PRODUCT

SOLUTIONS

- BY INDUSTRY

- B2B SaaS

- eCommerce

- E-learning

- Publishing

- BY BUSINESS SIZE

- Startup

- ScaleUp

- Enterprise

- BY BUSINESS MODEL

- Self-serve

- Sales-driven

CHARGEBEE RETENTION

9 Popular Pricing Strategies to Maximize Revenue Growth

Pricing is one of the most crucial and influential levers in driving revenue for your company. Unfortunately, many organizations take a “set and forget” approach to pricing and fail to develop a comprehensive, research-backed strategy to determine appropriate pricing points.

This mistake leaves a significant revenue opportunity on the table and is responsible for as much as 18% of startup failures.

It seems obvious: optimizing your pricing strategy so you’re maximizing revenue from each customer leads to improved growth and higher profit.

However, many SaaS revenue leaders fail to put this simple idea into effective practice.

This guide will dive deep into the importance of pricing strategy, discussing nine of the most powerful strategies before outlining how to choose the optimal approach based on the type of company you operate.

What Is Pricing, and Why Is It Important to Get Your Pricing Right?

Simply put, pricing is the process of determining what you’re going to charge for your company’s products or services.

The operative term in this definition is “process.” Setting your price must not be an arbitrary decision based loosely on market norms and competitor price points (though these factors should be taken into account).

That “process” (which we’ll discuss in more detail in subsequent sections) is informed by your pricing strategy — the theory and principles behind your product pricing.

So, why is it so crucial to get pricing correct?

The main reason is that pricing optimization leads to increased profits. Studies show that a pricing increase of just 1% can induce profit growth of more than 11%.

Of course, by setting prices too high, you’ll alienate certain market segments and risk pricing yourself out of the market. You need to find the right price, or prices, to maximize market penetration.

More than that, a company’s pricing contains inherent indicators of value and how customers should perceive that product.

At a basic level, higher-priced items are perceived as being of higher quality (a psychological phenomenon known as premium or prestige pricing) and vice versa.

How, then, do you determine the optimal price point for your product or service? First, you need to determine the pricing strategy that best fits your revenue and organizational goals.

What Are Pricing Strategies?

Your pricing strategy is your methodology, concept, or theory behind your product pricing.

Pricing strategies allow you to make informed decisions on pricing changes and to understand how those changes will be impactful and appeal to your target audience.

Let’s take two common pricing strategies to illustrate: price skimming and cost-plus pricing (both of which we’ll discuss in more detail shortly).

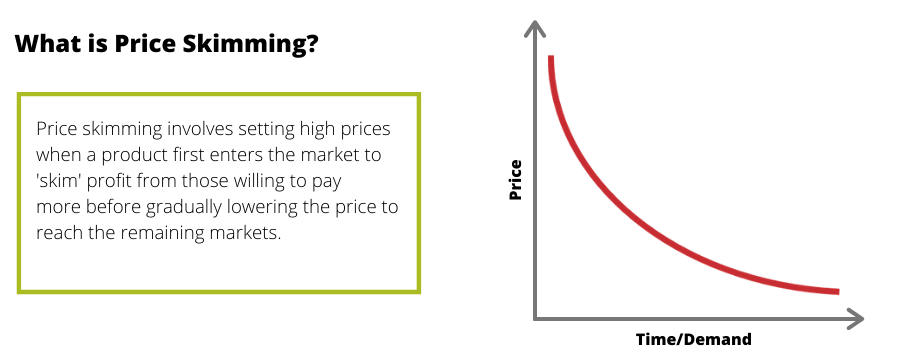

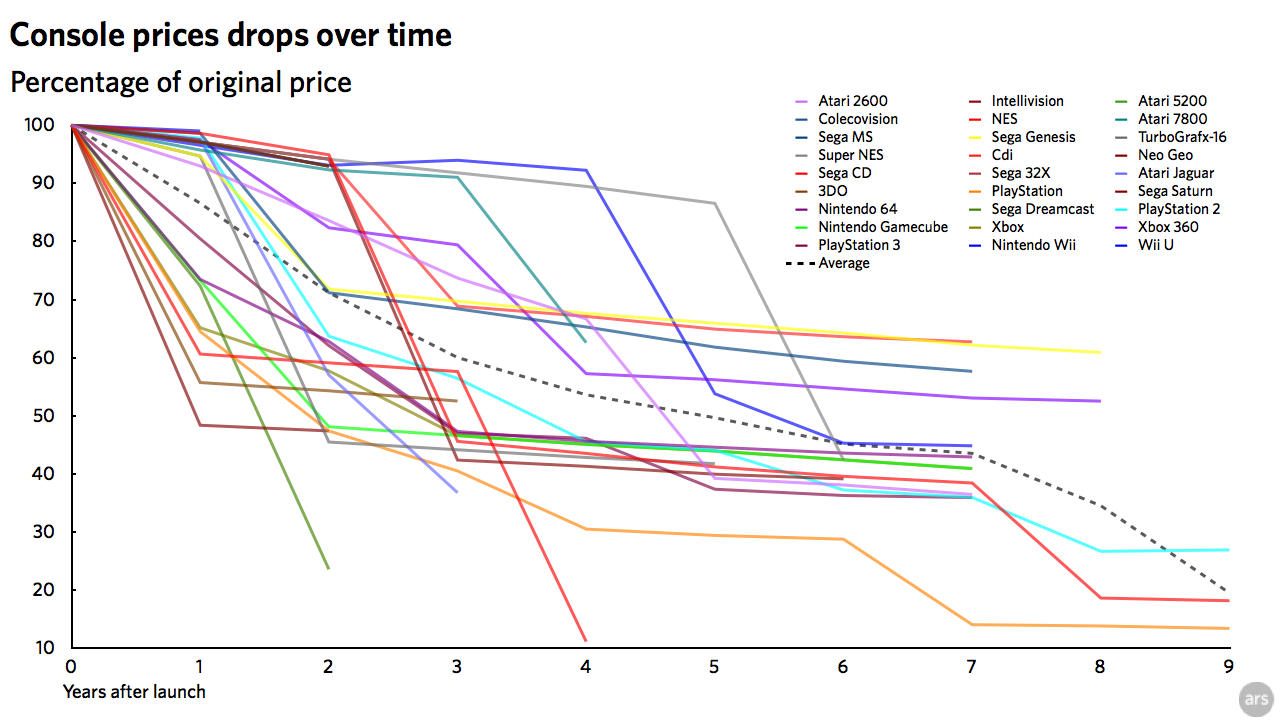

Price skimming is a strategy where you start by setting high prices — as high as the market can tolerate (capturing maximum revenue per unit early on) — and then gradually lower prices to reach a wider audience as demand reduces.

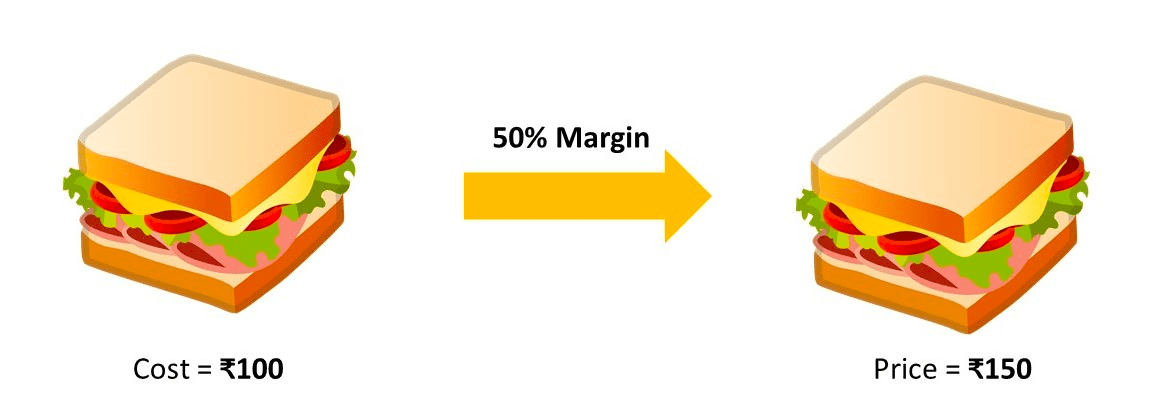

Cost-plus pricing is a strategy that takes your total production cost and adds a margin on top of it (typically a percentage).

A startup entering the CRM market, for example, might perform research and determine that the maximum they can charge for their product right now is $80 per user (using the price skimming strategy). They’ll capture some high-value clients upfront and then slowly reduce their price over time to widen the pool of potential customers.

If they choose to use a cost-plus pricing strategy, however, with a margin of 50%, they may calculate the total cost of production to $30 per user and so decide to set their price at $45 per user.

