The Australian Goods and Service Tax is levied on physical and digital goods that are traded for consumption within Australia.

If you have a commercial presence in Australia, and your business has a gross income of over AUD $75,000 without tax, it is recommended that you register your business for GST.

Additionally, if you are a registered business outside Australia and selling digital products/services and/or low value physical goods to Australian consumers, then you should collect and remit GST.

If you run a business in Australia or provide sales/services in Australia and have a gross income (calculated without tax) of AUD $75,000 or more (AUD $150,000 or more for non-profit organisations) you need to register for GST. If you're starting to get your business off the ground, calculating what you expect to make will give you an idea of whether you need to register for GST. Find out how to estimate your turnover here.

To register for GST you need an Australian Business Number or an ABN. Equipped with an ABN, you can register for GST online, via phone or through a registered tax agent.

GST is set at a flat rate of 10% and is required to be included in the invoice of your product or service. As per the Australian tax invoice rules , a tax invoice with sales in excess of A$1000 must capture the GST for each line item individually.

Tax rates were revised on 8th Sept, 2017.

Merchants selling Digital services/goods from outside Australia to Australian customers will have to collect GST from their customers. Learn more about when you need to charge GST.

Currently, merchants based outside Australia do not have to collect tax for physical goods sold to customers in Australia, less than or equal to A$1,000. For goods imported in a consignment over A$1,000, any GST, customs duty and clearance charges will be charged under existing processes.

Starting 1st July, 2018, Australian GST will be applied on goods imported into Australia, with a consignment less than or equal to A$1,000 as well. Learn more . The price excludes taxes, shipping charges and other additional charges, if any.

If there are multiple physical good items, then the price of all the items will be considered for the calculation. Also, Chargebee considers one invoice as one consignment for applying taxes.

Price is Tax Inclusive: If the prices are Tax inclusive, Chargebee will check if the product price excluding tax is less than or equal to A$1,000. If it is, then GST will be applied. Here's a sample:

| Price inclusive of tax | Price excluding tax | GST Calculation |

|---|---|---|

| A$1,320 Inclusive of 10% GST | A$1,200 | GST will not be applied |

| A$880 Inclusive of 10% GST | A$800 | GST will be applied |

If consistent pricing is enabled then Australian GST (destination based) will be calculated and excluded to check if the price exceeds A$1,000 or not.

If consistent pricing is not enabled, then the tax of organization address (source based) will be calculated and excluded.

B2B Sales: If the merchant has provided ABN Number and has checked the ‘Registered for Tax' option in Tax settings, then tax will not be applied as per Reverse Charge mechanism. Else tax will be applied for invoice amounts, less than or equal to A$1,000.

Multi Currency Configuration: If you are operating in AUD and other currencies, Chargebee will consider the exchange rate configured in your Chargebee site. If AUD is not configured in your Chargebee site, Chargebee will derive the rate internally to check if the amount exceeds or not in AUD currency.

If your customer has added digital and physical goods in a subscription, all the digital goods will be taxed as per current GST policy on digital goods. For physical goods, if the invoice amount of the physical goods is less than or equal to A$1,000, then GST will be applied.

Here are the list of scenarios explaining what tax rates will be applied based on where you are registered and what you are selling, digital or other products/services:

| Scenario | Products | Tax Rate |

|---|---|---|

| Aus Merchant to Aus Customer | Digital or Non-digital | 10% GST |

| Outside Aus to Aus Customer | Digital | 10% GST |

| Outside Aus to Aus Customer (price greater than A$1,000) |

Non-digital | No Tax |

| Outside Aus to Aus Customer (price less than or equal to A$1,000) |

Non-digital | 10% GST |

A GST invoice sent to a customer must contain the following information

This section will walk you through configuring GST in Chargebee:

Step 1: Update your organization address

Make sure you've added your organization address at Settings > Configure Chargebee > Business Profile. You cannot configure taxes in Chargebee without completing this step in your initial setup.

