To enable automatic synchronization of Invoices, Customers, and other data from Chargebee to Intacct integrate your Intacct account with Chargebee for financial management and analysis.

We recommend consulting your accounting advisor before configuring the integration. You can test the integration on the Test Site before setting up the integration on the Live Site.

To set up the integration in Chargebee follow these steps:

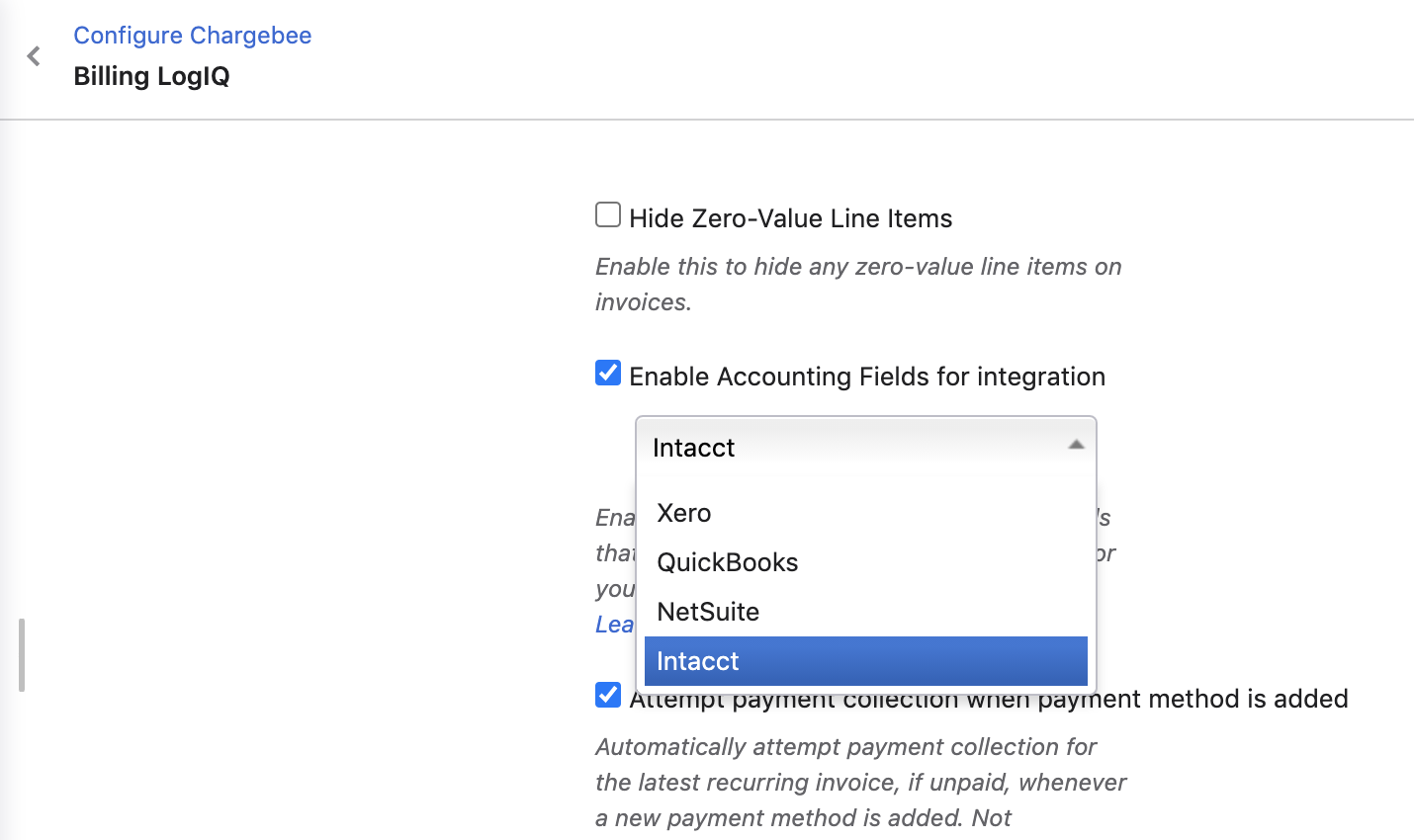

Click Settings > Configure Chargebee > Billing LogIQ and Enable Accounting fields integration by selecting Intacct from the drop-down.