Why Are Pricing Strategies Important?

Without an effective pricing strategy, you’re essentially throwing darts in the dark — there’s a chance you’ll hit the bullseye, but you’re more likely to miss the board altogether.

Several things go wrong when the price of a product is not informed by a sound strategy:

You fail to meet market expectations

You fail to capture as much revenue as you could

You risk losing business to competitors whose pricing more accurately reflects market sentiment

You fail to communicate the real value of your product

Your marketing strategy misses the mark

To illustrate, let’s examine the opposite scenario.

You’re releasing a new product, and it’s time to nail down pricing and get it to market. Because you aren’t using a specific pricing strategy, you’re just going to make your best guess at what the price should be and see how things pan out.

One of two things will happen:

1. Your price is too high. Most of the market isn’t going to buy from you. If you’re really good at selling value, you might capture a few upmarket buyers, though they’ll likely churn once they realize the value you sold isn’t reflective of the actual product, and they’ll move to a competitor that offers the same value for a lower price.

2. Your price is too low. The majority of the market sees your product as cheap, inferior, and altogether not worth purchasing, as the price point you’ve selected doesn’t indicate the product’s true value. You’ll close a few frugal customers, but you won’t generate much revenue from them. If you’re not careful, you may even fail to set the price high enough to cover your production costs. Then, when you realize you’ve gone too low, you’ll increase your pricing and lose the majority of those buyers who only purchased your product — because the price was the most important factor to them.

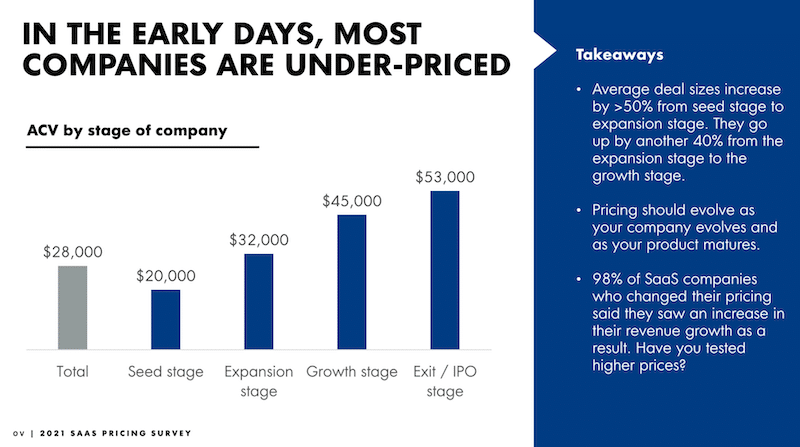

The latter is more likely, statistically speaking, as the majority of startups underprice their products and gradually increase total deal size as they grow.

But it’s not as simple as continuing to bump up your product’s price point. Inevitably you’ll reach a glass ceiling, and you’ll experience diminishing returns. Once you exceed a certain pricing threshold, you’ll narrow your addressable market, close fewer deals, and risk actually reducing total revenue.

So, neither of the above scenarios is ideal, but the problem runs deeper.

Because you don’t have a well-developed pricing strategy in place, pricing across your product range is likely to be disconnected, particularly when you have different leaders in charge of each.

And, as you continue to adjust to the market and learn more about how your pricing fits (and the fact that you got it wrong to begin with), you’re going to keep changing it, which is a sure way to confuse and alienate your existing customer base.

Pricing strategies are crucial because they help you to:

Communicate the value of your product and create expectations you can actually make

Target the right customers to increase average deal size and minimize churn

Differentiate your offering from competitors — a good pricing strategy can be a competitive advantage

Types of Pricing Strategies

There are a number of pricing strategies that SaaS companies adopt to communicate value to their target audience and drive revenue.

Before settling on a singular strategy for your own company, take time to consider these nine approaches and how they might impact your own profitability.

1. Value-Based Pricing

Value-based pricing is the most common approach for SaaS and subscription businesses. With the value-based pricing strategy, you’re setting pricing based on what your customers believe the value of your product to be.

That is, you charge as much as your customers are willing to pay.

It doesn’t take into account cost factors, as the assumption is that if the cost of producing that product exceeds what customers would be willing to pay, then the business model isn’t viable and not worth venturing into.

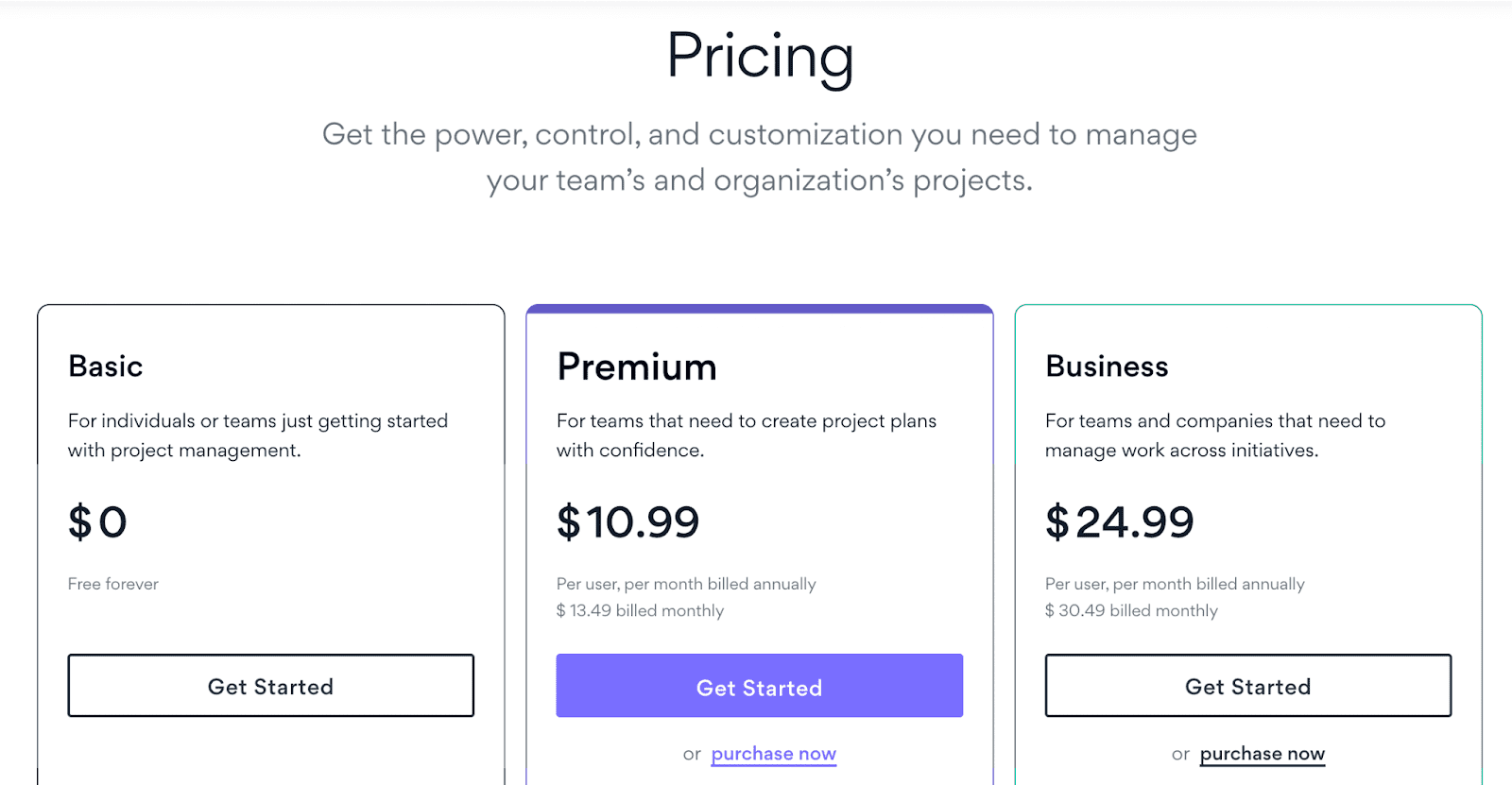

Many B2B SaaS organizations use this strategy. Take Asana, for example.

Asana uses a freemium model (more on that later), with two paid pricing tiers: Premium and Business.

Note that the Business plan costs twice as much as the Premium plan. That’s because, with the features included in this plan, Asana can demonstrate how they’ll create significant value for their Business customers, and so they’ve priced this plan based on that value.

Value-based pricing is the most suitable strategy for the majority of subscription businesses for a few reasons.

