Enabling Agile Finance: The Strategic Toolkit for Modern CFOs

The ‘agile approach’ is commonly used when talking about product development or GTM functions in SaaS. In companies where finance and operations are an afterthought, people and tools are typically brought in when their problems break loose.

And that’s already too late.

Having an agile finance function is essentially growth planning.

“When you ask founders what GTM means to them, people often say GTM is sales and marketing. It’s our view that GTM is every single function within the business. That also includes finance and operations which enable and support scalability and growth.”

– Joyce Mackenzie Liu

Modern CFO & Founder of Pegafund

But with growth, comes competition. Companies which have outgrown their peers have been consistently agile in the face of unexpected changes and have evolved their strategies accordingly. For example, Superfoods Company leveraged pricing experiments to increase subscriptions during the pandemic and achieved 4x growth in revenue within 12 months.

A CFO in a high-growth business needs to look at the business cross-functionally and react to changes proactively. They need to set up processes that can accommodate near-term growth spurts and long-term strategies.

“The ultimate question is what can CFOs do today to future-proof the finance function for tomorrow.”

– Krish Subramaniam,

CEO, and Founder of Chargebee (source)

And that’s why CFOs obsessing over having the right tech stack directly enable growth by future-proofing their business to scale seamlessly. “The right team members and infrastructure at the right time can be a game-changer, accelerating growth.” says Mike Beach, CFO, Chargebee.

A robust tech stack lays the foundation for future growth, providing the regulatory and reporting framework you need, the data management and automation your teams need, and the flexibility and scalability your business requires. CFOs who recognize the importance of building a sound tech stack play a strategic role in their company’s growth.

In this blog, we will look at how CFOs can drive agility within an organization and the complete toolkit they can use to go beyond financial planning to the realm of business strategy.

How can Modern CFOs Drive Agility Within an Organization?

Here are three ways CFOs can drive agility within their organizations from day 0.

Set up processes for revenue visibility and predictability

In a high-growth environment where multiple initiatives compete for time and budgets, it’s imperative to set up processes that provide revenue visibility and predictability – which are inarguably the drivers of growth in SaaS businesses.

Align your revenue operations

Connecting the cash and the cost of the business with the revenue generated is a plausible expectation from every finance operations team, albeit a tricky one. There are several gaps to fill, and as the company grows, the gaps become harder to plug. If you don’t want to wait that long, start here: Automate your revenue operations.

Map processes between people and tools

As your organization grows from startup to scaleup, it’s critical to have a single source of truth across the business. As you onboard more team members and begin using different tools, things can get chaotic quickly. When discussing a cross-functional metric, are you sure everyone is looking at the same number?

Given the rapid pace of change in the SaaS industry, implementing the right toolkit for finance-led business planning provides CFOs the opportunity to be adaptive – pre-empt changes and plan for it – and in turn, allows their organization to react quickly to new opportunities. Let’s look at what modern CFOs need in their arsenal to unlock strategy in finance.

Tools for the Strategic CFO

We spoke to some finance professionals who have thrived in changing business landscapes and noticed that their agility was strongly supported by the tools they used. Their tools are divided into two categories,

