Chargebee integrates with Softrax Revenue Manager to automate financial compliance with ASC 606 and IFRS 15 regulations. You can sync subscription information from Chargebee to Softrax and generate the revenue forecast schedule. This forecast can be used for recognizing revenue on a monthly basis in your accounting system.

Once you have created a Softrax Revenue Manager account, you should configure the following settings in Softrax before integrating in Chargebee:

Caution!

The above mentioned prerequisites are mandatory. Failing to configure any of them in Softrax would lead to sync error and you can not proceed with the integration.

Additional Prerequisites

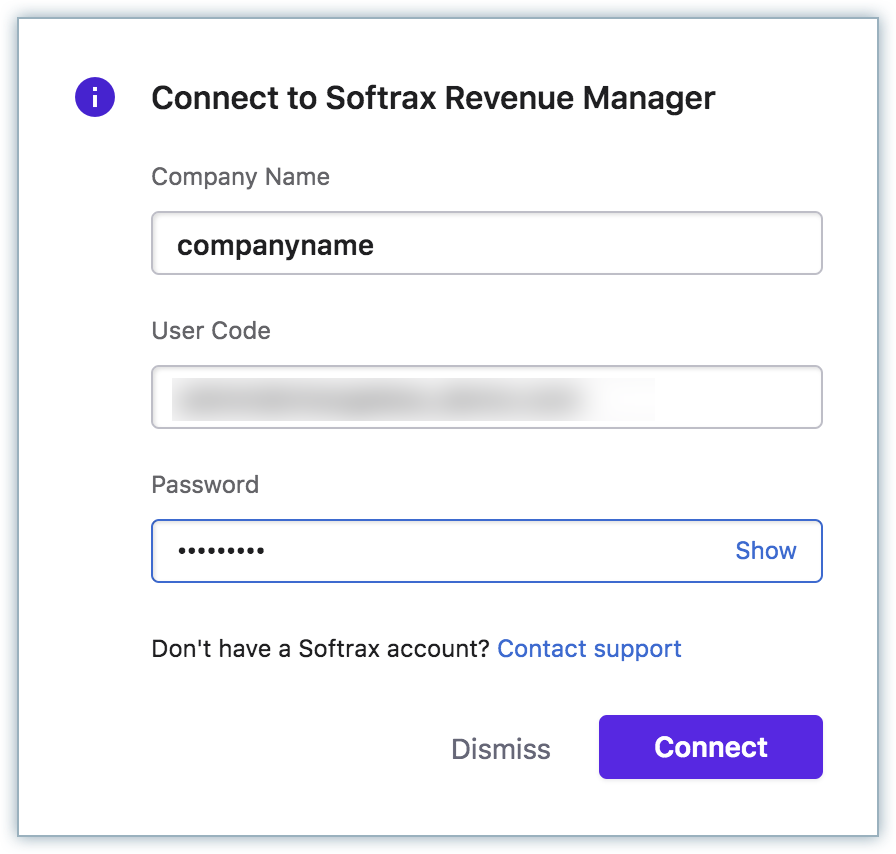

Log in to Chargebee, click Configure Chargebee > Third-Party Integrations > Softrax Revenue Manager > click Connect > enter the login credentials.

Enter your company name, user code, and password. Your company name is derived from your Softrax URL, such as "companyname".softrax.com.