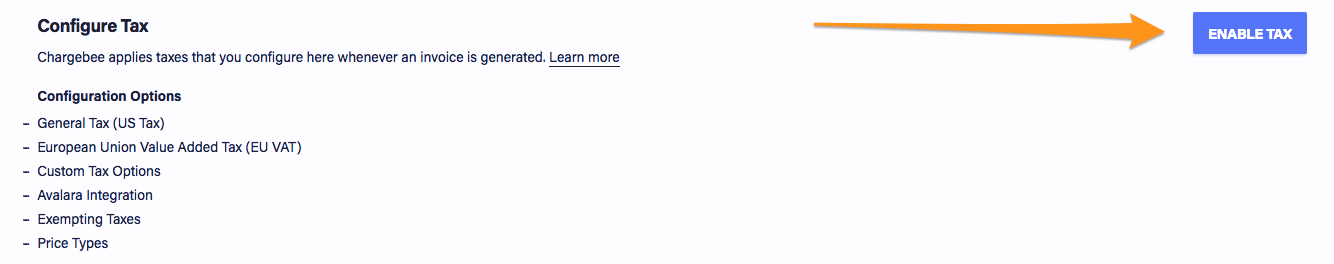

Step 2: Enable Tax

Go to Settings > Configure Chargebee > Taxes and click the Enable Tax option. If your Chargebee site has an existing Tax Profile, you will find the option Add Region instead. You will find a list of regions to choose from, choose Australia from the list.

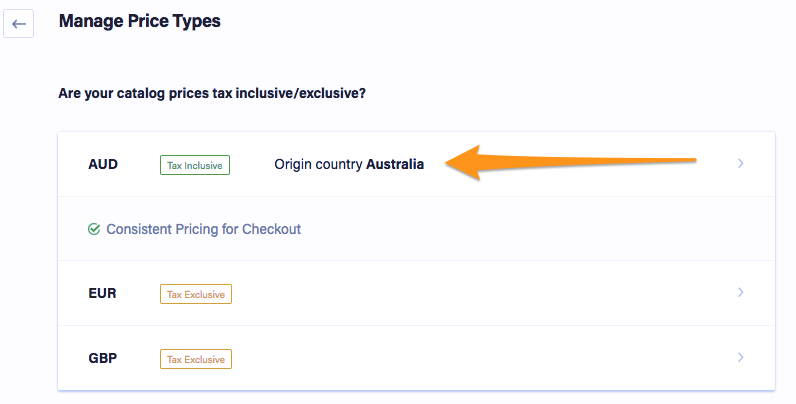

Step 3: Choose a Price Type

Once taxes are enabled, you will be redirected to a page containing all the currencies that you have enabled for your site. Step 3 is configuring a price type (the price that you quote for your product/service/addon can be either inclusive of tax, where tax is included in the price, or exclusive of tax, where tax is added to the price) for each of these currencies.

If you are selling to customers in Australia, then AUD will appear on your list of currencies automatically.

Step 4: Add 'Australia' to Tax Jurisdiction list

Click on Add Region and select Australia from the country list.

You will now be redirected to a GST configuration page.

