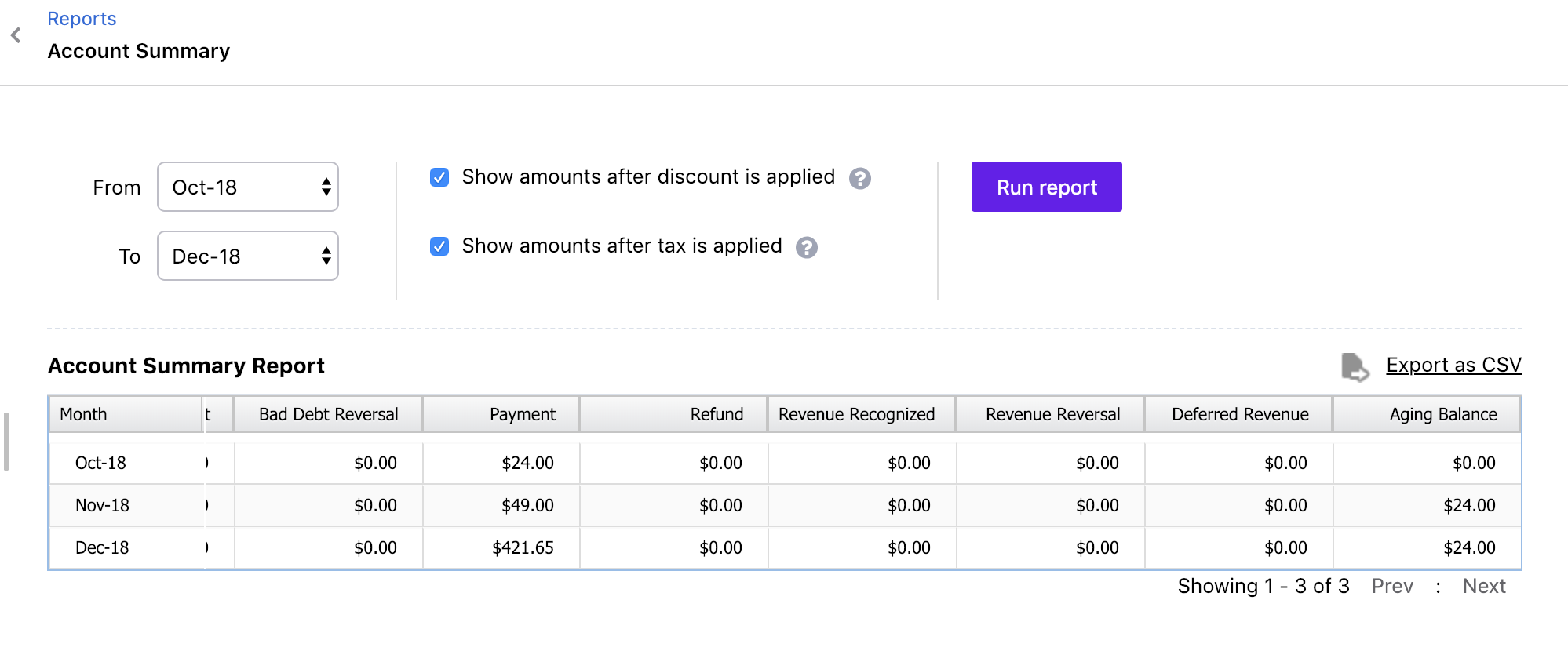

The Account Summary Report is a monthly report of your sales, discounts, bad debts, and reversals, that can be used for accounting purposes.

If you are processing large number of invoices and do not want to sync each and every invoice to accounting systems (or via Xero or QuickBooks Online integration), you can refer to the Account Summary Report and update the summarized amounts manually.

| Report Details | Description |

|---|---|

| Sales & Sales Reversals | Sale amount from all invoices and credit notes |

| Discounts & Discount Reversals | Discounts provided on purchases & Discounts reversed due to cancellations/refunds/voids etc |

| Taxes & Tax Reversals | Taxes collected on subscription & Taxes reversed due to cancellations/refunds/voids etc |

| Bad Debt & Bad Debt Reversals | Payment due invoices written off and bad debts incurred & Bad debt reversals |

| Payments & Refunds | Payments received & Payments refunded |

| Revenue Reversal | Recognised revenue to be reversed due to cancellations/refunds/voids |

| Revenue Recognized | Total revenue recognized for the month, |

| Deferred revenue | Deferred revenue at the end of the month |

| Aging Balance | Total aging balance (unpaid customer invoices and unused credits) at the end of the month. |

Whenever a charge is raised, its service period can lie – partly or wholly – in the past. In such situations, the revenue reports in Chargebee are updated in one of two ways:

In this method, the revenue recognition reporting for the past is updated to reflect the change introduced by the new charge.

Example

Consider the following revenue recognition report on say, Jun 12.

