6 Best Practices For Accounts Receivable Automation

An organization’s cash flow is its lifeblood. And at its heart lies collecting dues on time. Improper accounts receivable management – either through manual processes or ineffective automation – can only complicate the process due to human errors, inaccuracies, and delays, leading to severely clogged collections.

In the era of shifting financial landscape, the move to incorporate automation for accounts receivable must be well thought out.

Let’s further explore the necessity of automation before we cover the best practices you can follow.

Why You Should Automate Accounts Receivable

Accounts receivable denotes the money owed to your company for your products or services. Since your order to cash cycle relies heavily on your AR, it’s a necessity to ensure important functions such as ensuring efficient invoicing, optimal days sales outstanding (DSO), quick dispute resolution, and the like. Apart from carrying out these critical functions, here are the core reasons why considering accounts receivable automation is beneficial:

1. Saving time and human effort

The core function of automation is to build a logic around your accounts receivable process, including which customer to charge, how to charge, when to charge, and what to charge for.

For instance, say a customer has an annual contract. The first quarter went by smoothly but the customer wanted certain adjustments (such as add ons, upgrade/downgrade, and the like) to be made during the second quarter. So, you adjust the subscription pricing manually. But imagine hundreds or thousands of customers instead of one – it would be impossible for any company to pull this off manually.

2. Predictable Cash Flow and Lower Bad Debt

Another core advantage of automating accounts receivable lies in having a predictable cash flow for your company. Without automation, your prediction could be completely off from what you’re actually collecting. You can automate payment notifications, reminders, and emails to ensure collection on time. Automation will help you stay on top of your collections process, ensuring consistent cash flow, and lower bad debts.

3. A/R Dashboards

Most automation solutions provide interactive analytical dashboards. They give accurate and helpful information on the right KPIs, like days sales outstanding (DSO) and collection effectiveness index (CEI), and enable you to make strategic financial decisions.

Now that we’ve covered the main reasons why you should automate your accounts receivables, let’s take a look at the best practices that companies can – and should – follow.

Accounts Receivable Automation Best Practices

Here are eight golden tips to streamline your AR automation:

1. Involve your accounting department

While deciding whether to go for automation software can be a high-level decision, the question of which tool in the market to purchase and the features needed should be answered by your accounting team. They know the ins and outs of your accounting workflows and hence know best about the various pain points your company is facing currently and how best to tackle that.

Additionally, get your team to clarify and reconcile workflows. A typical AR workflow would include a number of steps pertaining to sales and delivery (communication with the customer), invoices (sending invoices), payment collection, and reconciliation. Mapping out a system of your workflows helps you to figure out what to streamline and automate, and what unnecessary steps you can eliminate to reduce payment friction and simplify billing interaction.

For instance, Chargebee, as part of its billing logic provides one-click reconciliation between your payment gateways and accounting tools, enabling you to sync everything and completely eliminate manual work.

Relevant read: How automating reconciliation can save you hundreds of dollars every month.

Pro tip: Automate gradually

While jumping in and automating everything may seem tempting, keep in mind that this will put unnecessary stress on the onboarding and training process. The key is to gradually implement the new functionality and give AR teams the time to adapt naturally.

2. Ensure seamless integration of tech stack

Pretty much every company has payment gateways and accounting software in place before deciding that the functionality is limited in certain ways and they need to go for a more comprehensive billing software to achieve hypergrowth.

And if and when you make the decision to adopt such a tool, the first question you should be asking yourself is “will this tool integrate seamlessly into my already existing tech stack?”. If the answer to this question is no, it might end up more time-consuming and expensive than you expected, and the shift to another tool becomes a headache rather than a problem-solver.

