Driving Hypergrowth: Why ‘a seat at the table’ is no longer enough for CFOs

In 2020 legendary investor Warren Buffet invested in an IPO after more than half a century. He hadn’t invested in an IPO since investing in Ford in 1956, choosing to stay away from them because of all the hype involved.

The company that made him change his thesis was cloud data warehousing firm, Snowflake which raised $3.4 billion, making it the largest software IPO in history. It was a bet his firm Berkshire Hathaway didn’t regret making, having more than doubled its $800 million bet on the listing. But Snowflake was worth all the hype around it and then some. From revolutionizing the data warehousing industry with its cloud data platform to its unconventional pricing model, Snowflake wasn’t afraid to challenge the status quo to get on the hyper-growth path. Currently, at a jaw-dropping valuation of $68 billion, the company has an annual revenue run rate of over $700 million, a record-breaking net retention rate of 168%, and over 4000 customers (186 of them Fortune 500 companies). All this in just six years! Yes, you read that right! It’s the kind of hypergrowth that most firms would kill for, but few can manage.

Shifting gears from being a start-up to the hypergrowth phase is challenging. Companies need to make informed decisions to adapt to rapid and constant changes and then implement new strategies. Agility allows companies to adapt to disruptive changes and leverage growth opportunities ahead of their competitors. More so if you are in the fast-growing world of SaaS. With enterprises accelerating cloud adoption, SaaS, the largest segment, is expected to touch $145 billion by 2022, growing 40% in two years. But hyper-growth attracts a lot of competition, and to stay ahead of the pack, your company needs to be agile and adaptive. As a CFO, you need to be at the forefront of building that agility across the organization and driving change. “CFOs are now Chief Growth Officers. It’s essential to be able to execute with precision in times of rapid change. CFOs play a critical role in driving revenue visibility and predictability, therefore a key influencer in a company’s go-to-market strategy,” says Joyce Mackenzie Liu, founder, Pegafund, which provides strategic CFO services to B2B software start-ups.

So, how can you ensure your company’s transition to hypergrowth?

Managing the Messy Middle

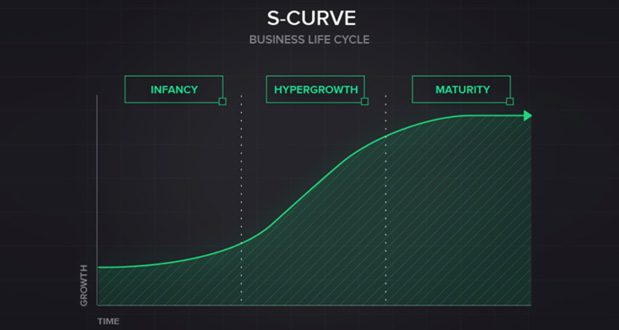

The term “hypergrowth” was first introduced by Alexander Izosimov in a Harvard Business Review article in 2008. He described it as, “The steep part of the S-curve that most young markets and industries experience at some point, where the winners get sorted from the losers.” The companies that manage to ride this wave successfully are the ones that not only are agile but also adaptive and can scale when explosive growth opportunities come their way. For instance, Zoom saw a 30 x surge in its user base at the onset of the pandemic as the world worked and studied from home but more importantly, it saw the number of paying business customers saw a 6x increase. Zoom’s ability to scale and leverage the once-in-lifetime opportunity by introducing new features for B2B usage saw its revenue soar by more than 3x to $2.6bn; profits increase by 33x. To ensure continuous scalability, companies need to navigate unpredictable landscapes and seldom have the luxury of following a set roadmap.

As businesses become more competitive and global today, CFO’s remit extends beyond just gatekeepers and cutting costs. Reporting, closing the books, and driving cost efficiency are no longer enough. A CFO with a “financial reporting mindset” tells his organization what happened. But in a fast-growth environment, financial reporting tunnel vision can be a liability and often lead to missed growth opportunities.

Steering the Ship

In a hypergrowth environment, speed is everything but speed without direction will not set up the company for long-term success. CFOs now have the vantage point to provide that direction. “By leveraging real-time data from multiple sources, both internal and external, CFOs are uniquely positioned to help businesses understand and predict the outcome and trade-offs for any strategic decision that can impact growth under multiple scenarios,” says Narasimha Kini, Head of Finance, EXL which specializes in operations management and analytics. CFOs now have the ability to monitor the impact of these growth initiatives in real-time and can course-correct at any time, thereby playing a crucial role in setting the future direction of the business. So, CFOs have evolved from their traditional role which focused more on accounting, tax, financial reporting, internal controls, budgeting, and risk management to becoming Chief Growth Officers playing an integral role in strategic initiatives, be it capital allocation, investment in technology, or GTM plans. “By creating a culture of visibility, the CFO can drive a deeper level of accountability and alignment across the organization and help transform the company’s revenue potential,” says Bill Tobia, CFO, Edmunds GovTech, which delivers ERP solutions to local governments in the US.

