Steps for Fundraising in Recoveries

According to the National Venture Capital Association, venture capitalists raised $46.3 billion in 2019. It’s the second-highest annual total of the past decade.

That means a massive amount of capital is up for grabs even though the economy as a whole is in crisis. The fundraising process looks different than it did before the pandemic but it is not dead.

We are going to share insights into how to prepare to fundraise and the fundraise itself. But first, let’s take a look at the current fundraising environment.

What’s Changed?

Who is getting capital has changed. Venture firm Redpoint Capital’s Tomasz Tunguz compared the fundraising data 2 quarters into the downturn Covid-19 has created. The numbers below represent the percent change in venture dollars by round.

- Seed: – 37%

- Series A: + 10%

- Series B: – 23%

- Series C: – 29%

Series A is the only round getting more capital than before. Mature companies who have shown viability are getting cash. Investors aren’t willing to fund earlier teams the way they have been in the past. They’re looking for safer bets with staying power. This does not mean other stages are not getting funding, they’re just getting fewer dollars.

Companies who are getting capital are getting more of it. Median round sizes are up across the boards, by 25% at the least and up to double for seed stages.

The market is contracting, investors are deploying cash slower, and the process is taking longer. But, there is still a large sum of capital to invest. For more on the current climate or how it compares to the financial crisis of 2008, check out Redpoint Capital’s Tomasz Tunguz post on fundraising 2 quarters into the virus.

How to Prepare

To start you need to clean the house a bit. If you haven’t already, now is a good time to adjust projections and forecasts. With an uncertain future, investors want to see best and worst-case scenarios. Here are a few areas to check on.

Cash Flow – As always, cash is king. Be on top of cash in the bank, does it match your financial statements? You should know how much will be coming in and going out over the next few months.

Review Expenses – cut the “nice-to-haves”. If you have to make layoffs make sure not to cut too deep into one team. You don’t want to create vulnerabilities. Make sure you’re operating lean and efficient.

Forecasts – This is where you’ll need to have a few different assumptions. Make forecasts that show expected growth. Deals to SMBs are down. Enterprise sales have slowed. Show some scenarios with increased churn and a slower than normal growth rate.

Customer Retention – Maintaining your customer base and avoiding churn is a priority. If you’re struggling with a churn problem, check out Chargebee’s tips on reducing churn.

Accounts Receivable – Will you be able to collect as usual? Who will pay? Who will be late? Who might be struggling during these times? Even though this doesn’t affect top line revenue it will affect cash flow. We have noticed customers aren’t paying as timely as they used to.

“With the world adjusting to a new normal, we’re all left to adapt and prepare for coming out of the age of coronavirus into a society we don’t fully recognize.”

For more insight on how to navigate, see our 7 Steps for Founders and CFOs to Prepare for a Downturn.

Fundraising isn’t dead but do I need to raise?

Investors are active and you reviewed your financials, but do you HAVE to raise? Unfortunately, there isn’t an exact answer to that question. Your runway can help decide, but it is fluid.