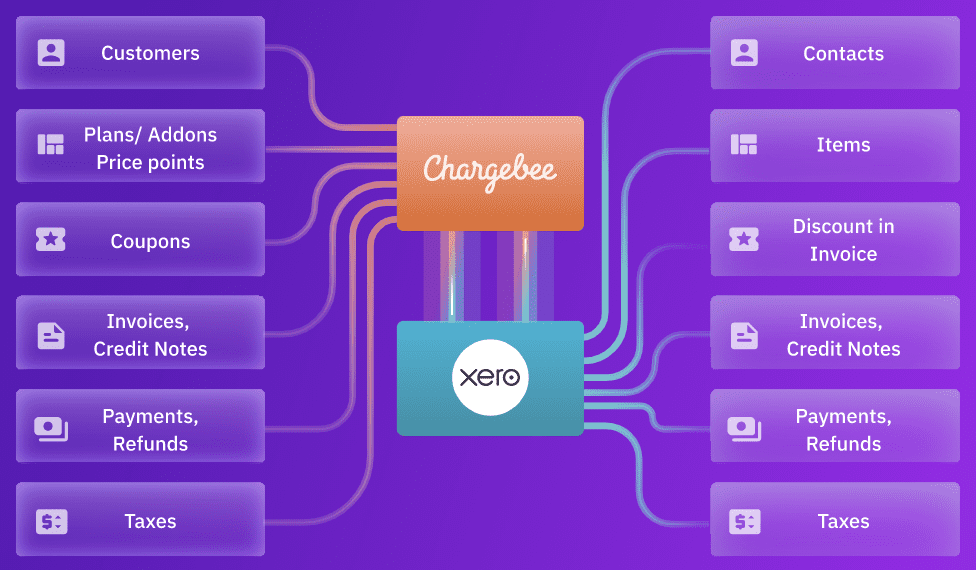

Hence, ensure that the integration aspect checks out. For instance, Chargebee integrates seamlessly with tools like Stripe and Xero, allowing you to:

- Avoid/reduce payment failures by setting up a backup payment gateway or using multiple payment methods

- Cut down mundane work by automatically syncing invoices, payments, credit notes & more to your accounting tool

- Get comprehensive reporting and set up dashboards to make data-driven decisions.

Fishburners‘ Financial Controller, Aayush Patel, says, “The (Chargebee + Xero) integration saves our finance team 8 hours a week from manual work. Our accounts team has gone from doing admin billing work to proactively analyzing our revenue figures in Chargebee to create strategies to sustain revenue growth.”

3. Incentivize advance payments

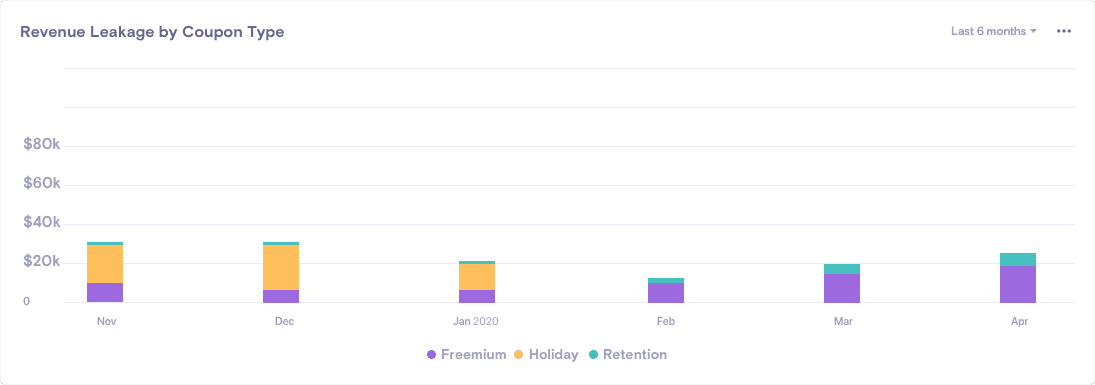

Establish payment conditions that include incentives for customers to pay early (or penalties for persistent late payers). Offer early or upfront payments discounts if you can afford it; you can also go ahead and offer incentives to customers who choose annual payment plans. In some cases, even substantial discounts may be preferable to receiving no payment at all. Both you and your customers will benefit from this arrangement. However, keep track of how the discounts affect your bottom line. Here’s a graph that indicates revenue leakage by coupon type:

Pro tip: Encourage online payments

Integrating with online payment gateways is the need of the hour. Offline payment methods can be highly unpredictable – say a cheque that doesn’t reach you on time or getting lost in the post – leading to delay in collection. By choosing to go online you can increase payment speed by 20-30% by allowing your customers to pay through PGs directly from your reminder emails. B2B PGs can operate on flat fees regardless of the amount transferred. Incentivize these payments for your customers.

Additionally, give customers flexibility in terms of more payment options. For instance, Chargebee offers multiple online (and offline) payment options (25+ payment gateways in over 50 countries), allowing you to not only reach a broader audience but also to boost conversion rates and retention rates.

4. Ensure Quick dispute resolution

One of the most common causes for non-payments and rising DSOs are disputes. Monitor disputes, understand the reasons for them, and try to resolve them as soon as possible. Remember that a delayed resolution will only lead to further delays!

