PRODUCT

SOLUTIONS

- BY INDUSTRY

- B2B SaaS

- eCommerce

- E-learning

- Publishing

- BY BUSINESS SIZE

- Startup

- ScaleUp

- Enterprise

- BY BUSINESS MODEL

- Self-serve

- Sales-driven

CHARGEBEE RETENTION

Expand your Subscription

Businesses Globally

Handle the growing pains of a subscription business with Chargebee and Adyen.

Supported Markets

Asia- Pacific, Europe, America

Suited Business Type

Mid to enterprise merchants catering to international markets

Payment Frequency

Recurring payments are supported along with one-time payments

Open up to New Markets with Local Payment Methods

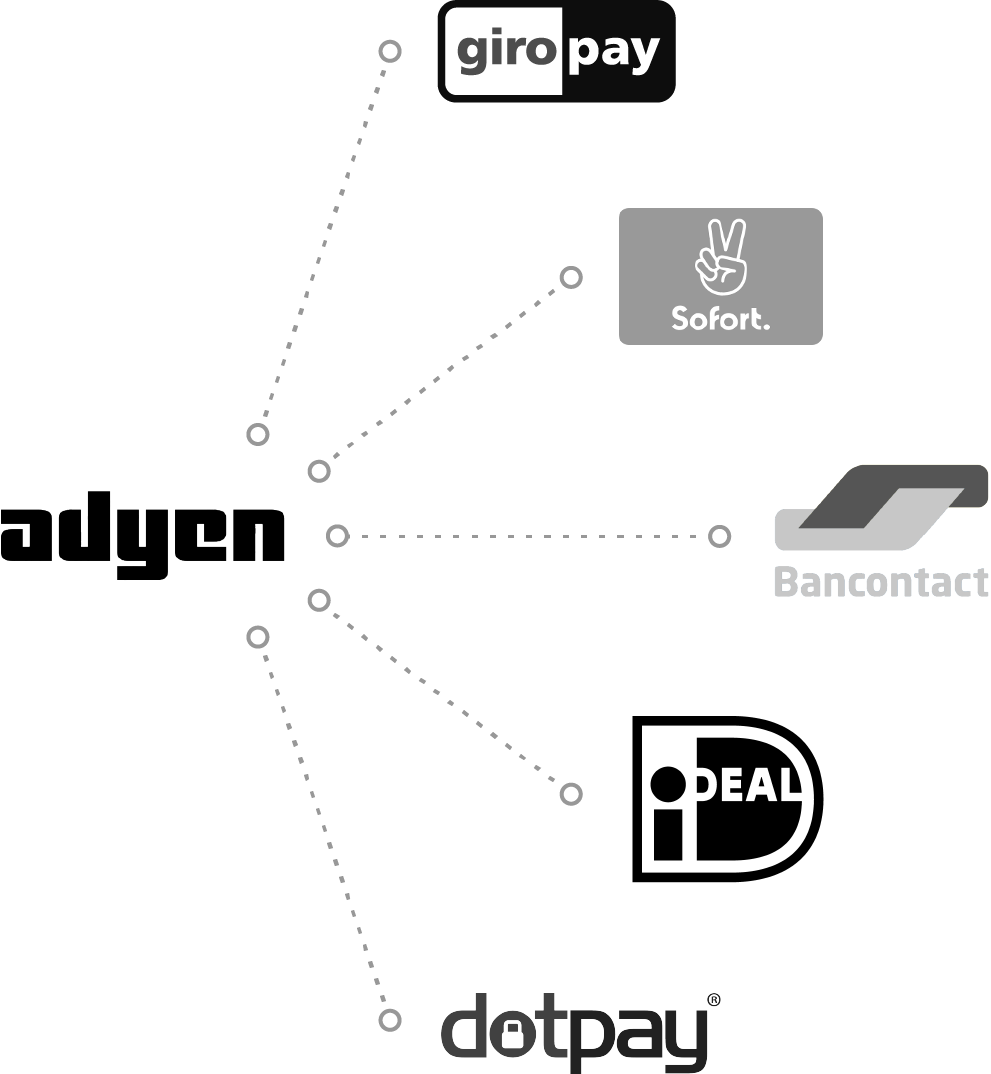

Don't limit your payment options to just credit cards. Customers in Europe prefer to pay using bank-based payment methods that work directly with their bank accounts. With the Chargebee and Adyen combo, you can accept payments through iDEAL, Sofort, Giropay, Dotpay, and Bancontact. Expand your reach to customers in Germany, Austria, Switzerland, Sweden, Belgium, Poland, Netherlands, and many more countries across the EU. You can convert one-time bank payments into recurring payments using SEPA Direct Debit.

Focus on the Perfect Checkout

Optimize your checkout flow by focusing on the user experience. Showcase your brand voice and let Adyen and Chargebee handle PCI compliance, tokenization and all the other details to help your customers convert in minutes and not weeks.