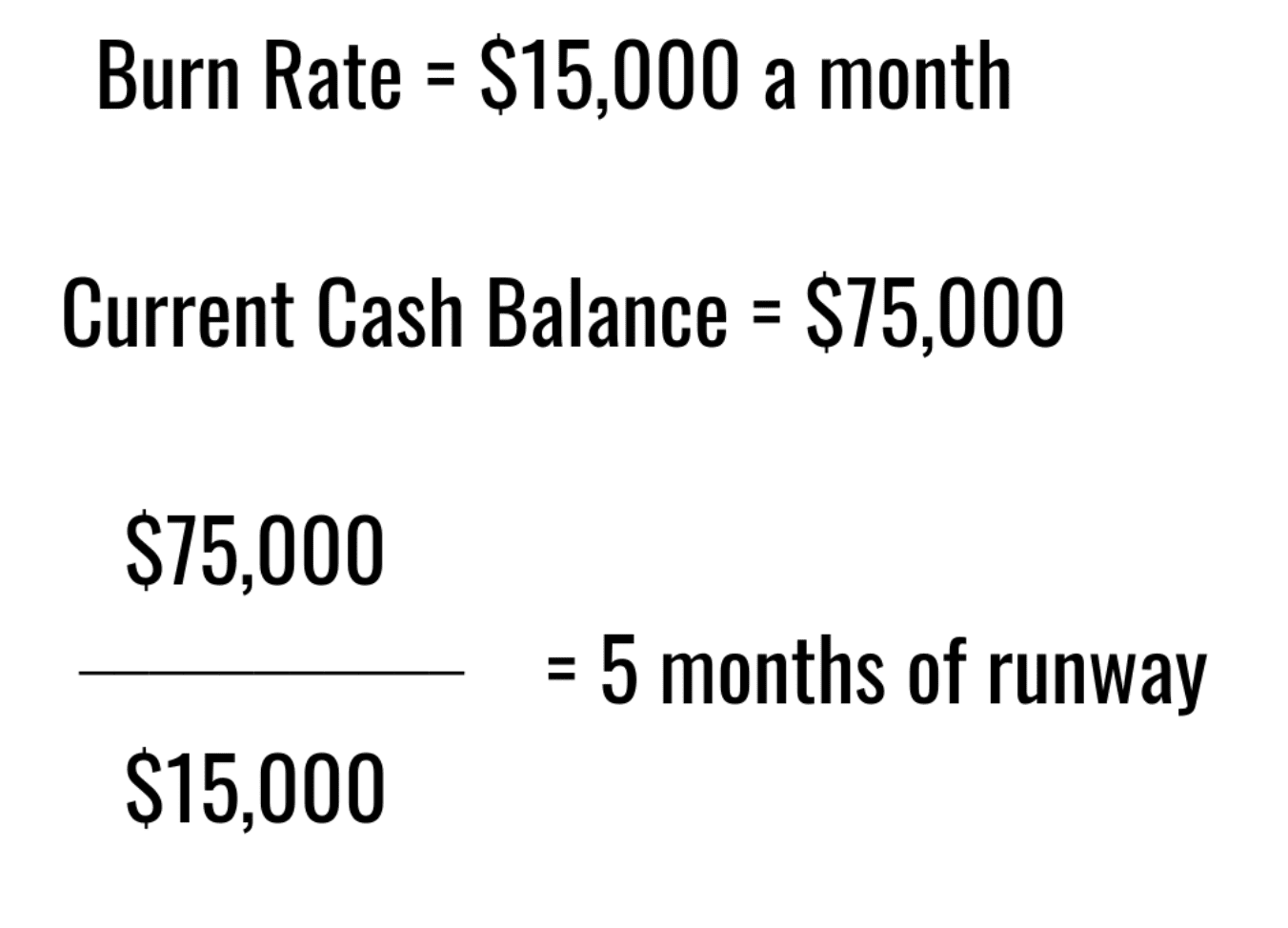

To calculate runway, you need to divide your cash by your burn rate. What you’re left with is how many months of life your team has. This won’t take into account your growth rate though so again, it is fluid.

The obvious note here is that the longer your runway is, the longer you can put off fundraising. The time to fundraise is before you need it and depending on how strong your growth rate is, that time may never come. If you’re reading this and made it this far, you’re likely thinking about it already which means it might be time.

“There are two aspects to extending the cash runway of a company – cash conservation and customer retention.” – Sr. Director of Finance at Chargebee Karthik Srinivasan. If you’re unsure of a fundraise, read the rest of the insight for prolonging your runway.

What do investors want to see?

As before the downturn, metrics and the story to tell should be crisp and bulletproof.

Know your numbers. Decreasing burn and increasing runway will show you can pivot during uncertainty.

Metrics still matter. Know your Retention, Recurring Revenue, LTV:CAC, Gross Margins, Magic Number, Rule of 40, and the other customer unit economic metrics. Be 100% certain they are accurate.

Struggling with understanding those SaaS metrics? We break them down to make them clear to understand in KPI Sense’s Metrics Deep Dives.

Show how you plan to use the cash. Prepare for each recovery type and show the growth you can create with the capital injection.

Need help straightening out your financials or metrics? Chargebee can help for all your billing and revenue needs.

What will the recovery be like?