First of all, determining the cost of production (in order to use a strategy like cost-plus pricing) is more well-suited to physical goods than virtual goods like software platforms. With software, once a product is built, it’s built, and so the cost is less relevant to pricing than it would be for, say, a smartphone.

Secondly, it’s the best way to maximize your revenue. Charging based on value allows you to find the optimal balance between revenue per user and the number of users in total.

Thirdly, it puts the customer at the center of your pricing decisions.

This ensures an alignment between the product and its pricing (as both are designed around the end-user) and puts upward pressure on your company to provide more value. If you can deliver more value than your competitors, you can justify charging a higher price and prevent engaging in a race to the bottom (a competitive situation that occurs when companies compete solely on price).

However, there is one drawback of using the value-based pricing strategy: it’s a reasonably time-consuming process.

Where strategies like competitive pricing are easy to implement (you monitor what your competitors are charging and adjust when they do), value-based pricing requires a deep understanding of your target audience, their needs, and the benefits your product provides.

It can also be hard to satisfy different segments, like price-sensitive small businesses and big-budget enterprises, with the same offering.

That said, you should get to know your target market and different segments in-depth anyway if you want to effectively market your product, so it’s not the most concerning drawback.

Value-based pricing is a fairly dynamic approach. It involves testing different pricing points (whether actively in the market or by conducting surveys) as well as performing customer research and interviews.

And, of course, each time you release a new update or feature, your value changes, so you’ll need to reassess how that impacts your pricing.

While the value-based pricing strategy is best implemented through a combination of testing and research, a simple formula called the 10x rule can be used to get you into the ballpark:

Value-based price = Value you provide to client (monetarily) / 10

That is, the value you provide in monetary terms — either the additional revenue you help to create for a customer or the amount of money your product saves them — should be 10x your price.

If your product costs $499 per month, for instance, then you should be saving or creating $4999 of value per month for the customer — a premium price needs to line up with your product’s perceived value in your customer’s mind.

2. Competitive Pricing

Competitive pricing is a fairly straightforward strategy. You’re simply setting your prices in accordance with what your competitors are charging.

It’s not a particularly sophisticated strategy, but it’s an easy one and one that can help you find a decent pricing range fairly quickly, assuming your product or service is very similar to the companies you’re competing with.

A company using the competitive pricing strategy would assess the competitive landscape and the various pricing models used and then determine whether they want to sit slightly above, slightly below, or on par with the market.

If you’re new to a market that has a few established businesses, then competition-based pricing can be a reasonable approach (though it should really only be used as a starting point).

Let’s say you’ve developed a new CRM for sales reps. You’re entering a pretty well-established (and fairly saturated) market, so there’s plenty of competition to base your pricing on.

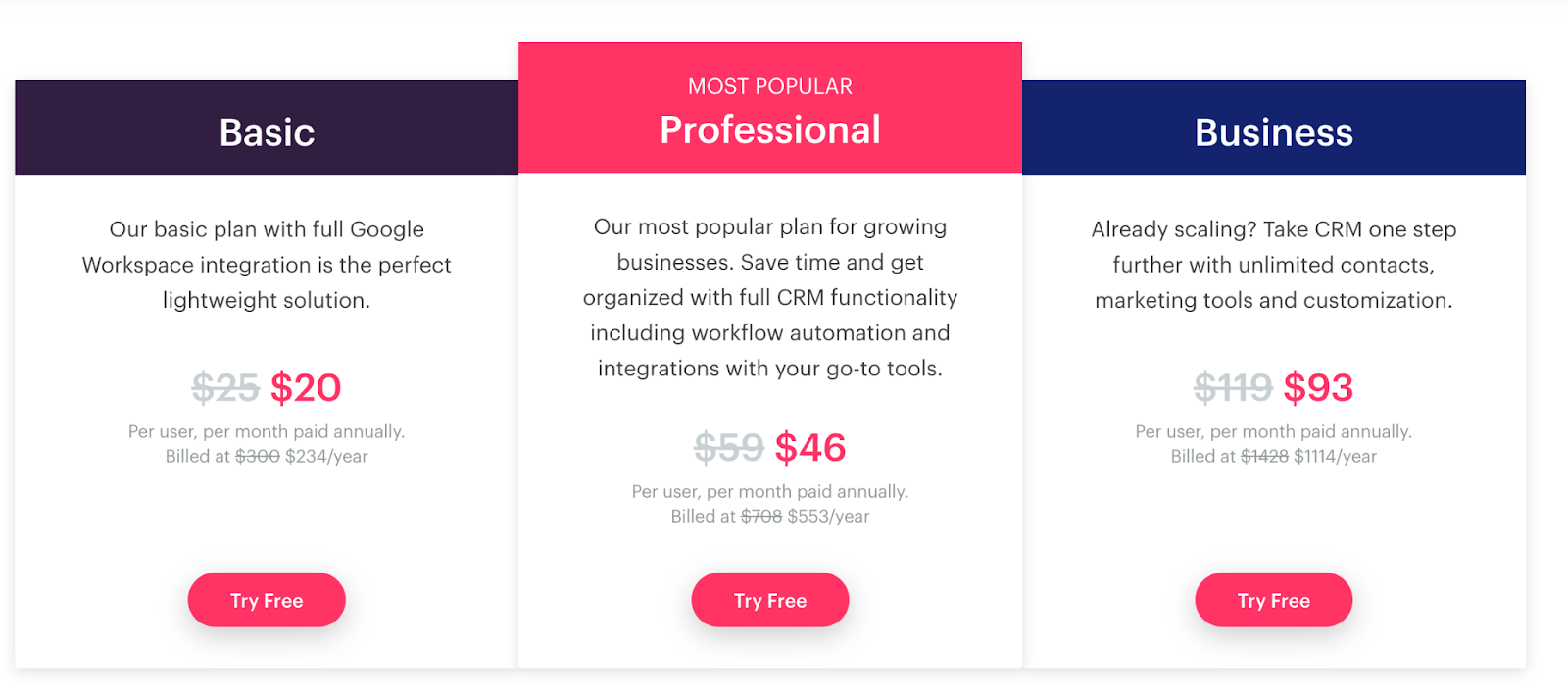

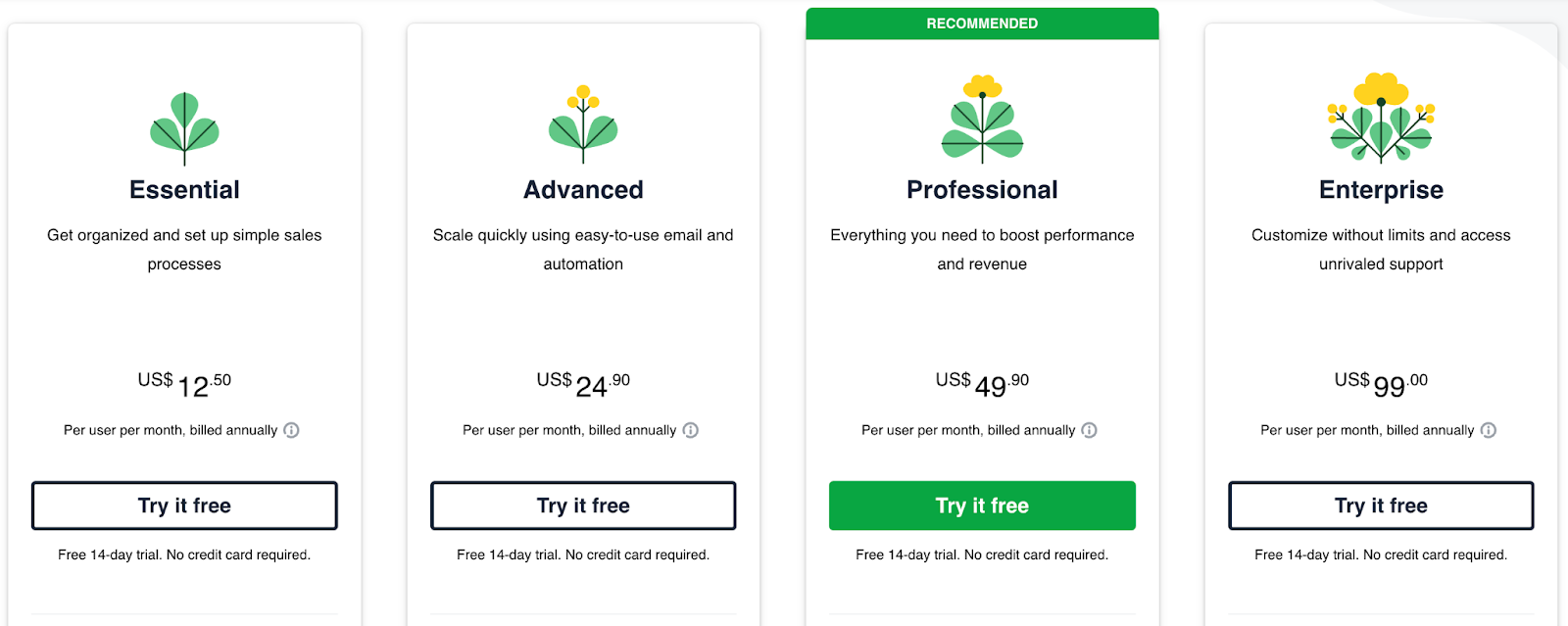

First, you check out Pipedrive.

