Why SaaS Finance Controllers Deserve a Seat at The Table

As a new-age finance controller in SaaS, you’re no longer just a backstage coordinator.

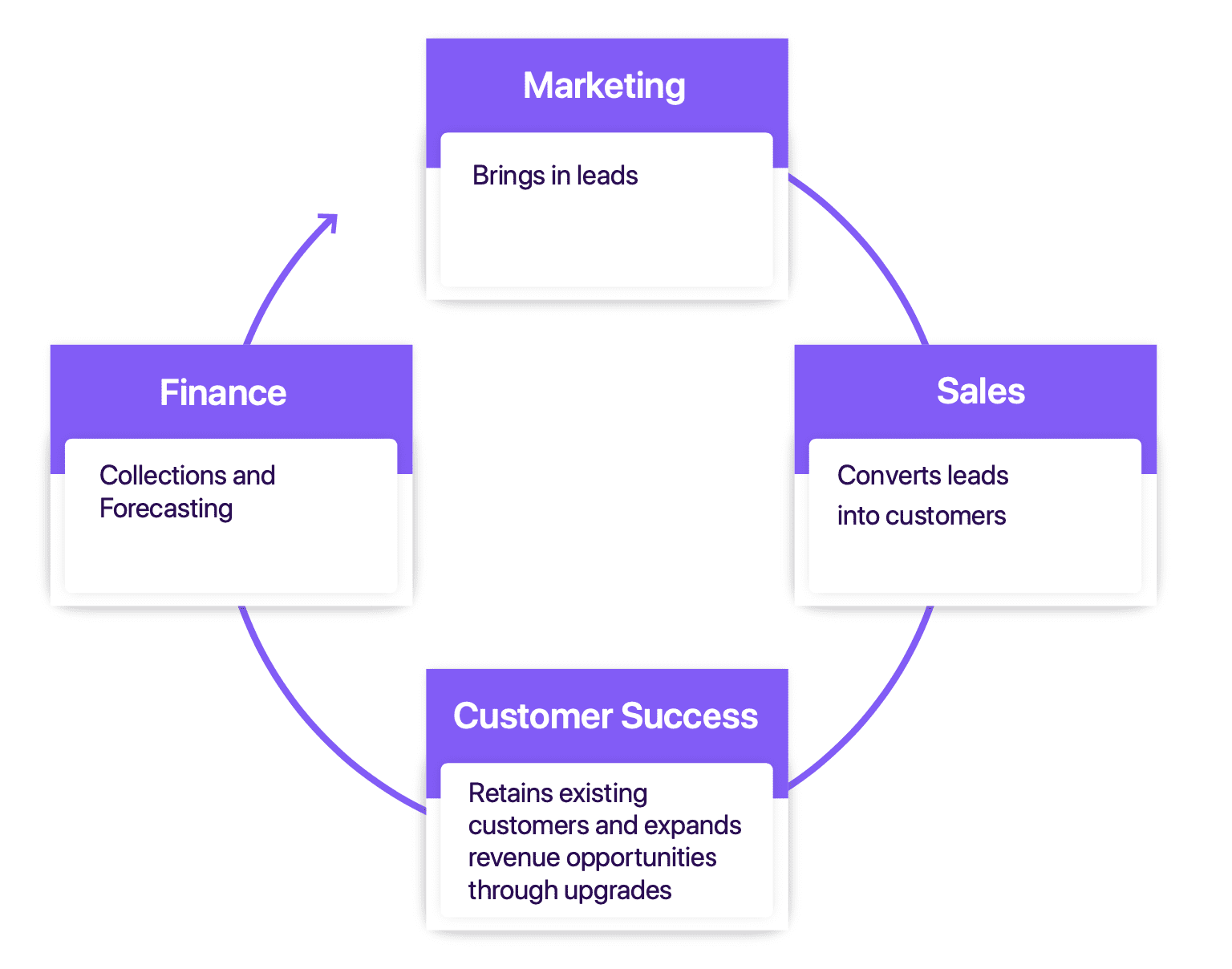

In SaaS, success is defined by how long customers, rather subscribers, are retained, one billing cycle after another. This amplifies the revenue implications of every function, including a traditionally back-end function such as finance, through every recurring cycle.

As a finance controller in SaaS, you have a key role to play in the revenue engine, and to do so efficiently you should be well prepared to take on the challenges that the SaaS world presents.

