Last Updated: Dec 10,2021

Stripe has now started enabling e-mandate workflow in Stripe Live mode for select accounts based on case to case basis until further notice. Our partner Stripe continues to engage with their partners and issuing banks to enable the new e-mandate workflow for additional banks

While we will continue to monitor and communicate any updates. We suggest you review our recommendations to continue collecting payments from your customers.

The Reserve Bank of India (RBI) is India's central bank and is responsible for the regulation of the Indian banking system. The RBI announced a host of new guidelines to streamline the process and security measures for card payments, including the requirement of Additional Factor of Authentication (AFA), especially for ‘card-not-present' transactions. This brings changes to the existing e-mandates that are set up to manage recurring payments.

All financial institutions, associated partners, and gateways must comply with these guidelines starting September 30, 2021.

E-Mandate is a digital payment service initiated by RBI for customers to virtually authorize merchants to collect recurring payments primarily using debit or credit cards.

Chargebee associates each mandate with a subscription and it is recommended that you set up separate mandates for each subscription.

The following guidelines are prescribed by the RBI:

e-mandates must be set up with Additional Factor Authentication (AFA) with Additional Factor Authentication for every subscription in order to automatically collect recurring payments.

The AFA requirement for transactions is now increased from INR2000 to INR5000. This means that AFA is mandatory only for transactions that exceed INR5000.

Banks must inform the customer at least 24 hours before the actual debit/charge of the customer and process payments upon receipt of confirmation that the pre-debit notification has been sent.

Banks must also provide a post debit notification which includes the name of the merchant, transaction amount, date/time of debit, reference number of transaction / e-mandate, the reason for debit.

Banks must allow the cardholder to withdraw an e-mandate anytime and immediately stop all recurring payments.

No charges can be levied to the customer for the creation or modification of e-mandates.

Non-adherence to these guidelines will mean your customers will experience failures for their recurring payments. Additionally, customers will be required to complete AFA for each transaction as a one-time transaction.

The following impact may apply to your Stripe integration:

Stripe's e-mandate creation is limited to cards issued in India and INR currency only. Issuing banks and Stripe do not support the creation of e-mandates for Non-INR currency. As a workaround for non-INR transactions, you can utilize Pay Now to process payments manually.

Banks will trigger dynamic authentication to complete additional factor authentication (AFA) when setting up the mandate and for transactions that exceed INR 5000. However, not all banks support dynamic authentication.

Note:Please reach out to Stripe for the list of supported banks.

Note: If the amount exceeds INR5000, then the e-mandate will require AFA during the pre debit notification.

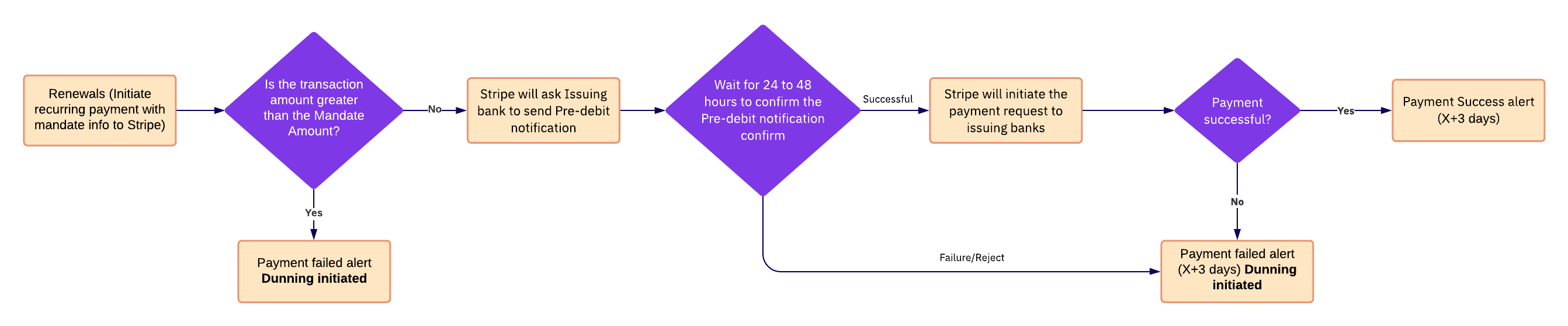

For sub recurring payments,Pre-debit notifications must be sent 24 hours before every renewal payment. However, you may experience delays of up to 3 days for payment confirmation.