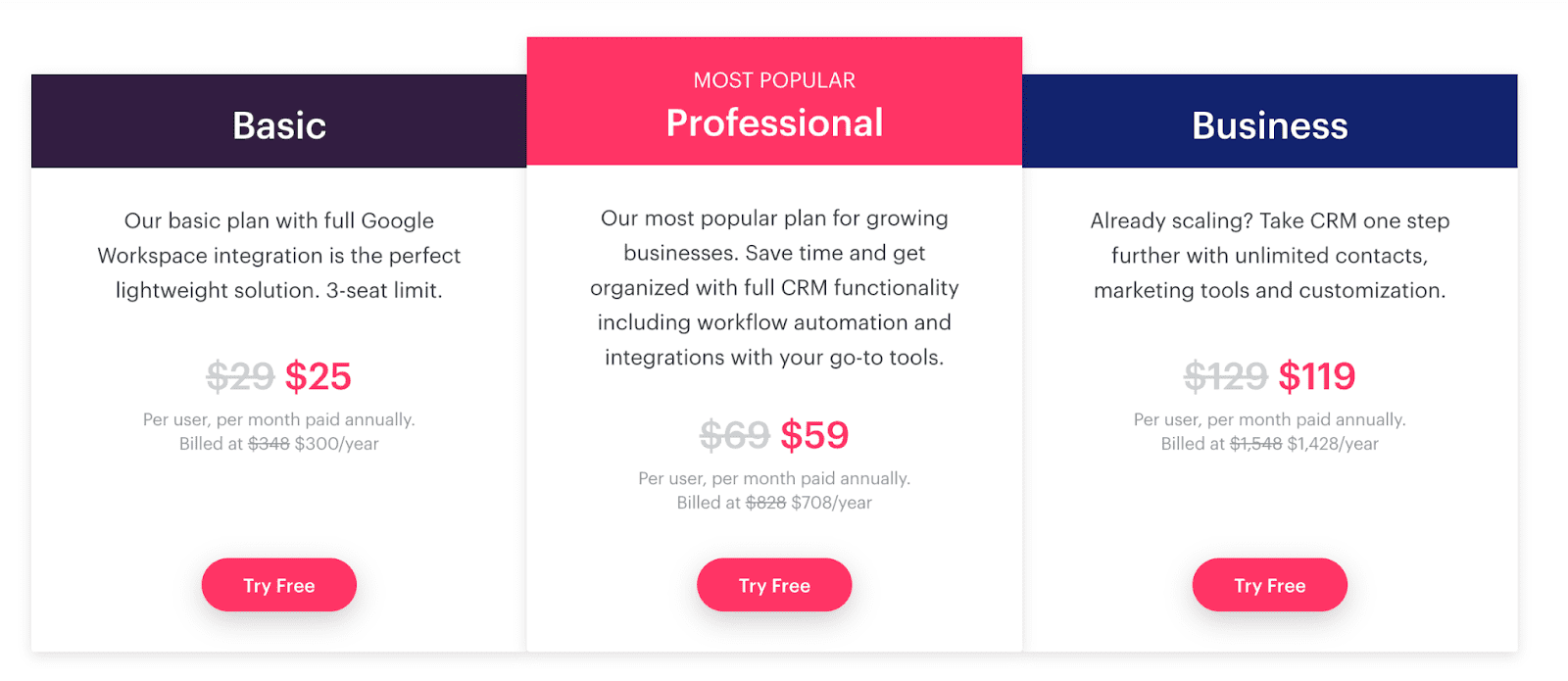

Then, Copper.

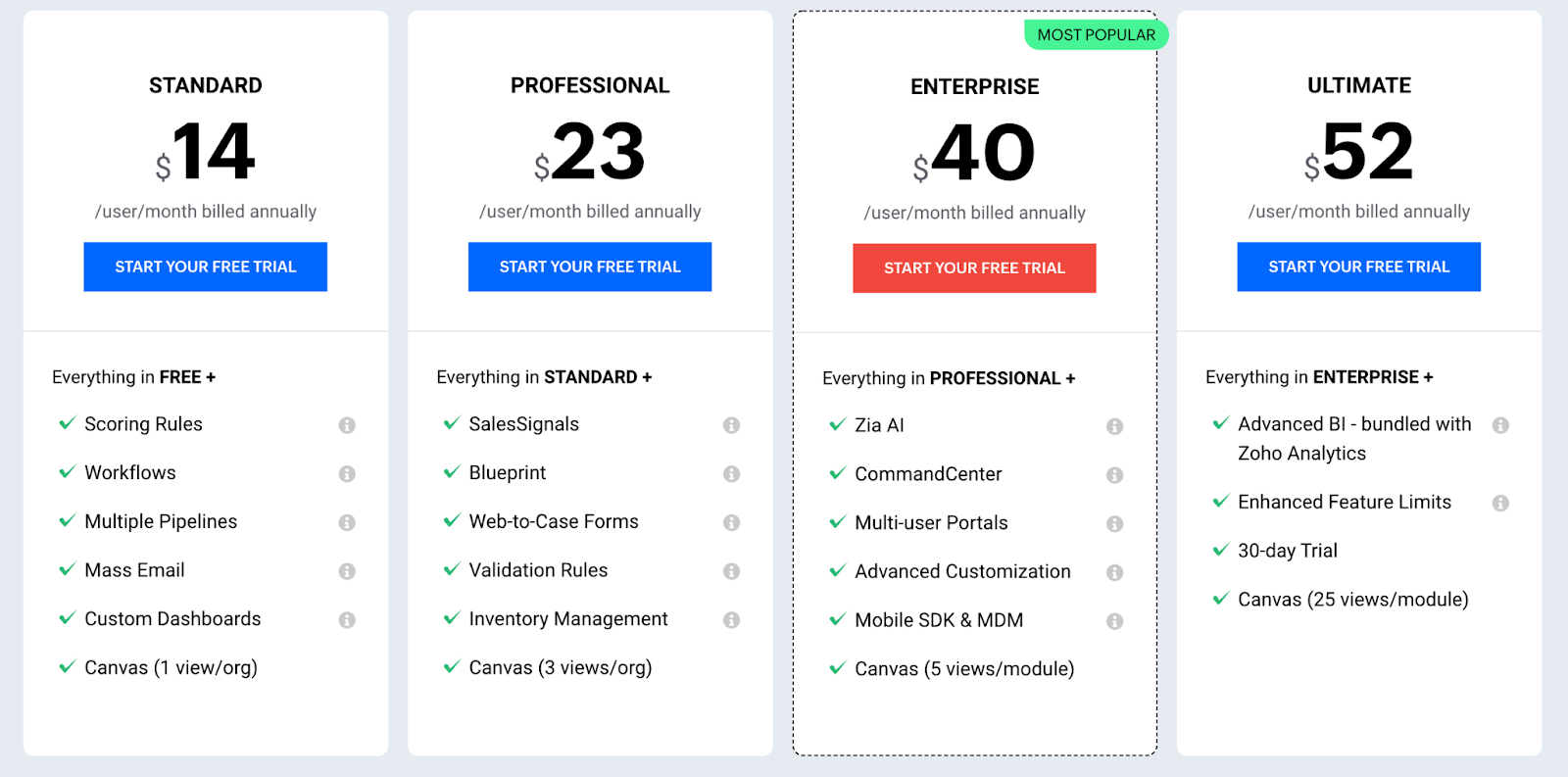

And a third for good measure: Zoho CRM.

Now we’ve got some good ballpark figures to work from. If you’re planning on offering three different plans, you should start your pricing in these ranges:

Tier 1 - $15-20

Tier 2 - $40-50

Tier 3 - $60-90

Remember: use these figures as a starting point only. You should test and optimize from there, and ideally move toward a value-based pricing strategy once you’re able to establish and demonstrate the value your product delivers

If your product or service differs significantly from what your competitors offer, then competitive pricing might not be a suitable strategy, as you’re not comparing apples with apples, despite competing in the same market segment.

The other downside of the competition-based pricing model is that you’re relying on someone else’s research, and as we know, that research isn’t always applicable to your business.

