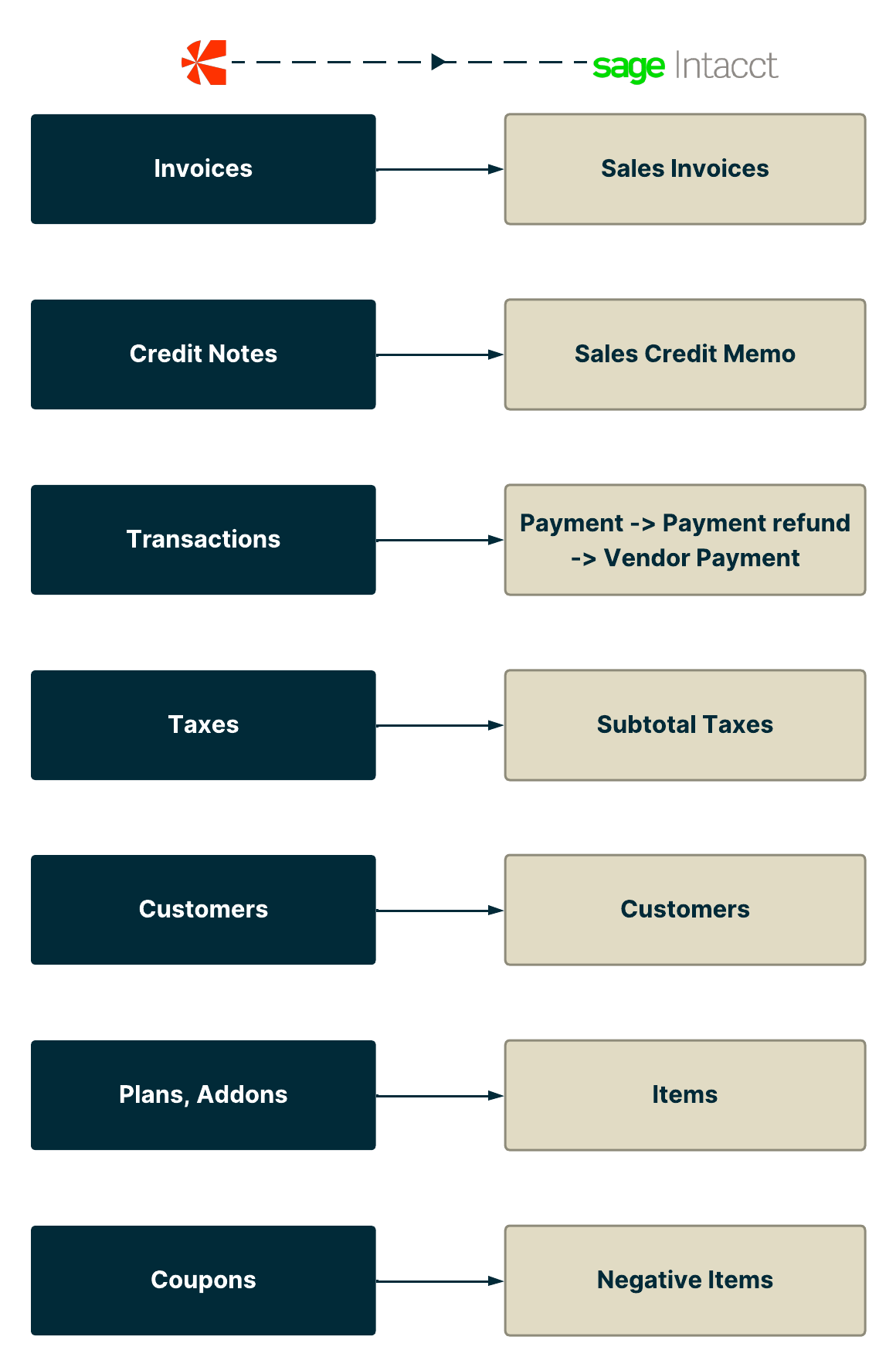

Businesses across the world use Sage Intacct as their financial accounting system to store, manage, and balance the transactions and information that govern the company's finances. Chargebee integrates with Intacct to sync invoices and import A/R data to reduce manual efforts involved in managing your financials.

This is a one-way integration of sales invoices from Chargebee to Intacct. Sync runs once every 24 hours.

Chargebee supports integration with both Single-Entity or Multi-Entity - (Top Level) account. You can connect your Chargebee site either with specific entity in Intacct or you can also connect with the Top Level. All objects (Customers, Products, Coupons, Invoices, Credit Notes, Refunds, and so on) will have one-way sync.