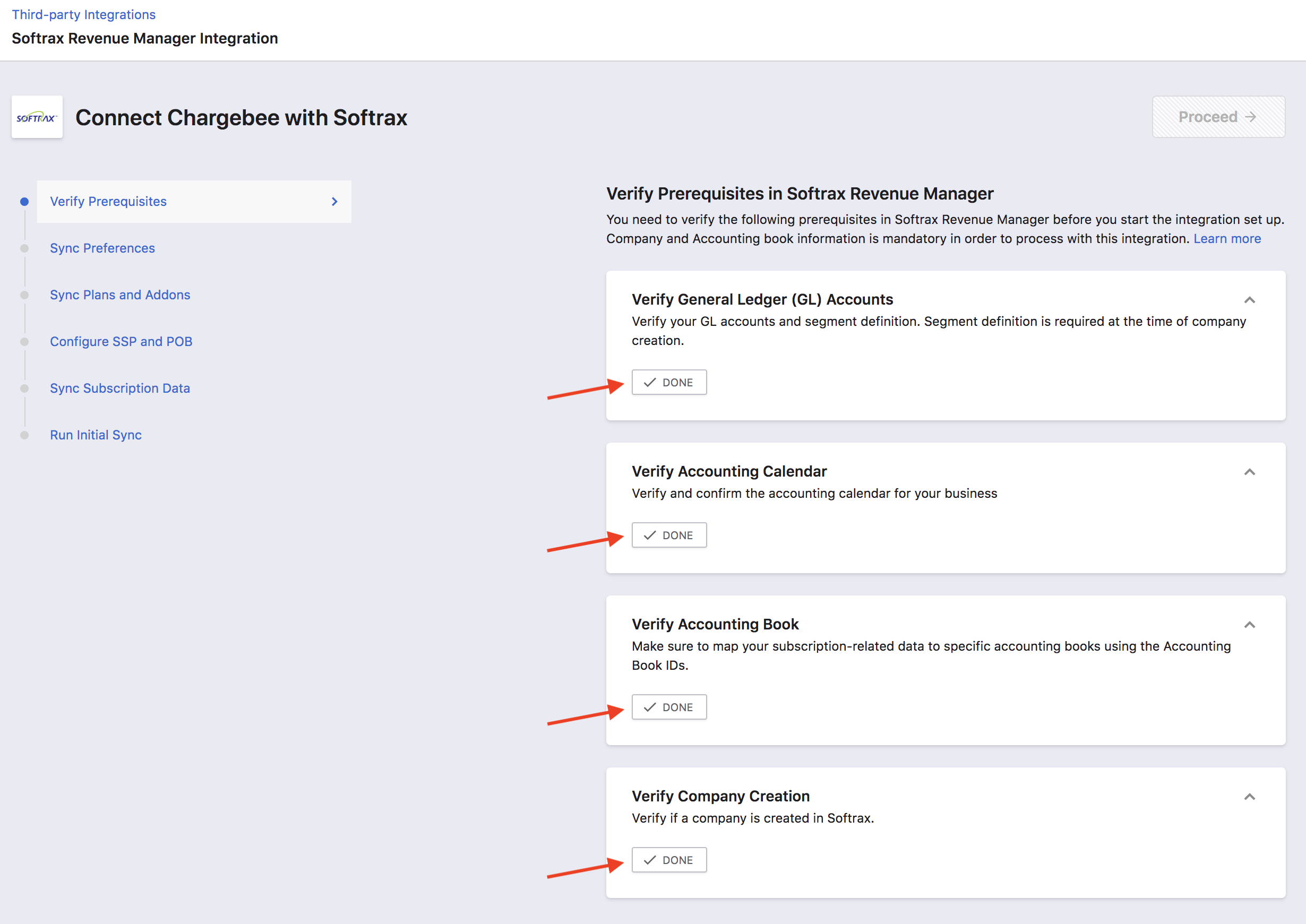

Chargebee displays a checklist as follows to verify if these settings are configured in Softrax :

Click Done for each setting and click Proceed.