In some instances, it might even be non-existent, and so you’re setting your prices based on a competitor with a price point that isn’t backed by data.

All things considered, paying attention to your competition is still an important aspect of pricing, regardless of your chosen strategy.

Charge much more than your competitors (without being able to communicate additional value), and you’ll likely alienate a large segment of the market. Charge much less, and customers are likely to make the assumption that your product is somehow inferior.

3. Price Skimming

The price skimming strategy is all about squeezing as much revenue out of each customer as possible, focusing initially on those who are willing to pay the most.

With the price skimming strategy (also known as the high-low pricing strategy), you start by setting your price as high as the market will tolerate. You’ll capture revenue from buyers who have the most need and demand for your product or service, but be priced out of the market for the majority.

As time progresses, you’ll gradually lower your price to capture more of the market.

This is a pretty common approach in the electronic goods market, with console producers like Sony and Microsoft using the price skimming strategy for their PlayStation and Xbox product lines.

This pricing strategy works best for products that are able to be positioned as premium (iPhones, for example) and for one-off purchase items such as electronic goods (the intersection of these two product types is ideal).

It’s not so well-suited to subscription products or services because your intention with this style of business is to grow revenue over time. But if you continue to lower your prices, you’ll reduce your revenue from each existing customer and ruin your Customer Lifetime Value (LTV).

But many of today’s consumers are aware of this pricing strategy, and they understand that prices for certain goods are likely to come down with time. Many will even wait for price reductions before purchasing. So inevitably, you won’t capture the full market demand in the short term, slowing down your cash flow.

4. Cost-Plus Pricing

Cost-plus pricing is an incredibly simple pricing strategy — it’s your costs plus your markup.

To set prices for a new product, you take the total cost of producing it, then add a percentage on top to determine your price.

It’s easy to calculate but not really suitable for anything other than physical products, where your production costs align reasonably closely with an increase in the number of units produced.

With software products, however, the majority of the production costs happen up front. The cost to develop the product is the cost to develop the product; that doesn’t change each time you land a new customer.

As such, cost-plus pricing is generally unsuitable for subscription-based businesses.

On the other hand, the major benefit of using this pricing strategy is that it guarantees your profit margin and provides some security as far as profitability is concerned. If you build a 50% margin into your pricing, then you’ll always maintain a healthy profit margin.

5. Penetration Pricing

Penetration pricing is a strategy commonly used by new companies looking to break into an existing market and generate a solid customer base that they can then leverage to create social proof and move upmarket.

With the penetration pricing strategy, you set your prices far below what your competitors are charging but provide the same (or similar) value.

The idea here is that customers will switch over to your company from a competitor, and you’ll be able to gain a foothold, despite making less revenue and profit per customer than you could if you charged more. In some cases, companies using penetration pricing actually make a loss but offset this against future gains.

There are, of course, a few drawbacks to this strategy:

You’ll need to close a lot more customers to make decent revenue

There’s a significant risk that as you increase pricing, you’ll lose existing customers

You risk setting a low pricing expectation in the market, which could prevent you from lifting prices later on

There’s always a risk that you’ll be unable to survive the phase of unprofitability while prices are set so low

