Five Principles To Help You Recover Revenue Better

Recovering revenue is a balancing act—a tightrope between collecting a payment and providing a stellar user experience. Here’s how to approach it so you can minimize involuntary churn, and maximize revenue in the process.

If you send invoices out to your customers, here’s what the payment failure lifecycle looks like:

- the invoice is generated,

- the payment is due,

- the first charge on the payment method fails,

- emails inform the customer that the charge on the invoice cannot be collected and urge him to take action,

- consecutive charges on the payment method fail,

- if no action is taken, the associated subscription is modified in some way (either deactivated, paused, or canceled).

It seems there’s very little you can control at each stage—from the invoice to the churn.

This is simply not true.

Whether you’re trying to

- minimize false credit card declines,

- plan for soft payment failures,

- remind your customers that a payment is coming up so it doesn’t slip under their radar,

- recover revenue that you might have lost to a payment failure, or

- reactivate a subscription that’s fallen victim to the payment failure lifecycle,

There is something you can do at every single stage of the payment failure lifecycle.

The tactics are not the whole picture, though. Of the twenty odd tactics that you can use to recover failed payments, a different combination will suit every business and every customer differently.

The remaining piece of the puzzle is how to inform these choices in a way that balances your business’s need with your user experience.

This post has the answers you’re looking for.

Recovering revenue is a balancing act

Every tactic you can implement for revenue recovery is geared toward planning so there’s never (or rarely, at the very least) a situation where a customer who wants to pay you can’t.

What makes the tactics challenging, however, is that

- Blind implementation can break user experience and create friction

Take the example of two tactics that you can implement before a payment actually fails—pre-dunning emails and in-app notifications.

Both serve the purpose of informing a customer that a payment is coming up or that a subscription term is coming to an end, or that their card is about to expire.

Together, they can potentially catch multiple instances of a potential payment failure. They can’t be blindly implemented, however.

While all customers can be sent emails reminding them that a payment is coming up, only the ones who aren’t using cards that are automatically updated ought to get an ‘update your information’ reminder.

Choosing the right combination of retries, emails, and post-recovery subscription action for every customer or customer segment (depending on how granular you’d like to get) is integral to preserving user experience during revenue recovery.

- They put you on a tightrope as far as tone is concerned

On the other hand, you have to hit the right tone with the tactics that you do employ.

When you’re recovering revenue, you have to do this magical thing where you make a customer feel comfortable and valued and, at the

very same time, demand that you are paid what you are owed.

Here’s why the balancing act is tricky:

- It differs from business to business, customer segment to customer segment, even customer relationship to customer relationship.

- It is multifaceted in that it is much more than customer communication. You navigate this balance in the frequency of payment retries, the parts of the process you automate and the parts that you don’t, and the subscription actions you prescribe when you fail to recover revenue.

To help solve these problems, here are five principles that can help balance revenue recovery with your user experience.

Five principles to help you recover revenue better

1. A good defense is a strong offense

The most that can be done for a failed payment is before it fails—in the gap between ‘payment due’ and the ‘first charge’. So, principle number one is: implement as many pre-dunning tactics as you can.

We’ve touched upon email and in-app or website notifications, but backup payment methods and backup payment gateways are incredibly effective at lowering a false positive card decline rate.

Backups (whether they’re payment gateways or payment methods) offer a safety net in case a payment goes wrong during checkout or renewal.

For example, Baymard holds that these tactics alone saved them up to 1% of all potential sales.

On the revenue side, the upshot is clear. A failed payment can be caught almost immediately and fixed before it even enters the revenue recovery cycle.

On the user experience side, the flexibility to support both backup payment methods and payment gateways ensure that soft declines are completely minimized.

A soft decline occurs for reasons that have nothing to do with your customer, and minimizing these kinds of declines can elevate user experience—if you’ve ever had ‘technical difficulties’ ruin your experience of something, you know what I mean.

This still leaves the problem of implementing two tactics that end up working against each other. Don’t worry, I’ll cover that in a minute (skip to principle 3 to dive in now).

2. Keep an eye on customer behavior

Once a payment fails, the first thing you do is reach out to your customer to 1) let her know that her payment has failed and 2) ask if she can give her payment details a look over just in case they’re out of date or false. This is widely known and common practice—nearly 44% of all card declines occur due to insufficient funds.

What’s less applied—the immediate charge as soon as payment method information is updated.

Apart from recovering revenue as soon as possible, retrying a card as soon as it is updated

- Mirrors the customer’s urgency for a successful payment,

- Informs her that you were expecting the update and planning for it.

- Meets her expectation that her subscription is good-to-go the minute the update is complete.

(If you’ve set a retry schedule that does not pay attention to when a payment method is updated, you will not be able to meet this expectation. Quick action ensures that subscription experience isn’t broken.)

