Winning the Recession: The 5 Metrics that Every CFO Must Keep In Mind

On the sunny morning of June 8th, 2020, the National Bureau of Economic Research notified that the longest expansion in the US economy which began in 2009, has come to an end. They also officially confirmed that from February 2020, the US has been sliding into a recession. To be considered a recession by the bureau, an activity should have a considerable depth of contraction, duration, and diffusion of the downturn across the economy and last more than a few quarters.

In the case of the 2020’s recession, the bureau was quoted saying. “The pandemic and the public health response have resulted in a downturn with different characteristics and dynamics than prior recessions”. The unique nature of this recession makes it even harder to predict the future state of affairs.

But all is not hell in the home turf. SaaS provides solutions that are agile, accessible, cost-effective, and easy to implement which makes it sell like hot bread in the background of the current economic conditions.

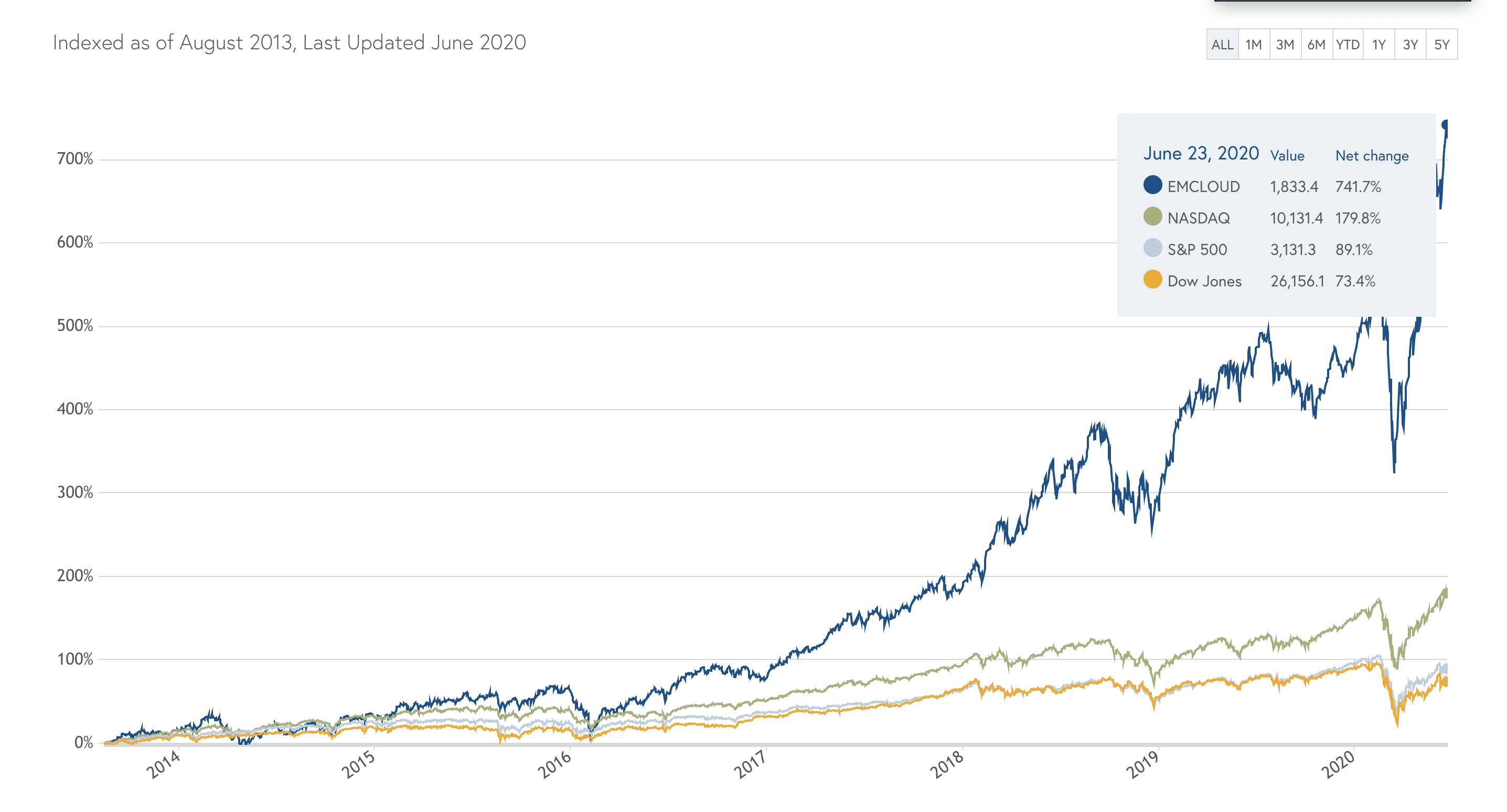

Some SaaS products which facilitate remote working like Zoom or Slack, have seen a tremendous adoption rate. Investors want to buy stocks of anything digital which fits in squarely with the description of any SaaS company. The overall digital transformation also excites investors in the future of the economy (and their stocks), leading to increased valuations for SaaS companies. This mindset is reflected in Bessemer’s Cloud Index which updates on a day-to-day basis.