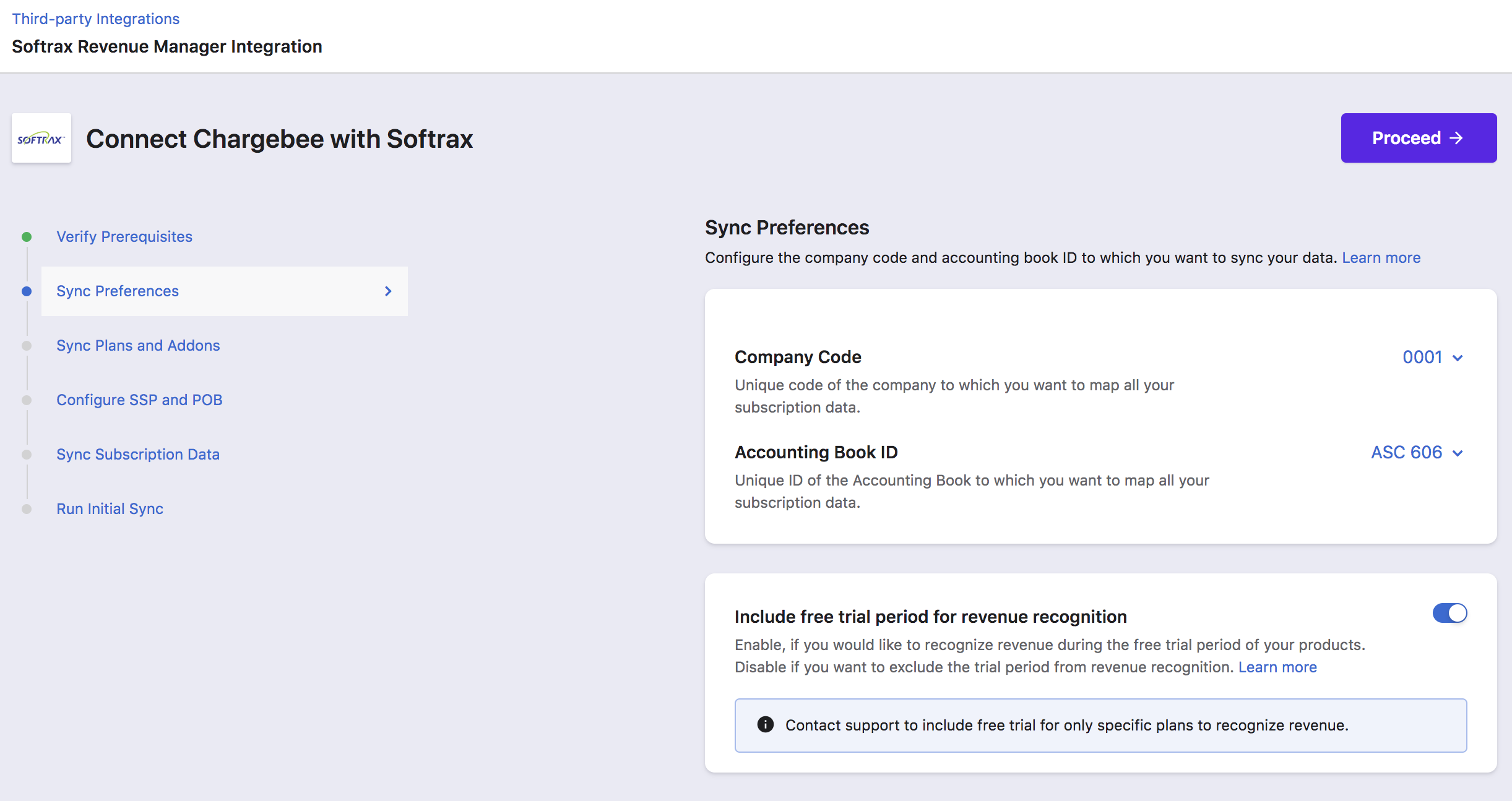

You can do the following mapping for the sync:

Click Proceed.