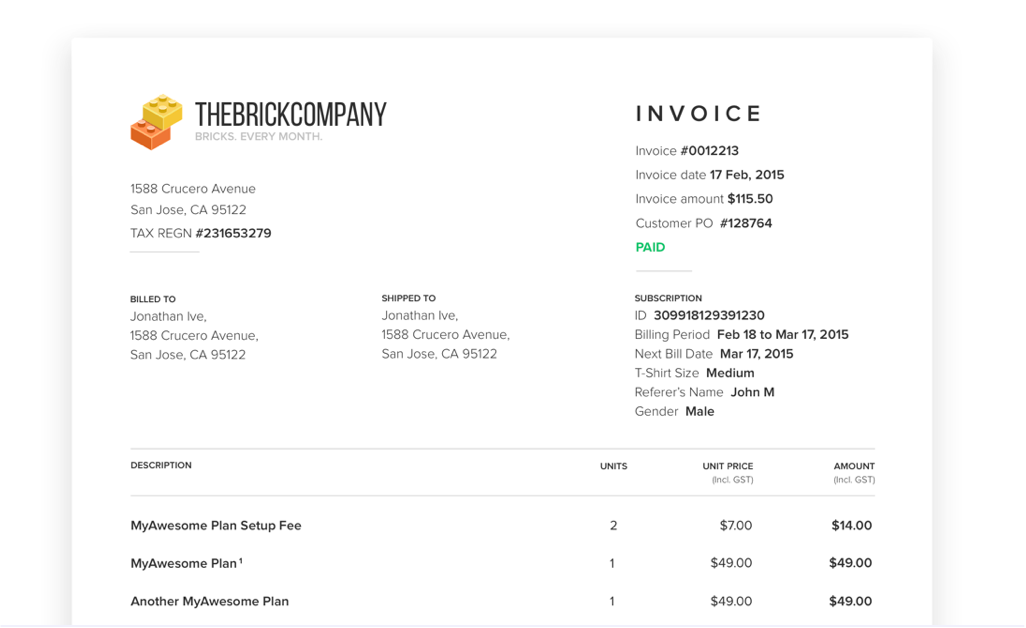

Automated Invoicing

Automated Invoicing

With the Chargebee and Adyen duo, send out beautiful, branded invoices with all the essentials. Get the invoices reconciled as soon as payment is received.

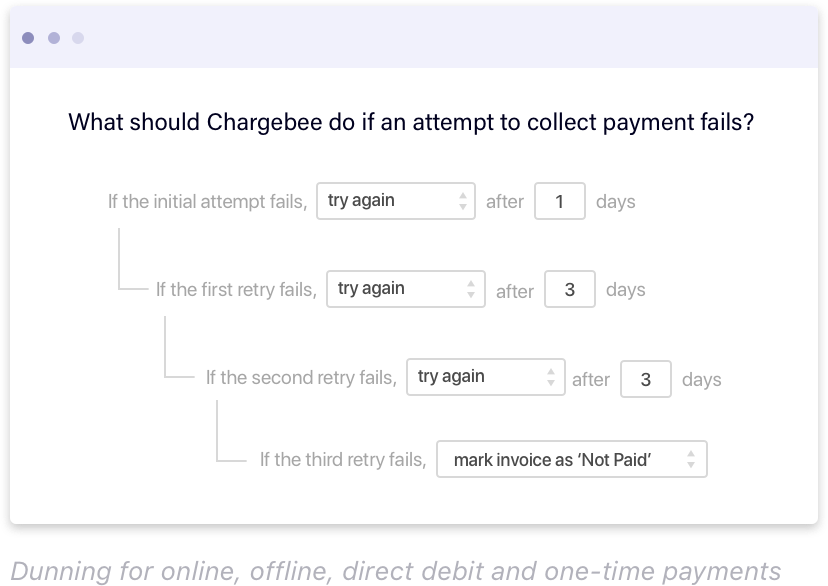

Churn Management

Churn Management

Curb involuntary churn with optimized retry strategies for recurring payments. Retry failed payments at a suited time based on your customers' transaction history. Send email notifications decoupled from retry attempts that don't annoy customers.

with Chargebee.

Speak Your Customers' Language

Tailor the billing experience around your customers' local language. With Chargebee and Adyen, localize email notifications, invoices, customer portal, and checkout pages easily.

Automated Taxes

Navigate through tax regulations easily with Chargebee and Adyen. Global tax profiles are applied automatically based on your customer's billing or shipping address. You can apply multiple taxes that cater to specific regions. Let global tax rules be one less thing to worry about.

GAAP Compliant Revenue Recognition

Recognize revenue every month, determine pending revenue to be recognized for a subscription period and obtain a monthly account summary report with Chargebee and Adyen.

Track Key Metrics with RevenueStory

With RevenueStory, gain real-time insights into your business's performance with slice and dice reporting. Review metrics that really matter to your business and power up your strategies to gain momentum in growth. From checking your MRR to ARR, or getting churn reports, build a dashboard that's customized just for your business.