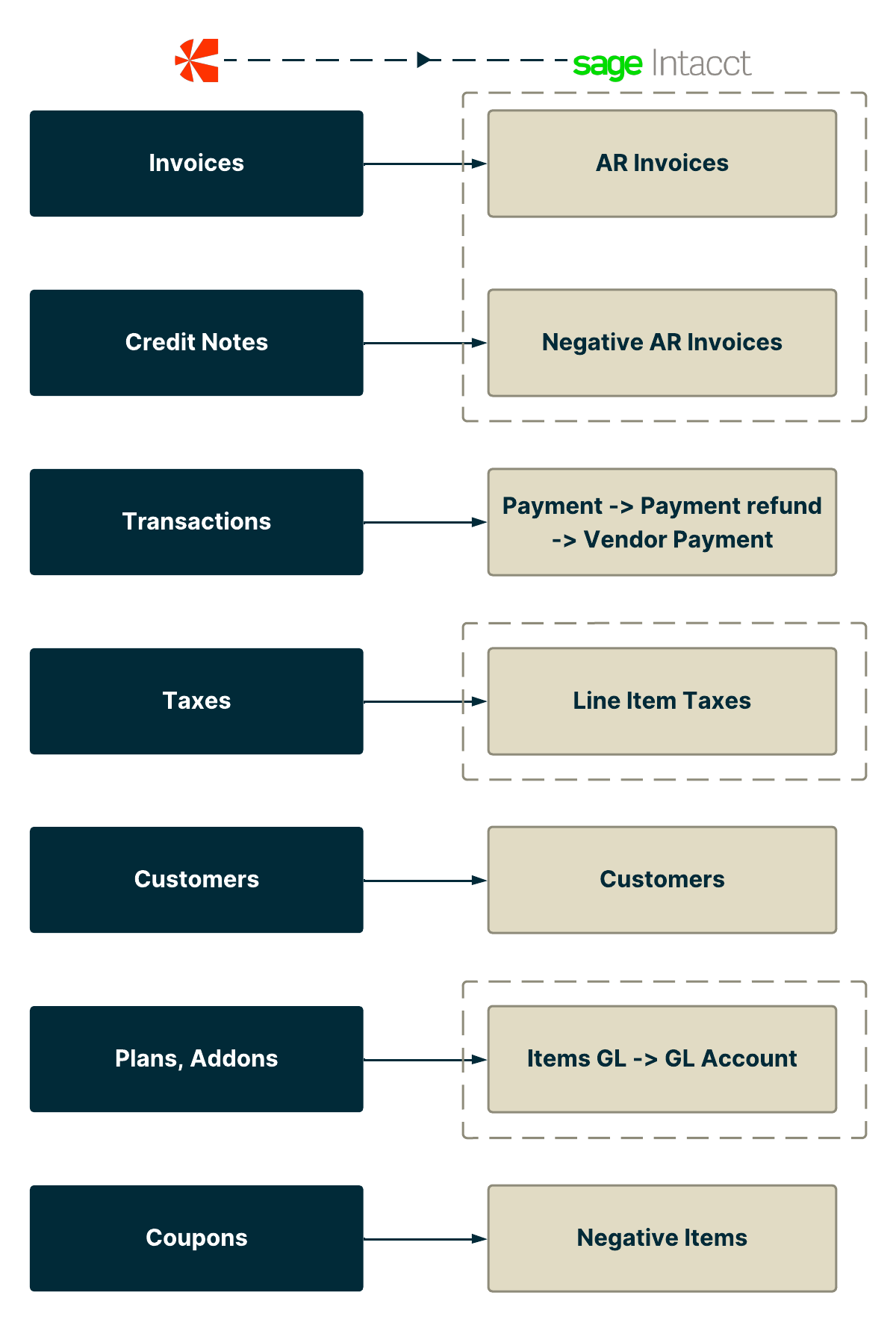

Chargebee supports integration with Single-Entity mapping for AR invoices.

AR Invoices and Credit notes referring to GL Account group with tax details for each line item.

Supports both the workflow of countries with tax solutions and without tax solutions.

If the customer chooses the top-level entity then the entity's base currencies should be the same to sync. If they have multiple entities with different base currencies then it is recommended to have Chargebee sites for each entity and connect the same with Intacct.