A billing system can help automate this without too much hassle. It can keep an eye on payment information and retry a card the minute it is updated, irrespective of the retry cycle that has been put in place for it.

3. Personalize behind the curtain

This point and the next one are all about personalization, the cornerstone of good user experience. They’re also an answer to the question of how to approach combinations of tactics.

Data can offer tremendous insight into how long retry cycles should be, when the right time to retry a card might be, and how often to follow up with a customer.

If you can customize retry cycles based on where your customer lives, when he is most active on your site, what plan he’s on, and which payment method he’s using, it puts a bunch of revenue recovery elements that were previously out of your control squarely in the palm of your hand.

Data can offer some much-needed flexibility in a mostly automated system.

For example, you can disable payment failure notifications for customers who have a history of prompt payments. Or put your higher ticket customers on a retry cycle that lasts weeks instead of days to accommodate for internal red tape.

Behind the scenes, it makes sense to tailor revenue recovery to your customer with data.

4. Personalize under the spotlight

In communication, on the other hand, it’s best to personalize to a customer with insight.

Andrew Culver, the founder of Churn Buster, has the perfect example: ‘Don’t email customers at 3 AM in the morning because that’s when the payment processor failed the payment…email them at 2 PM on a business day because that’s what MailChimp tells you your most successful time of day for reaching customers is’.

The first step, as Culver points out, is to decouple your retry cycle from your email cycle. Depending on how you’ve laid out your retry cycle (with data, hopefully, as principle 3 suggests), you can create and segment email campaigns to experiment with tone and volume.

For example, you can try a professional tone vs. a more conversational tone for certain customer segments, or personalize based on the type of decline, skipping an email for customers whose payment has been declined because of an issue with the gateway.

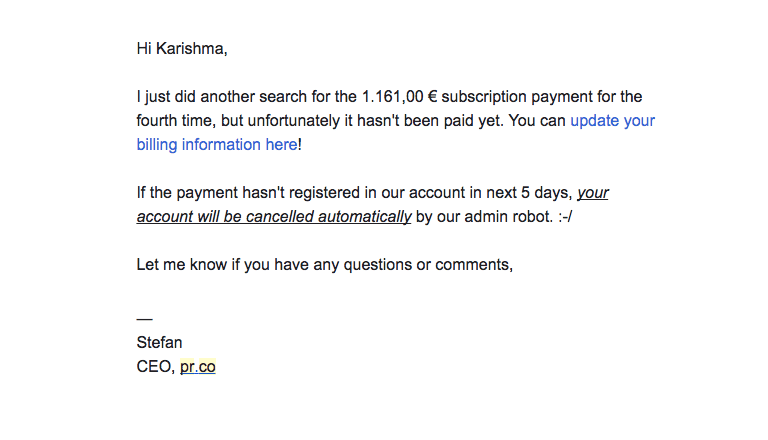

The next is to use customer data to personalize the email itself. First names, a knowledge of payment attempts, and clear CTAs to direct customers to fix the problem can go a long way. Here is an excellent example from pr.co:

5. Give the customer the benefit of the doubt. Always.

Finally, personalize subscription and invoice actions if a payment cannot be recovered.

When a payment fails, as far as a subscription goes, you can choose to:

- Keep the subscription active,

- cancel, or

- pause or temporarily deactivate it

As for the invoice, on the other hand, you can choose to:

- Void the invoice, or

- mark it as unpaid

Given how valuable customers are in SaaS, the balance we recommend here is to pause the subscription rather than cancel it when a payment cannot be recovered.

This way, you withhold future service while giving the customer time and, more importantly, the benefit of the doubt. It also irons out subscription complexities if your customer comes through with the payment—it’s easier to unpause a subscription than it is to reactivate a subscription or create a new one.

We’ve baked these principles into Chargebee’s revenue recovery

In essence, the best way to choose a combination of tactics that balance revenue recovery with user experience for your business is to approach the choice with a customer-centric mindset.

If all this looks a little overwhelming, we get it, we built a revenue recovery engine ourselves and we know how complex this balance can be.

Chargebee’s data reveals that 5.1% of revenue across merchants makes its way into the revenue recovery cycle from failed payments.

Chargebee recovers 65% of revenue lost to failed payments, almost all of it within the first ten days.

With logic to optimize how much revenue you can recover, you can use Chargebee to focus on your customer experience—a failed payment should never result in a disappointed customer. You can leverage Chargebee to keep your customer relationships steady during revenue recovery by:

- Personalizing the experience (with targeted communication and specific retry cycles),

- Giving the customer the benefit of the doubt (by customizing subscription action if the payment isn’t recovered), and

- Easing concerns and worries (with immediate collection).

Take Chargebee for a spin. Find out how much revenue it can save you.