All existing customers would need to set up their mandates again post-October 1, 2021 to ensure recurring payments can be processed without AFA.

Note:Failure to setup updated mandates with customers will require customers to complete AFA for recurring transactions post October 1, 2021.

Click here to access the Stripe's help document.

You must complete the following to prepare for this change:

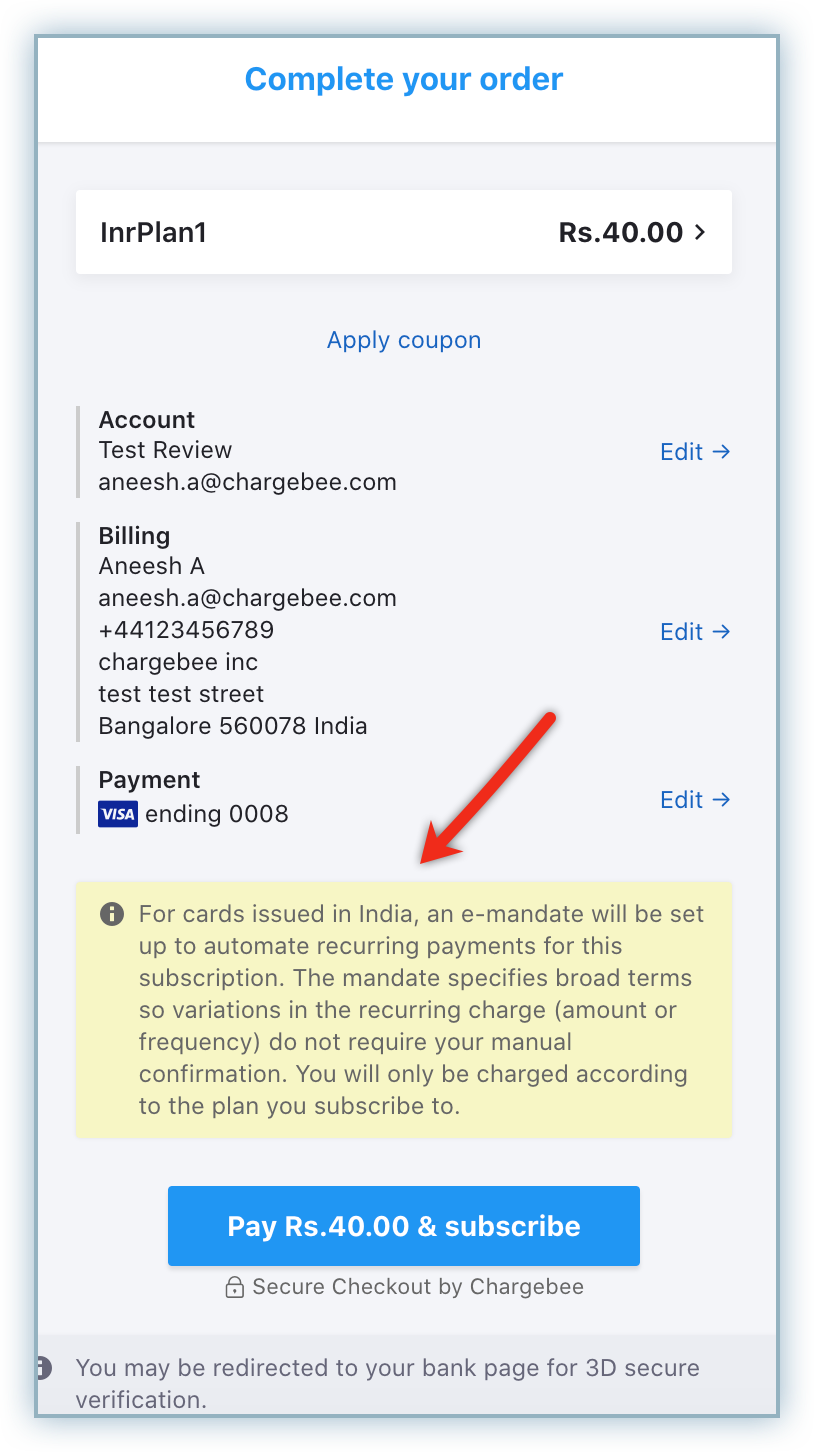

The e-mandate will encompass a broader scope to avoid the need for customers to complete the Additional Factor Authentication(AFA) for any minor changes in amount and frequency. The maximum amount and frequency of the mandate are set up as INR5000 and Sporadic (As presented) respectively.