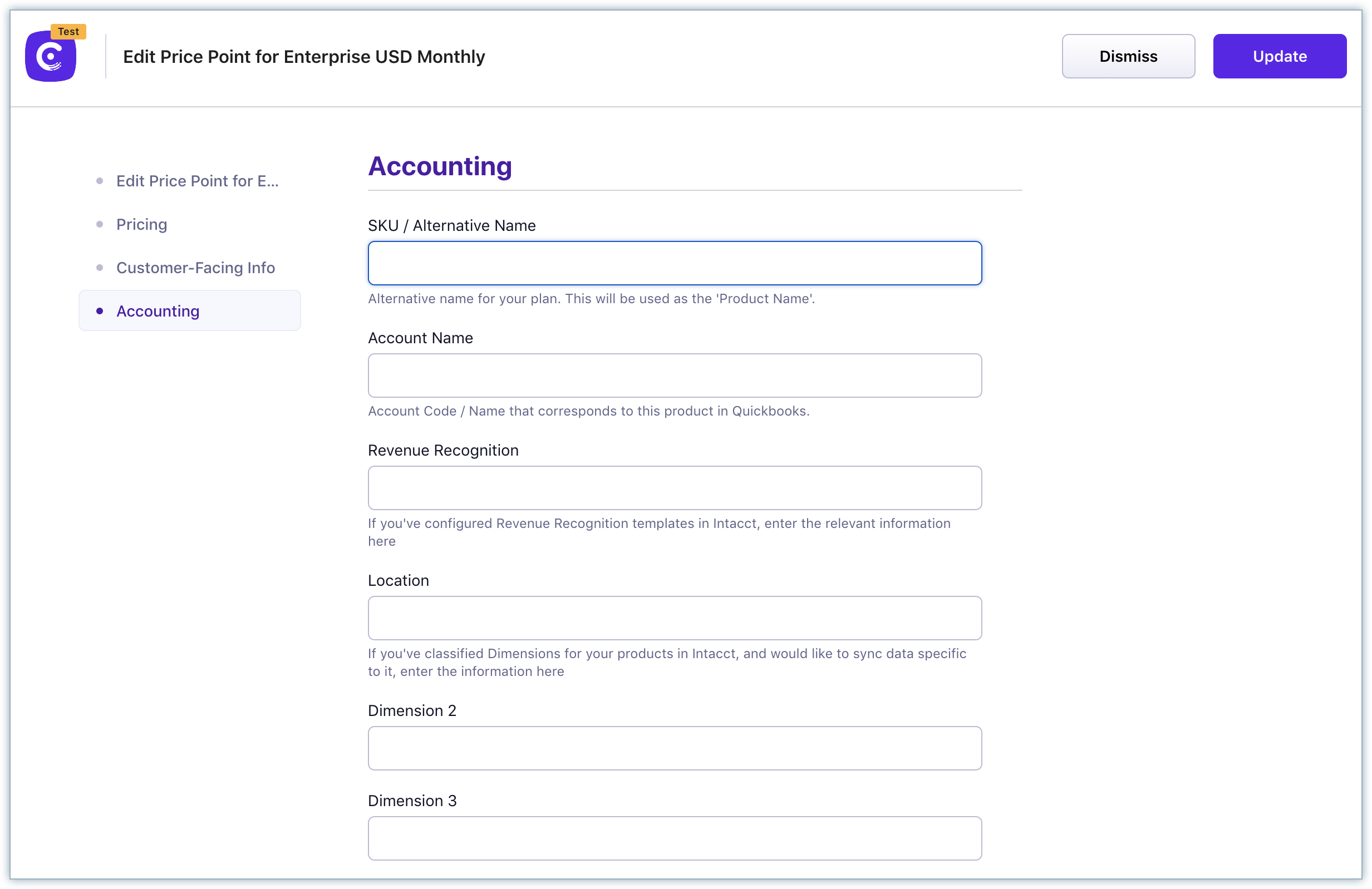

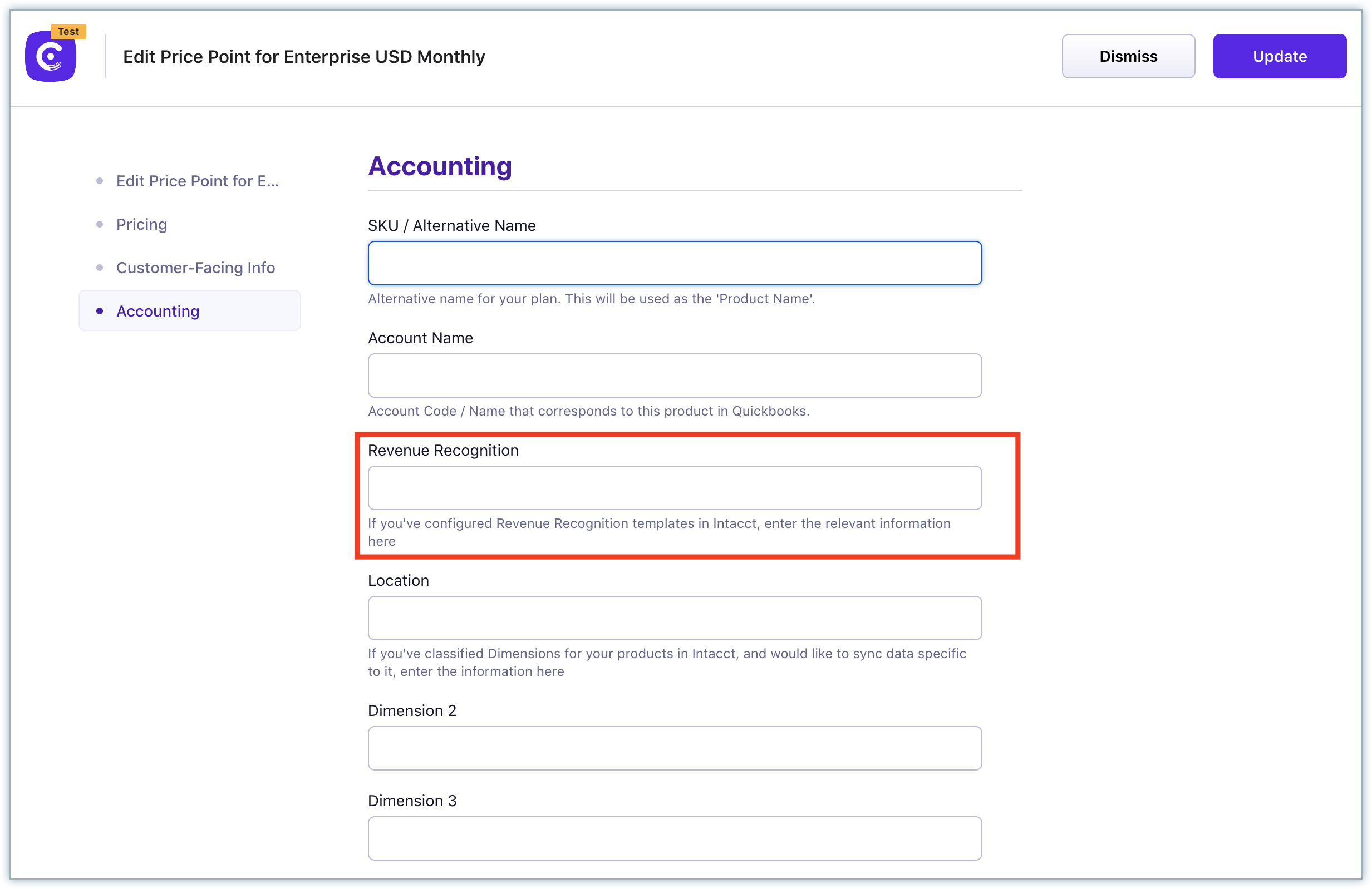

Enter a GL Account for each Plan/Addon in Chargebee. Click Product Catalog > Plans/Addons > Select a Plan/Addon > Select a Plan/Addon Price Point > Accounting Information > enter the GL Account Name. You can also provide a Revenue Recognition Template ID for Plan/Addon Price Points.

If the Plan ID/ Addon Price Point ID is greater than 30 characters, you should provide an alternative name in the Alternative Name/SKU field.

Caution!

If the Plan ID/ Addon ID is greater than 30 characters, you should provide an alternative name in the Alternative Name/SKU field.

Verify if the base currency in Chargebee and Intacct are the same. If you have multiple currencies enabled in Chargebee, then you should ensure these currencies are enabled in Intacct as well. You can view the currencies in Chargebee by navigating to Settings > Configure Chargebee > Currencies