Take Russell Lester, for example. Russell is the CFO of Calendly and has played a key role in the company’s hypergrowth. According to him, it is absolutely essential for aspiring CFOs to familiarize themselves with the moving parts of the business operations and how to optimize them. Russell is just as comfortable measuring the effectiveness of the top-of-the-funnel activities as he is tracking the key SaaS metrics.

You can find out all about his journey of becoming a modern CFO here.

What does a Modern Finance Controller Look Like?

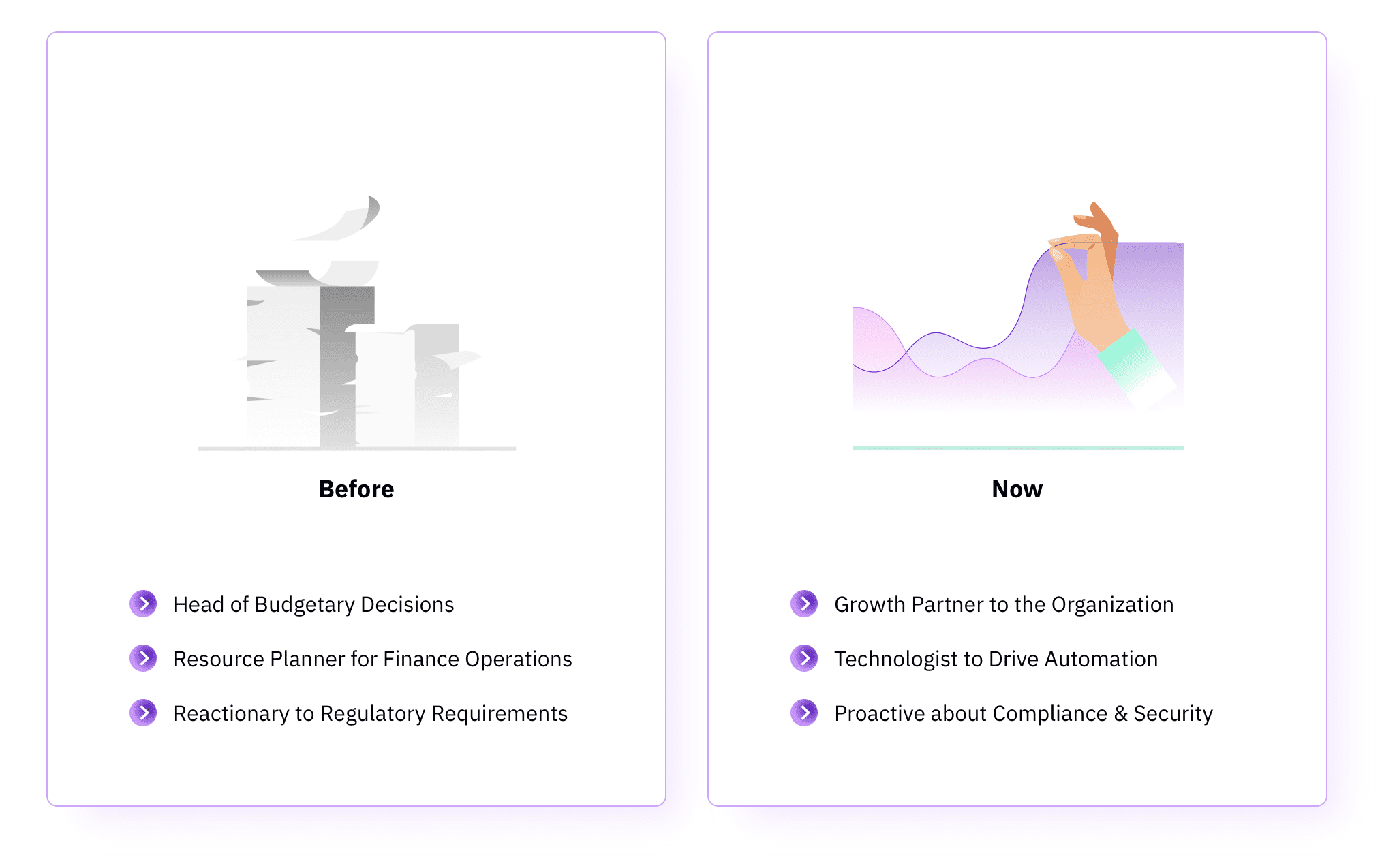

While there’s no denying that activities like bookkeeping, budgets, resource planning, and keeping track of regulatory best practices are critical to business operations, finance controllers of fast scaling businesses need to go above and beyond.