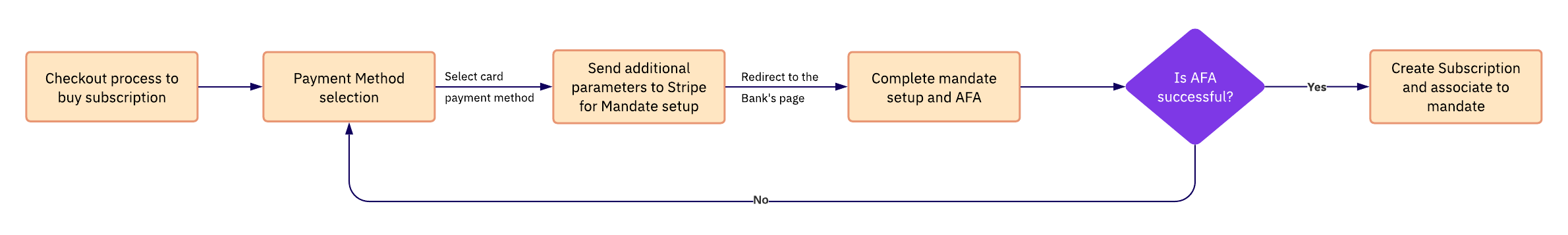

The following workflow applies to the setup of an e-mandate as part of the checkout flow.

The following workflow applies to the recurring payments associated with an e-mandate.

The e-mandate update process can be initiated by a customer using Chargebee's checkout, Pay Now link, or Self-Serve portal.

The customer is directed to complete the normal checkout process. As part of this checkout, they would be notified about the need to set up e-mandates and their relevance to successful recurring payments. This checkout process will conclude with the customer being redirected to the AFA (3D Secure) process prescribed by their issuing bank.

After successful completion of the authentication process, the e-mandate is set up and all subsequent recurring payments are scheduled subscription cycles based on the e-mandate.

If the initial subscription payment exceeds INR5000, the payment will be processed successfully with AFA. However, the e-mandate will be set up to a maximum limit of INR5000 under current regulations. As a result, recurring payments that exceed the mandate amount may fail and will require customers to manually process payments with AFA.

When a recurring payment fails due to e-mandate failure, customers will receive dunning emails based on your configuration notifying them of the payment failure and include the link to the Pay Now interface.