For instance, Chargebee’s automated workflows assist in dispute resolution, making refunds and chargeback management easy: track and record chargebacks effortlessly, get an accurate picture of your AR and deliver a superior customer experience.

Relevant read: What are chargebacks? How can you protect your business from it?

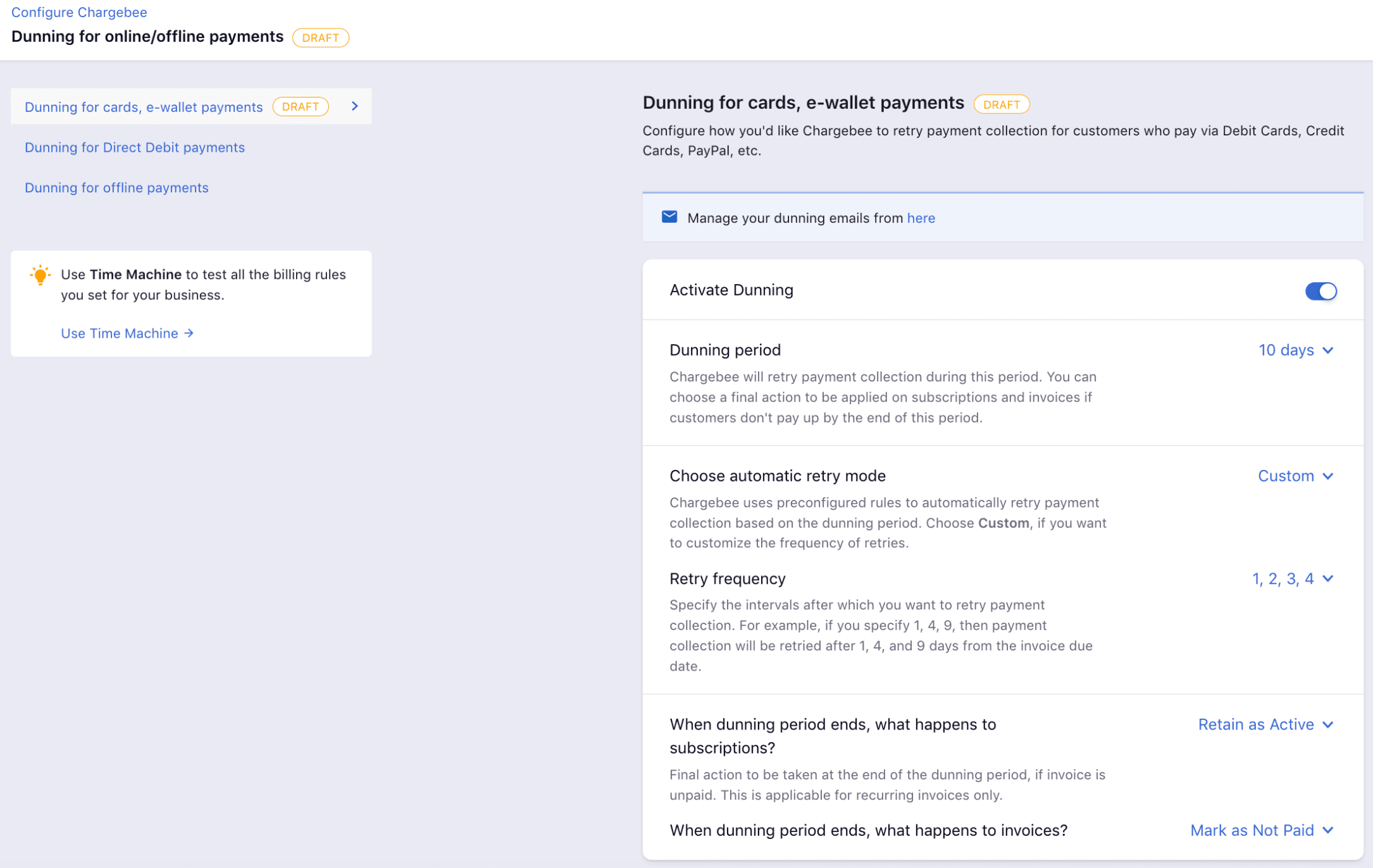

Pro tip: Have a robust dunning mechanism

Dunning is the method of communicating with a customer in a systematic manner to guarantee collections. For online payments, dunning comes in handy in the case of unsuccessful transactions and declined credit cards. Dunning can also be used to ensure that your payments are ensured when paying offline or for payments with credit days.

Chargebee’s smart dunning management handles failed payments and involuntary churn with smart payment retries, helping you maximize revenue recovery.