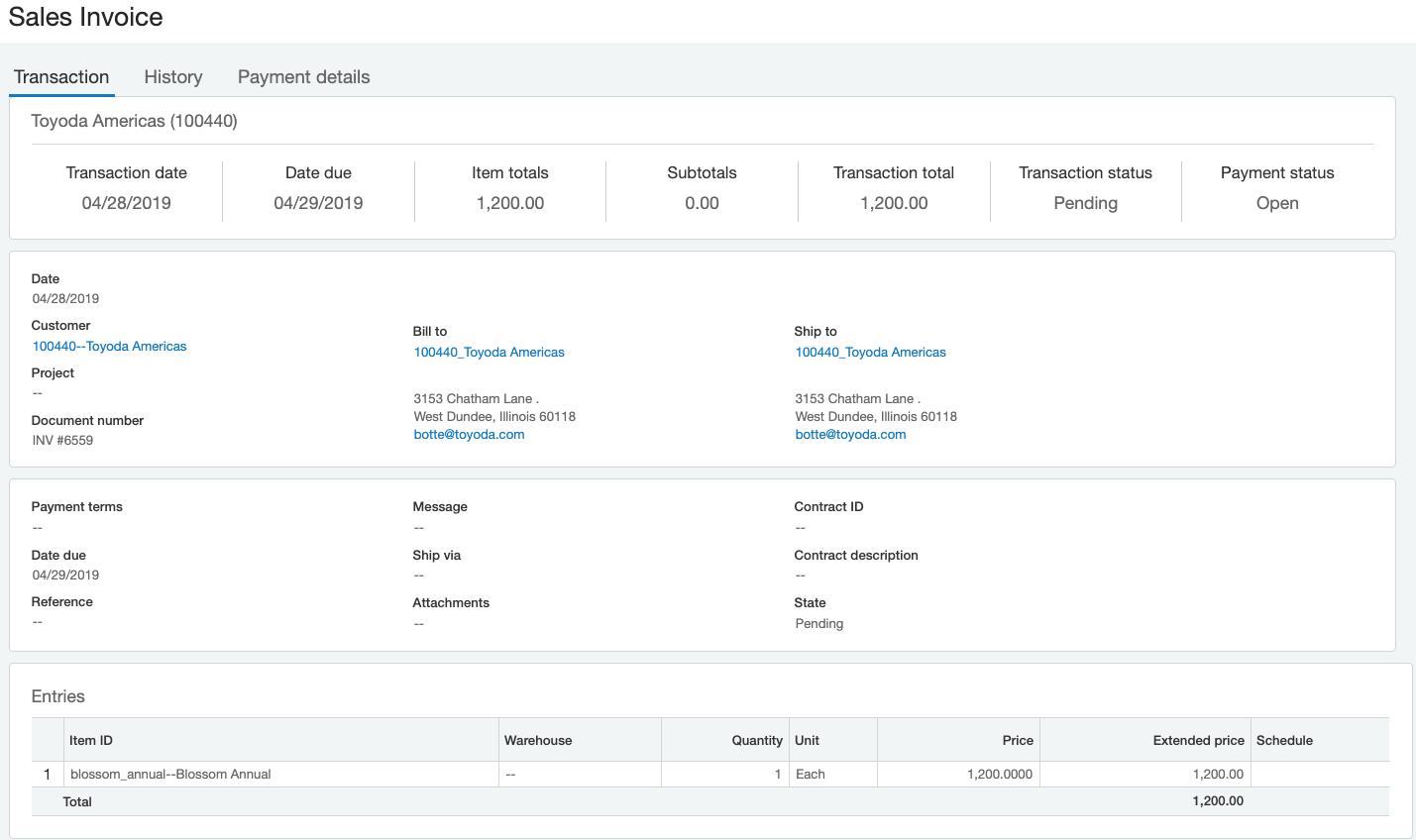

Invoice flow when the tax solution is disabled:

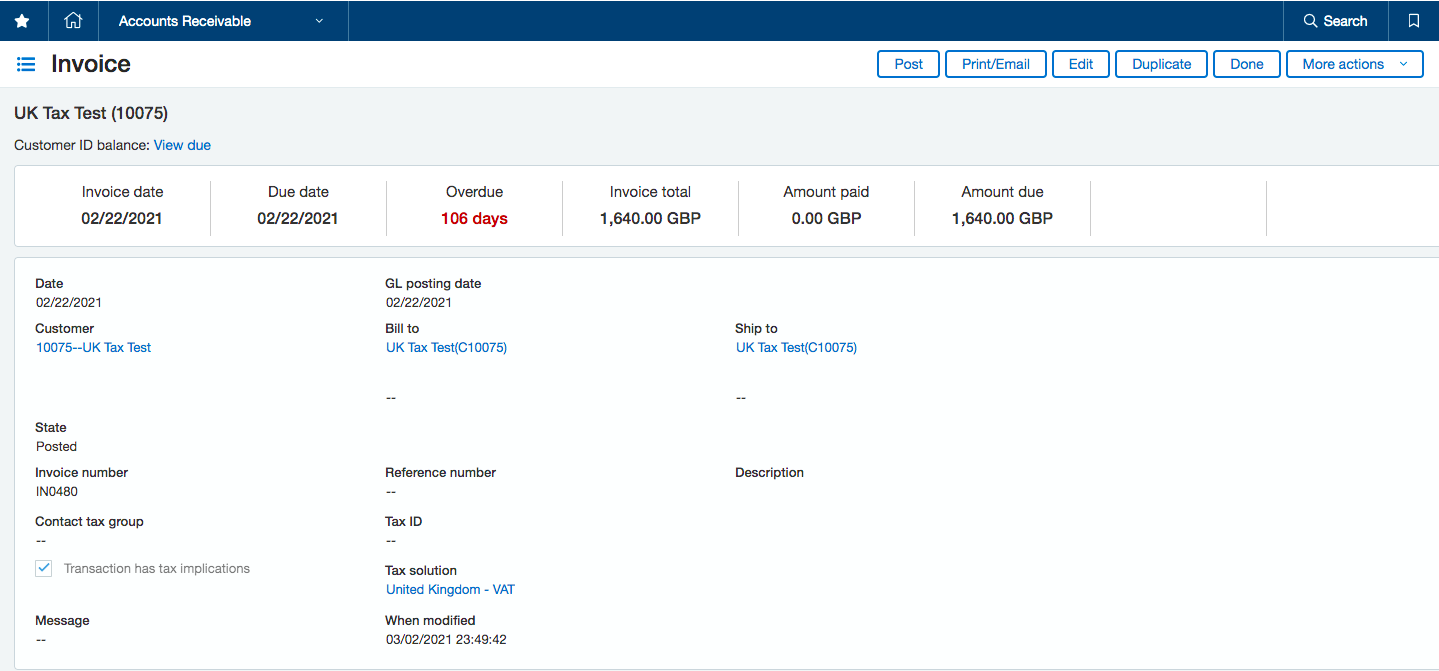

Invoice flow when the tax solution is enabled:

As part of the integration, we create the AR invoice directly in Intacct using the posting configuration as defined in transaction definition.

When an invoice is voided in Chargebee, a negative AR invoice is created in Intacct when the Tax Solutions enabled.

To adjust the AR balance for your customers, you should do the following:

You need to enable Revenue Recognition at AR invoice for configuring the Tax Solutions.

This is a pre-requisite only if the Tax solution is enabled as part of the configuration provided and if you had purchased the revenue recognition module in Intacct.

Follow these steps to enable Revenue Recognition at AR invoice:

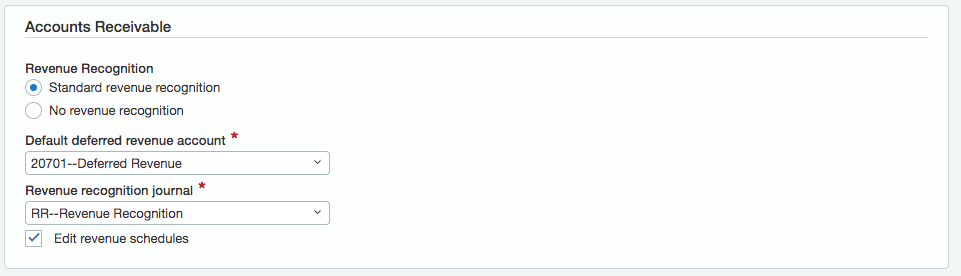

Select Company>Admin> Subscriptions> Revenue Management> Configure

Then Select Standard Revenue Recognition

Dimensions: For custom tracking/reporting, you can provide additional information at a customer or product level, namely Dimensions in Intacct. The following dimensions are supported: Location, Class, Department, Vendor, Project and Employee.