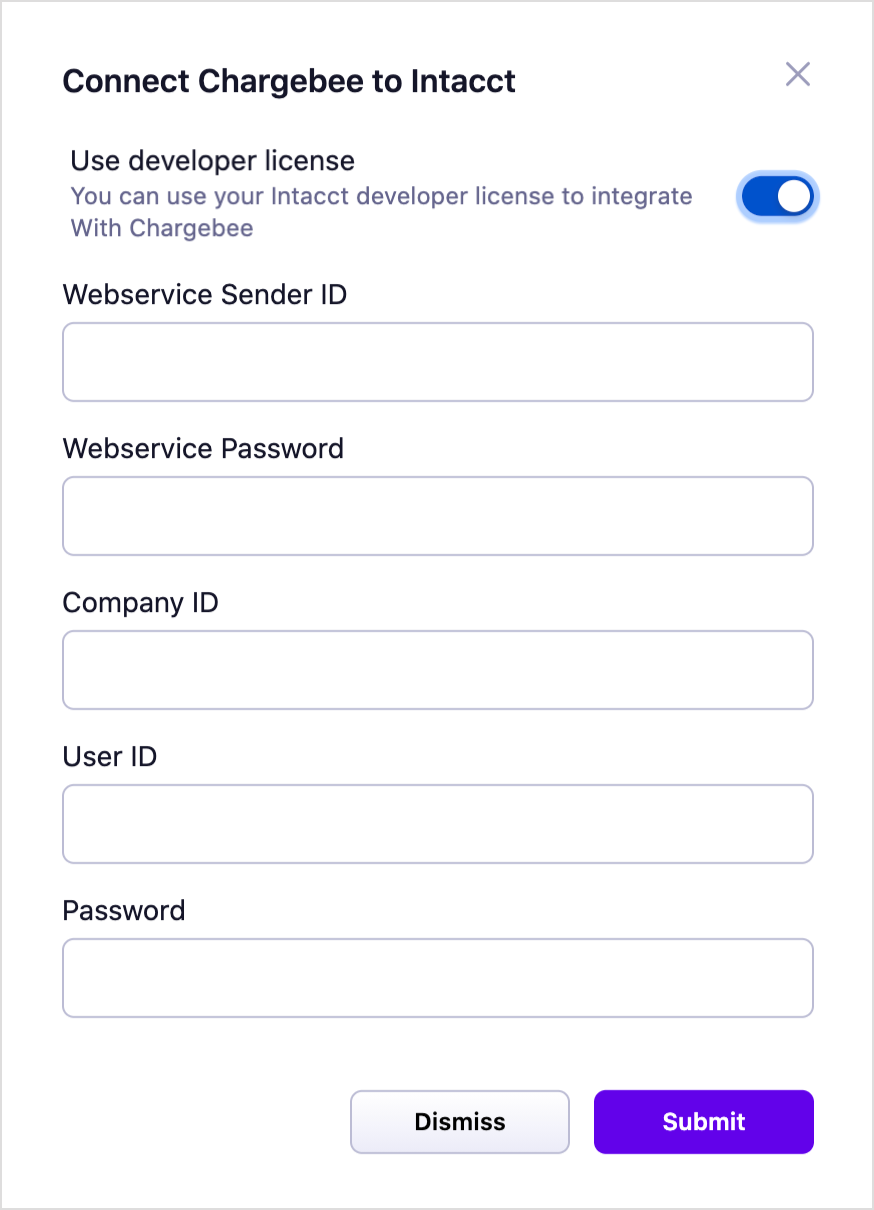

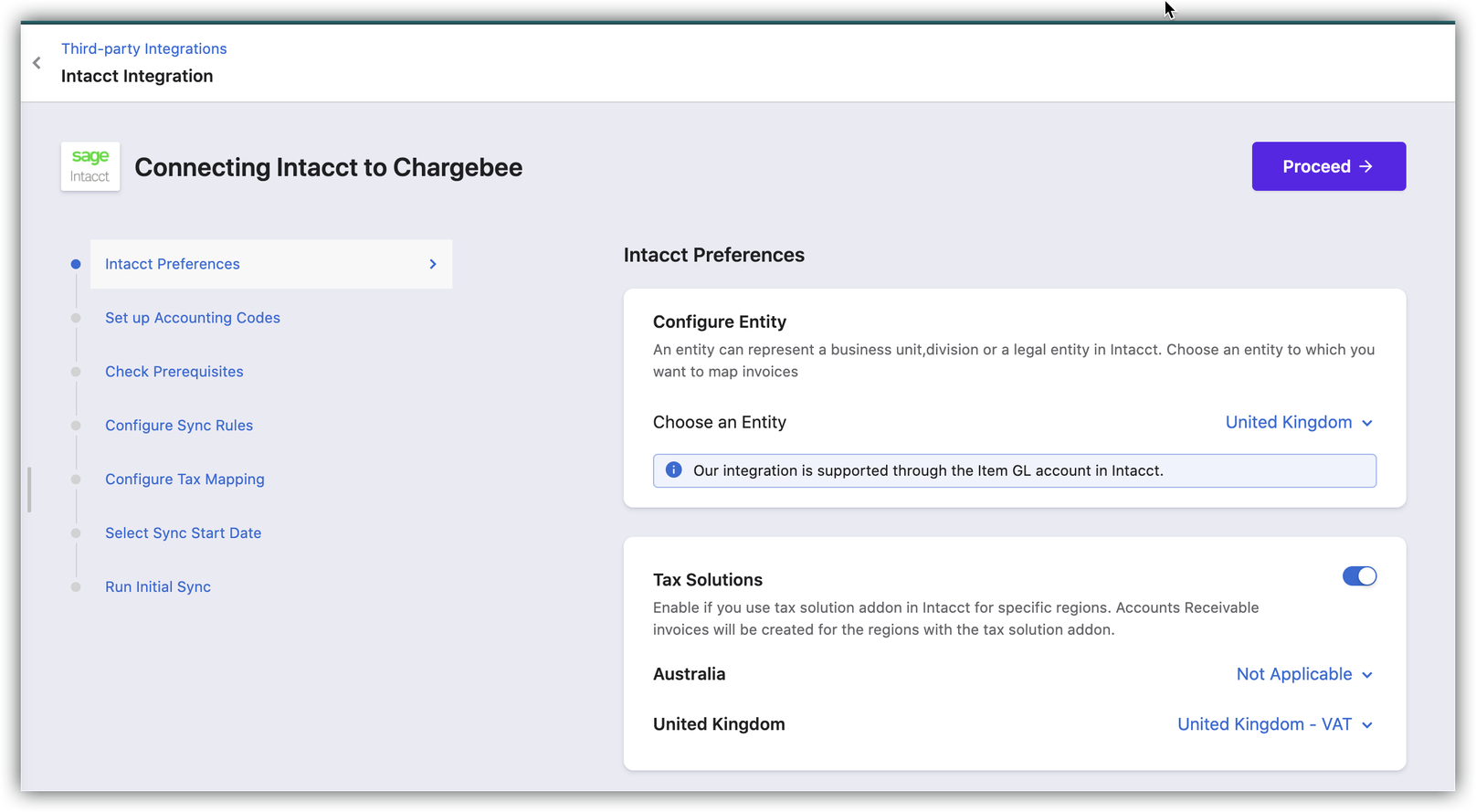

Once you have logged in to your Chargebee site, follow these steps to initiate integration:

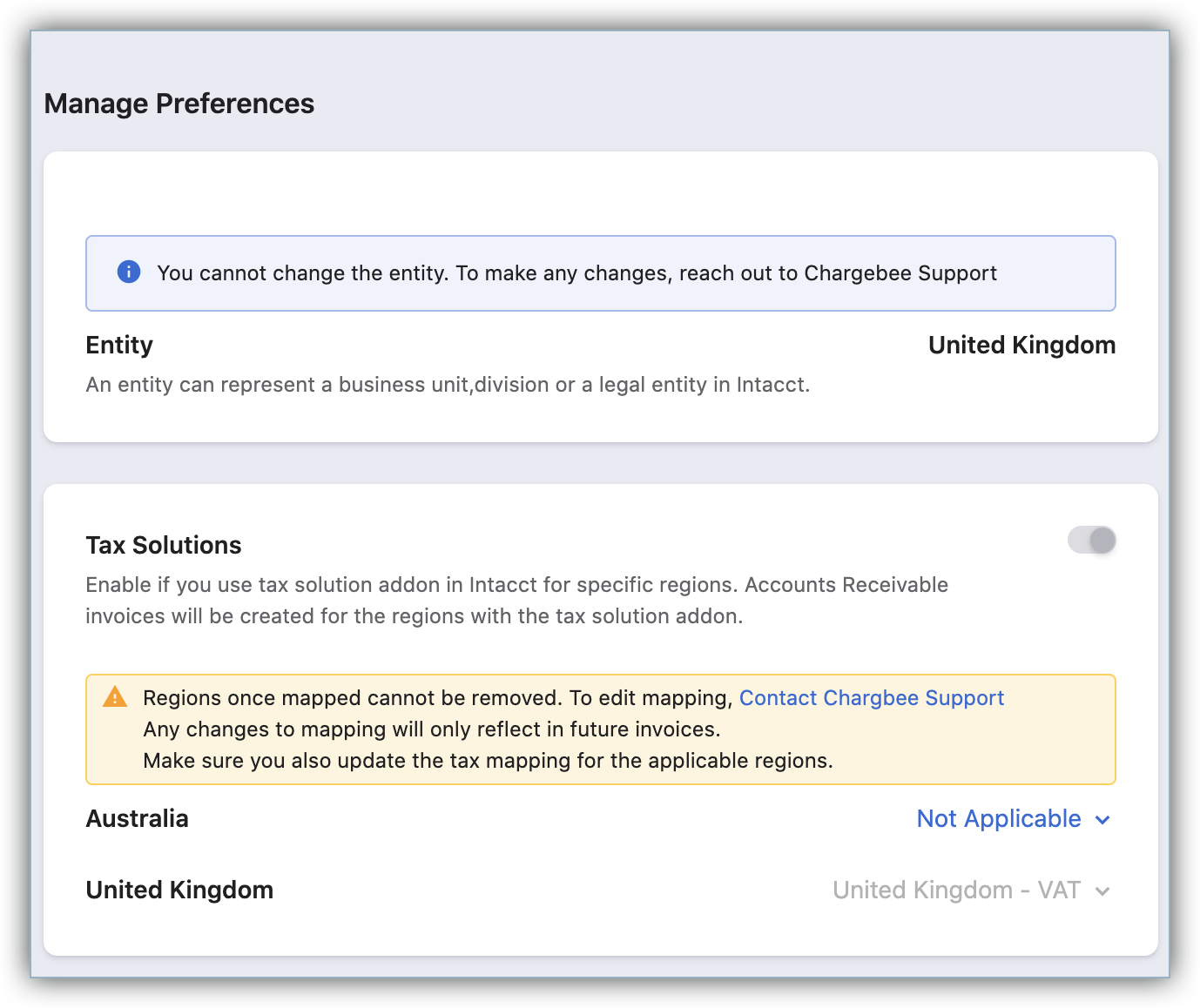

Select an entity and the account type in Intacct to which the invoices should be synced to.