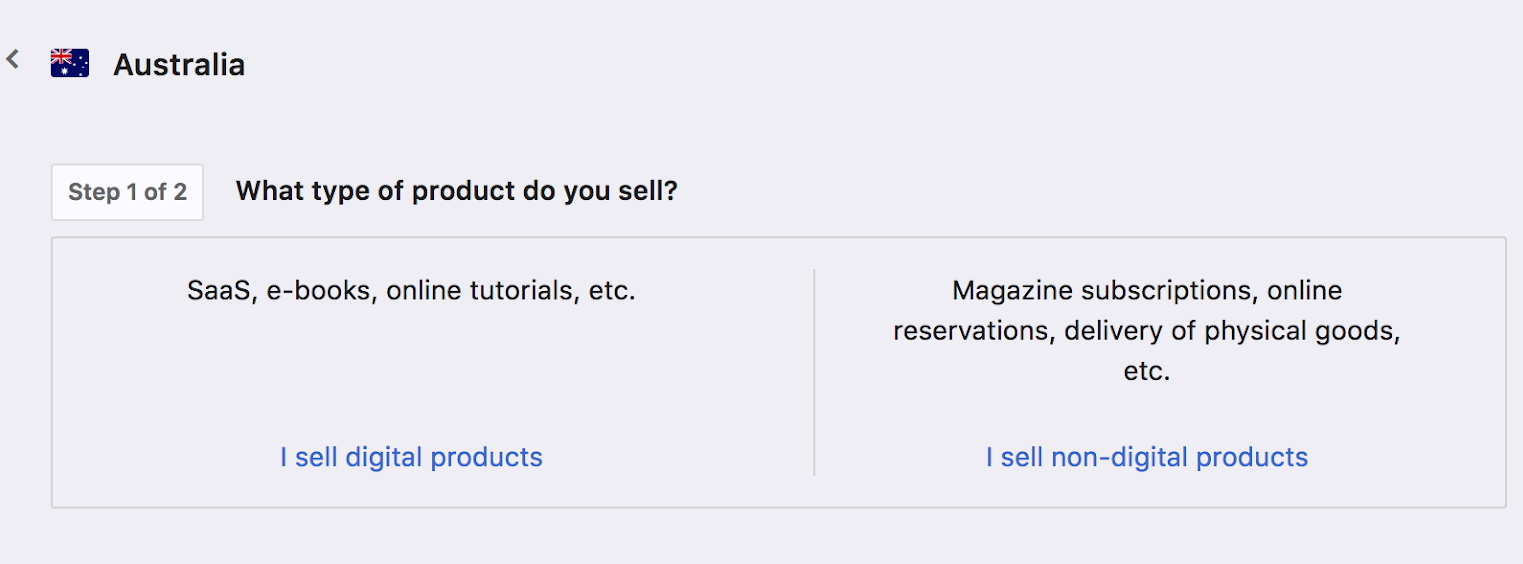

Step 5: Select product type

Choose the product type, Digital or Physical, based on the products/services you are offering.