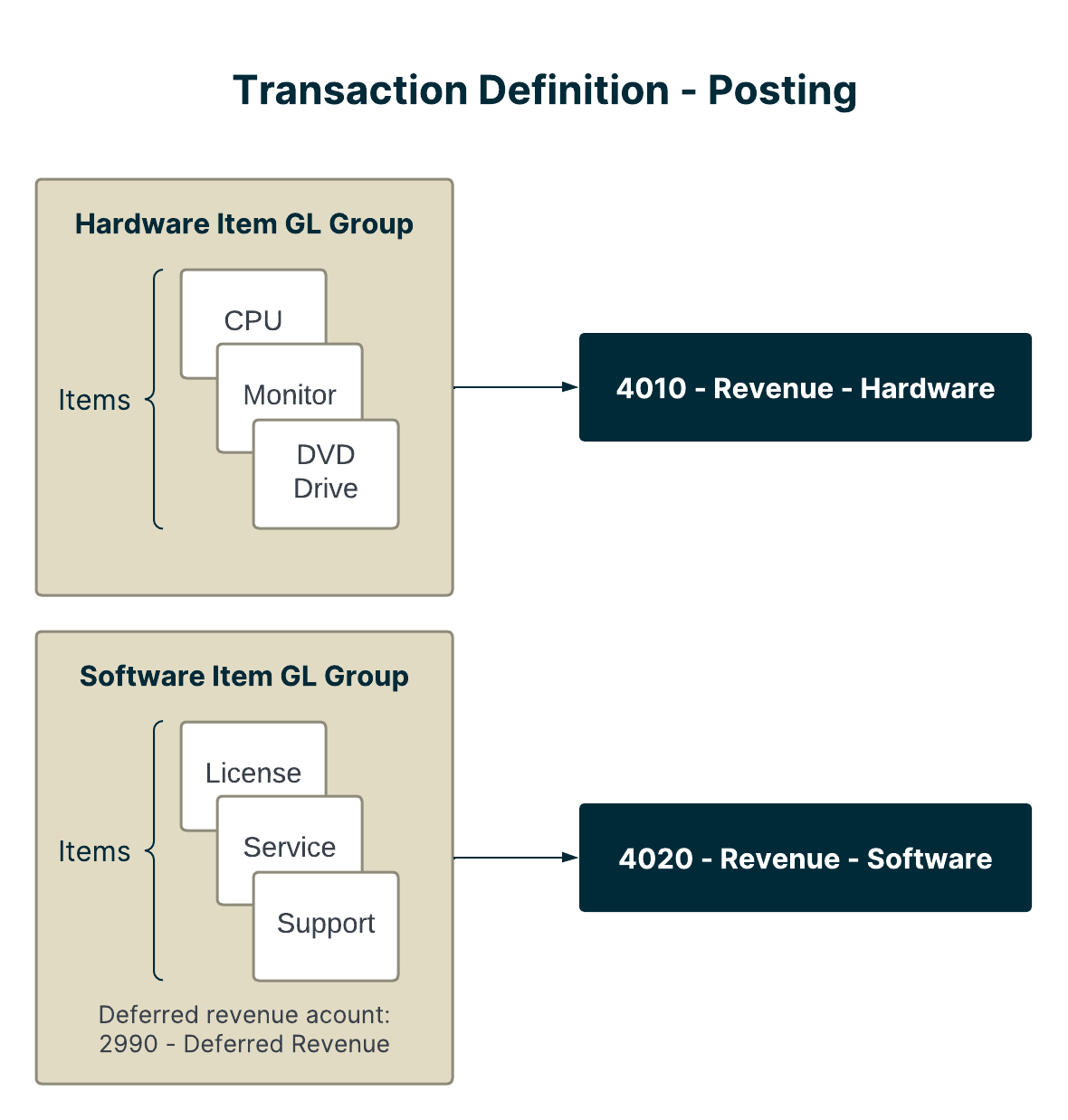

Item GL Group: Each Item GL Group has a default Revenue and Deferred Revenue Account associated, in Intacct. You can use item GL groups to categorize items and post transactions to specific GL accounts. In case you are selling products/services which should map to the Revenue/Deferred Revenue Account, you can create a group and map products accordingly. For instance, you can create Item GL groups Software and Hardware, and select a group name while mapping line items in Chargebee.

GL Account Group: A GL Account group can consist of a GL Account and/or Dimensions and/or other GL Account groups.

Product Line: You can provide a product family name for items created/mapped from Chargebee. If you have multiple Chargebee sites, you can categorize the items by providing a Product Line in Chargebee.

1. We create Sales Orders for fulfilment, how does this work as part of this integration?

Sales Orders are not created as part of the integration. Sales invoices are only created when they are synced from Chargebee.

2. Do we support the tax solution module?

Yes, we support the Tax Solution by creating the AR invoice and not the Sales Invoice.