Revenue Recognition on Jun 12th |

||||

|---|---|---|---|---|

Mar |

Apr |

May |

Jun* |

Jul* |

$150 |

$300 |

$256 |

$200 |

$51 |

(* indicates projected revenue)

Now, say that on the next day (Jun 13), a charge is added for $153 with a service period from Mar 1 to Jul 31 (153 days).

With retrospective accounting, the revenue of $153 from the charge would be recognized as below:

|

Mar |

Apr |

May |

Jun* |

Jul* |

|---|---|---|---|---|

$31 |

$30 |

$31 |

$30 |

$31 |

The revenue recognition report on Jun 13th would be the sum of the data in the previous two tables:

Revenue Recognition on Jun 13th |

||||

|---|---|---|---|---|

Mar |

Apr |

May |

Jun* |

Jul* |

$181 |

$330 |

$287 |

$230 |

$82 |

Retrospective accounting is the default behavior for reports in Chargebee. Contact [email protected] to switch to non-retrospective.

With non-retrospective accounting, when a new charge is added having all or part of its service period in the past, the past days' reporting is not altered. Instead, the prorated charge for the past days is calculated and recognized on the current day (the current time when millisecond-based billing mode is used).

Example

Say the revenue recognition report on Jun 12 looks as below:

Revenue Recognition on Jun 12th |

||||

|---|---|---|---|---|

Mar |

Apr |

May |

Jun* |

Jul* |

$150 |

$300 |

$256 |

$200 |

$51 |

(* indicates projected revenue)

Now, say that on the next day (Jun 13), a charge is added for $153 with a service period from Mar 1 to Jul 31 (153 days).

With non-retrospective accounting, the revenue of $153 from the charge would be recognized as below:

|

Mar |

Apr |

May |

Jun* |

Jul* |

|---|---|---|---|---|

0 |

0 |

0 |

$122 |

$31 |

Let's see how we get the numbers in the table above.

The service period of the charge is split into two parts:

Part A: March 1st - June 12th (The part of the service period lying in the past). The revenue from this part is recognized on the present day (June 13th).

Part B: June 13th - July 31st (The remaining part of the service period). The revenue recognition for this part is done as usual.

Accordingly, on June 13th, the revenue recognized for the month of June is arrived at as follows:

Period in June |

June 1st - 12th |

June 13th |

June 14th - 30th |

June Total |

|---|---|---|---|---|

Revenue Recognized |

0 |

Revenue recognized for Part A + Revenue recognized on June 13th = $104 + $1 = $105 |

$17 (projected) |

$122 |

Adding the data in the second table to the first, we get the revenue recognition report on Jun 13th as below:

Revenue Recognition on Jun 13th |

||||

|---|---|---|---|---|

Mar |

Apr |

May |

Jun* |

Jul* |

$150 |

$300 |

$256 |

$322 |

$82 |

If you change the billing mode of your site from millisecond-based to day-based or vice versa, any impacts on the accounting reports due the change are always made non-retrospectively.

If you are operating in multiple currencies, then Chargebee will display the details in the base currency and the currency in which the invoice was processed.

Assume, you are operating in USD, EUR, SGD, base currency set in your Chargebee site is EUR, and you have processed invoices in all the currencies:

| Customer 1 makes a purchase | Invoice 001 raised in USD |

| Customer 2 makes a purchase | Invoice 002 raised in EUR |

| Customer 3 makes a purchase | Invoice 003 raised in SGD Invoice 004 raised in SGD |

When the reports are loaded, the amount will be calculated and displayed in base currency by default, (in this case, EUR). Read more about how exchange rate conversion works in Chargebee.

You can choose a different currency to view details of invoices raised in additional currencies

I've already recognized revenue for a particular period manually, how can I move to the recognition process in Chargebee?

You can import the invoices and subscription data that you have recognized already into Chargebee, and then run the revenue recognition report. Chargebee considers the data imported to calculate the amount which were recognized for the past periods, and the amount to be recognized for the upcoming months.

How should I use the Revenue Recognition report to update the books?