“Today’s finance leaders must break away from the number-cruncher stereotype and think of themselves as more of a strategic player in the company. There will always be a need for someone to balance the books, crunch the numbers, and perform critical routine tasks but the role is much more dynamic today.”

– Bill Tobia, LLR Partners’ Managing Director of Strategic Finance (source)

But to become a strategic partner, you must break free from the traditional, inflexible systems that slow you down by creating broken and messy workflows.

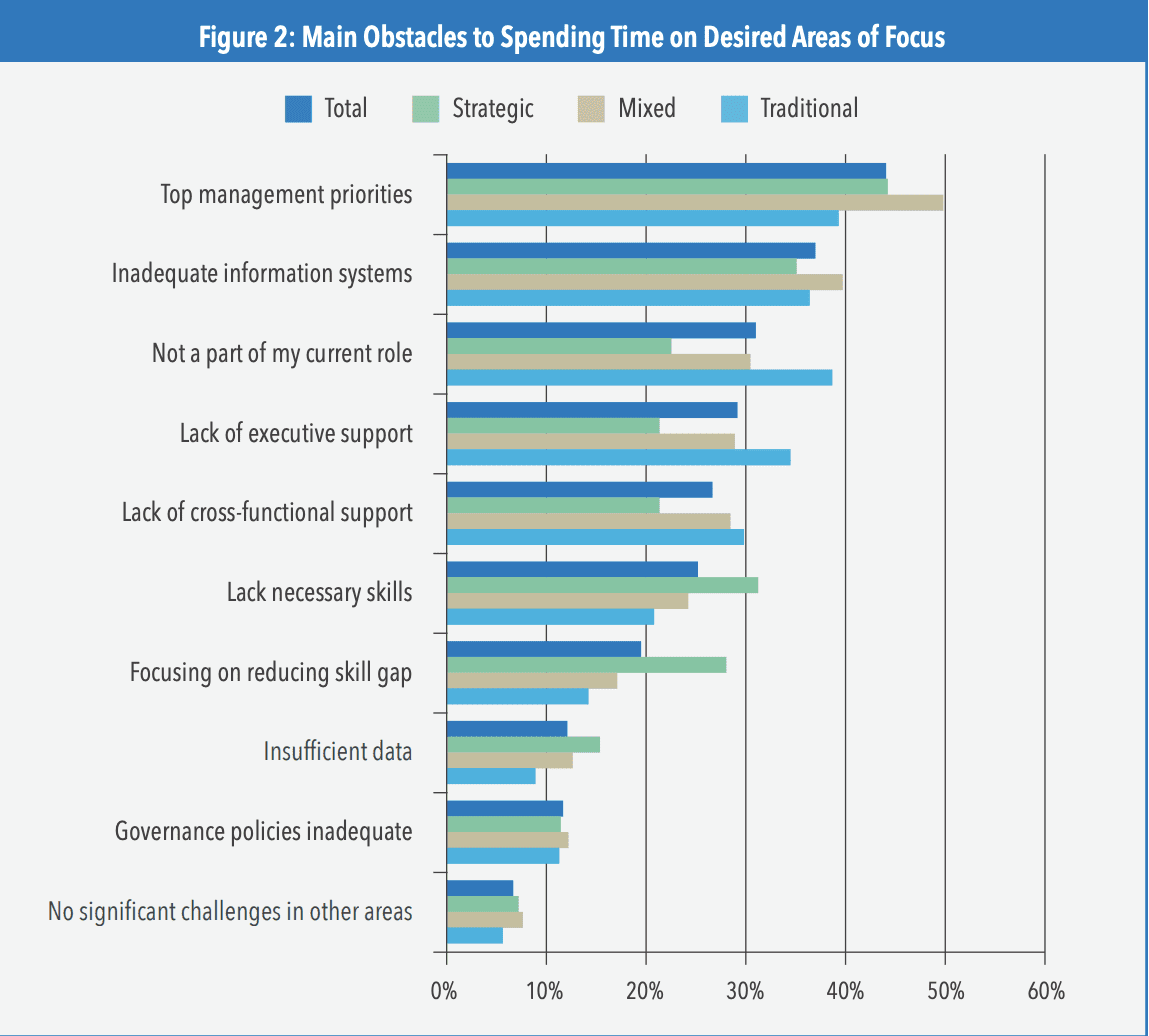

Here are some more factors that stop controllers from spending time on strategic initiatives:

(Source)

These time-consuming and error-prone activities can and should be automated. This will enable you to spend more time to partner with strategic leaders in the organization, analyze and preempt future trends, and lead transformation to keep the business on the right track.