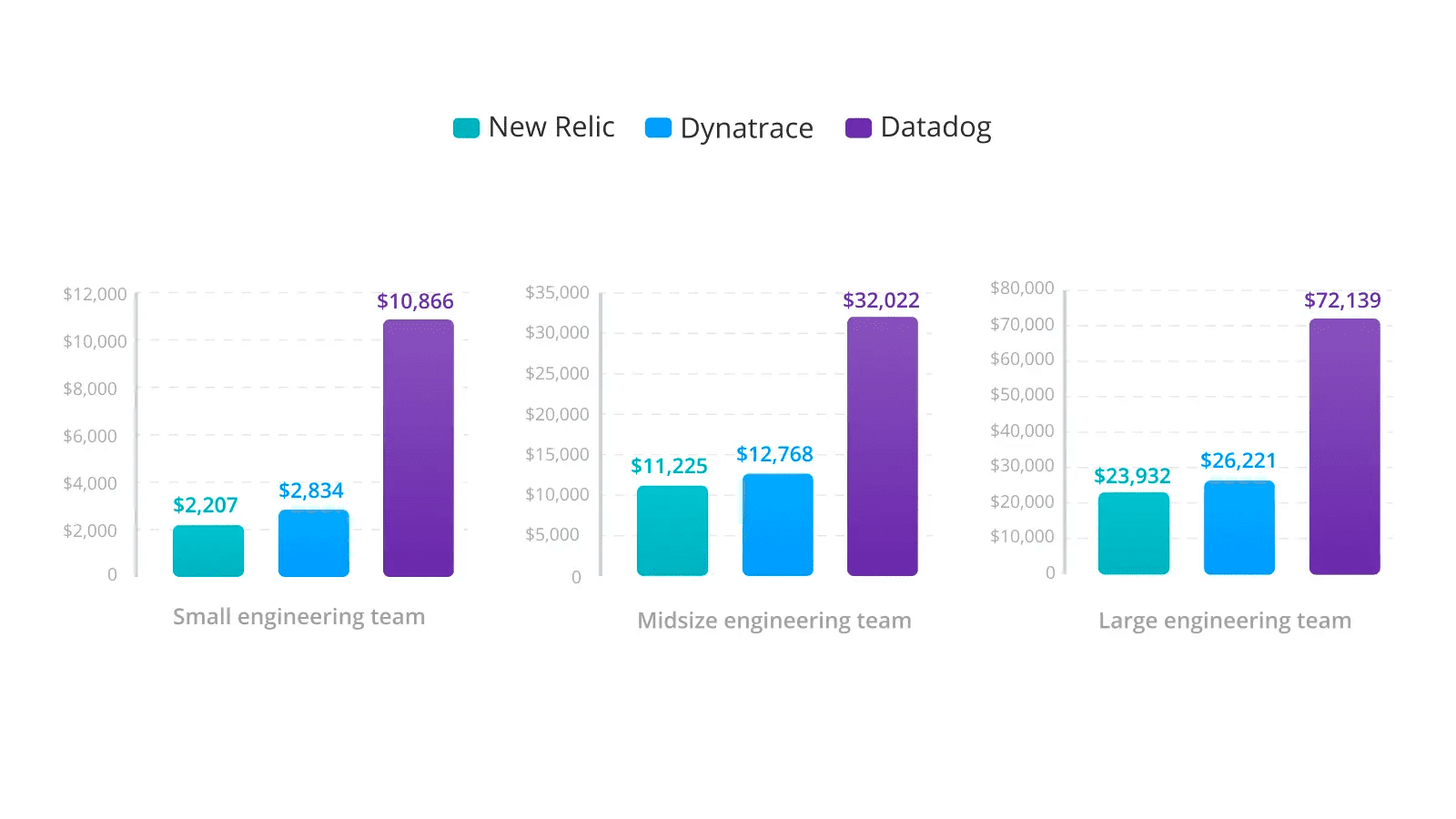

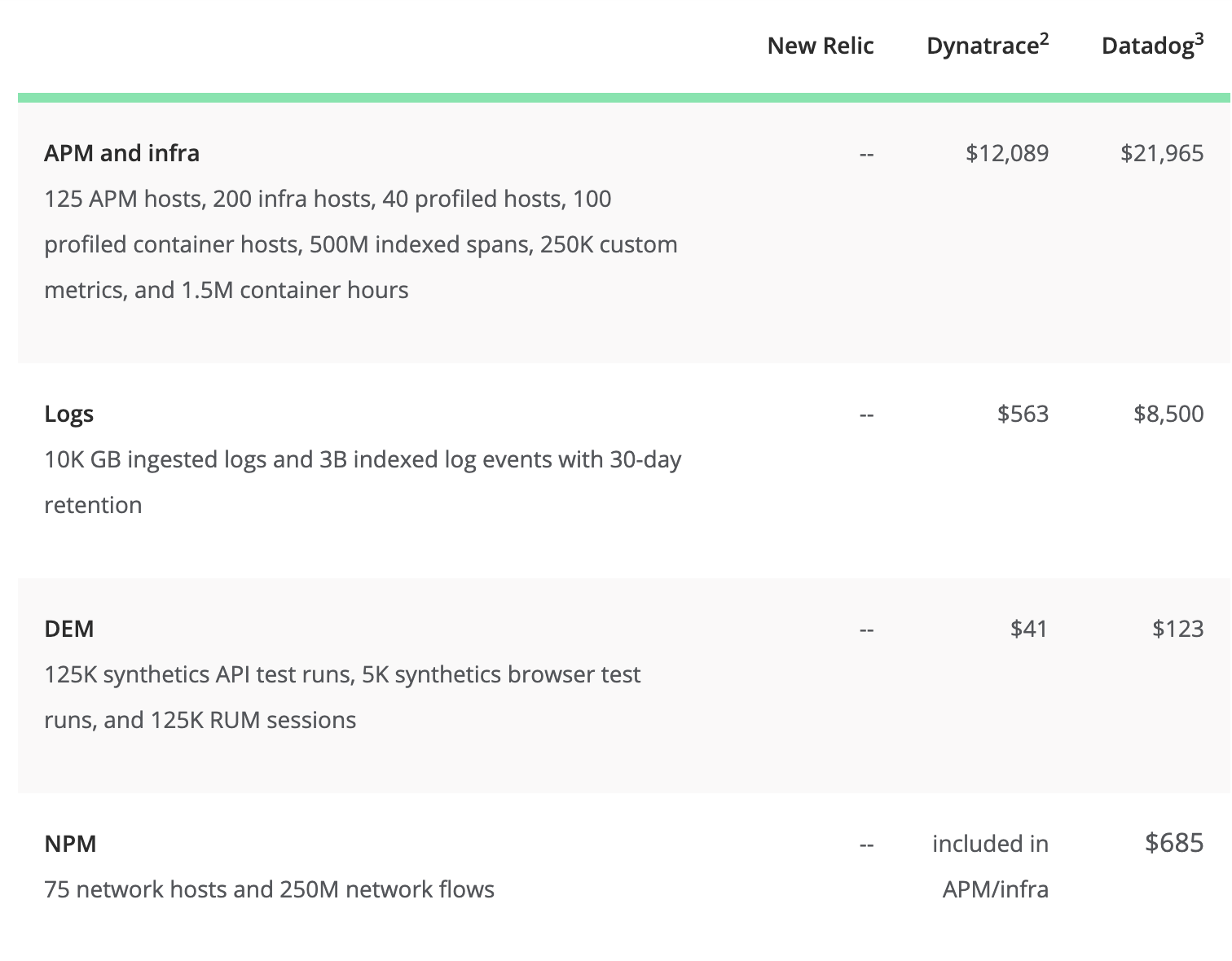

New Relic, an observability platform for developers, is a great example of a company using penetration pricing to gain some ground in the market.

Competing with existing industry standards like Datadog and Dynatrace, New Relic offers a similar feature set but charges significantly less than its competitors.

It’s worth bearing in mind that some customers may be wary of newcomers who are charging significantly less. Pricing has a major psychological impact on how customers perceive your value, so penetration pricing does put you at risk of customers thinking your product is inferior.

New Relic does a fantastic job of overcoming this objection by providing a breakdown of the features they offer (and how they charge for them) in comparison to competitors, demonstrating that they can offer the same value at a fraction of the price.

The penetration pricing strategy is best utilized by companies in markets where consumer demand is reasonably elastic (demand is significantly influenced by price).

6. Economy Pricing

Economy pricing is all about sales volume.

With the economy pricing strategy, you aim to produce a product with lower production costs than your competitors (which often means you create an inferior product) and sell it at a lower price. The idea is to sell the product at a higher volume and thereby generate the same profit as you would if you sold a lower volume at a greater price.

This is the pricing strategy that generic soda brands use to compete with established and recognizable brand names like Coca-Cola and Pepsi.

However, it’s not a great fit for subscription and SaaS businesses, as it limits your revenue potential and generates downward pressure on market pricing.

Plus, it incentivizes producing an inferior product, which is not a strategy that’s suitable for delivering long-term growth in SaaS, where customer relationships are everything.

7. Dynamic Pricing

Dynamic pricing is a pricing strategy that involves rapid changes to your pricing in response to either market demand or costs of production.

Depending on the approach you take, you set your initial price (based on current conditions) and then continue to alter it upward or downward based on cost or demand.

As you can imagine, this isn’t a very suitable pricing strategy for subscription businesses, but it does have a place in certain markets and is more common than you might expect.

Entities like Shell and Mobil, for example, use a dynamic pricing strategy to set pricing for their fuel. In this case, their dynamic pricing is informed by the cost of crude oil.

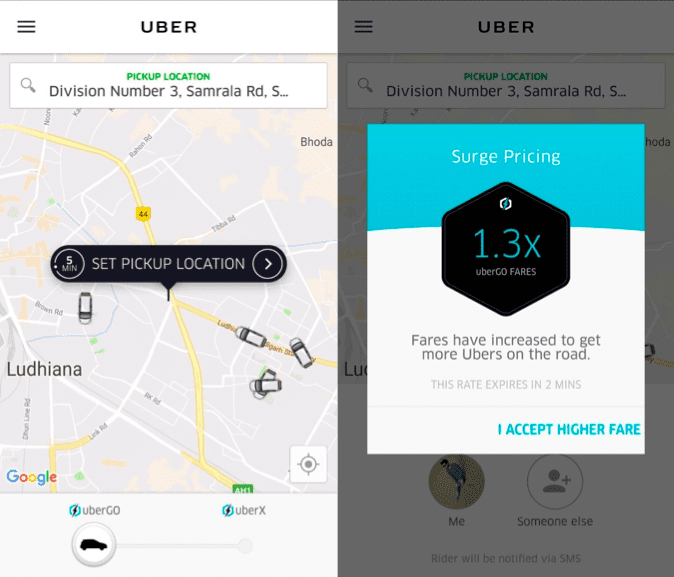

On the demand side, we can look to Uber for an example of the dynamic pricing model in action.

When immediate demand for Uber’s service is high, the company imposes “Surge Pricing,” an inflated pricing differential designed to capitalize on the fact that a high number of users in the area are seeking to access Uber’s driver network.

8. Geographic Pricing

The geographic pricing strategy involves setting different prices based on your customers’ geographic location.

Market demand differs from country to country, which has a major impact on local pricing expectations. As such, it may be appropriate to use different pricing structures in different markets.

This approach ensures you’re capturing maximum revenue in markets where demand and price expectations are high and meeting the largest market possible in markets where the opposite is true.