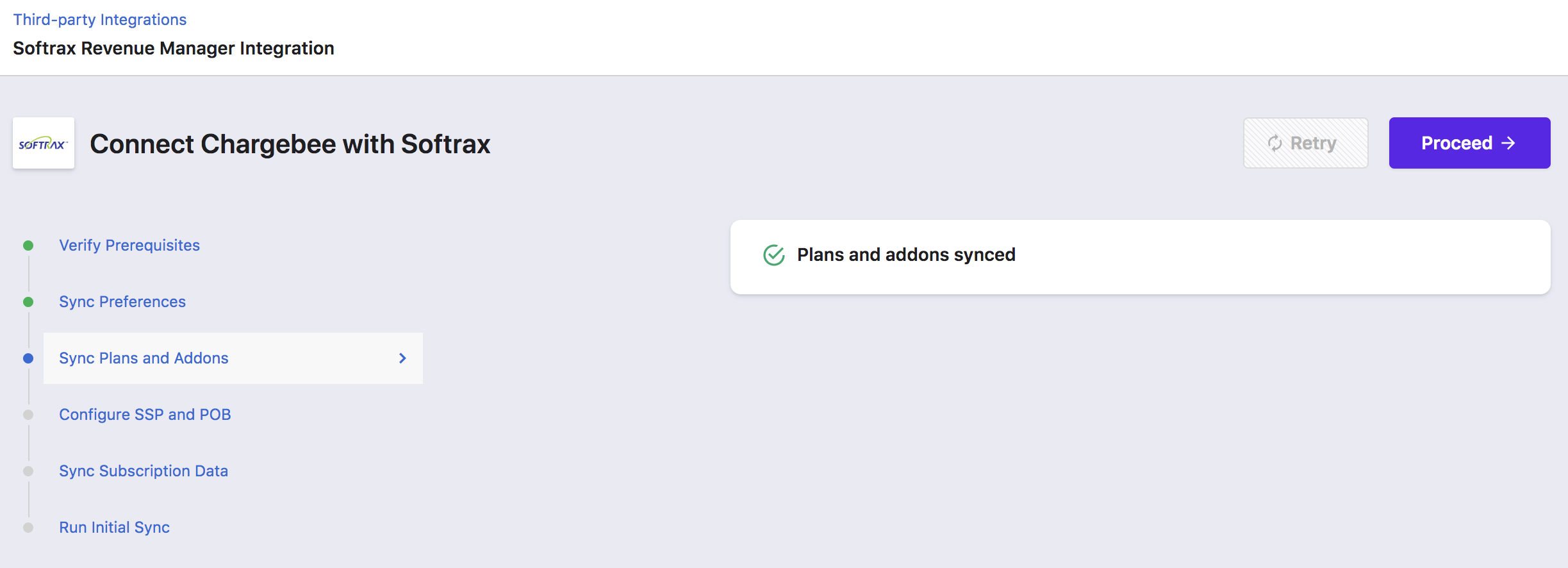

Chargebee creates all plans/addons in Softrax as Products.