In this blog, we will look at four key areas you need to keep in mind to successfully gain a much-deserved seat at the table:

- Subscriptions and recurring billing make SaaS finance complex, much beyond the scope of traditional finance operations.

- Spreadsheets are not enough. Think automation before you lose a reasonable chunk of revenue to manual errors.

- In numbers we trust! Identify and measure SaaS finance metrics that matter.

- Measuring metrics is only meaningful when used to derive meaningful and actionable insights.

Managing Complexities in Subscriptions and Billing Operations

If you’re a finance professional, you already know that things get crazy at the end of the month. Only in SaaS, it’s a bit more complex, with refunds, promotional credits, reversing taxes, changes in subscriptions. And let’s not even get started on reconciliation.

With recurring revenue in play, the cash flow in SaaS is a different ballgame. Walking this tightrope becomes easier if there’s a seamless mechanism for Account Receivables and to improve recovery by using dunning.

The impact of expansion is heavier on the finance team since any changes in the workflows have critical revenue implications and require expert change management.

A subscription management platform can simplify your finance operations by:

- Integrating your finance and revenue management toolkit for accurate revenue recognition and reporting.

- Standardizing your accounting with the changing finance landscape.

- Automate global tax management for every country, state, and city you’re selling to.

Scaling processes efficiently is a challenge for finance since the existing processes and stack are often inflexible and unscalable.

The FinOps team should preempt the requirements for their next stage of SaaS growth and be equipped for efficiency.

Traditional Finance Operations Are Not Cut Out for SaaS

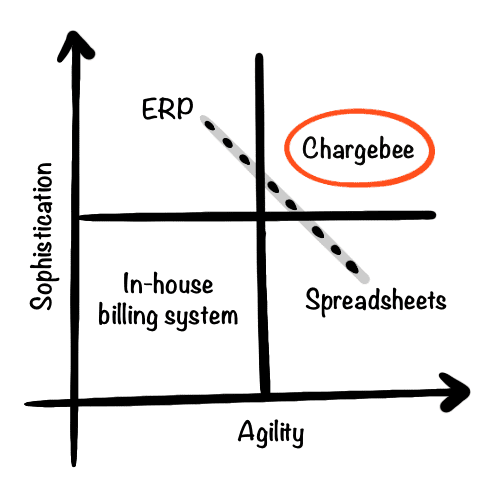

At the early stages of a SaaS startup, the priority is to acquire as many customers as possible and to improve the adoption rate. At this stage, there may not be a full-fledged finance team in place yet and spreadsheets are just enough to keep track of your SaaS. But as the organization scales, finance workflows typically become more complex and susceptible to errors. You need enterprise-like sophistication while still maintaining your agility.

Relying on spreadsheets as you continue to scale is a short-term approach that soon leads to disconnected sources of data, missed insights, misalignment among business functions, and ultimately, poor and delayed decisions.

With scale, your revenue workflows inevitably develop some cracks and leaks. The key to plugging these leaks is to automate repetitive tasks. Check out our SaaS Finance Ops Maturity Model which prescribes the ideal workflow at each stage of growth of your SaaS.

So bid adieu to spreadsheets and start thinking automation. It’s time.