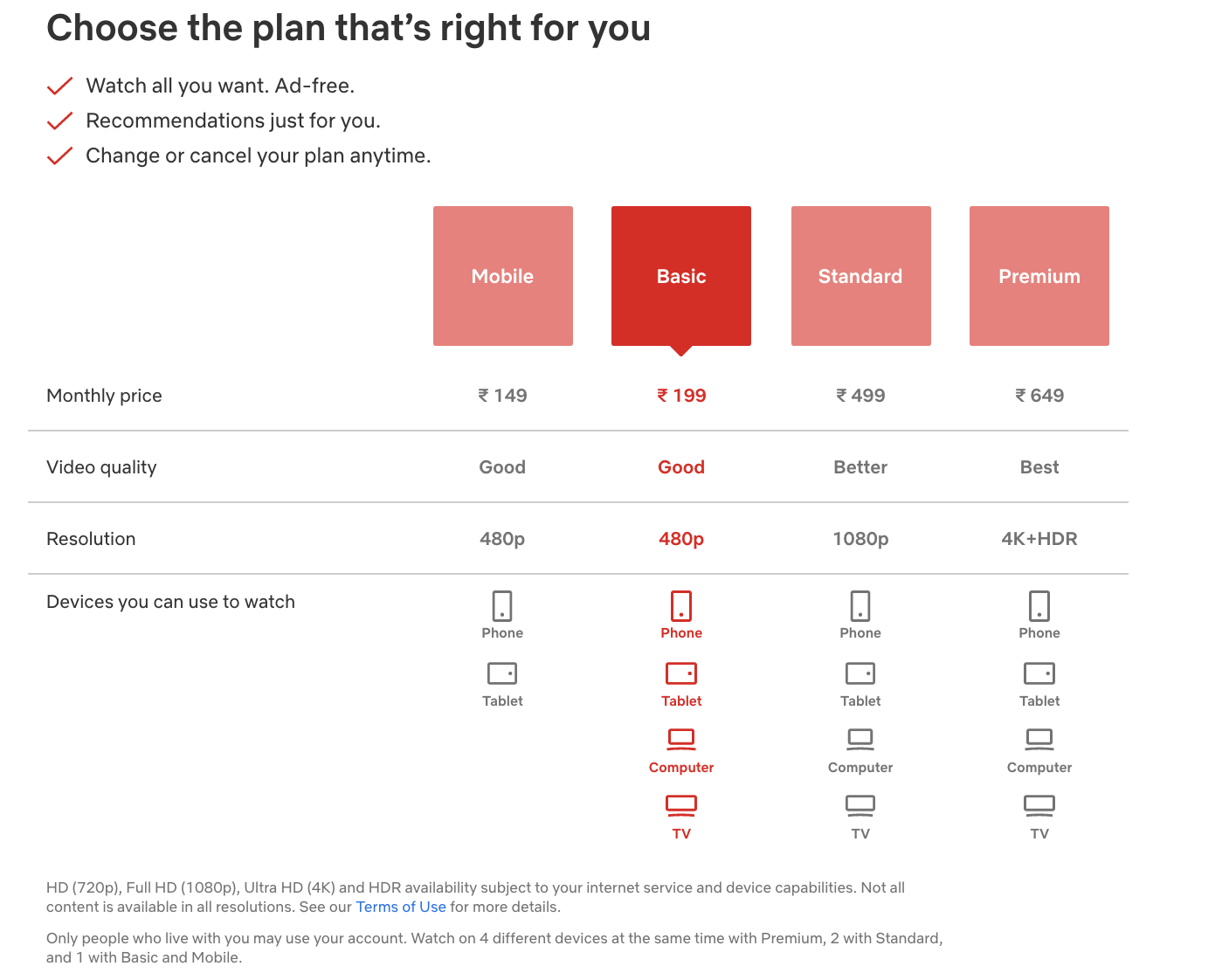

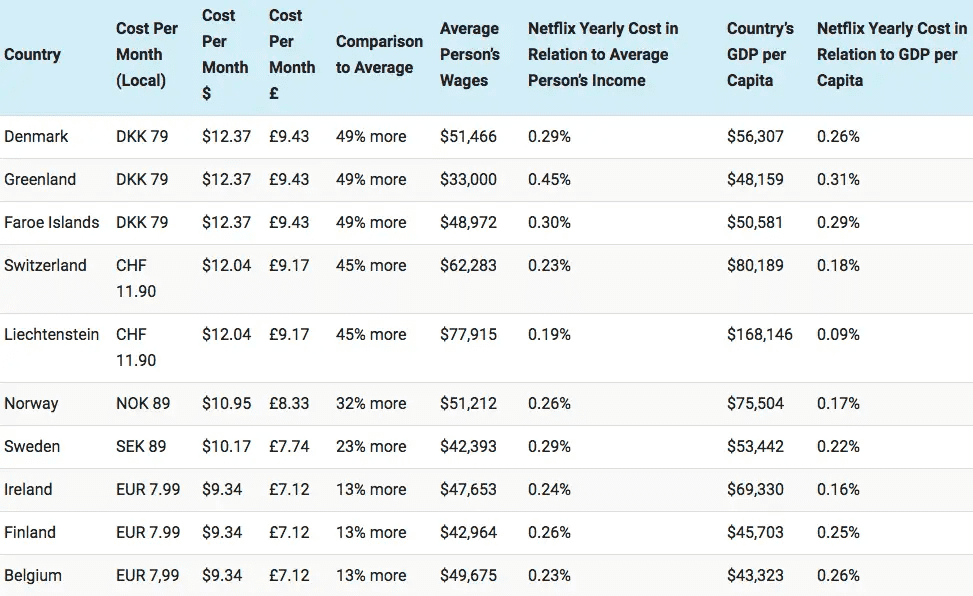

Most global enterprises follow this strategy. Consider Netflix’s pricing in different regions.

In India, the cost of a Netflix subscription starts as low as ₹149 ($1.95).

In Denmark, customers are paying 10x that price, with a Netflix subscription topping $12 a month.

Of course, the geographic pricing strategy can be combined with any of the other strategies we’ve covered here. For example, you could use an economy pricing strategy as your general approach but then use market insights to determine what pricing level is appropriate in each country.

9. Bundle Pricing

Bundle pricing is a strategy employed to create the appearance of greater value while simultaneously maximizing the throughput of product lines that might otherwise be purchased less frequently.

With bundle pricing, you sell multiple similar products as a package (i.e., a bundle) rather than separately.

The bundle pricing strategy is prevalent in the fast-food industry, with companies such as McDonald’s regularly promoting products together.

There are three factors that make this such an effective pricing model for a company like McDonald’s.

Firstly, meal deal combos include a main, a side, and a drink; a fairly standard combination, meaning they’re appealing to existing demand.

Secondly, the difference in the cost of the bundle and the price of the items individually is significant (it’s much cheaper), so it creates the illusion of greater value. We say illusion because, in reality, very few people purchase the items individually.

Thirdly, the addition of extra items like fries and, in particular, a drink comes at a minimal cost increase to McDonald’s, especially compared to the price increase. The difference in price between the burger on its own and the bundle might be a couple of dollars, but the cost increase to McDonald’s is mere cents.

This pricing strategy has an application in the SaaS and subscription industries as well.

