Basics of Quote-to-cash Process and How you can Ace it

Closing a deal is a great feeling. The pitch, the negotiations, and finally the adrenaline rush of closing! So closing a deal is definitely a cause for celebration. But I wouldn’t open the bubbly just yet!

I don’t mean to be a wet blanket but it’s a long hard road from closing a deal to finally realizing the sweet, sweet cash in your books. So, what’s the ‘quote-to-cash’ process all about? Let’s dig a little deeper.

What is the Quote-to-cash Process?

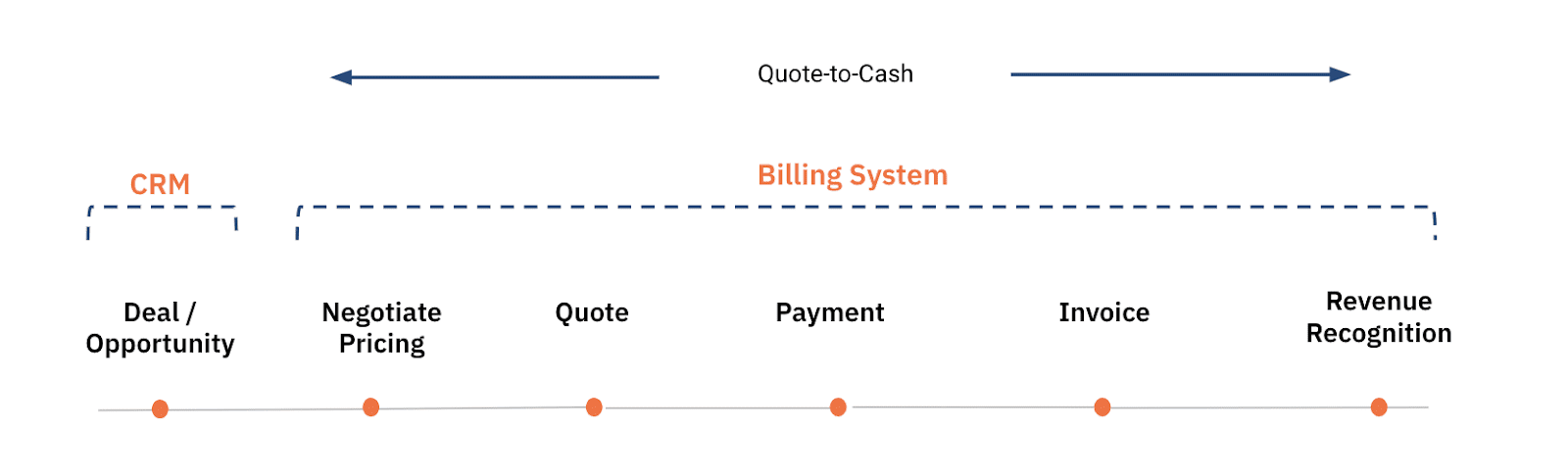

Quote-to-cash process is the journey that begins the moment a buyer expresses intent to buy your product and ends in what’s the raison d’être for every business – revenue.

Quote-to-cash or QTC is an end-to-end business process that includes all sales processes, contract lifecycle, order management, billing, collections, covering the entire customer lifecycle. It is larger in scope than the Order-to-cash or OTC process which deals mainly with order fulfillment. To know about the differences between QTC vs OTC, head here.

An efficient and effective QTC process can help a business establish omnichannel selling strategies and quality customer experience. A path that will eventually lead to profitable growth.

The Quote-to-cash Workflow

Your QTC workflow is at the heart of your revenue generation. Here’s what a QTC process looks like:

Deal/Opportunity:

It all starts with a deal or an opportunity created in the CRM. In the holy trinity of ‘Configure Price Quote (CPQ)’, the ‘configuration’ takes place in this stage. It is important to understand the needs of the customer and recommend the right combination of features in the product/service. This is the first stepping stone to closing the deal.

Negotiate Pricing:

A critical step in the QTC workflow, this includes identifying and negotiating the right price for your product/service. At this stage all the coupons, discounts, offers are given and then the negotiations ensue. It is important to walk the thin line of offering lucrative discounts that don’t gnaw away at your bottom line.

Quote:

In this step, a quote is issued to your prospect. Although it does not serve as the final offer, creating an accurate quote is an important step to lock-in the customer. A quote has to be quick and error-free to ensure a continuous dialogue with the customer that leads to finalizing the contract terms.

Payment:

The contract is signed and the said order is fulfilled on time. It’s now time to collect the payment. Here’s where technology and automation play a major role. It is important to streamline the QTC process to ensure visibility across all stages such as the pricing, quote agreement, and contract terms. This makes the next step easy. Payments can be made through offline or online methods, depending on your customer.

Invoicing:

With a streamlined QTC process, automated invoicing after the payment can be generated with an integrated billing system. An invoice can even be sent along with the payment link if your business prefers that. Details such as discounts, agreed-upon timelines for payments are very important for your finance teams and need to be captured. That’s why an integrated billing system that takes care of these nitty-gritty details will make the lives of sales and finance teams much easier.

Revenue Recognition:

The final cogwheel of a QTC workflow is recognizing the revenue. According to US GAAP, revenue can only be recognized once it is ‘earned’ by providing the said product and service to the customer. But more on revenue recognition, here. With sales reps juggling multiple spreadsheets, there are bound to be errors in recording the correct contract and payment terms. Automating revenue recognition and integrating it with your billing system will enable finance teams recognize revenue accurately.

Challenges in Quote-to-cash Process

Despite being an important business process, it is prone to inefficiencies sprawled across various departments such as marketing, sales, and finance. Each department has different priorities and the QTC process often falls victim to departmental silos.

In the absence of an automated and well-oiled QTC process, sales reps have to sift through tons of spreadsheets for the right quote. That’s how errors in quotes are born, leading to the internal ping-pong between sales and finance that creates painfully long sales cycles.

Unfortunately, these inefficiencies translate into revenue leaks due to poor response time, erroneous quotes, and missed cross and upsell opportunities. In the long run, inefficient QTC processes can also lead to cash flow problems owing to delayed collections.

Driving Success in the Quote-to-cash Process

To avoid siloed processing, you need 360-degree visibility in every step of the QTC process. What you need is a tool that ties your CPQ (Configure Price Quote) process, Contract Management, and Revenue Recognition. This will ensure an automated, seamless, and error-free QTC workflow by:

- Automating repetitive and error-prone tasks for the sales teams

- Enabling sales reps to create accurate proposals and quotes within the organization’s guidelines of approved discounts

- Reducing the sales cycle by reducing errors and the interdepartmental back and forth

- Bringing legal and finance teams on the same page enabling effective contract and revenue management

- Minimizing the risk of inaccurate revenue recognition

- Opening up revenue opportunities for upselling, cross-selling, and contract renewals

- Providing a deep-dive into sales analytics and metrics that will enable you to tweak your sales & marketing strategies on the go

At Chargebee, we have created a framework for a winning quote-to-cash workflow harnessing our integration with Salesforce.

Closing deals is important but remember that it doesn’t end there. A healthy QTC process is essential for higher revenue, lasting customer relationships, and ultimately profitable growth.