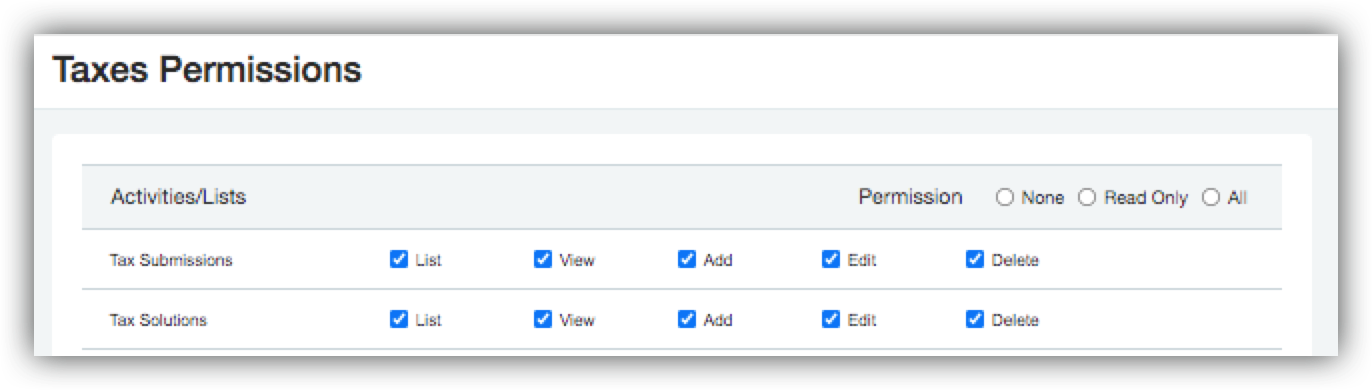

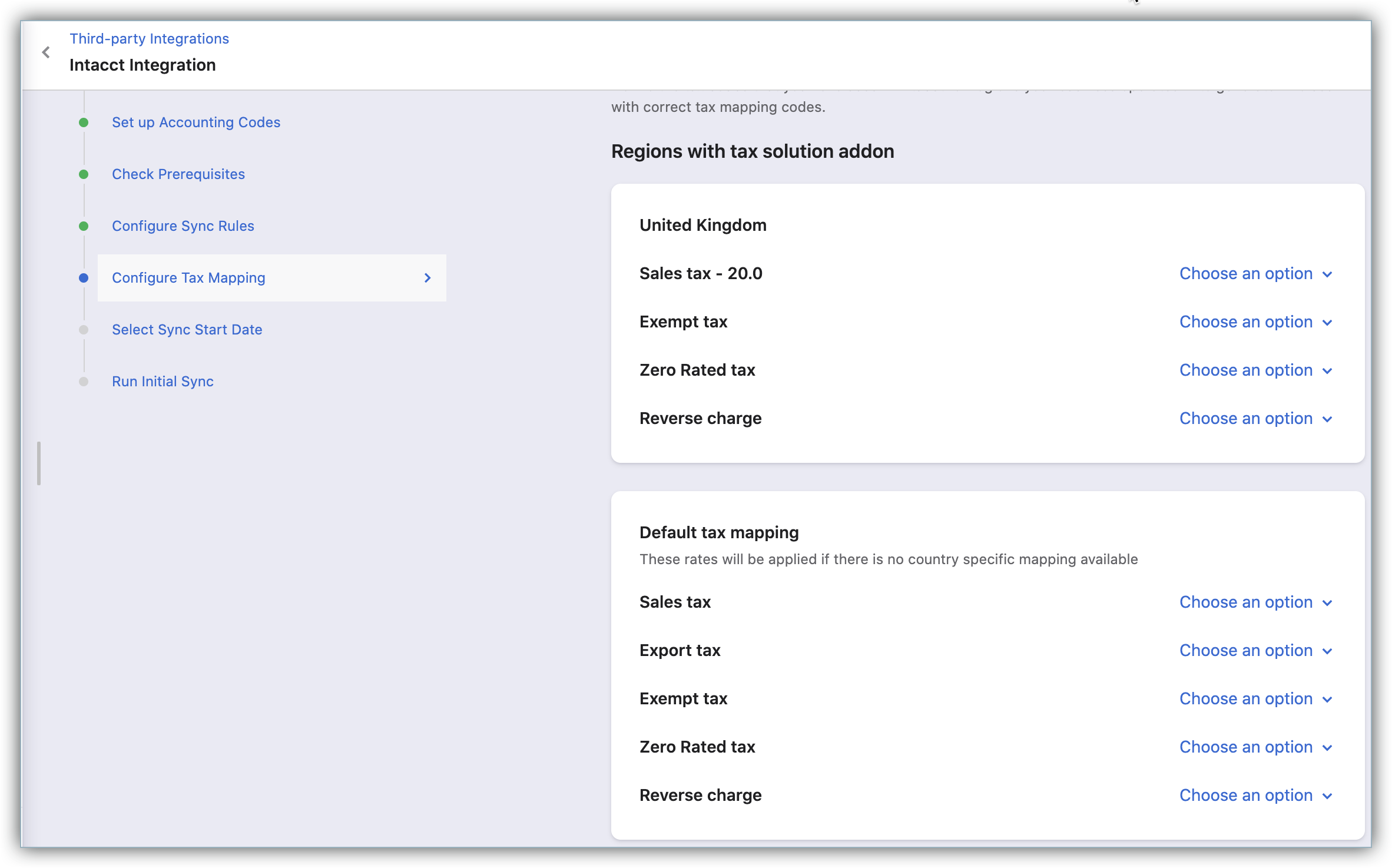

Note: Tax Solutions block is visible only if the customer has the View enabled in the Tax Solutions configuration in Intacct.

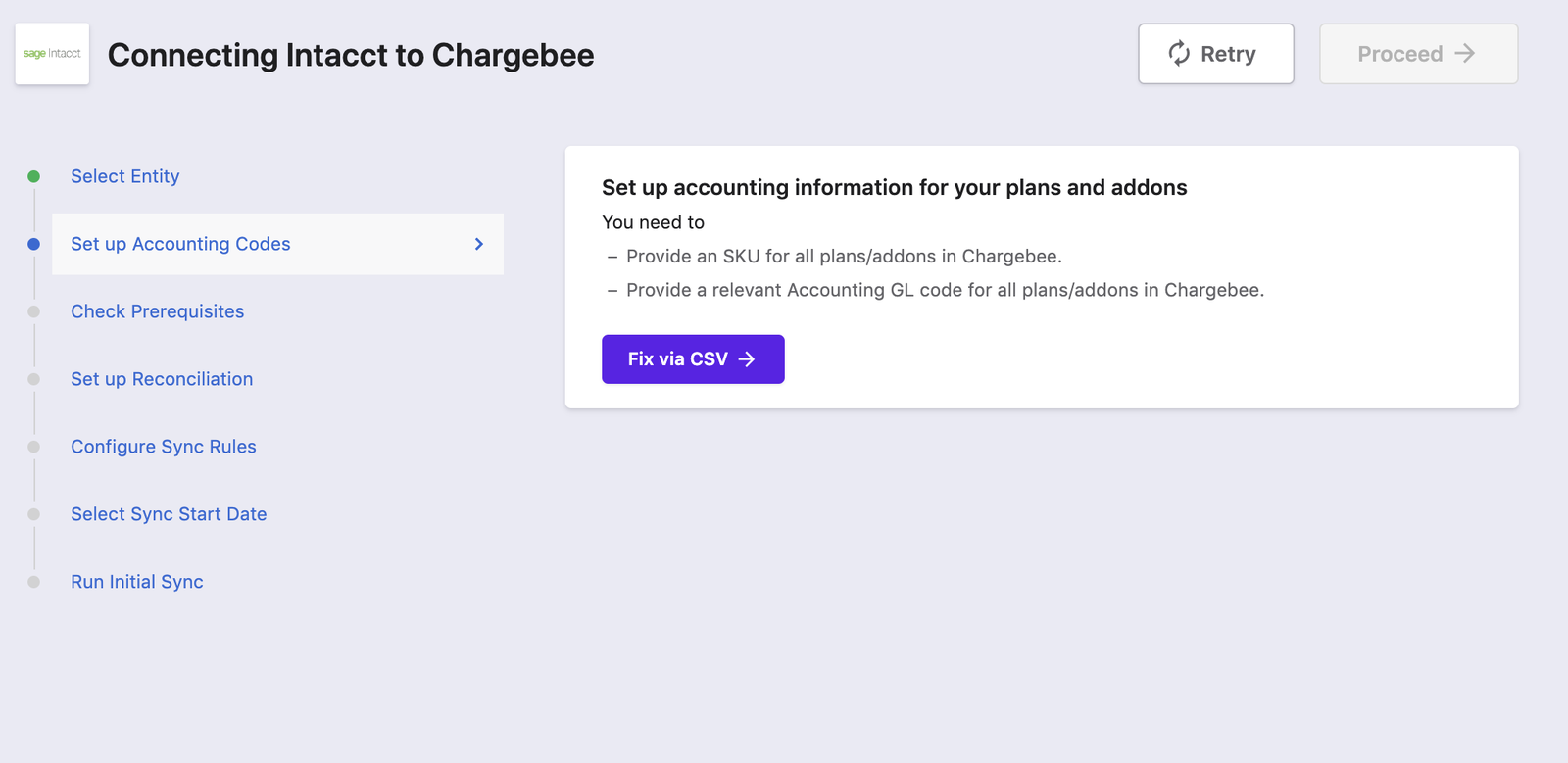

Chargebee checks whether your plans/addons have valid GL information. If a plan/addon doesn't have the GL information, the error details will get listed. You can download the CSV file, update the details and upload the file back into Chargebee.

Caution!

If you make any changes to the GL Account Name in your Intacct account anytime after the integration is set up, you need to update them in Chargebee as well. Failing to do so could lead to a sync error.