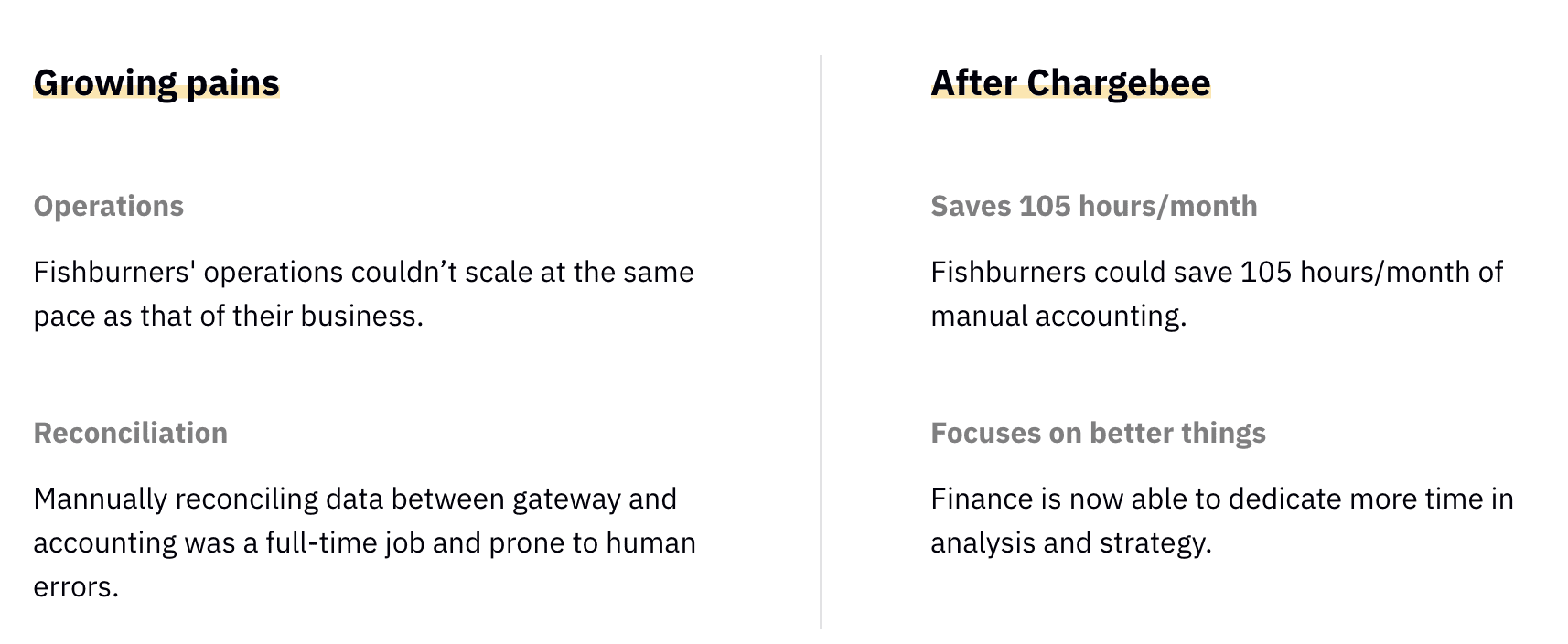

Take Fishburners, for instance. They spent 25+ hours a week in manual accounting work. Managing fast-growing subscriptions across geographies was a challenge too. After automating their accounting with Chargebee and Xero, they ended up saving 105 hours a month, opening up time for analysis and strategy. They also scaled to three geographies seamlessly! You can read more about Fishburner’s story here.

Measuring SaaS Finance Metrics That Matter

Efficient SaaS finance operations start with measuring what matters. Traditional finance metrics aren’t a good indicator of performance because they simply don’t work for a recurring revenue business model and do not provide a complete picture of the state of affairs. As a finance controller of a fast-growing SaaS, you need:

- An understanding of SaaS metrics to be tracked and why

- GAAP financials that, when enriched with SaaS metrics, provide actionable insight

There are two types of metrics that can give you a 360° view of your SaaS: standalone metrics and relationship metrics.

Standalone metrics such as MRR, ARPU, Churn rate help you take stock of the health of the organization at any given point of time. Whereas relationship metrics such as LTV/Customer Acquisition Cost, Payback Period, MRR Retention Cohorts help you understand the progress of a particular metric with respect to another.

Interpreting the metrics is as important as tracking them. Check out our subscription metrics analytics tool to nail down what is affecting your revenue now.

Unearth the Story Weaved by Numbers

When you step into the shoes of a SaaS finance controller, a ton of questions wait for you: Am I making more money than I’m losing? What’s my day-sales-outstanding? How much is being lost to churn?

Keeping track of these individual metrics can be a nightmare if you do not have consolidated analytics templates and dashboards set up and ready to use.

With a strong analytics platform in your armory, you will be able to:

- Derive actionable insights about your subscription business with billing, leakage, and transaction analytics

- Identify and seal revenue leakages

- Get a single view of your business’s growth and risk stats

Check out Chargebee’s Revenue Analytics to see how you can get a holistic view of your SaaS analytics.

Make Way for the Strategic Controller

By focusing on these key areas, you get to venture beyond to a more strategic role that partners with the CXOs in steering the business in the right direction.

It can be challenging, but it is equally enthralling as you realize that you have a seat at the main table and how directly you impact the growth of your SaaS. So fasten your seatbelts and prepare to ride the SaaS wave.

Chargebee integrates seamlessly with the tech stack of your core business functions and helps you manage pricing, automate recurring billing, tax management, reconciliation, and revenue recognition. Understand how Chargebee can help streamline your Finance Operations by scheduling a demo with us today.