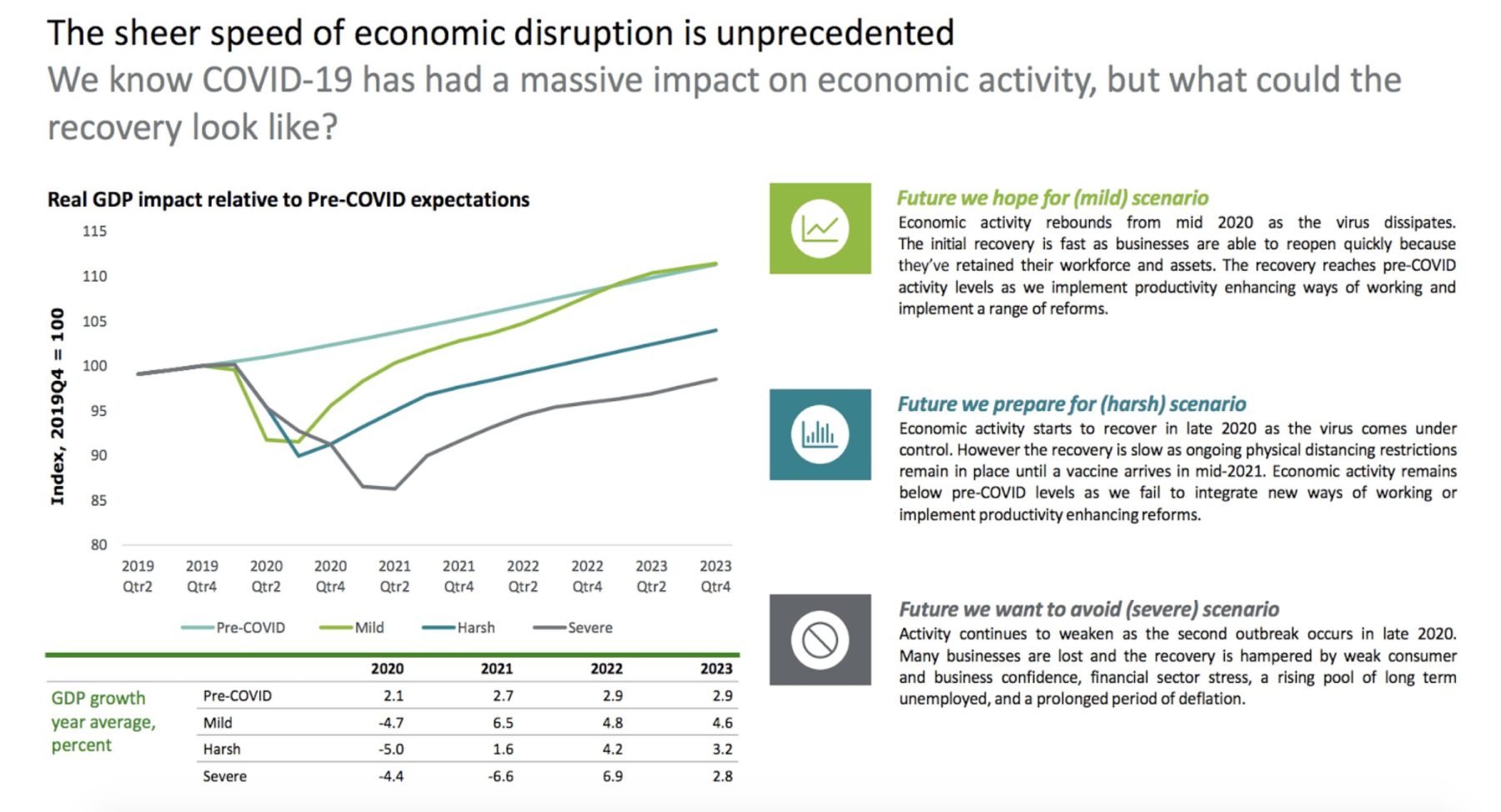

While there are predictions floating around, it is impossible to know if there will be a U, V, or W-shaped recovery. This is important to consider when analyzing runway and if you can make it through or not and how much to raise.

U-Shaped – Represents a slow recovery

V-Shaped – Represents a quick recovery

W-Shaped – Is an up and down recovery, it usually dips again into another recession after a period of recovery.

Check out Deloitte’s take on the potential economic recoveries.

Wizer Feedback, a customer research startup, surveyed more than 100 venture capital funds back in March and this is what they had to say:

- 47% of investors thought the current environment would last at least 6-12 months

- 49 of investors recommended raising money immediately and another 10% said to raise in the near future

How much do I raise?

“We’re mindful of our portfolio companies having at least 24 months’ runway – this can mean companies are reducing their burn rate, or they’re raising slightly larger rounds than they would normally. ” – Andrei Brasoveanu – Partner, Accel

“We’re encouraging founders to have a plan that shows 18-24 months of cash runway. This ensures you can manage through a long term period of uncertainty, and sets you up to take advantage of opportunities as we come out of that period.” – Columbia Lake Partners

Raising 24 months or having 24 months of runway should put you in a good spot.

Fundraising Remotely

Fundraising and investor relationships are human to human. With face-to-face out of the question for most, here is where to start and what to expect.

- Approach existing relationships first. With the process taking longer, existing relationships are going to be more efficient. Still reach out to new people but know they may take longer to write checks.

- Investors have the negotiating power in these times. Be ready for any terms they may want and know what they mean and how to combat them.

- Get comfortable pitching over video calls. Your energy and body language will not translate the same as in-person. Practice and get feedback.

Fundraising comes down to only a few things but you need to nail them all. Know the ins and outs of your business and over-prepare. Fundraising is not easy or fast but there are active investors waiting to hear from you.