Next, Chargebee performs a list of checks in Intacct:

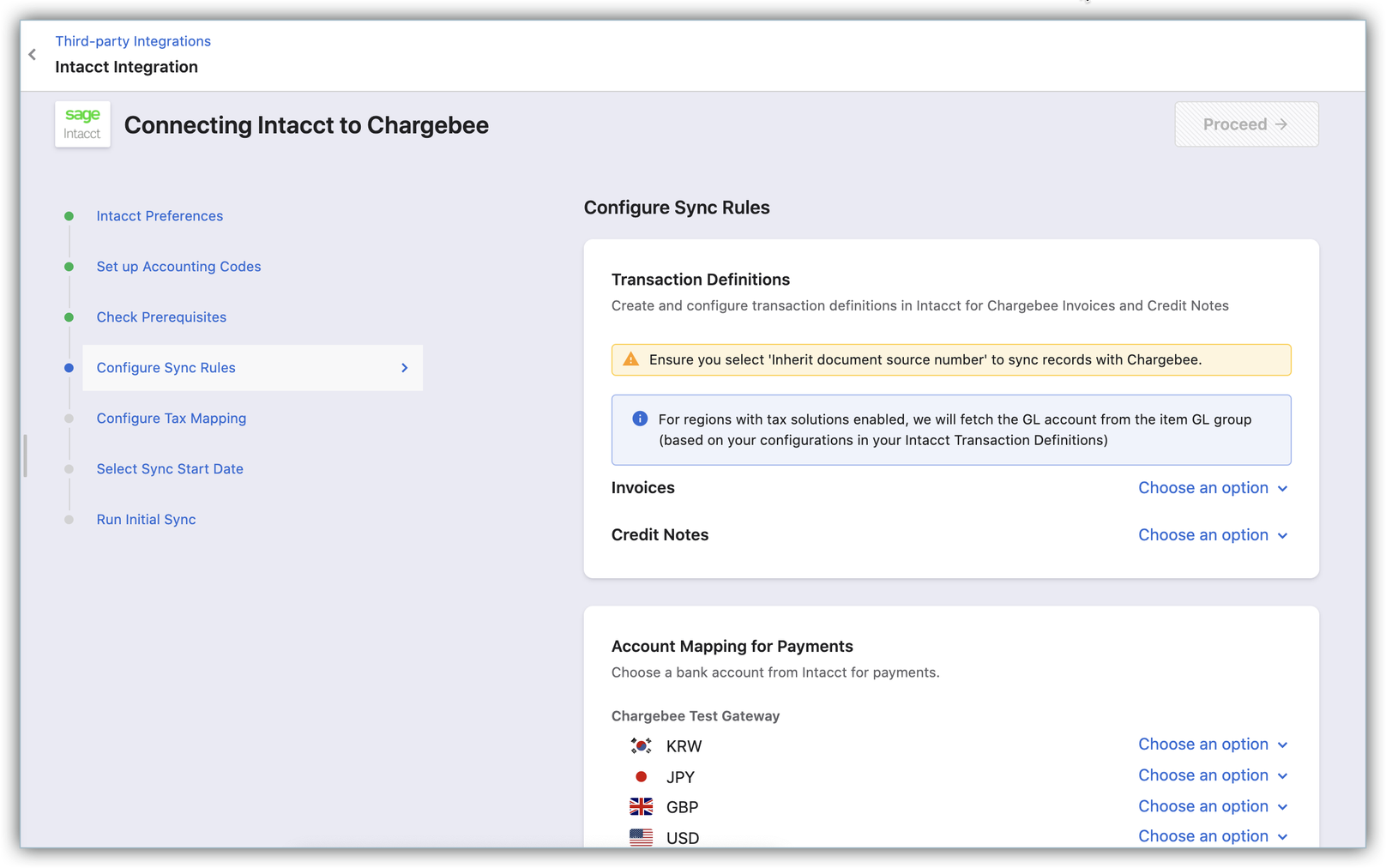

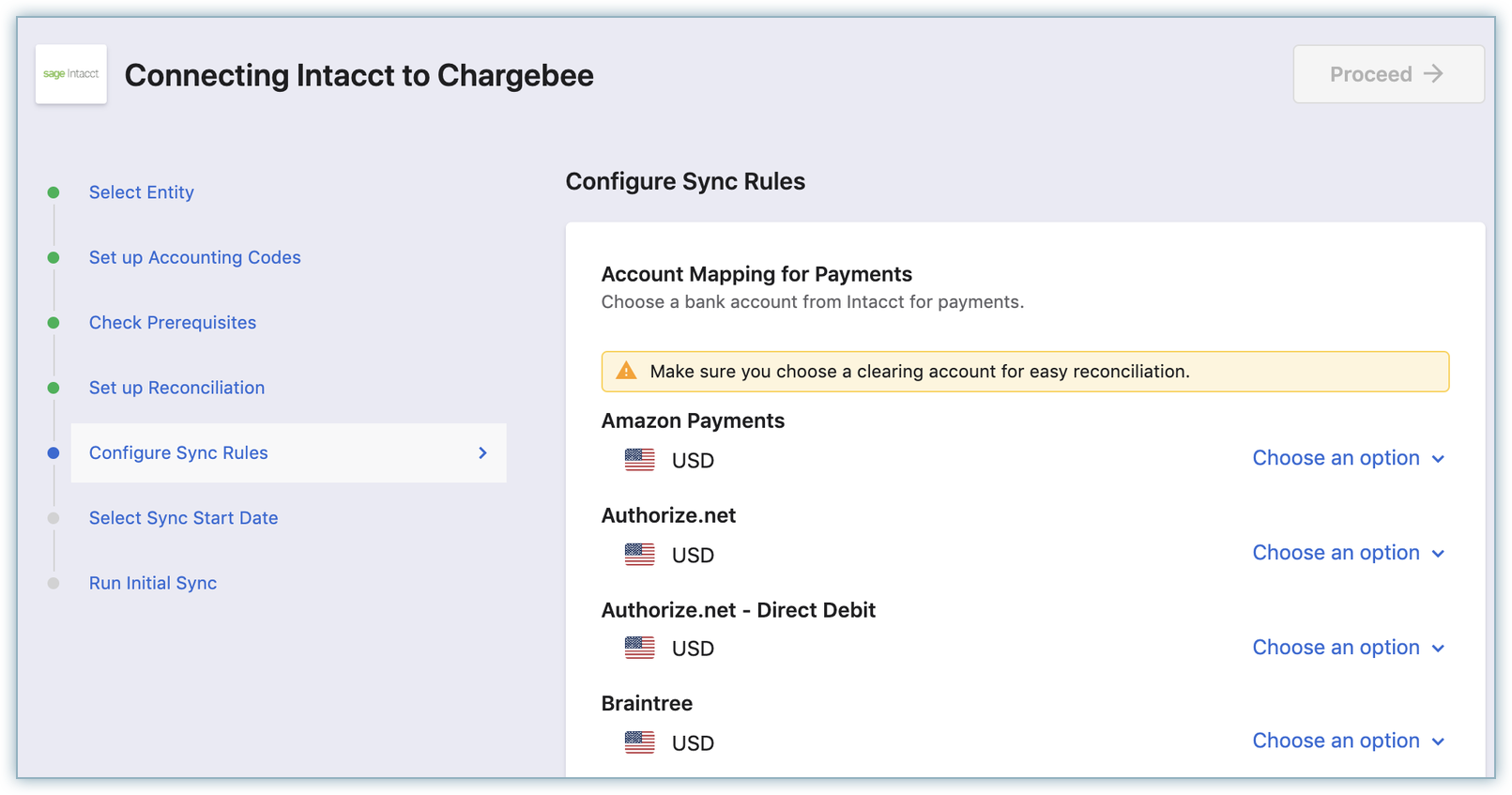

Configure how Chargebee integrates with Intacct:

Transaction Definition

a. Payment Account Mapping: Payment transactions recorded in Chargebee can be mapped to payment accounts in Intacct. For reconciliation purposes, you can select a clearing or undeposited funds account. If you have multiple currencies or payment gateways or payment methods enabled, you can choose a specific payments or checking account.

