PRODUCT

SOLUTIONS

- BY INDUSTRY

- B2B SaaS

- eCommerce

- E-learning

- Publishing

- BY BUSINESS SIZE

- Startup

- ScaleUp

- Enterprise

- BY BUSINESS MODEL

- Self-serve

- Sales-driven

CHARGEBEE RETENTION

Acquisition

What is CAC-LTV Ratio?

The CAC-LTV ratio helps you determine how much you should be spending on acquiring customers. If this ratio is low, you're pretty much burning money in the long run.

CAC vs LTV

Now, before we get into the ratio as a whole, let's break down the components.

Customer Acquisition Cost

CAC is calculated as the total cost of acquiring customers, divided by the total customers acquired over a given period. The 'cost' is your total spend on sales and marketing costs.

For example, if you spend $1000 acquiring new customers in Q1 and acquire 500 customers, then your CAC is $2.

Lifetime Value

And for the Lifetime Value metric, you must first calculate the Average Revenue Per User (ARPU) and your Churn Rate.

Or, you could also calculate it as LTV = ARPU * Gross Margin * Average duration of customer contracts

We have a pretty detailed blog that tells you how to calculate lifetime value (and it comes with a ready-to-use template too!)

Calculating CAC-LTV Ratio

Once you've found the CAC and LTV, you can now calculate the ratio. To do that, you simply divide the lifetime value by the customer acquisition cost.

What is a good CAC:LTV Ratio?

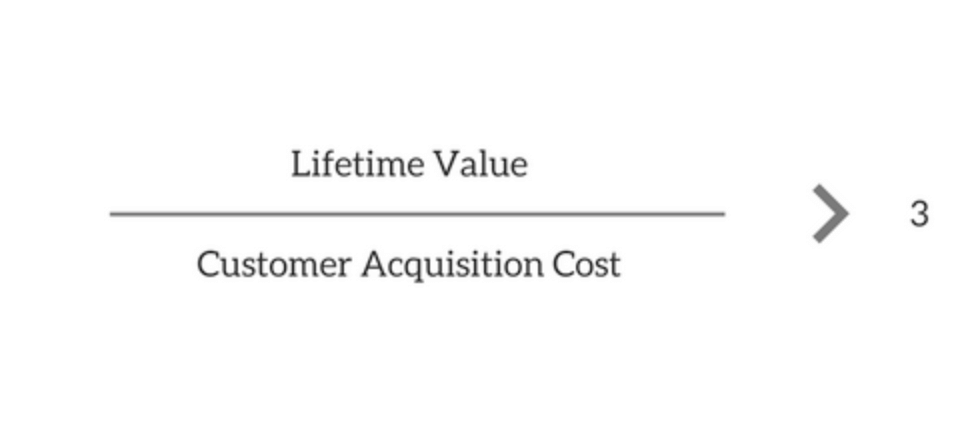

Ideally, LTV/CAC ratio should be 3:1, which means you should make 3x of what you would spend in acquiring customers.

If your LTV/CAC is less than 3, it's your business sending out a smoke signal! It's an indicator to try and reduce your marketing expenses.

How does the CAC-LTV Ratio help?

What type of customers to acquire

An enterprise customer can have a high CAC, but they'll also have a higher LTV since they tend to churn less. It makes sense to look at these enterprise customers, yet the CAC-LTV can help you uncover valuable revenue. For example, in the case of HubSpot, they had two personas: Owner Ollie and Marketer Mary. The former was the owner of a small business and did their marketing. While the latter worked for a slightly bigger company and was in charge of marketing. At first, they concentrated their efforts on Marketer Mary, which had an LTV of $11,125. But later, selling to Owner Ollie through a channel partner produced an even better LTV of $11,404.

How much to spend on acquiring customers

As a subscription or saas business, you'll be spending some dime on acquiring customers through sales and marketing. But how much do you spend? For example, if the LTV of a customer you want is $100, and you're looking to hit an LTV/CAC ratio of 3:1, then you'll need to spend approximately $30 on an acquisition.

Raising investments

If your customers are worth three times the value of the acquisition, then investors are all ears. But the point here is not to parade this metric around. But to show the investors that "this company has a broad product-market fit and its strong LTV: CAC today is likely sustainable at similar levels over time."

How to optimize the CAC-LTV Ratio?

Before optimizing your spend, make sure you've calculated the CAC accurately. If everything is in place, here are a few pointers to help you out.

Focus on the right channels

The channels that bring in many customers aren't necessarily the ones that work. If those customers churn out quickly, there's no point in crying over spent costs––which is why you should invest in channels that facilitate inbound marketing. Since 81% of consumers conduct online research before buying, having a targeted and informed approach will attract leads who are more likely to be interested in your solutions. It gives you a good quality of customers while having less spend.

Experiment with pricing

If you have a freemium model, try experimenting with your pricing to figure out the factors that could convert more paying customers. It could be an increased pricing tier, a feature-based pricing model, seat-based pricing, etc. The more quickly you can convert freemium users to a paid plan, the lower your CAC would be. But don't compromise on customer happiness.

Reduce sales complexity

An arduous sales process or a longer sales cycle will lead to a higher CAC. Keeping your prospects engaged with an effective hand-holding process and proper onboarding is critical. Ensure you invest in setting up a tight funnel and make each step easily navigable. Customer retention is key.

If you want to be a profitable business, you have to cut your cost of revenue––as a digital business, the majority of this will come from CAC. And at the same time, you need quality customers, who love your business, and stick with you for long periods of time, enabling high lifetime value and a chance at expansion revenue.

In Conclusion

A saas business (or subscription business) is by no doubt a customer-centric business. You need to acquire customers at low costs and keep them happy for an extended period. The CAC-LTV Ratio serves as a guardrail for maintaining these conditions. So keep peeking over at these KPIs as a pulse check––it's also one of the critical saas metrics investors use for the valuation of companies.