PRODUCT

SOLUTIONS

- BY INDUSTRY

- B2B SaaS

- eCommerce

- E-learning

- Publishing

- BY BUSINESS SIZE

- Startup

- ScaleUp

- Enterprise

- BY BUSINESS MODEL

- Self-serve

- Sales-driven

CHARGEBEE RETENTION

Where's Your SaaS Revenue Leaking?

Get to the root cause of your SaaS finance pains. Plug revenue leaks with in-depth Leakage & A/R reports.

SaaS Revenue Operations

The Revenue You See

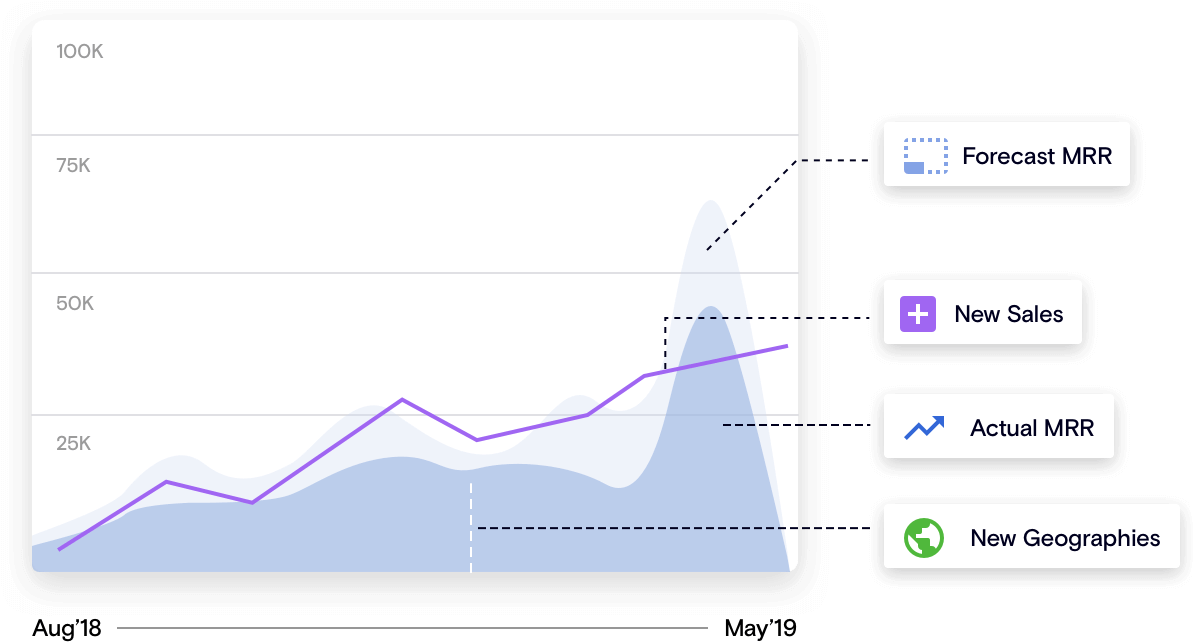

We think we'd know exactly how much subscription revenue we make right now. But after accounting for all the leakage from coupons, credit notes, failed payments and cancellations? The actual revenue you realize in your SaaS application could be hidden deep within your sales, finance and subscriptions workflow. Billing Analytics reports in Chargebee surface the money actually hitting the bank, and compare it to the Monthly Recurring Revenue (MRR) value you'd forecast. And you get to analyze which part comes from new sales, new geographies, plans, and even the non-recurring components of your subscription business.