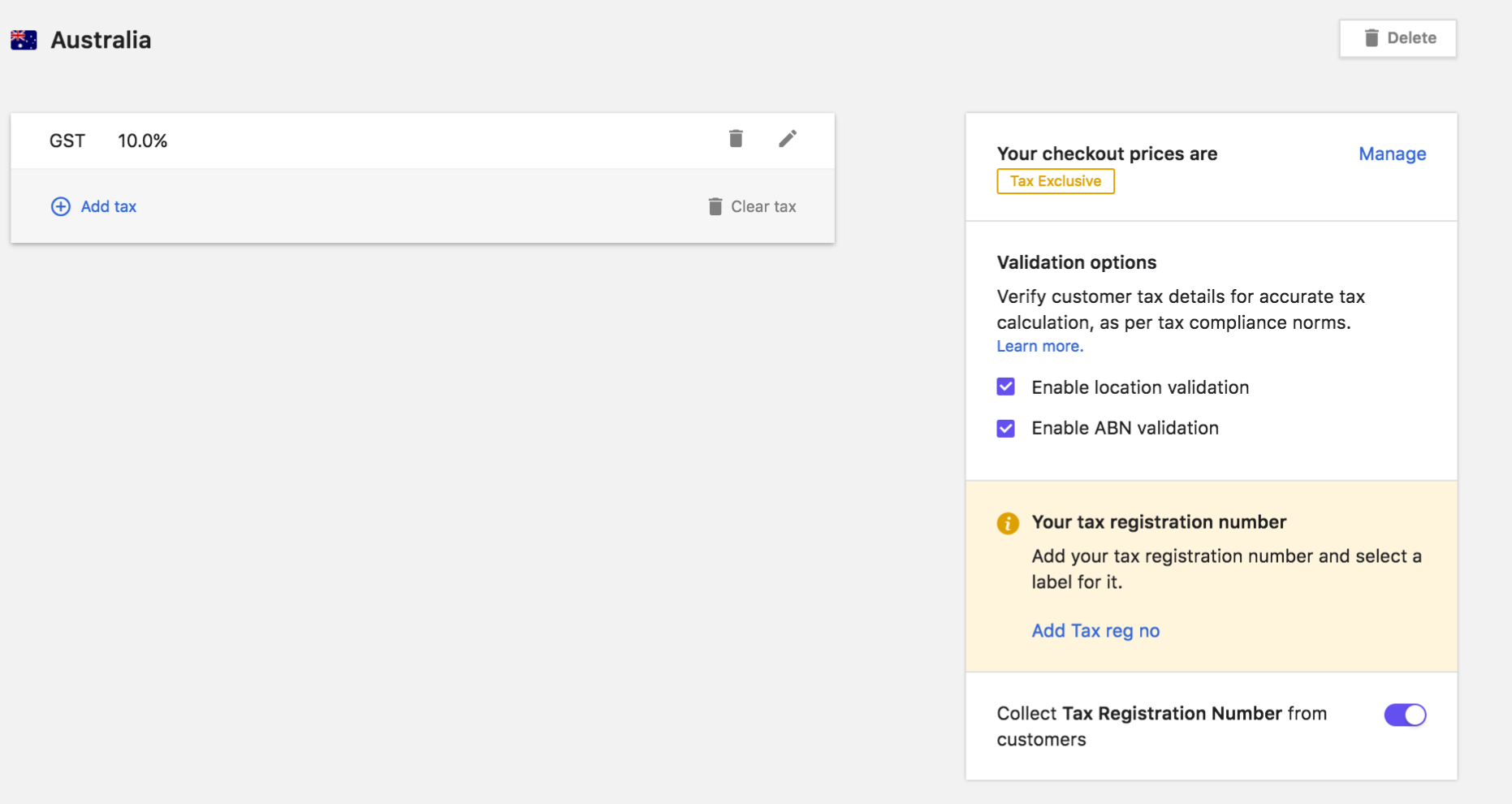

Step 6: Enter tax details

Tax Registration Number: Set the tax label as ABN and enter your ABN here. This will be displayed in the invoices sent to your customers.

Location Validation: Choose to enable location validation based on whether you have to collect and store your customers' address proof or not.

Collect Tax Registration Number: You can choose to collect your customer's ABN Number or not.

ABN Validation: Choose whether to perform ABN Validation against ABN Lookup service or not when the ABN number is entered by your customers

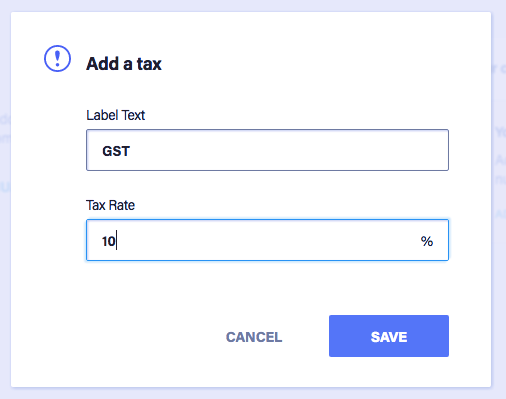

Step 7: Add tax rate

Finally, you will need to provide a Tax label and the tax rate that you would like Chargebee to apply to your invoices. As per GST regulation, you should set your tax rate to 10%.

If a merchant, registered outside Australia, is selling products/ services to a Business customer in Australia, then Tax will not be applied. In addition, the following conditions should be met:

Else tax will be applied.

Registered for GST option is available in Hosted Pages v2 only.

