Why should you implement Multi-Currency Support for your Subscription Business?

SaaS and Subscription businesses are built for global growth. Companies like Dropbox and SurveyMonkey, have shown a huge portion of their customers are global.

A common recurring theme in the success that these companies have had, has been a thorough practice of Price Localization. Allowing a customer to pay in her native currency, with a preferred mode of payment, is indeed a big deal.

This ‘deal’ gets even bigger in the case of subscription based businesses, as a customer might take a chance with a one-off payment, but will definitely refrain from the possibility of getting billed for a different amount every month/quarter, owing to the ever-changing exchange rates.

When SurveyMonkey shared that their business was 55% US-based, and that they were bent on bringing it down to 25%.

Selina Tobaccowala, their former CTO and President who led the global expansion efforts, noted that building internationalization right into the payment systems remained a key building block. “Regardless of the payment service providers you use today, you’re going to have to use a different one for other countries.”

She goes on to add, “This sounds easy enough, but it requires abstracting payments in your app so you can connect to a different PSP later. If you think about it early enough, you can create the abstract layer and avoid rebuilding your entire checkout system.”

With the capacity to handle multiple payment gateways, accurate calculation of country-wise taxes, and accounting integrations, Chargebee already lets you achieve this abstraction.

But with a more powerful feature like Multi-currency Pricing support, you can sell from Anchorage to Canberra in Australian Dollars, from Toulouse to Saint Petersburg in Russian Ruble, and so on. You can accept over 100+ currencies, and manage all your subscriptions within one dashboard.

You can eat a chocolate chip cookie, while enabling multi-currency.

It’s that simple. Learn how to setup multi-currency for your business with Chargebee.

Why should you implement Multi-Currency Pricing?

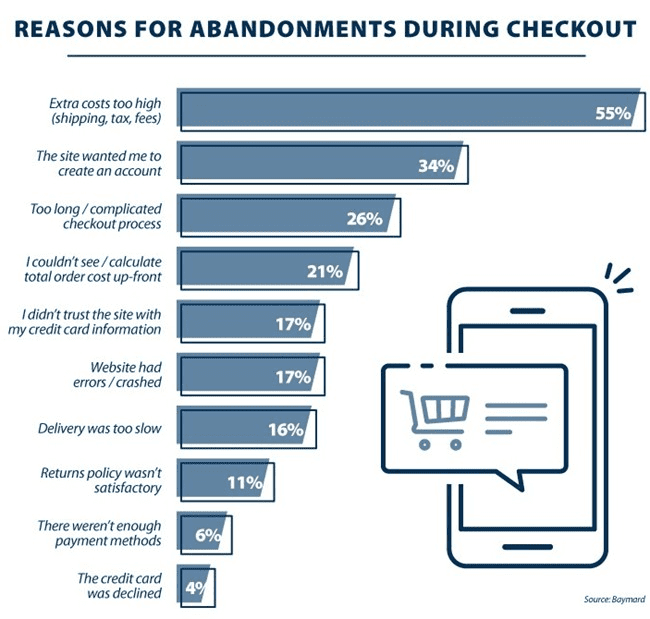

One of the most frustrating challenges faced by SaaS companies and e-commerce stores is shopping cart and pricing page abandonment.

When industry abandonment rates can be as high as 90%, it’s infuriating to think that you could be generating 10x as much revenue if every single website visitor who added something to their cart or visited your pricing page actually went through with the purchase.

Of course, we don’t live in an ideal world where every single visitor to your website is a fully-qualified buyer. Most aren’t ready to buy, and are looking for every excuse to… not.

That doesn’t mean you shouldn’t do everything you can to increase checkout and conversion rates.

And one of the simplest (and most impactful) things you can do is add multi-currency support.

If you’re not offering your product or service in the local currency of each region you’re selling in, then you could be missing out on a serious opportunity for growth.

Top 3 Struggles businesses face without Multi-Currency Pricing

If you haven’t yet adopted multi-currency support, you might be missing out on sales conversion and retention opportunities.

Here’s why:

#1. The Exchange Rate Is Constantly Changing

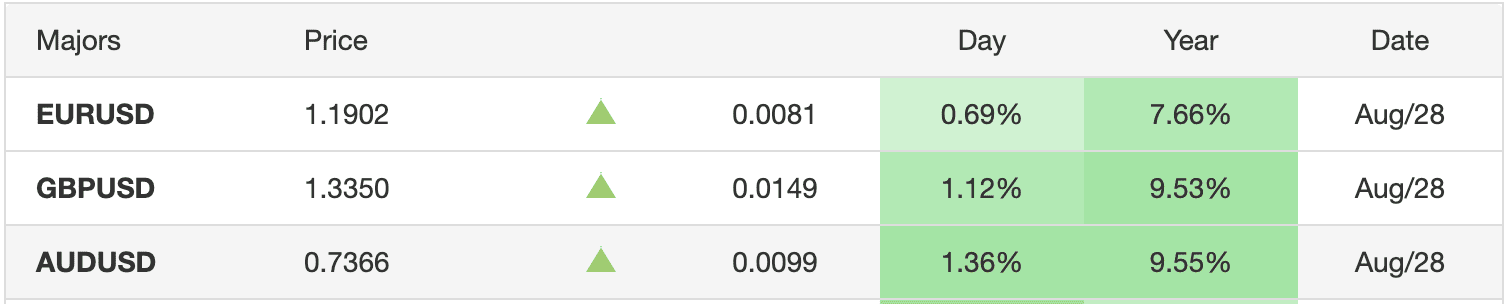

The nature of international exchange rates is that they are constantly fluctuating, and that can be incredibly frustrating for your customers if they aren’t paying in their local currency. That’s because every month when their credit card gets charged, a different amount comes out.

For single users of a B2C style SaaS product, the difference may be negligible. Not enough to cause any great individual concern, as the difference is a few dollars at most, but it’s still pretty annoying.

For larger B2B customers, who might be spending tens of thousands of dollars a month, this monthly difference can be huge. From their perspective, this creates a budgeting nightmare.

For instance, let’s say you’re a B2B SaaS based in the US, and you charge exclusively in US dollars. A major client of yours is based in Australia, and their account value is $100,000 a month.

In the last 12 months, the AUD to USD conversion rate has fluctuated around 10%, which for that client means the $100K they signed up to just became $110K.

For your customer, this represents an additional $120,000 per annum that was not budgeted for, enough for any CFO to question the longevity of the relationship with that company, and to order a review of that subscription and of other potential options.

Differences can be even more extreme between GBP and USD, where the British Pound is 25% undervalued against the US dollar, and the rates are even more volatile.

#2. Foreign Currency Conversion Fees

If you’ve ever bought something online from an international company, you’ll have seen the impact of foreign currency conversion fees.

These fees are charged by your banking provider, and in some cases can be as high as 5%.

As a consumer, 5% may not seem like a whole lot when you’re buying a pair of shoes online, and though the charge that shows up on your card can still be several dollars, you tend to write it off as part of the convenience of buying internationally from your computer.

For large-scale B2B transactions, though, these fees can add up significantly. That Australian customer that’s paying you $100K a month? They’d be paying as much as $60,000 a year in foreign currency conversion fees!

To give you a little more perspective on just how quickly these charges can add up, here’s a breakdown of foreign currency conversion fees your international customers might be paying, depending on their monthly subscription costs.

| Monthly Subscription Cost | Conversion Fee of 1% | Conversion Fee of 2% | Conversion Fee of 3% | Conversion Fee of 4% | Conversion Fee of 5% |

| $1000 | $10 | $20 | $30 | $40 | $50 |

| $10,000 | $100 | $200 | $300 | $400 | $500 |

| $100,000 | $1000 | $2000 | $3000 | $4000 | $5000 |

| $500,000 | $5000 | $10,000 | $15,000 | $20,000 | $25,000 |

The consequence of all of this is that the actual cost of your product or service ends up becoming significantly more than advertised (or expected), which doesn’t spell anything good for your churn rate.

For singular retail purchases, such as on ecommerce stores, it can mean customers don’t return, despite the fact that it wasn’t your company that charged the fee itself. In fact, just 16% of online shoppers would return to purchase from an ecommerce store after a negative experience.

The bottom line then is that you’ve only got one opportunity to impress, so you’d better make it count.

#3. Getting An Unpleasant Surprise When You Aren’t Advertising In Their Local Currency

If you’re in Europe buying out of the US, it’s pretty obvious when a price isn’t in your currency.

If, however, you’re based in Canada or Australia, seeing that $ currency symbol doesn’t necessarily make buyers assume the currency is set to USD.

For global buyers in these nations, the fact that they also use a dollar-based currency can cause a lot of confusion.

This can cause an unpleasant surprise when you get to the checkout stage and realize it was in US dollars all along.

Shopping cart abandonment is already a huge problem for online stores, with abandonment rates typically averaging between 68% and 75%.

Of course, there are a whole host of reasons why, but with the rate being so high, you’ll want to do everything possible to reduce it.

Adding to these already alarming statistics is the fact that approximately 13% of potential purchasers abandon their shopping cart at the last minute when pricing is in a foreign currency.

That’s a huge number of customers you could be missing out on, especially when the solution (multi currency functionality), is incredibly easy to implement.