SaaS experts have commented that, as more people feel the weight of the recession, some of the SaaS companies might face increased rates of churn. However, SaaS still seems to be a good investment at least as a part of a bigger business model. Bessemer released the 5 C’s of SaaS finance after the great recession of 2008. Some insights from the report can still resonate with the current times and help SaaS businesses stay ahead of the curve. We have taken inspiration from the report’s anchoring metrics but have modeled them to fit into a new age pandemic fuelled recession.

The 5 C’s you need to be aware of to save your business during a recession are:

- Committed Monthly Recurring Revenue (CMRR)

- Cash Flow

- Customer Acquisition Cost (CAC) Payback Period

- Customer Lifetime Value (CLTV)

- Churn and Renewal

1. Committed Monthly Recurring Revenue (CMRR)

“When CMRR is designed correctly, it can help identify the customers who can benefit from increased usage limits or other related products (opportunities to up-sell), customers who are under-utilizing the solution, and could probably churn (at-risk revenue streams).”

To gain clarity, many SaaS businesses might turn to the value of the contract or even Monthly Recurring Revenue (MRR) but CMRR is more insightful as it is a prediction metric that combines recognized revenue, MRR, new bookings, churn, downgrades and upgrades. To explain this further let’s look into a few of the related metrics.

The duration of the contract is one such metric. It wouldn’t be a major variable but if the cash collections and monthly subscriptions are volatile, then one needs to keep a close eye on both the Total Contract Value (TCV) and the Annual Contract Value (ACV). Even then, the TCV and ACV can be flawed as they over-emphasize the contract duration and miss out on the actual value of the contract.

A major advantage of the CMRR is that it provides the clearest view of the health of a SaaS business and when CMRR is designed correctly, it can help identify the customers who can benefit from increased usage limits or other related products (opportunities to up-sell), customers who are under-utilizing the solution and could probably churn (at-risk revenue streams).

CMRR tracked on a monthly basis it can also help imprint a positive behavioral change across the organization such as,

- Good cadence between sales and product development

- Better sales compensation plans with cash flow alignment

- Heightened awareness around small MRR changes

- A deeper understanding of customer price sensitivity

2. Cash Flow

Gartner conducted a survey from December 2019 to February 2020, when the pandemic was slowly unleashing its claws on the economy. 55% of the tech CEOs in the survey admitted that they have not started preparing for an economic downturn. 43% of the tech CEOs were aware of the problems that a recession would have on their growth and a majority of them tracked revenue growth and profitability. Only a handful of them calculated the ‘cash burn rate’. Burn rate is a measure of negative cash flow where a company’s expenses are greater than its revenue. Gartner suggests that this lack of focus on the cash burn rate has led to severe cash flow problems for companies during the pandemic and resulting economic downturn.

Why is the Cash Flow analysis important?

The one thing that CMRR lacks is in giving a picture of the ‘cash health’ of a business. Cash flow analysis comes in to save the day here. The gross and net burn rate should be analyzed and measures should be out in place to bring them down as during tough economic times the capital will start drying up.

By tracking CMRR, burn rate & cash flow, a company can get to know the true picture of its cash balance and understand the number of months of runway available. CEOs have to track this religiously and implement a variety of insurance plans in consultation with their board members.

In Saas businesses, there is a definite advantage as the revenue is recurring in nature. If the cost of capital spikes or sales metrics deteriorate, decision-makers can freeze hiring, slow marketing spend, or make other relevant targeted cuts.

Keeping the cash flow running positive during hard economic times is very important and means to ensure that has to be put in place immediately. Check out our video series to get more insights on how finance leaders can keep the lights on during tough times.

3. Customer Acquisition Cost (CAC) Payback Period

It stands by the classic adage of “you’ve got to spend money to make money.” CAC is the amount of money spent on acquiring a customer. The shorter the payback period on CAC, the faster your company can grow.