(1) Automation Tools

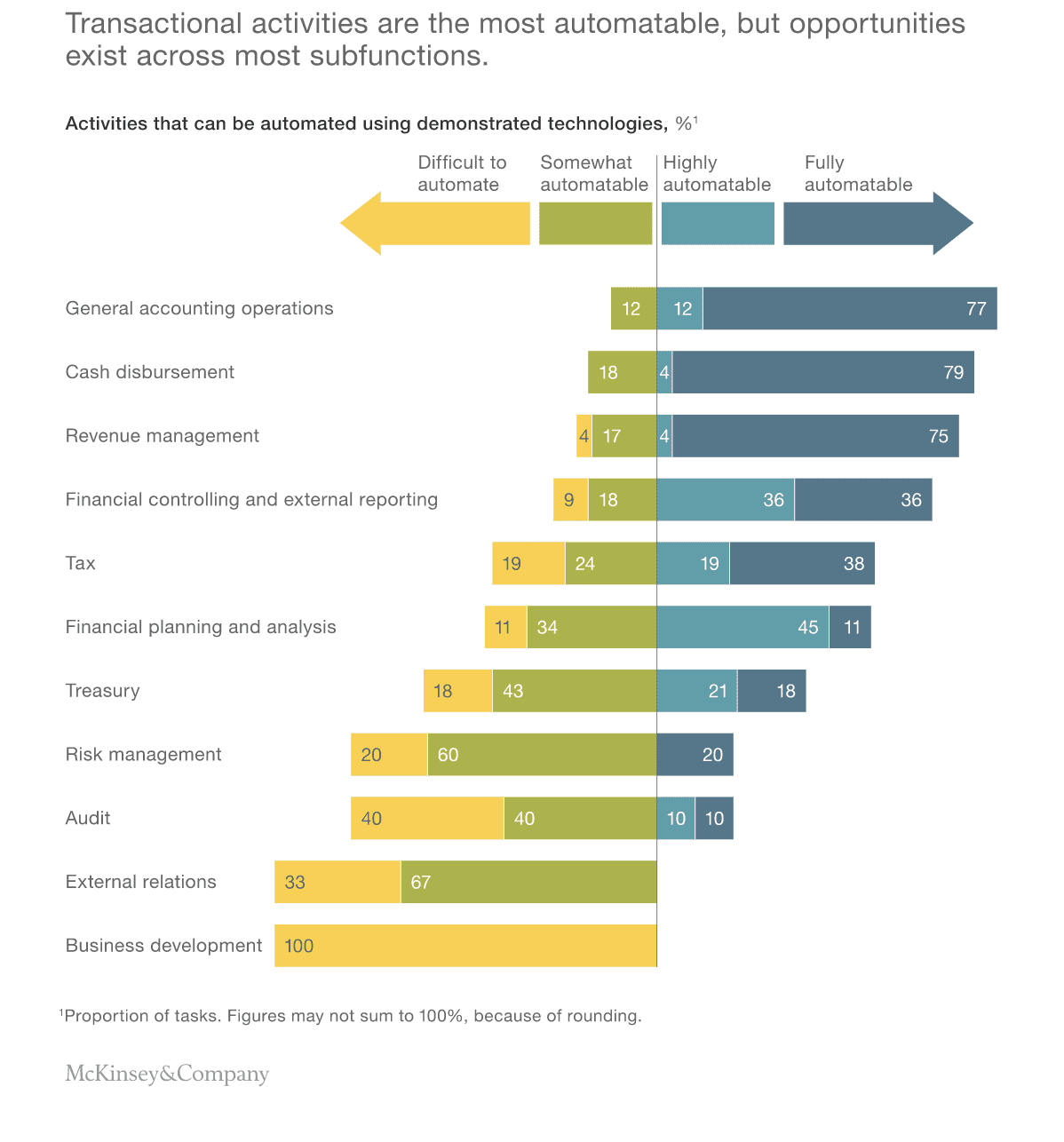

According to McKinsey, about 40% of finance activities can be automated. With the rapid growth of digital technologies, we can only imagine this number increasing.

Automation tools can be useful in 4 functions within the finance teams. They are,

Accounting

SaaS accounting could be quite an arduous task. Mid-cycle changes such as cancellations, upgrades, pauses, and downgrades add an extra level of complexity to this accounting. (You can read more on this in our ‘Complete Guide to SaaS FinOps’).

Implementing automation from day one for repetitive processes such as accounting for recurring billing or reporting gives the finance teams more time to concentrate on tasks that require strategic decision-making.

Popular accounting software include Quickbooks and Xero.

Payroll

Payroll software helps track employee time and attendance, improves compliance, withholds the appropriate tax, and generates tax forms. Automating payroll can not only help one stay compliant but also ensures regular payout for the employees for their work. Gusto and Namely are some of the widely used software for payroll.

Customer Payment Processing

The global average rate of cart abandonment in 2020, is 75.6% – Truelist

Truelist conducted a survey of cart abandonment rates in 2020 and found that the global average is at an alarming 75.6%! Apart from the general cold feet of customers, the other biggest reason is the unsupported payment method.

Siloed payment solutions may not suit or adapt well to the specific needs of merchants and marketplaces. Moreover declined transactions and long latency times for approvals can damage the goodwill and reduce customers’ lifetime value. This can be avoided by integrating multiple payment support. Many fast-growing companies rely on multiple payment gateways to expand into new markets, geographies, and industries.

Drawboard, an Australian PDF markup software company, caters to different geographies. A portion of Drawboard’s customers preferred paying via wire transfer along with card payments. With Chargebee’s multi-currency support, the team was able to have ‘local financial representation’, which allowed for transfers across borders far easier. This way, they could gain new business from markets across the globe.