The ‘Register for GST' option can be updated in the following ways:

As per IR regulations, you need to ensure that the customers or businesses you are selling to are, in fact, residing in Australia. Your customers are required to provide two non-conflicting pieces of evidence that indicate the same. Chargebee collects the following location information:

Customer's IP Address

HOSTED PAGES: If you have integrated with Chargebee using the hosted pages, the IP Address of the customer will be collected automatically.

API: If you use the Chargebee API, you will have to pass the IP Address of the customer to Chargebee using the User Details Header API.

Card BIN of the Customer

The first six digits of a card constitute the Bank Identification Number (BIN). BIN gives us the information about the card issuing bank and hence can be used as a way to determine the customer's location.

HOSTED PAGES: If you have integrated with Chargebee using the hosted pages, the BIN of the customer will be collected automatically.

API: If you use the Chargebee API, you will have to pass the BIN of the customer using the card [number] parameter in the Create a Customer API.

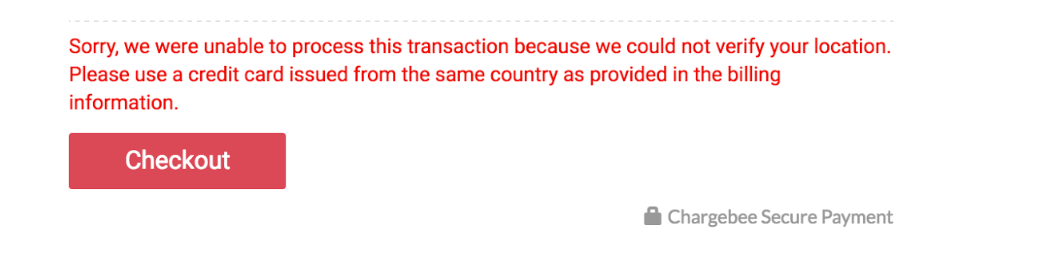

If the location validation fails, the customer will not be able to complete the order.

If your customer's location validation fails, they will not be able to complete their order. They will receive the following error message:

If a customer signs up for a trial plan which involves no immediate payment, the subscription is created irrespective of whether the location validation was successful or not.

The details of the customer are marked with a warning indicating that the location validation failed.

Chargebee validates the ABN and confirms whether the number is valid or not. Based on the validity, Chargebee will apply taxes. Sometimes the ABN lookup service may be down, in such cases, here's how Chargebee handles the error -

When the ABN Look up service is down due to a ABN Look up service internal error, Chargebee will not be able to know if the ABN was VALID or INVALID. In absence of a status, you can configure one of the options:

Based on your choice, Chargebee will create subscriptions (or not).

Contact [email protected] to configure the option of your choice - to allow or restrict subscriptions from being created (when the ABN Look up service is down)

By default, Chargebee will allow to create subscriptions.

If you have chosen to allow to collect and save the ABN without validation, when ABN Look up service is down, Chargebee will check for ABN status later, every 24hrs. Based on the response from ABN Look up, following actions will be taken

An email will be sent to the Chargebee Site Admin and Owner with the details.

During subscription renewals, Chargebee will validate customer's ABN, if it was not validated in the last 3 months. Chargebee will attempt to validate VALID ABN's only.

1. What is Netflix Tax?

Netflix tax is a common analogy for tax being applied on digital product or services sold by companies registered outside a country to a consumer of that country, in this case, Australia.

2. When is the digital tax rule applicable from?

Starting July 1, 2017, merchants registered outside Australia, selling digital products or services to consumers in Australia must collect and remit GST.

3. When is the low value physical goods rule applicable from?

Starting July 1, 2018, merchants registered outside Australia, selling physical goods less than or equal to A$1,000 in a consignment, to consumers in Australia, must collect and remit GST.

4. What is the significance of ‘Register for GST' option?

There are cases where an Australian Business has an ABN Number but did not register for GST additionally. With the GST tax policy updates (starting July 1, 2017), businesses are required to register for GST additionally. Hence Businesses with an ABN number and registered for GST will be eligible for reverse charge exemption. Refer this link for more details.