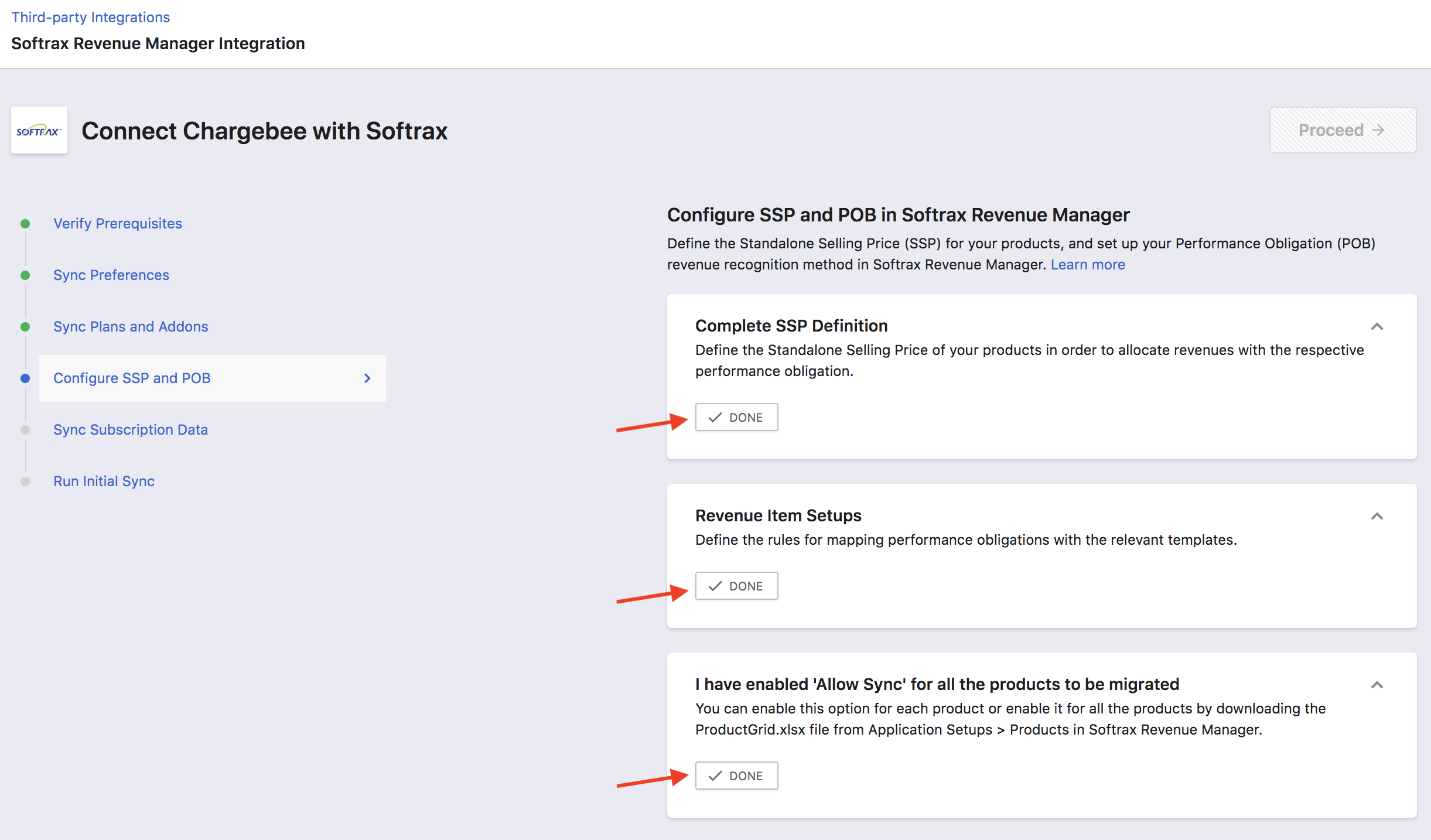

Ensure that the Revenue Recognition related configuration is completed in Softrax by clicking Done for the following:

You can sync all Products in Softrax or choose to update some Products in Softrax. To allow Chargebee to update the Products, you can enable "Allow Sync" option in Softrax, or disable this option for the specific Products as desired.

Click Proceed.