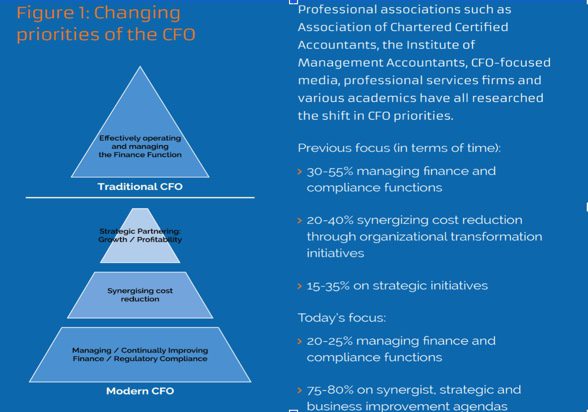

Over the years, the role of the modern CFO has become more strategic, with managing finance and compliance functions taking up only 20-25% of their time. “Earlier, I spent 40% of my time on compliance, but today I wouldn’t be able to do my job that way. COVID has accelerated the change as well. We have learned more in the past year than what we did in the past five years,” says Fuad Ahmad, CFO, Chargebee.

CFOs are more focused on setting the future direction of the business, influencing operating decisions, and messaging the market and investors. “Today’s CFO is expected to make decisions that will impact the business for the next five, 10, 15 years. The complexity of the job has grown a lot,” says Chris Dimuzio, leader of PwC’s finance transformation practice.

Preparing for Hypergrowth

As CFOs you need to create adaptable business models that can react quickly to changing market conditions and leverage every opportunity that the change may bring. So, you need to invest in technology that adapts and scales with your business. As you grow, your finance workflows become more complicated. Before you know it, your team juggles accounting, financial planning, managing the revenue cycle, ensuring tax compliance, and meeting regulatory requirements. You need a revenue infrastructure that helps automate many effort-intensive and repetitive tasks. Automation also goes a long way in eliminating inconsistencies and plugging revenue leaks. But most importantly, automation saves you precious time, so you can focus more on driving strategic initiatives such as increasing revenue, expanding into new markets, experimenting with pricing, and improving profitability.

For instance, in SaaS, geographical expansion is a no-brainer because there are no limitations on where you can sell your product. But international expansion means you have to worry about regulatory requirements, numerous payment methods, and tax compliance. Your tech stack should enable you to do so without having to worry about regulatory requirements like tax and payment compliance. Freshworks partnered with Chargebee to scale across multiple products, geographies, and industries. They were able to offer multiple payment gateways, localize experiences, and streamline their product catalog, which helped them bundle products together. Having one view across products and customers helped the company scale from 500 to 50,000 customers across 120 countries. Since 2018, Freshworks has seen a 3x increase in ARR to $300 million and a valuation surge to more than $3.5 billion.

As CFOs, you are also looking to align capital with growth opportunities with the highest ROI in the long term. So you need a single source of truth for data that helps you understand all the business components and how you can optimize them. You need those critical insights to see what drives incremental results for the company and can be scaled up. “You need to ensure you have complete revenue visibility with robust integrations with your CRM, customer support, billing and invoicing, and expense management systems. This way, your customer and employee lifecycle is integrated across the business and enables you to be agile in your go-to-market strategy,” says Pegafund’s Joyce. In a hypergrowth environment, data becomes critical for speed of execution and business performance.

Many hypergrowth companies leverage technology to make data-driven scaling decisions. Having the right technology in place enables CFOs to improve their speed of execution. Paul Kapsner, Director of Finance and Operation at Superfoods Company that sells natural plant-based products, roughly takes 30 minutes to decide on a pricing level and launch a new product with Chargebee. The ability to experiment saw SuperFoods increase its revenue by 4X in less than a year, expand its product line from one to five products and their subscriber base to over 200,000

A common thread that runs through these hypergrowth companies is that they had the right technology to manage constant internal and external change. As the CFO, you are the best person to lead an enterprise-wide alignment and transformation. You can leverage data and technology to become more efficient and derive insights to identify opportunities to fuel growth or even adapt to new business models.

Check out how we can help your company get on the hypergrowth path. You could be the next one that catches Warren Buffet’s attention!