Billing Intelligence

The core business of billing software is to efficiently process, collect, and account for money paid by customers. In matters of recurring billing with upgrades, pauses, and downgrades, billing gets very complicated. That’s why it’s important to think beyond a billing software that processes payments to a billing intelligence platform with many integrations and ties in different business functions together.

Chargebee offers a platform for SaaS businesses to not only manage recurring billing but also helps manage other aspects such as the lifecycle of the business, dunning, and churn prevention. It also helps sync data between other sales and accounting automation software. A Forrester study found that real-world businesses who use Chargebee receive 207% return on investment (ROI) while realizing a 15% improvement in customer retention.

(B) Reporting & Analysis

Forecasting

The modern CFO needs a single source of truth that could help highlight the right data and the right insights in a useful way, be it an audit or a board meeting. This can help in experimenting, financial analysis, and forecasting consistently. Based on your metrics, your financial forecasts need to be altered to match the changing scenarios every quarter.

For example, Rise Vision used third-party analytics tools that showed invoice-deep data. Since they ran their metrics on invoice information, their MRR was not a true representation of their revenue numbers as it did not take into account information such as promotional credits — something that Rise Vision issued in abundance to push for better product engagement and higher renewal. Chargebee’s RevenueStory provided a 360-degree view of the transaction and customer-level metrics. With the help of this, the team at Rise Vision saved 50% of their time that was spent in reconciling numbers earlier.

Data Visualization

Organizations today have access to more quality real-time data than ever from internal and external sources. Thanks to the wide array of analytical and cognitive technologies available for finance organizations, these teams are able to provide critical information for organizational decision-making. However, this story knitted by data might not be coherent to all the stakeholders.

Here’s where data visualization comes into place. Data visualization helps complement analytics and related data-crunching tools to provide user-friendly reports tailored to a specific audience. This gives clarity and helps to convey the same story to everyone across the organization in a way they would understand.

Today’s technology offering in the area of visualization tools falls under three main categories.

- Design-focused visualizations: These tools are quick to set up, offer multiple capabilities, and have access to data from different parts of the organization. It is a great choice for an organization that is beginning to familiarize its teams with visualization due to its ease of usage. Vendors include Tableau, Qlik, and others.

- Business Intelligence tools: They are broader in their nature and include vendors such as IBM, Oracle, SAP, etc. They can address complex platform needs but might need IT support to integrate these tools with underlying data and related applications.

- Open-source tools: D3 is one of the best tools for this purpose. It requires certain levels of competencies in JavaScript, HTML, and other coding languages. Open-source tools help develop interactive visualizations within websites, such as interactive maps, demographic trends, and other forms of data-driven insights.

Enterprise Resource Planning (ERP)

While traditional ERPs are not equipped to match the needs of the new age CFO, next-generation cloud-based ERPs such as SAP S/4 and Oracle Fusion, change the name of the game. These systems offer capabilities to handle large amounts of data and provide real-time analytics for an enhanced user interface. They also offer a simpler data model and enable easier integration to help build agile finance capabilities.