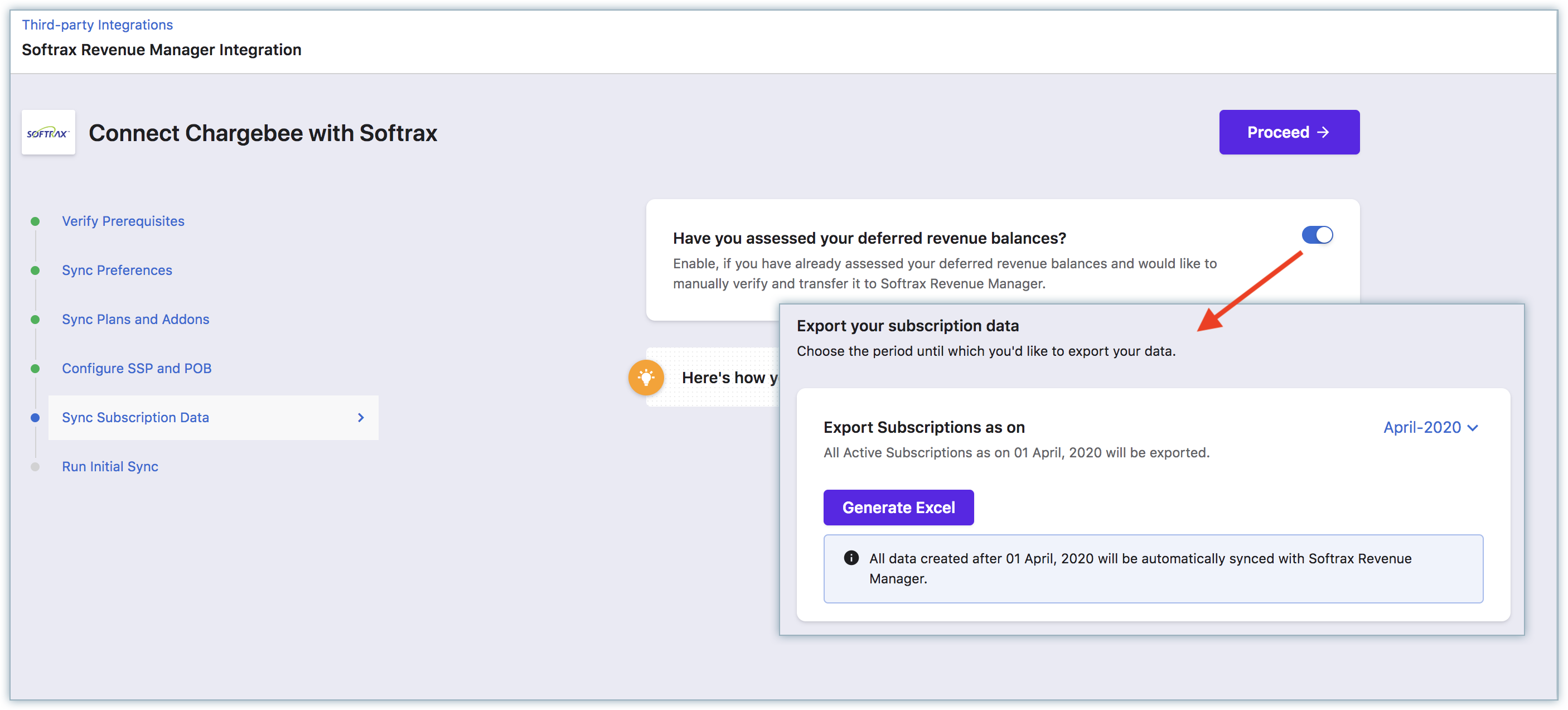

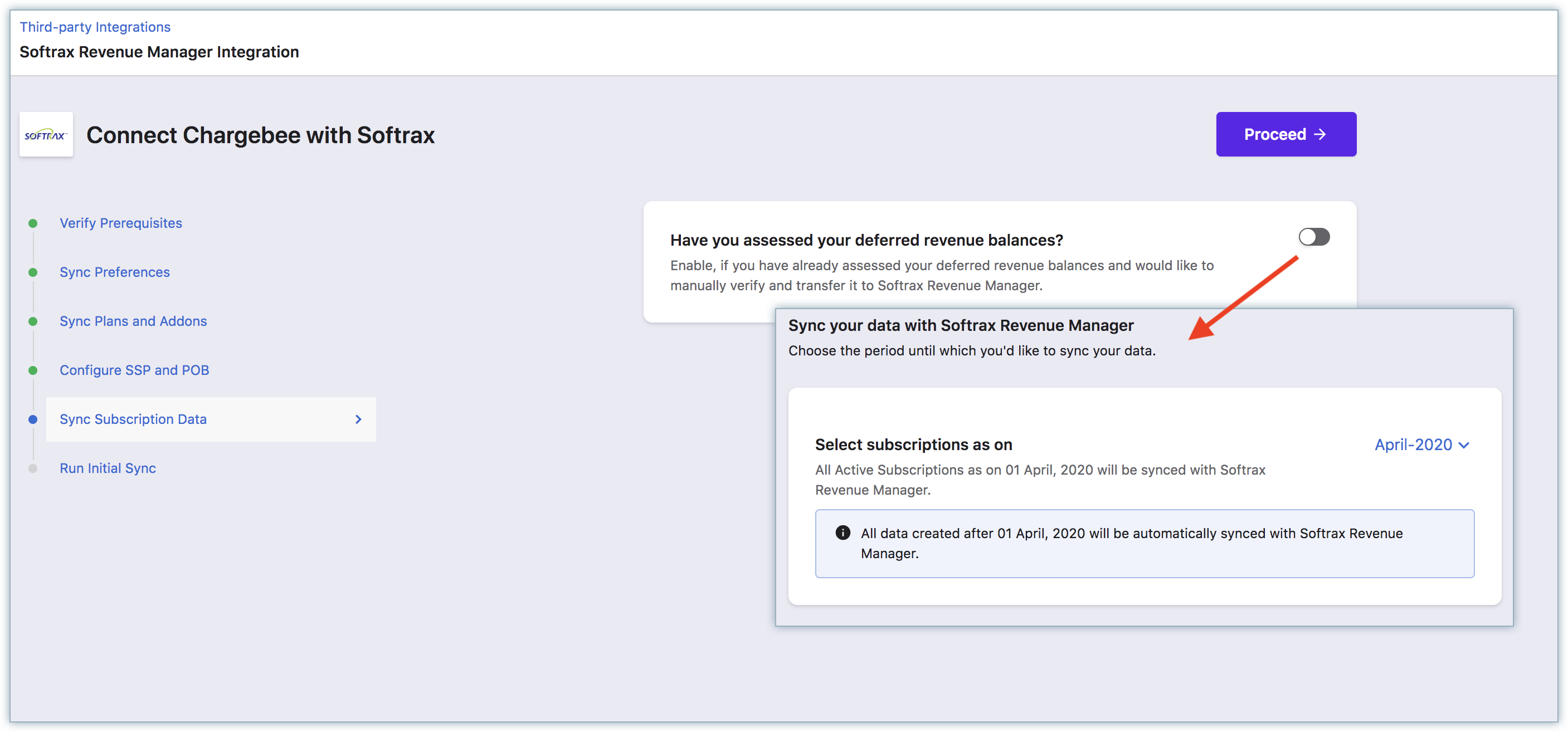

You can decide how you want to sync the deferred revenue data from Chargebee to Softrax.