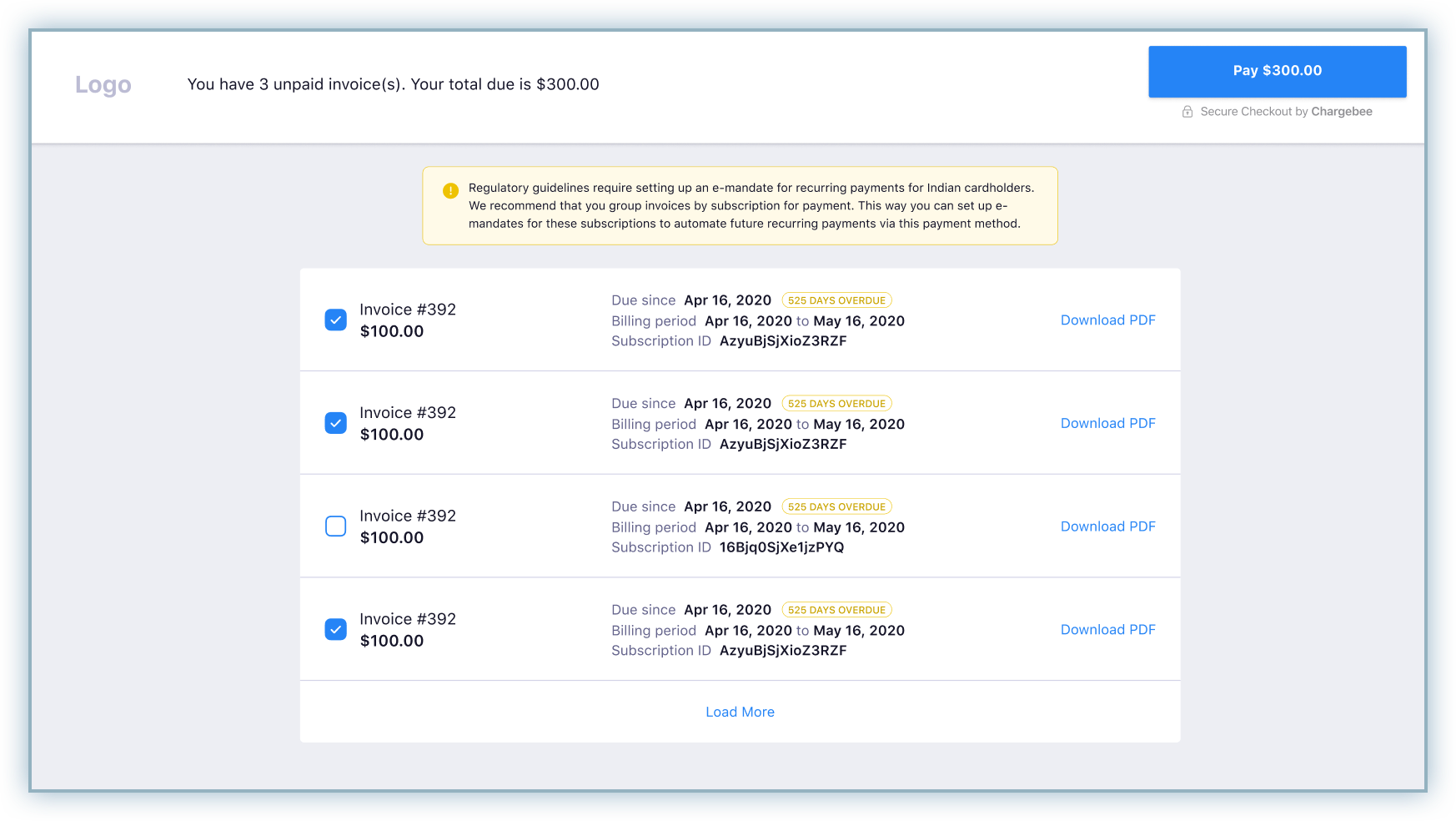

The Pay Now interface lists unpaid invoices, customers must select the invoices with identical Subscription IDs to set up a mandate for that subscription and complete the payment for those unpaid invoices while completing the AFA process.