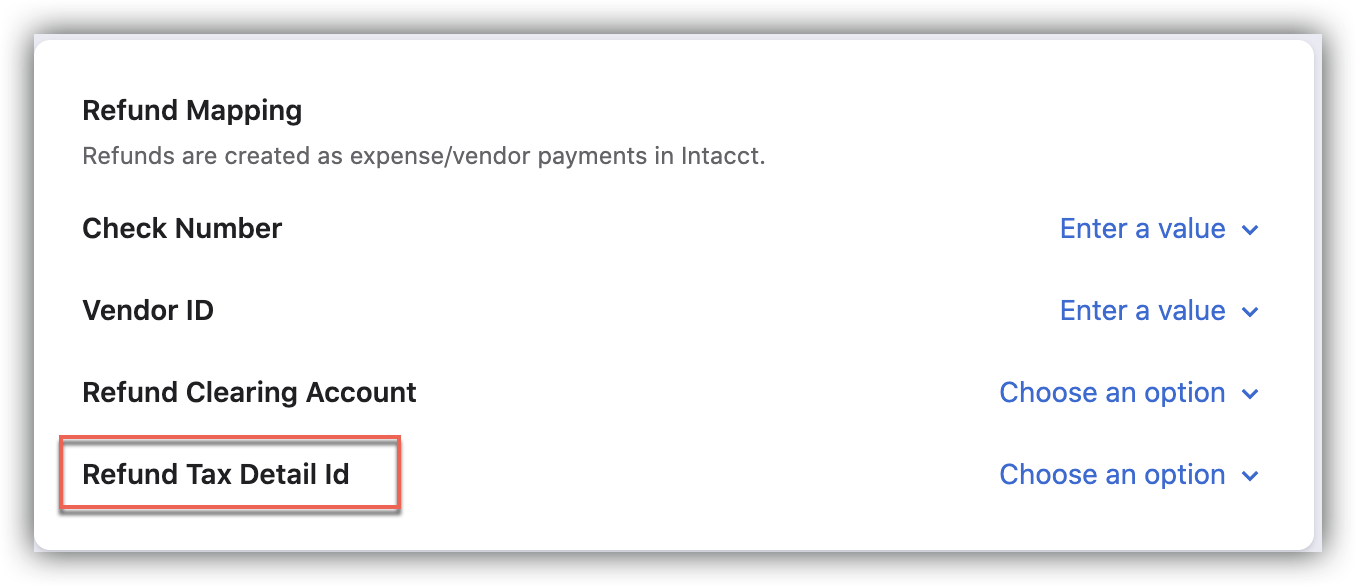

b. Refund Mapping: Refunds are created as Vendor payments in Intacct. You can configure the following for mapping refunds:

c. Account Mapping for Invoice Line Items:

d. Product Line: If you have multiple Chargebee sites you can provide a Product Line per Chargebee site. This is an optional step.

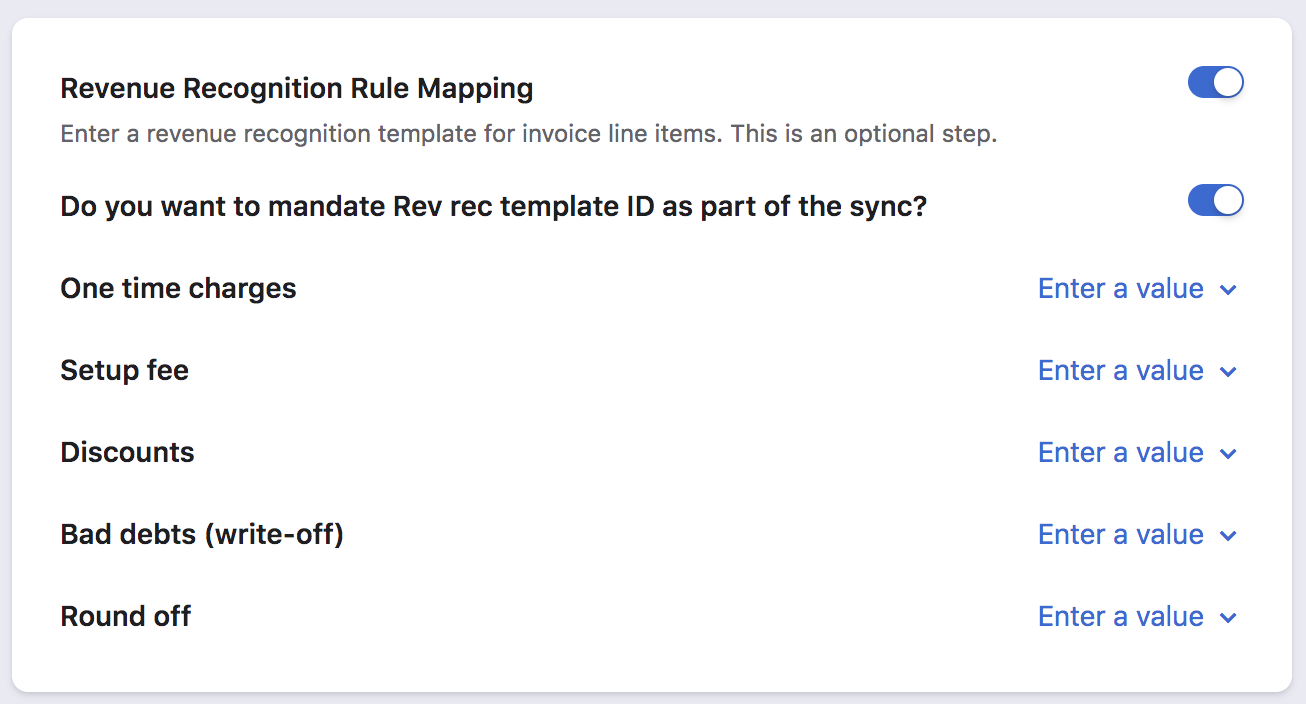

e. Revenue Recognition Mapping:

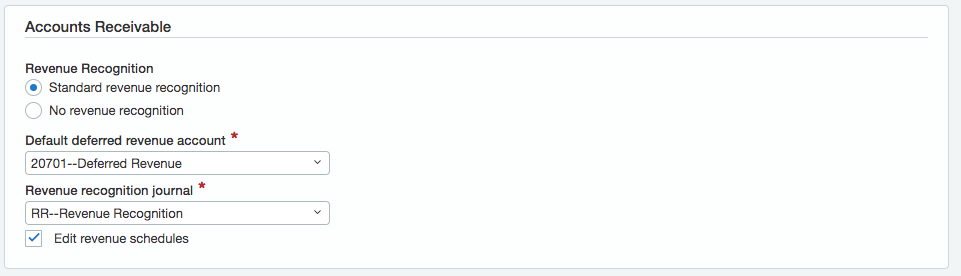

If Tax solution is enabled then the merchant should ensure that the Revenue Recognition is enabled at the AR Invoice.

Follow these steps to enable AR Invoice:

If you are using Intacct's revenue recognition module, follow these steps to send the invoice line amount, start date, and end date when an invoice is synced from Chargebee to Intacct:

If you are not using Intacct's revenue recognition module, you can skip this step during configuration. Learn more about how you can use Chargebee's reports for revenue recognition.

f. Sync Offline Payments:

When offline payments are reconciled against Payment Due invoices in Intacct, invoices get updated as Paid in Intacct. These payments can be synced back to close Payment Due invoices in Chargebee. You can choose to enable this option.