If you have already assessed your deferred revenue balances, turn the toggle on and click Proceed.

You can export your subscription data until a specific period to manually verify and upload it to Softrax Revenue Manager. Once you are done, click Proceed.

Alternatively, by leaving the toggle off, you can choose to sync all subscriptions data with Softrax Revenue Manager automatically for until selected period.

Click Proceed.

The latest date in the subscriptions exported is considered as the Sync start date. When the initial sync runs, it picks the subscriptions created after this date.

Once the configurations are done, you can click Run Initial Sync. Chargebee syncs the first 10 invoices. You can view a report of what was synced and what was not synced. If there are errors, you can check the details, fix them. It is recommended that you review the data in Softrax to ensure the sync is set right.

Once you have reviewed the sync details and when you are sure of all the settings, you can click Sync all Records.

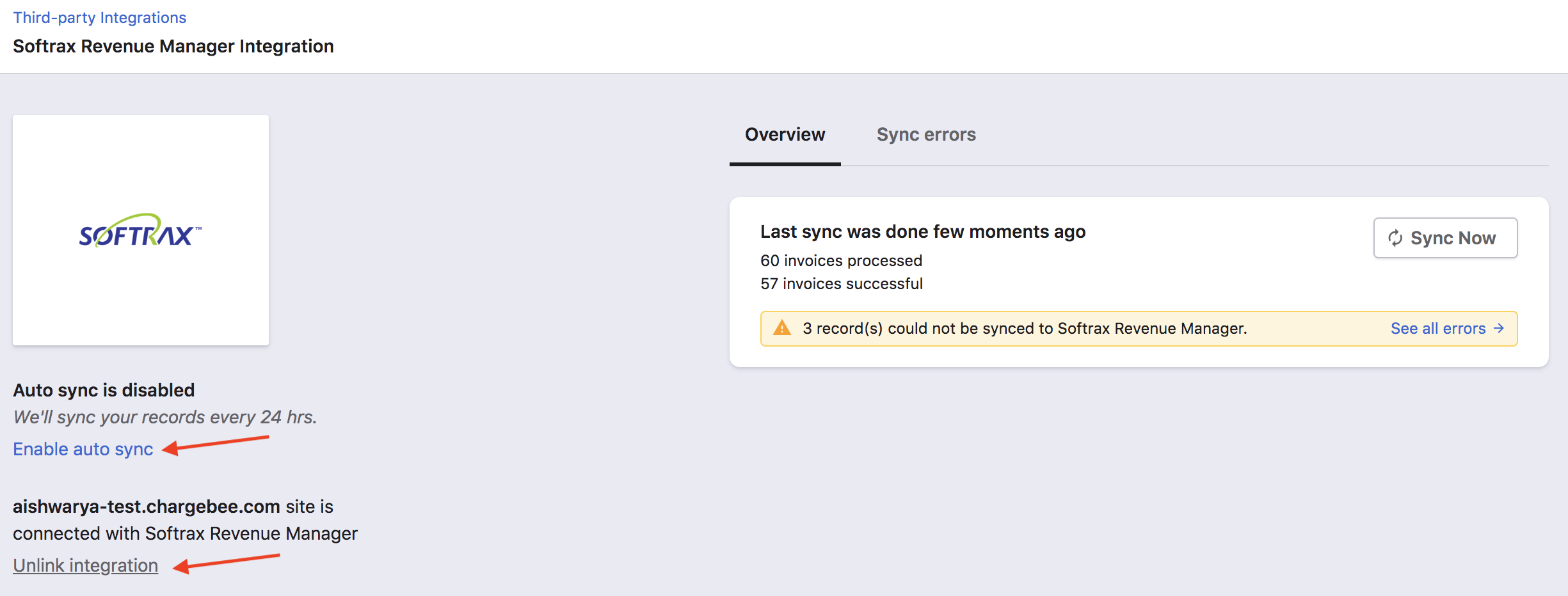

You can set a daily schedule to sync all the information to Softrax automatically. Subscriptions and related information will be synced, once every 24 hours. You can choose to disable auto-sync if required.

For on-demand sync, you can sync data from Chargebee to Softrax immediately.

If you want to stop Chargebee from syncing subscription information to Softrax, you can unlink the connection.