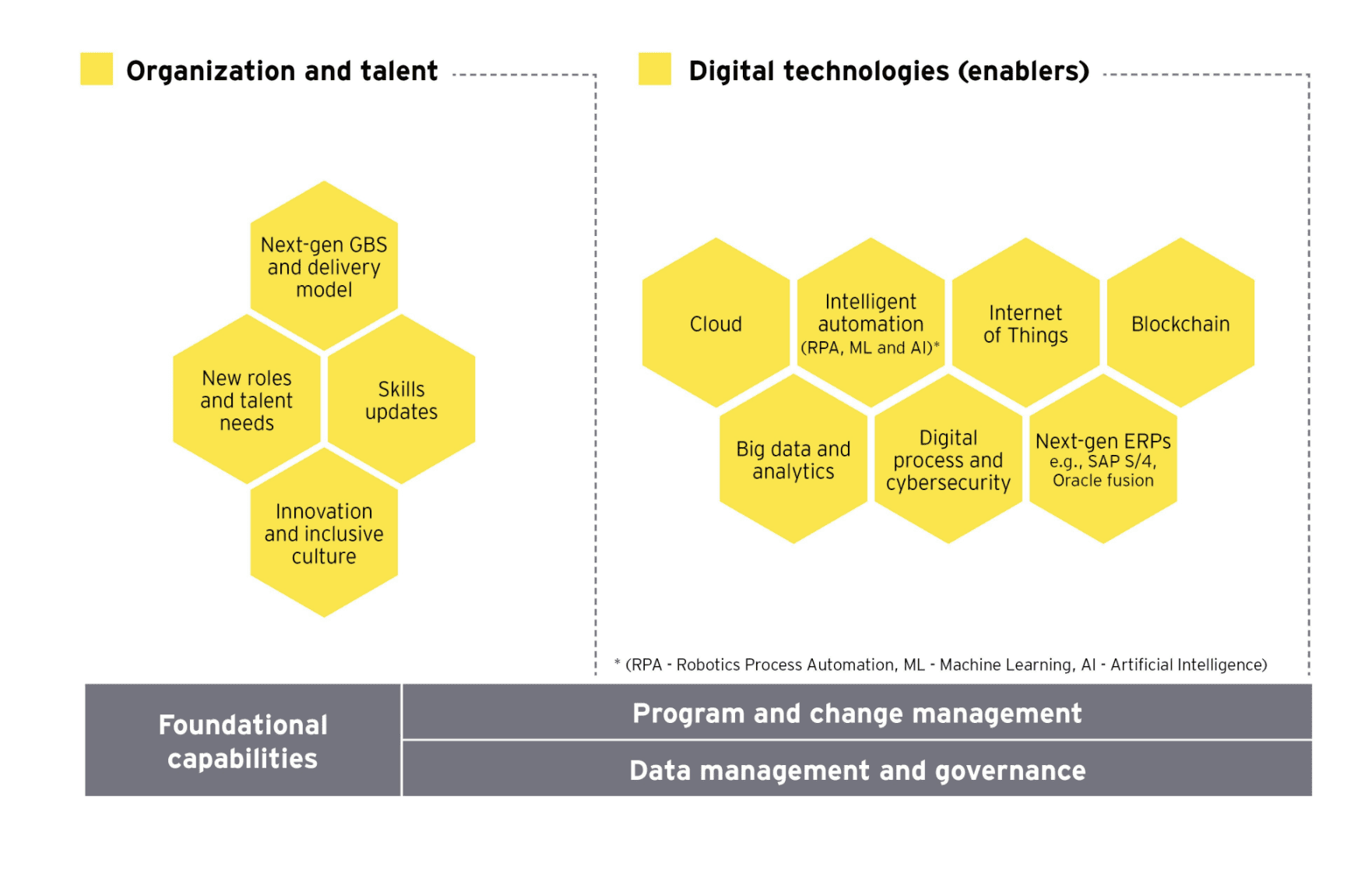

Ernst & Young suggests that to become truly agile, finance leaders need to think about automation technologies that will embed intelligence in the manual processes.

As any business grows, the complications it faces increase. And to combat those complications, the once traditional role of the CFO has evolved.

The modern finance leader is expected to straddle all three responsibilities- accounting, strategic finance, and leading the function – with finesse. And the cornerstone to said finesse is an integrated toolkit. The authors of the book Nine Keys to World-Class Business Process Outsourcing rightfully said: “The value is in the integrated toolkit, not any individual tool.” A cohesive toolkit will be the distinguishing factor from the best CFO to the rest. Hence, a comprehensive financial tech stack – that integrates seamlessly and serves as a single source of truth – should be a CFO’s best friend.

For instance, Chargebee ensures:

- Seamless billing and invoicing

- Consolidated invoices – accurate invoices sent on time, packed with all the relevant information

- Advance invoices – collecting payments for any number of future renewals for a subscription

- Global tax support – staying on top of tax rules in every country that you’re selling to

- Solid accounting integrations from the get-go – smooth pairing with popular finance tools like Xero, Quickbooks, and Stripe

- All the essential nitty-gritty of payments, automated

- Multiple payment options, gateways, and currencies

- Payment reconciliation in 1/10th of the time

- Efficient revenue recovery

- Accurate and real-time reporting – assessing the health of your business at the tap of a button

A cohesive financial toolkit will help shape the strategy of an organization, but it would also enable CFOs to become more agile.

If you’re a strategic CFO reading this and feel pumped up to unleash the agility in you, here’s how we can help drive more accuracy and productivity to your finance operations. You can always get in touch with our experts to know more!