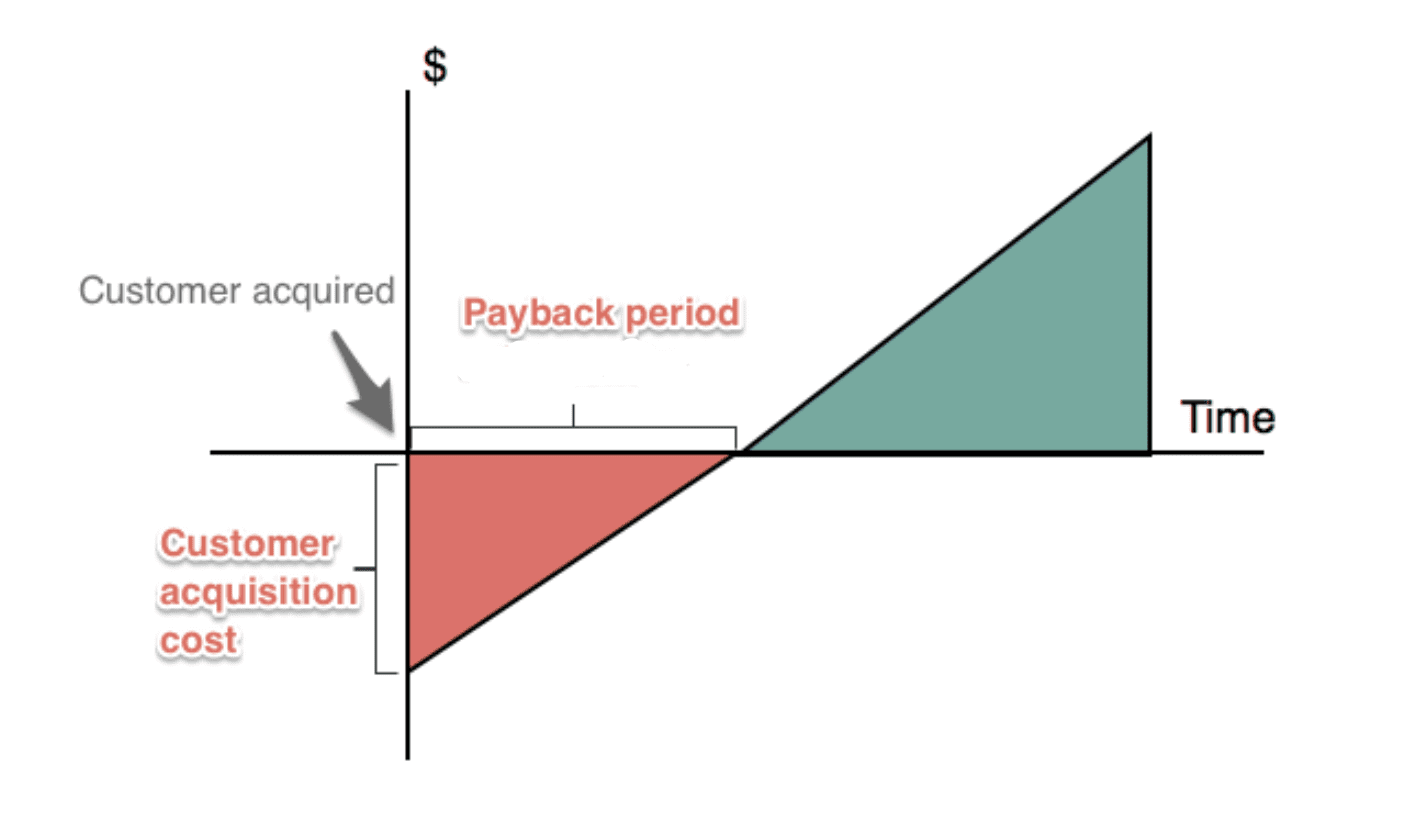

The payback period determines the efficiency of your company’s acquisition model and predicts the amount of time it takes for your company to recover the cost of one customer. Below is a diagrammatic representation of how the CAC payback model works.

Businesses hope to at least break-even on the initial CAC. In the subscription model, as the time increases, the customer eventually pays back that initial cost (seen in red in the above figure) due to the incremental subscription payments. Once the CAC on a customer is redeemed, it is represented by the crossing of the x-axis in the above figure and the green area is the time period where the customer’s payments go towards the company’s growth.

Calculating the CAC helps a company understand its acquisition efficiency for different types of customers and its impact on the finances. It also helps measure the sustainability of the company’s strategies in the long term.

The Ideal Payback period on CAC

The concept of “ideal” could be blurry to many, however, according to industry standards, SaaS startups have an average of 5-12 month payback period depending on their efficiency of operations. When high performing startup SaaS companies break even in 5-6 months, larger companies with more capital could have a longer payback period. In times of recession, these values might slightly fluctuate because there are many internal and external factors that could affect the payback period.

Irrespective of the changes, a company can shorten its payback period either by decreasing costs or increasing value as below,

- Reduce marketing spend: Focus on the niche of your product offering and use it to multiply your organic acquisition.