If you want to connect again to the same Softrax account, you can again click Connect and repeat the configuration steps as mentioned earlier.

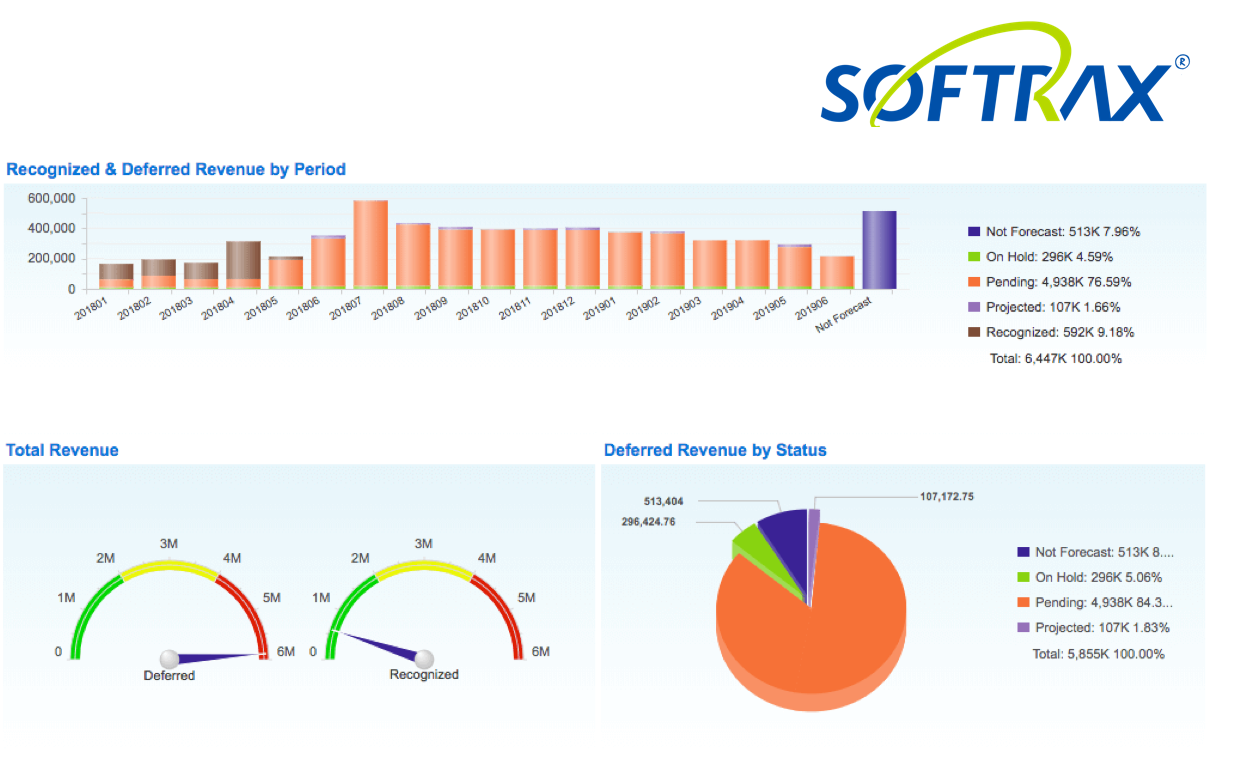

Once Chargebee syncs subscription data to Softrax, you can view the following reports in Softrax:

Deferred Revenue / Revenue Recognition Report

This report will display the amount to be recognized or pending amount to be recognized per month.

Journal Entry

During Journal Entry generation, Softrax Revenue Manager will aggregate the accounting entries and create a summarized Journal Entry. Journal Entries must be accurate and precise with regard to the accounts used, the amount of the revenue, and the timing of the Journal Entry for compliance with ASC 606 or similar.

Close Accounting Books in Softrax

After the revenue is recognized, it is recommended to close the books periodically. This is to avoid updating the revenue recognition retrospectively while importing the report in your accounting system.

1) Which Chargebee plan supports Softrax integration?

The Chargebee - Softrax integration is available on all paid plans.

2) Will Chargebee automate journal entries in my Accounting/ERP system?

No, Chargebee will only sync subscription data to Softrax. You should manage revenue recognition in your Accounting system.

3) Can I amortize the revenue recognition schedule for the sales commission?

Yes, you can manually import the excel file in a specified format in Softrax's revenue manager system to amortize the sales commission.