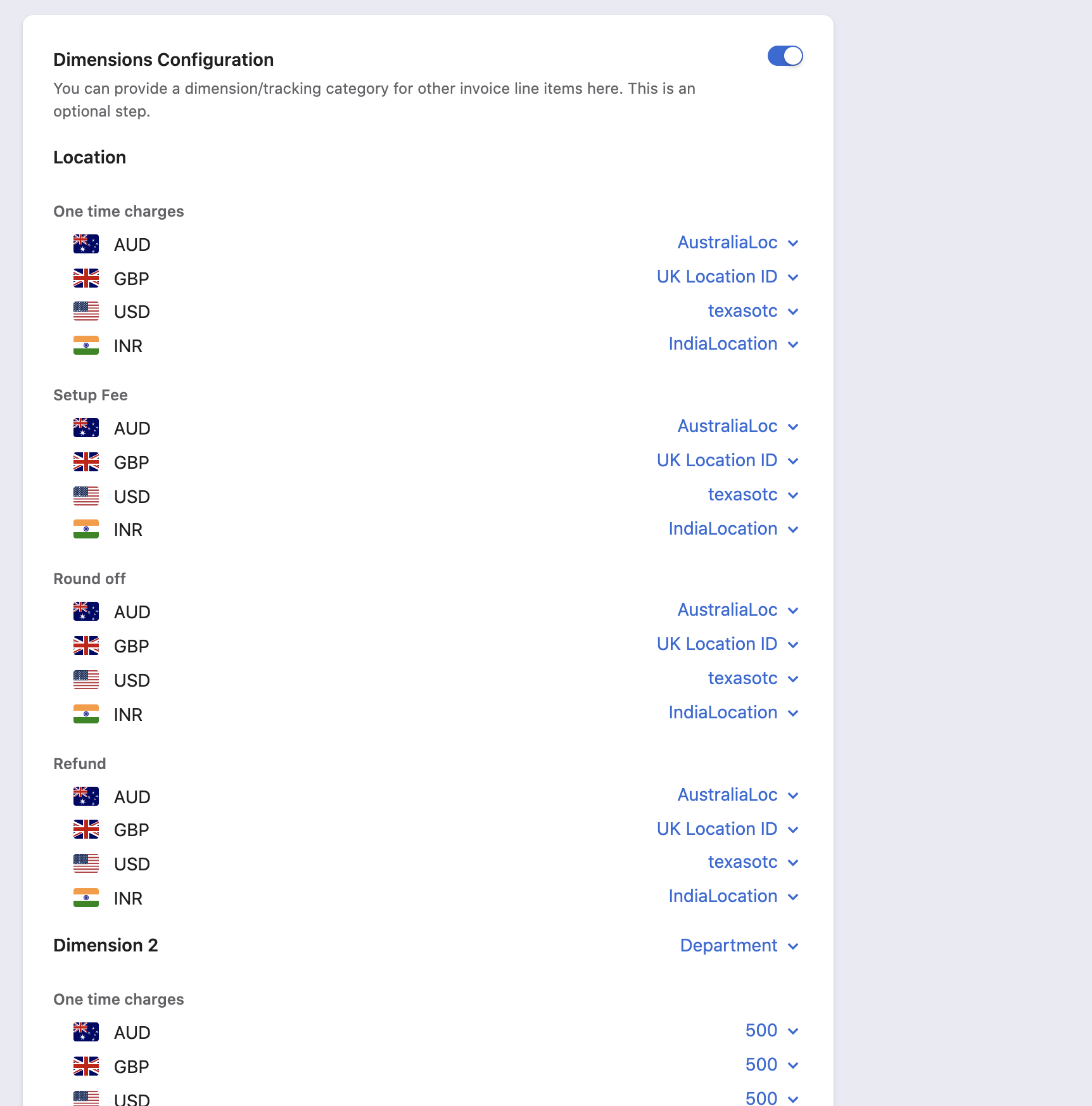

g. Dimension Configuration:

The customer defines the Dimension Configuration for each currency. The following are invoice line items within the Dimensions Configuration:

Note: Defining Dimension 2 and Dimension 3 is optional.

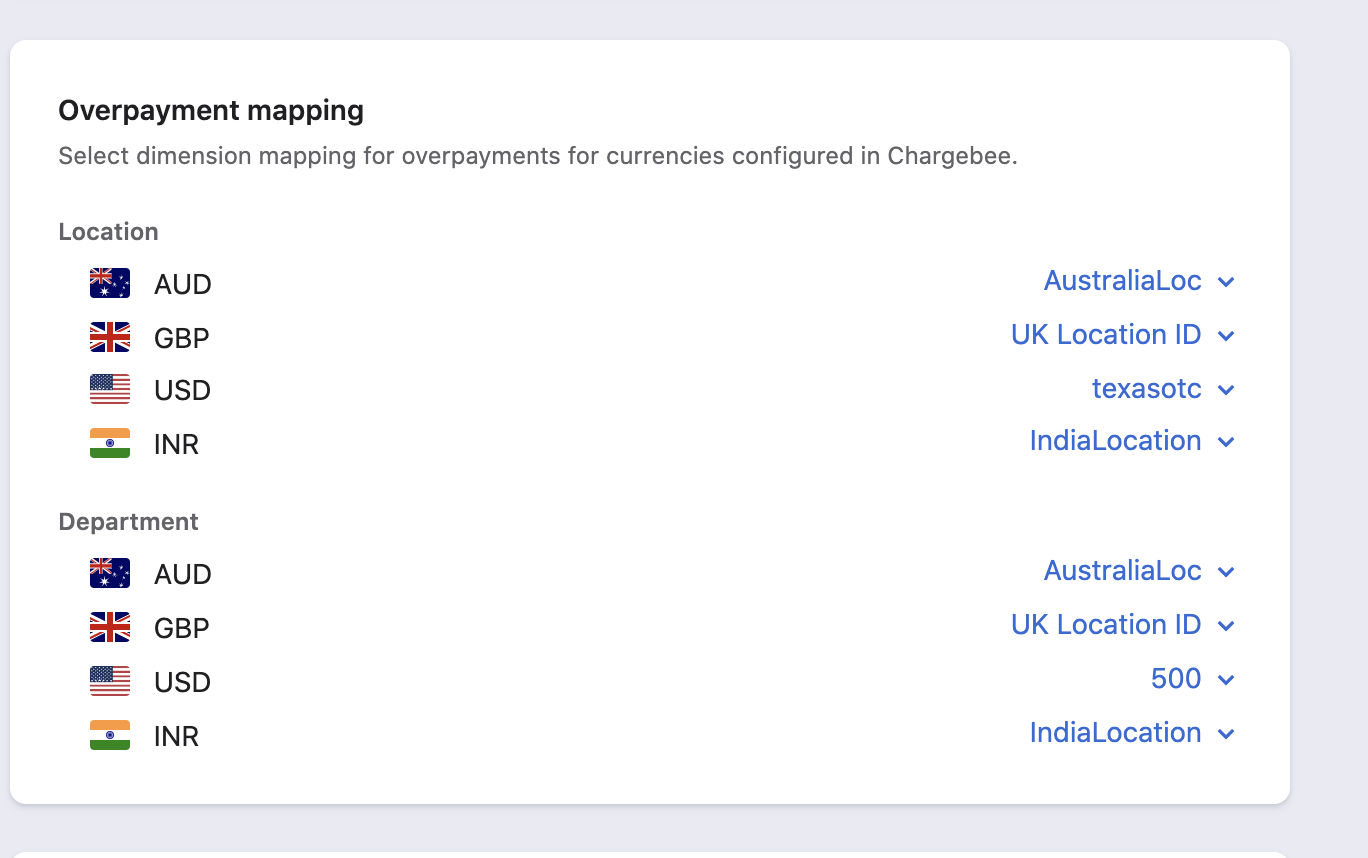

h.Overpayment Mapping:

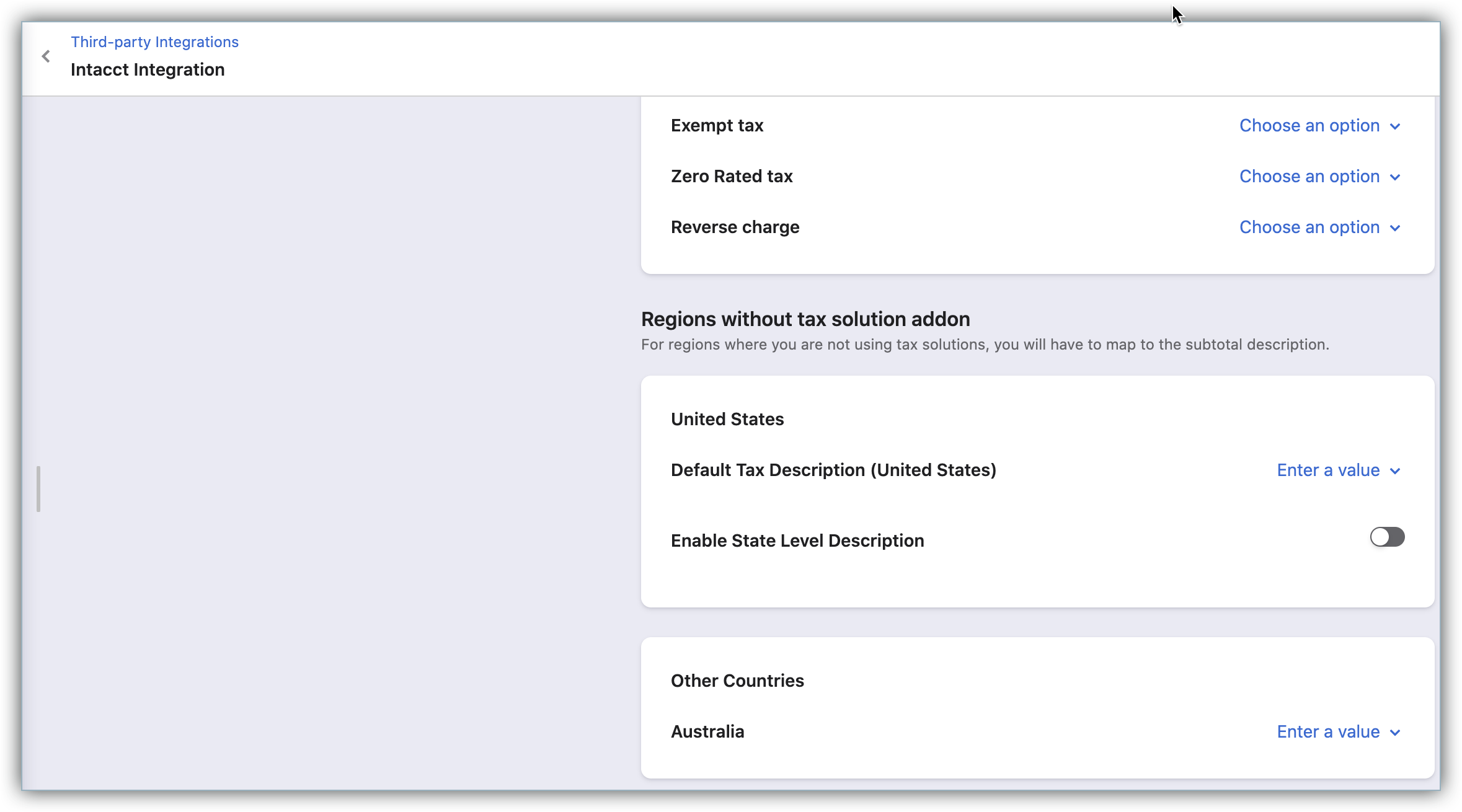

You can add taxes as sub-totals in Sage Intacct for Accounting or ERP modules. For example, if you are remitting sales tax in New York (which is based in the US), you can create a sub-total item for each tax jurisdiction within that region.

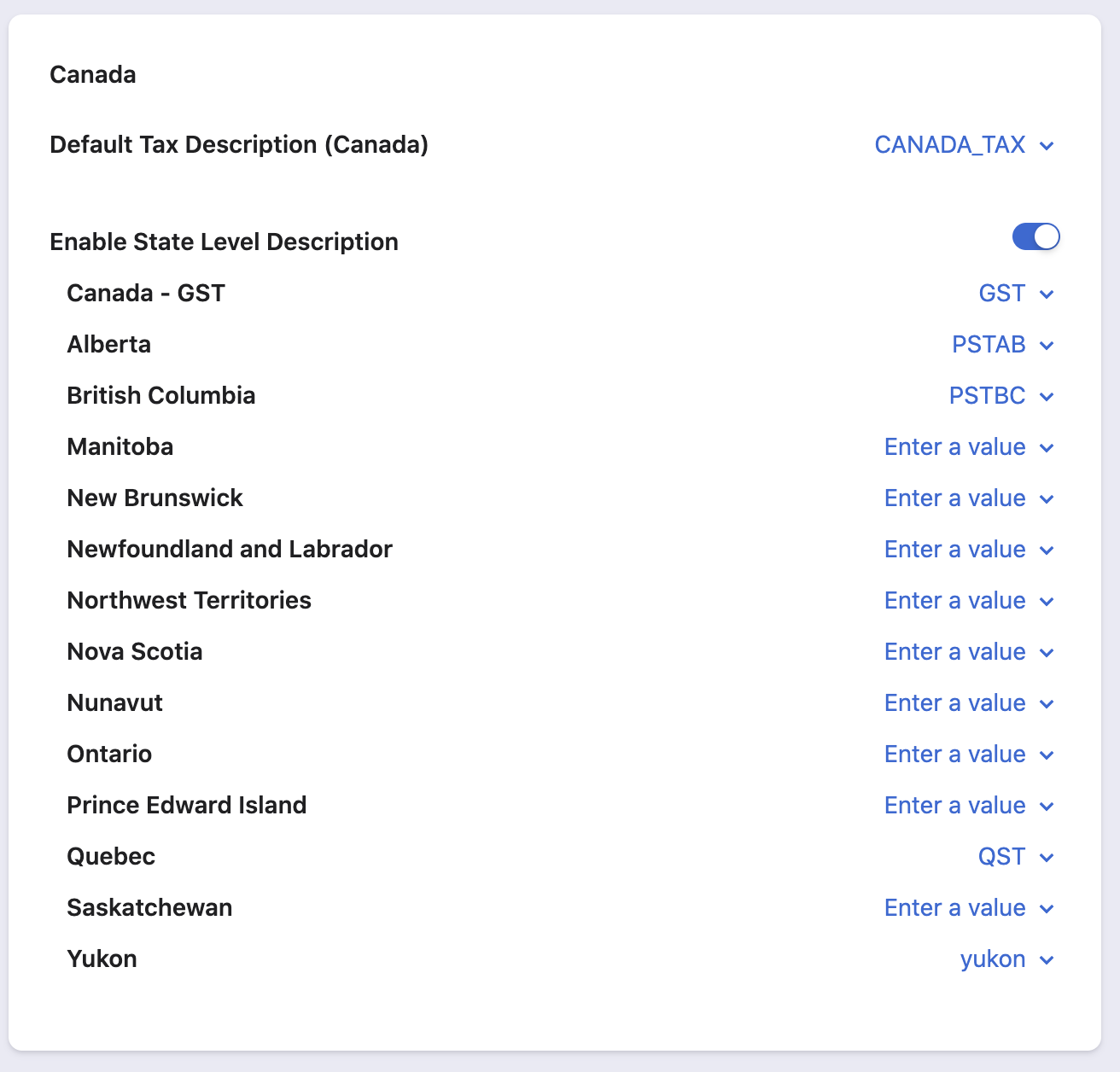

Tax mapping is enabled for individual tax components in Canada.

It has the following tax components enabled:

The default country-level mapping is considered if there is no tax mapping provided at the province level or GST. Then the tax amount will be synced to the provided Subtotal description.

Enable the province level to map the GST and province level tax to different sub-total descriptions.

The Intacct integration supports syncing the tax information if you have Avalara integration with Chargebee for the US & Canada region.

Note

Select a date from which invoices generated in Chargebee should be synced to Intacct.

You can choose from one of the following:

Invoices and related records, from the specified date will only be synced.

Caution!

Once the configuration is complete, you can begin the sync. Chargebee will sync the first 10 invoices, to ensure that mapping, conventions and sync criteria align with your requirements.

We recommend that you review these invoices in Intacct. If the sync works as expected, you can click the Sync All Records option and proceed.

Intacct setup is now complete.

Caution!

If you make any changes to settings like GL Account, Currency or Taxes in your Intacct account anytime after the integration is set up, you need to update them in Chargebee as well. Failing to do so could lead to a sync error.

Once the integration is setup, you can see when the last sync was run, success or errors in the sync, and options to edit the configurations:

Enable/Disable Auto Sync:

After setting up the integration, you can configure daily schedule to sync all the information to Intacct automatically. Invoices and related information will be synced once every 24 hours. You can choose to disable auto-sync if required.

Sync Now:

For on-demand sync, you can sync data from Chargebee to Intacct immediately.

Manage Mapping:

You can edit the configurations or GL Account mapping provided during the setup process.

Manage Tax Mapping:

You can modify the tax sub-totals provided during the setup process. If you have added tax regions in your Chargebee settings, you can provide new tax sub-totals here.

Manage Preferences:

You can enable the Tax solutions for the countries that do not have it enabled previously.

Unlink:

In case you want to stop syncing data from Chargebee to Intacct, you can unlink the integration.

1. We create Sales Orders for fulfilment, how does this work as part of this integration?

Sales Orders are not created as part of the integration. Sales invoices are only created when they are synced from Chargebee.

2. How does Chargebee sync data and invoices when you're using Sage Intacct's Tax Solution

Currently, Chargebee syncs all billing-related information to Sage Intacct including tax line items for US and Canada regions only. If you're using Sage Intacct's Tax solution module for the United Kingdom (UK), Australia, and South Africa regions, you can use this integration to sync your invoices and other data from Chargebee to Sage Intacct. This allows creating the AR invoice instead of sales invoice.

Contact Sage Intacct to determine if using the AR invoice in the integration will meet your requirements.

Contact Chargebee support for any further details.

3. What happens if the customer has the Intacct configured with multiple entities where the base currency is different and has some entities with the tax solution enabled?

We recommend the customer to have an individual Chargebee site to select each entity.

4. What is the limitation in Intacct for syncing the Overpayment once you enable the multi-entity support with different base currency features?

To sync, the Overpayment, Invoice location, Payment location, bank account, and location currency should be the same.