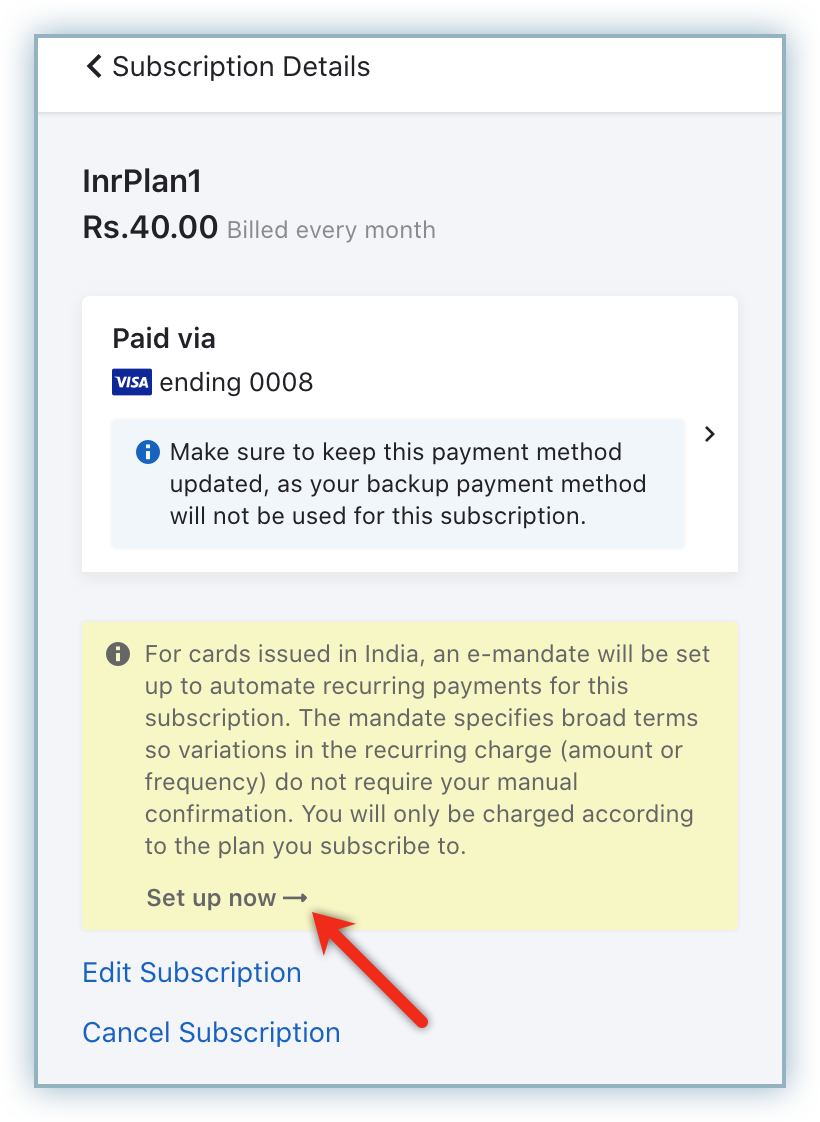

Customers can choose to utilize the Self Serve Portal to setup their e-mandates. The Self-Serve portal displays the customer's subscription details and directs them to review the notification and set up the e-mandate for their subscription.

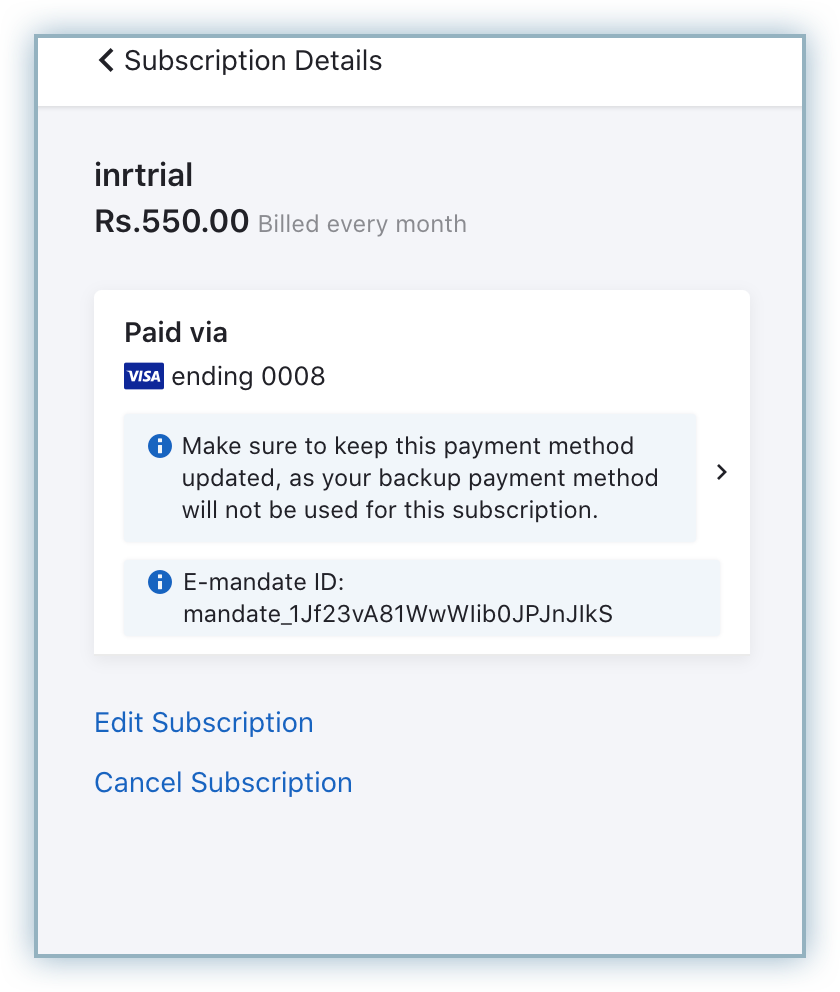

After the successful AFA process, the e-mandate is set up for recurring payments and customers will be able to view the e-mandate ID associated with that subscription with the payment method.