- Reduce sales spend: Deeply research the market to come to a product/market fit which would enable you to use a self-service model.

- Increase value: Understand your customer’s real pains and increase revenue through relevant up-sells and cross-sells. Up-selling to customers can also be achieved by charging them for their volume of usage and letting them grow along with your product.

- Constantly experiment with pricing: Even industry leaders don’t get it right all the time so make pricing a process of iteration.

4. Customer Lifetime Value (CLTV)

While CAC lets you know the payback period on the cost of acquiring a customer after accounting for the variable expenses or services, CLTV lets you know if the customer is profitable over time. The longer the customer stays in the business and continues to make purchases, the higher the CLTV increases.

When CLTV is taken in relation to CAC, it would help a business measure the ROI of each customer and this could help in setting marketing and sales budgets. It is recommended to have a CAC value which is one-third of the CLTV. This metric also helps you to understand the aspects of your offering that a customer likes which in turn aids in constructing your approach towards the target market.

How to measure CLTV?

There are multiple ways of doing this. It’s always better for a SaaS company to choose the calculation which makes more sense for their business. Few of the ways to do this are:

CLTV = ARPU x Customer Lifetime (in months)

Or, using churn,

CLTV = ARPU/ Customer Churn Rate (in months)

Read more about ARPU

You can read more about optimizing your CAC/CLTV here

CLTV would help to measure profitability. Hence use it to adjust your resource, development, general & administrative expenses.

Building Customer Loyalty in a Recession

During a recession, customers might be unwilling to open their wallets. Providing discounts could be one way of being empathetic to your target market. But not many companies can afford to do this. Another method to build customer loyalty would be to concentrate on what customers are actually looking for.

Offering add-ons that give them a sense of security or any service that would help them get clarity in uncertain times would make more sense to them. For example, along with subscription management Chargebee offers a platform called Revenue Story which gives an in-depth picture of your analytics metrics to gauge the performance of your company.

5. Churn and Renewal

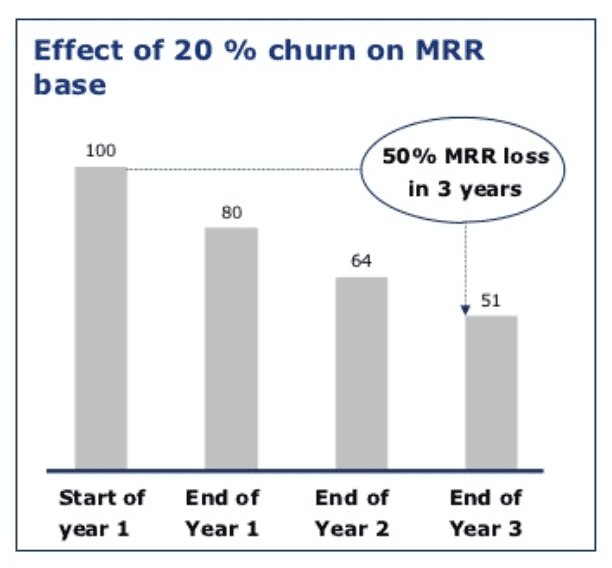

One of the biggest drivers of the long-term profitability of a firm is its renewal rate. But a 100% renewal is not possible in SaaS. Churn happens and if left unattended, can spell doom for a business. For example, when a 20% churn on MRR is left unattended, it grows to a 50% churn rate in a matter of 3 years.

To tackle churn, a deep understanding of the root cause is necessary. It could be pricing, UI, or plain customer dissatisfaction. Either you want to understand what churn rate is, or if you’d want to be one of those people who knew the 5 well-kept secrets of reducing subscription churn, or if you’d like to understand if you’re looking at churn through the right lens, or in a more relevant context if you’d like to know more about how to retain customers when it feels like the whole universe threatens to churn, we have an array of content in our blog page to match your mood.

Addressing Churn

Tracking both gross churn and net churn would help to zero in on the percentage increase in churn, as well as the dollar value lost to churning customers.

Different kinds of churn would call for different actions, however, there are few things that apply to any kind of churn.

- A keen observation of user activity would help understand who might churn. CMRR comes to play a huge role here.

- Observe application usage and try to recognize any trend that suggests the customer might churn. Reach out to them. Try to understand their position and try giving them a solution through pause or downgrades.

- If customers threaten to churn with cancellations, offer them a solution to pause. It is better to pause than churn.

- Keep a keen eye on platform stability and your product’s ease of use.

From earlier studies conducted during the previous 2008 recession, it could be observed that SaaS business models are generally resilient. But no business is bulletproof to a recession, so keeping an eye on these key metrics will help your business stay ahead of the curve even in uncertain times.