Leakage and Receivable Analytics

Plug the Leaks in Your

Revenue Plumbing

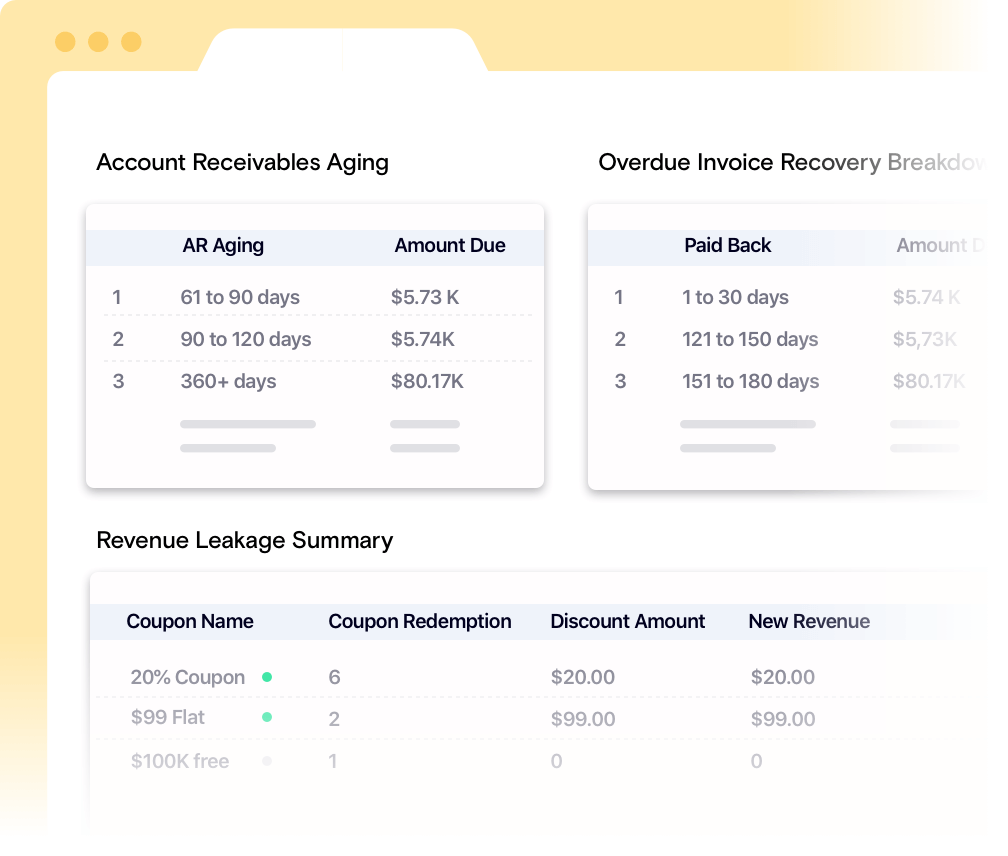

Discount campaigns and promotional credits drive in new MRR that month, sure. But when your finance team finally does the math, they eventually end up sucking the living revenue out of you. Overdue invoices and aged receivables come in a close second in the things clogging your subscription revenue flow. Receivables and Leakage Analytics reports in Chargebee let you identify the source of your revenue leakage. Contextualize revenue leaks from each coupon by visualizing it alongside the New MRR you're generating from the campaign. But that's not all. Draw A/R Aging reports to see which receivables are stuck at unmanned procurement desks.

Payment Analytics

You Need to Know Why

That Payment Failed!

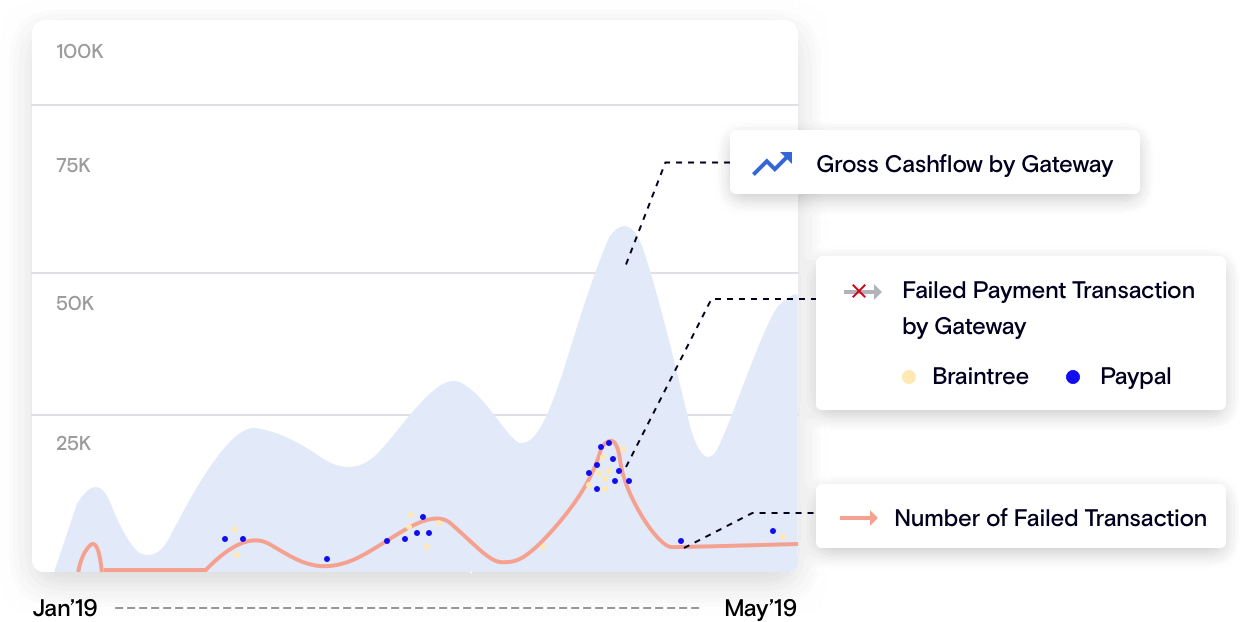

Not all payment gateways are the same. Not all payment methods are equal. Credit cards expire. Direct debit mandates get cancelled. And Apple Pay... well it could just be Apple Pay. With Transaction Analytics reports, you can analyze which payment gateway and method causes the most payment failures, and juxtapose it with gross cash flow by payment gateway and method, to optimize for payment failures. And once you've got those metrics sorted, perhaps you'd want a Smarter Retry and Dunning process to aid your recovery?