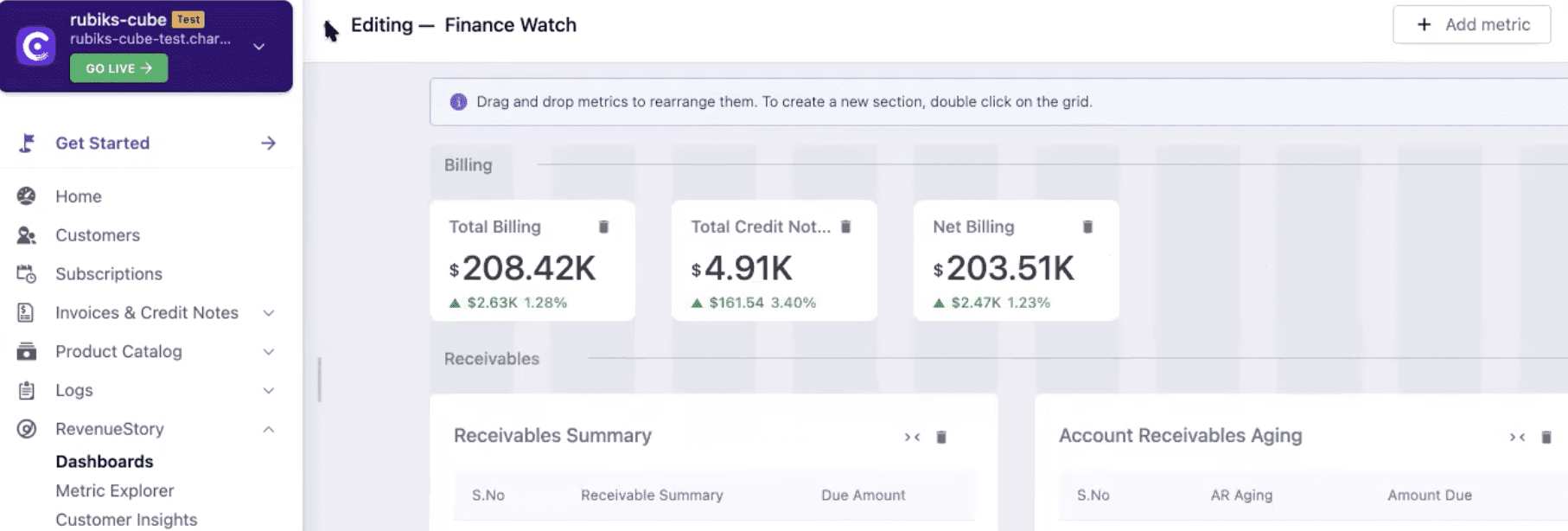

5. Set up an AR dashboard

Create dashboards for your AR analytics for easy tracking. The distinction between a healthy and a not-so-healthy cash flow will be dictated by your determination and rigor in measuring the right KPIs and recognizing insightful patterns.

RevenueStory gives you the analytics you need to discover and align your organization to growth. Create custom dashboards, showcase your growth metrics, and more.

Additionally, RevenueStory provides default dashboards for different business functions. Here’s a look at the dashboards for finance:

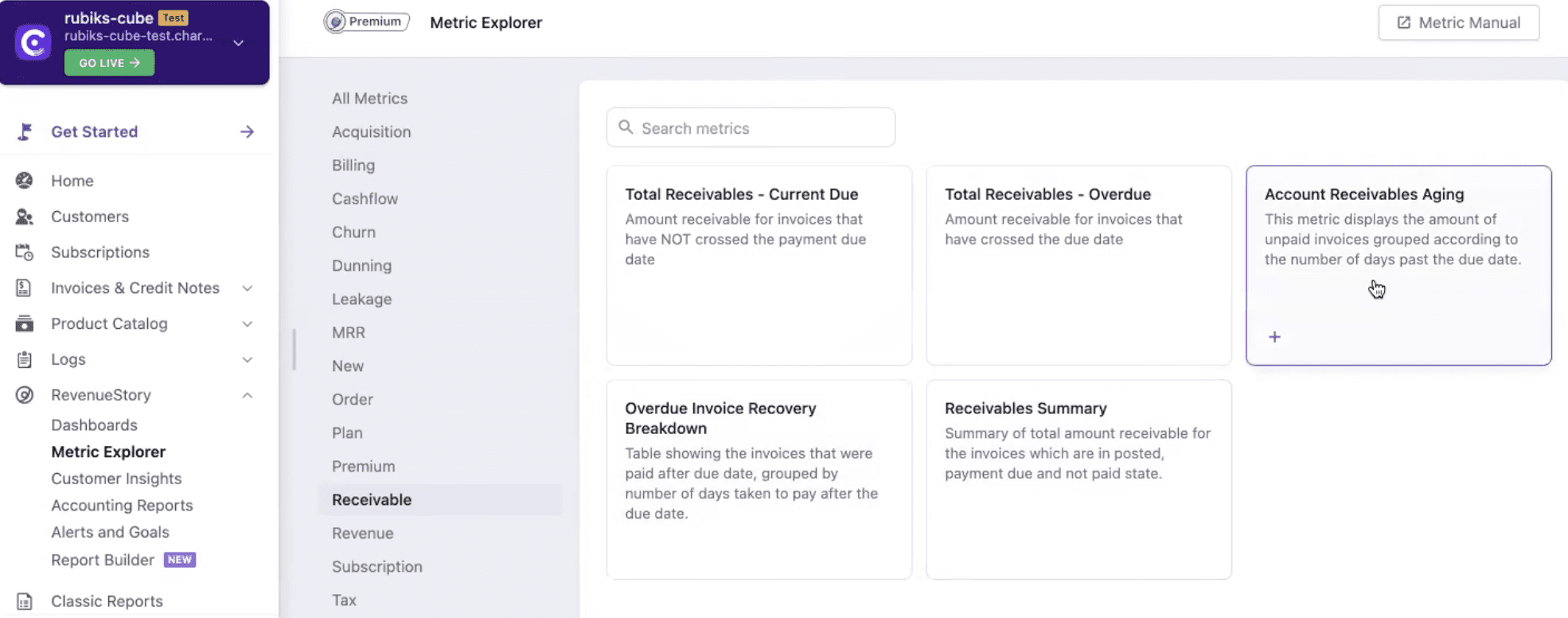

Pro tip: Review accounts receivable aging reports

Simply put, an AR aging report lists the amount due from your customers. Apart from helping you to understand the financial health of your company, it evaluates the efficiency of credit and collection activities as well as any current irregularities in the collection process. An AR aging report is important for a handful of reasons:

- It helps you identify concerns before they become a cash-flow crunch.

- If you have a customer making late payments, you can assess the situation and make the required modifications.

- It can help you withhold product/service offerings until the amount is paid by the customer on the specific due date.

For more information on AR aging reports, how it’s used and its benefits, check out our article: What is an Accounts Receivable aging report?

6. Ensure holistic operations

While your primary focus is on accounts receivable management, don’t forget that functions like invoicing and revenue recognition greatly aid the overall AR process. Move away from the complications of spreadsheets and automate your revenue workflow right from sales order to revenue recognition:

- Set up an efficient billing workflow and automate invoicing logic.

- Converge on your accurate valuation by adhering to ASC606 and IFRS15 revenue recognition standards.

In Conclusion

Managing receivables can be a difficult task. It involves making sure your customers pay their invoices on time with as little effort as possible on your part while lowering your collection costs, and of course, without jeopardizing the experience of your customers. However, the same process can be made simple and efficient with the help of proper automation.

What you need is a reliable billing system that abstracts all the billing complexities and lets you focus on what truly matters.

With Chargebee for Finance Teams, you can ensure:

- Seamless billing and invoicing – comprehensive invoices, advance invoices, and global tax support.

- Solid accounting integrations from the get-go – don’t spend an extra penny or a second or a contingent of developers to get things done.

- Credit notes for smarter credit handling – handle all credit snags including refunds, adjustments, setting of payables against receivables, cashback offers, and referral bonuses.

- Accurate and real-time reporting – stay ahead of the numbers game irrespective of the number of payment channels, subscriptions, or customers.

- All the essential nitty-gritties of payments, automated – multiple payment options, gateways, and currencies; payment reconciliation in 1/10th of the time; efficient recovery of lost revenue.

Walter Chen, the founder of Animalz, a New York based content marketing agency, says, “We had a back-office team and we paid them around $3,500 a month. And part of their job was to do accounts receivable. And once we had Chargebee, we really didn’t need them to mediate the accounts receivable process. We could just pull reports directly and follow up directly and I get it a lot better because it’s not done manually.”

The founder’s initial financial woes disappeared after the switch to Chargebee, and Animalz quickly streamlined their Account Receivables at a cost of less than 1% of their annual recurring revenue.

Wondering how they did it? Try Chargebee for yourself. You can also schedule a demo – our experts will get in touch with you.