3 Reasons to Implement Multi-Currency Pricing

Aside from solving some fairly serious online shopping issues, multi-currency support offers a number of unique benefits for ecommerce stores and scaling SaaS companies:

#1. Multiple Currency Support Allows You To Take Advantage Of Psychological Pricing

A simple solution to displaying your prices in your customers’ local currencies would be to install some form of currency conversion tool.

The issue with these is they work in real-time, which means your prices will not only fluctuate, but they’ll display rather exactly. Too exactly, in fact.

There’s a reason why you’d desire a pricing point of $49, rather than $50.47, for example.

Aside from looking clean and modern, by reducing the left number in your price point by one, you can increase sales by as much 24%.

That’s why this is such a commonly used pricing tactic, with 60-70% of retail pricing ending with the digit 9.

The good news is this; multiple currency support makes it incredibly easy to implement psychologically-focused pricing.

#2. Customers Can Pay By Bank Transfer In Their Preferred Currency

Not everyone likes paying their invoice by credit card (or even has one for that matter), and many buyers prefer the freedom and power involved in paying by bank transfer.

Cyber-security is something that’s important to all of us, and for some, allowing a company to take funds out of your account via direct debit presents a risk that you simply don’t want to take.

Allowing customers to pay via bank transfer can open up a number of revenue opportunities, especially when 7% of customers prefer this payment method. This is especially true for larger corporates, so if you’re chasing enterprise deals, then you’re definitely going to want to facilitate this as a payment option.

| Online Payment Method Usage Comparison | |

| Payment Method | Percentage of Usage |

| Credit and Debit Cards | 40% |

| PayPal and other e-wallets | 39% |

| Mobile Payments | 10% |

| Bank Transfer | 7% |

| Other (Cryptocurrencies, Gift Cards, etc.) | 4% |

To help your customers avoid transfer fees, you should also implement multi-currency support, which is made even easier if you:

#3. Set Up Multiple Bank Accounts To Handle International Payments

Though multi currency support makes your customers’ lives infinitely easier, it does have one drawback.

You’ve probably realized already that by allowing your customers to pay in their selected currency, the burden of foreign currency conversion fees may now rest at your end.

There’s a simple way to get around this, though: set up multiple bank accounts in different countries or currencies.

It’s not unusual for businesses to hold more than one bank account; today, even the average American consumer has five bank accounts.

Subscription billing platforms like Chargebee support billing in over 100 different currencies, so if you really want to take advantage of multi-currency support, and your company is planning to scale into new territories, you might want to set up a few.

How does Chargebee’s Multi-Currency Support work?

Chargebee’s multi-currency feature lets you create Plans that support multiple currencies, thus allowing your customers to pay in their local currency.

All you have to do is, enable multi-currency, configure the currency type, select the type of exchange rate, and you are set!

Your reporting will have it all

The ‘Base Currency’ will be your default currency and will also be used in the reporting. Foreign currencies that you transact in, will be considered ‘Additional Currencies’.

With exposure to automatic exchange rates, you can view your consolidated reports considering all the currency types, as well as individual reports, based on the choice of currency that you have selected for transactions.

You can select the necessary currency type and exchange rate type i.e. Manual, to configure exchange rates yourself, or Auto, where Chargebee automatically updates exchange rates based on information received from third party exchange rate providers like currencylayer and Open Exchange Rates.

(Dashboard displaying transactions in base currency, i.e., CAD)

(Dashboard displaying transactions in choice of currency, i.e., GBP)

Facilitate global transactions at scale

A key precept to global expansion is allowing different payment methods, gateways, and currencies. As a merchant, you may have multiple gateway accounts with, say, Stripe, Braintree, and Authorize.Net. You may also have multiple accounts linked to the same payment gateway, for different currencies – say, Stripe for United States, Australia, and Denmark. Chargebee has place for all of that, and more.

Managing multiple gateway accounts is now simpler, with our brand new Smart Routing feature. If your gateway requires you to configure more than one gateway to manage multiple currencies, the Smart Routing logic allows you to link different payment gateway accounts for different currencies and payment methods, and intelligently route those payments across global borders.

Clean UI, easy usage, and intelligent function – you can earn repeat customers from anywhere in the world, at scale.

Languages, currencies, global taxes, we have it all covered, for you to expand your borders.

Conclusion

With online purchases continuing to grow, and international growth a priority for many subscription companies looking to scale, you’re going to need to meet the needs of your global customers in order to succeed in your industry.

One of those needs is support for multiple currencies, which luckily is made simple with a subscription billing platform such as Chargebee.

By using Chargebee’s multi-currency support functionality, you can battle exchange rate fluctuations and foreign currency conversion fees, reduce shopping cart abandonment, and take advantage of the wide array of benefits offered by psychological pricing models.

Book a demo with one of our team today to find out more about how we can help your company succeed.