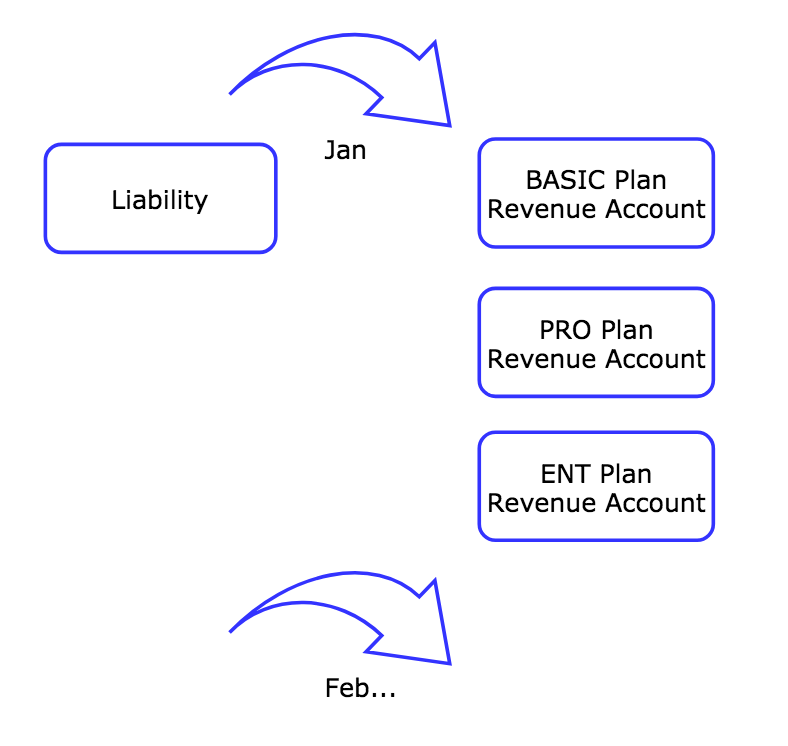

You may have setup Revenue and Liability accounts based on products/plans or a single account for tracking all the revenue.

In case you have setup GL Accounts per product, then you may setup Liability and Revenue Accounts and recognize revenue on a monthly basis

Refer the Revenue Recognition Report for the amount to be transferred from Liability account to Revenue account.

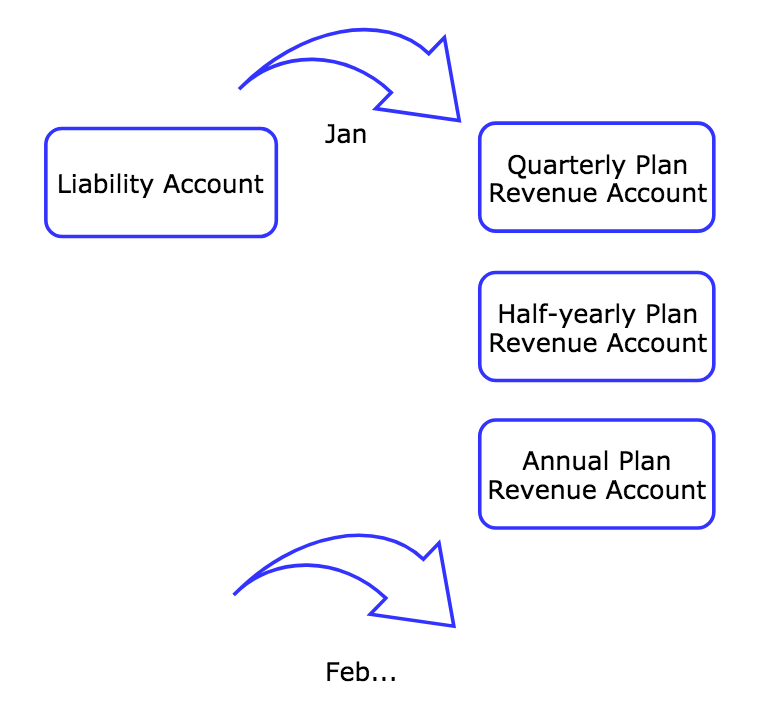

If you are operating with different Revenue/Liability Accounts for tracking Annual, Quarterly, Monthly Plan sales, you can refer the Revenue Recognition Report (search by product or invoice) and refer the amount to be recognized on a monthly basis.

I'm already using Chargebee's Xero/QuickBooks Online integration feature. How should I utilise this report?

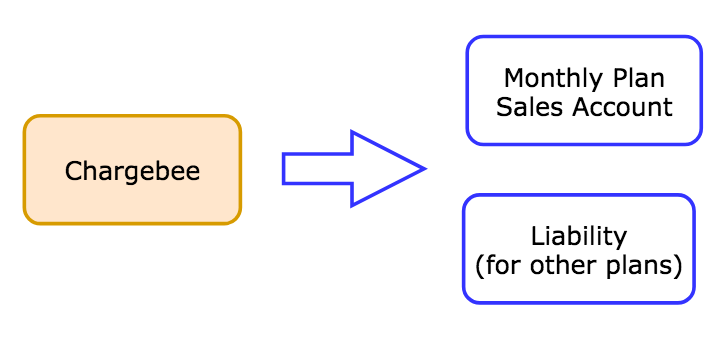

If you are using Chargebee's integration with Xero or QuickBooks Online, here are the recommended steps to manage deferred revenue in your accounting system.

Scenario 1:

If you have provided different Chart of Accounts for each product:

Scenario 2:

If you have provided the same Sales Account for all products, in this case,

You can create different Sales Accounts for each product in the Accounting system

You should then provide the Accounting code of the Liability account for plans whose billing frequency is greater than a month.

If you have integrated your Chargebee account with Xero/ QuickBooks Online, Chargebee will sync the data to the respective accounts, based on the GL Account provided in the product setup

Next, refer the Revenue Recognition / Deferred Revenue Report and transfer the amount from Liability to the respective Revenue accounts