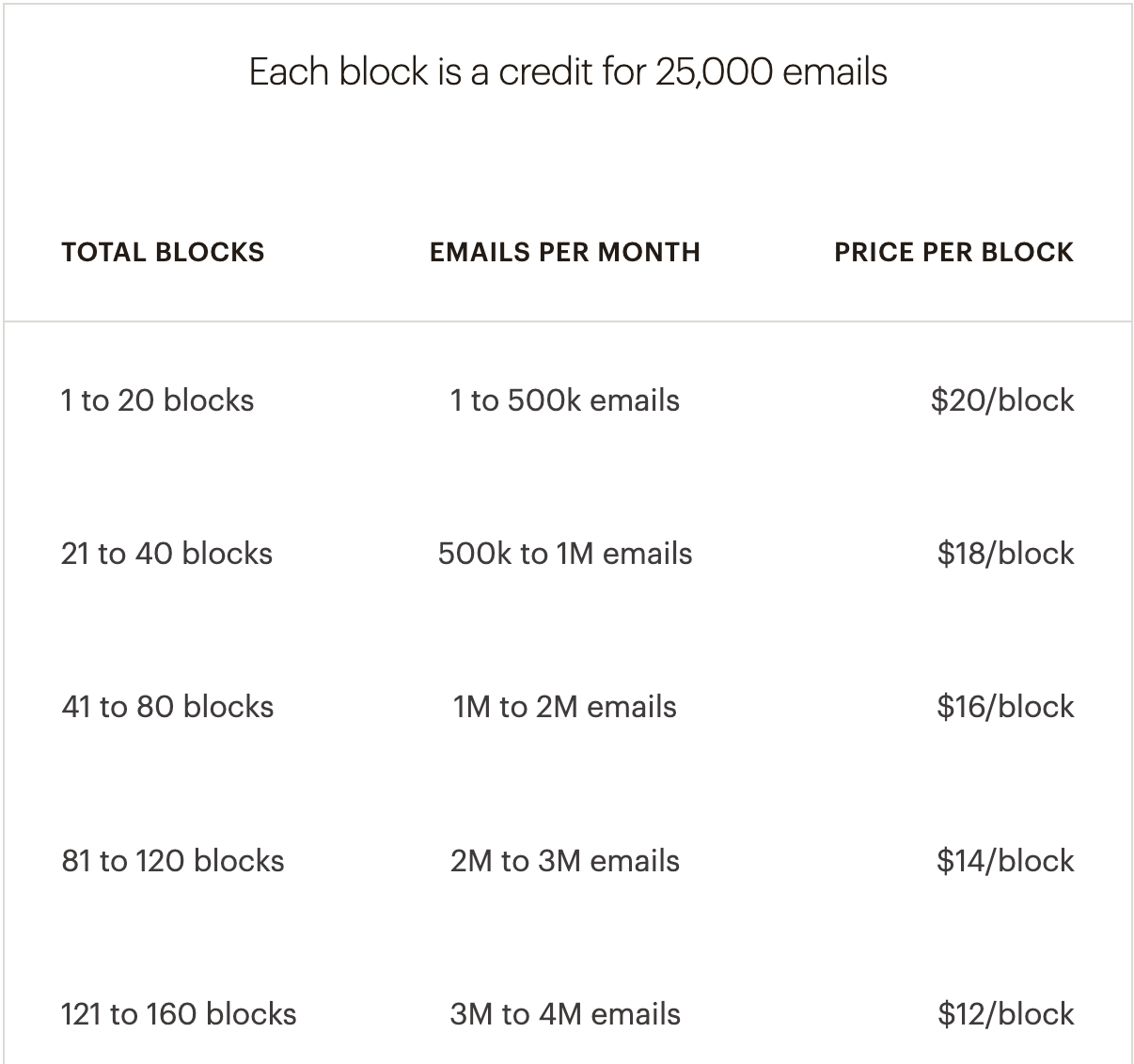

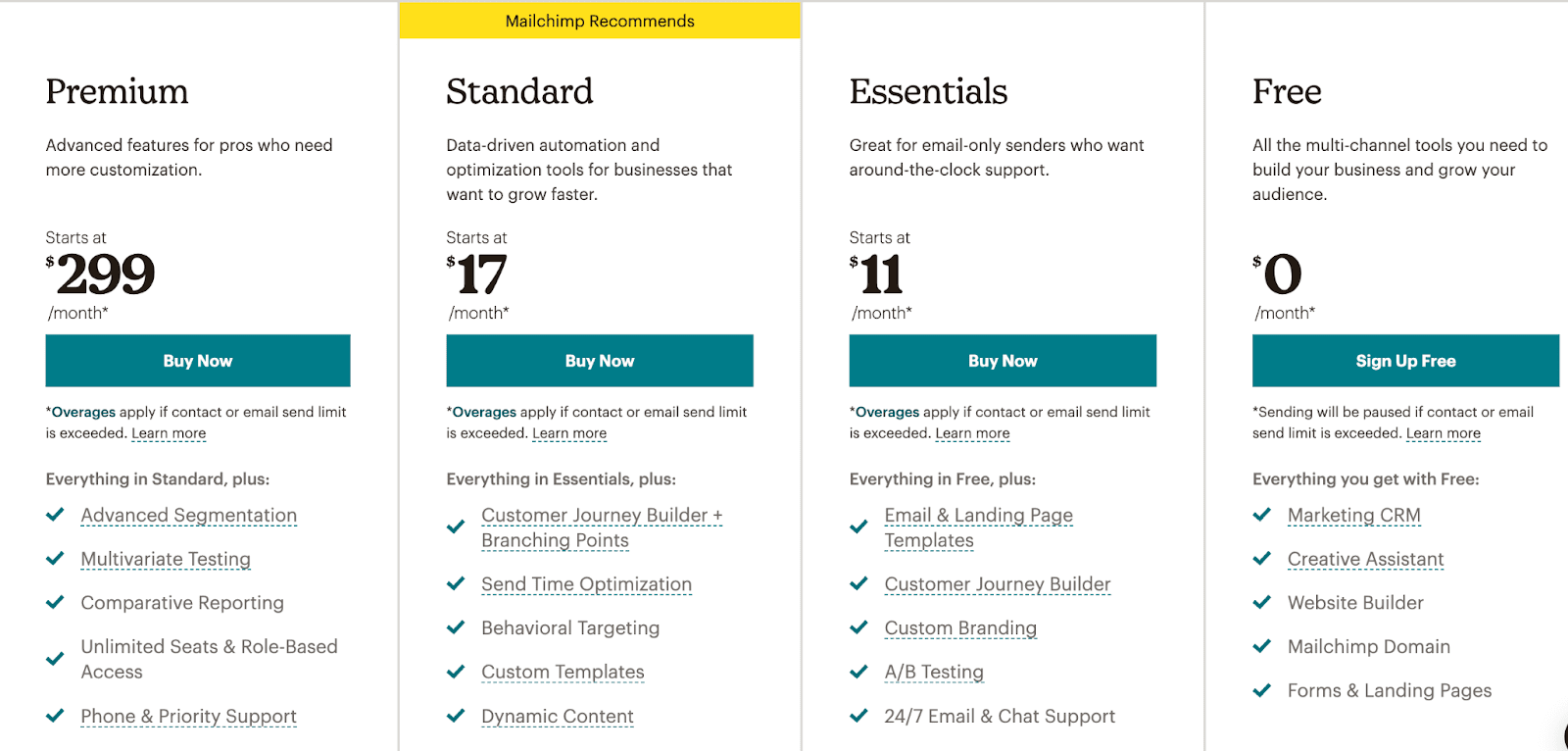

Mailchimp, for example, offers blocks of email credits for purchase individually.

Alternatively, customers can sign up for a bundle plan which includes a designated number of email sends (based on the size of your contact base), as well as access to their other tools such as landing page builders, automation, and A/B testing.

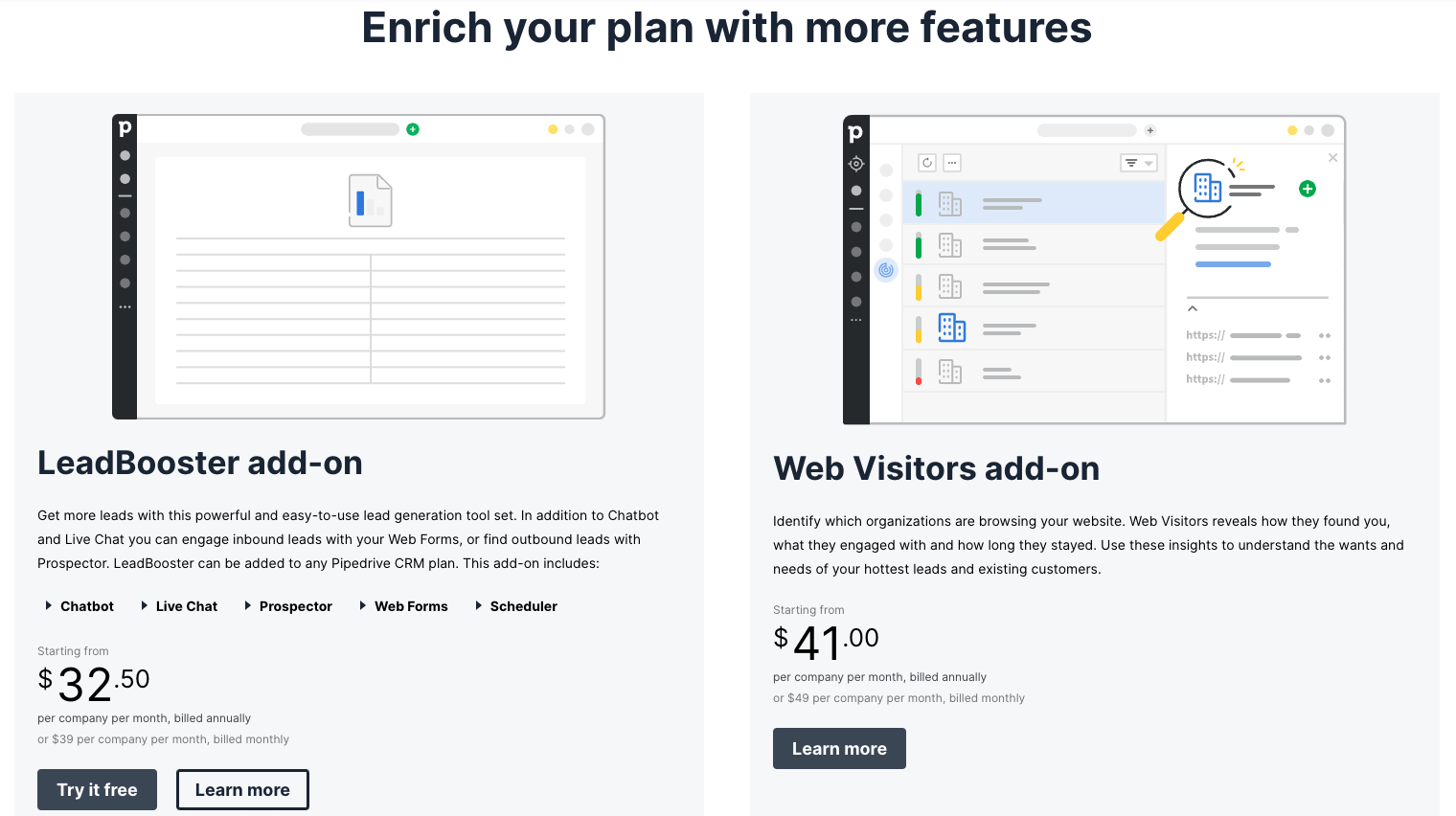

Pipedrive, for example, offers “add-ons” for customers subscribing to their CRM who need additional capability.

A pricing manager at Pipedrive could experiment with bundle pricing by creating a package that includes the standard CRM as well as all four available add-ons.

How to Choose the Right Pricing Strategy for Your Business?

Having a knowledge of the different pricing strategies available to you is important, but knowing how to apply that knowledge and choose the ideal strategy for your business is even more crucial.

We’re going to look here at six key steps to take in choosing the ideal strategy. When following these steps, bear in mind that the initial idea is to determine the broad range your product fits into. Is it a $10 product? A $50 product? A $500 product?

We don’t want to waste time here arguing over the difference between $45 and $49. We’ll optimize for that down the line. The important component here is understanding the broad category you’ll fit into.

1. Conduct Target Market Research

We know that a thorough understanding of our customers’ challenges, goals, and demographics is important for marketing a product, but we need some technical details in order to land on an appropriate pricing strategy.

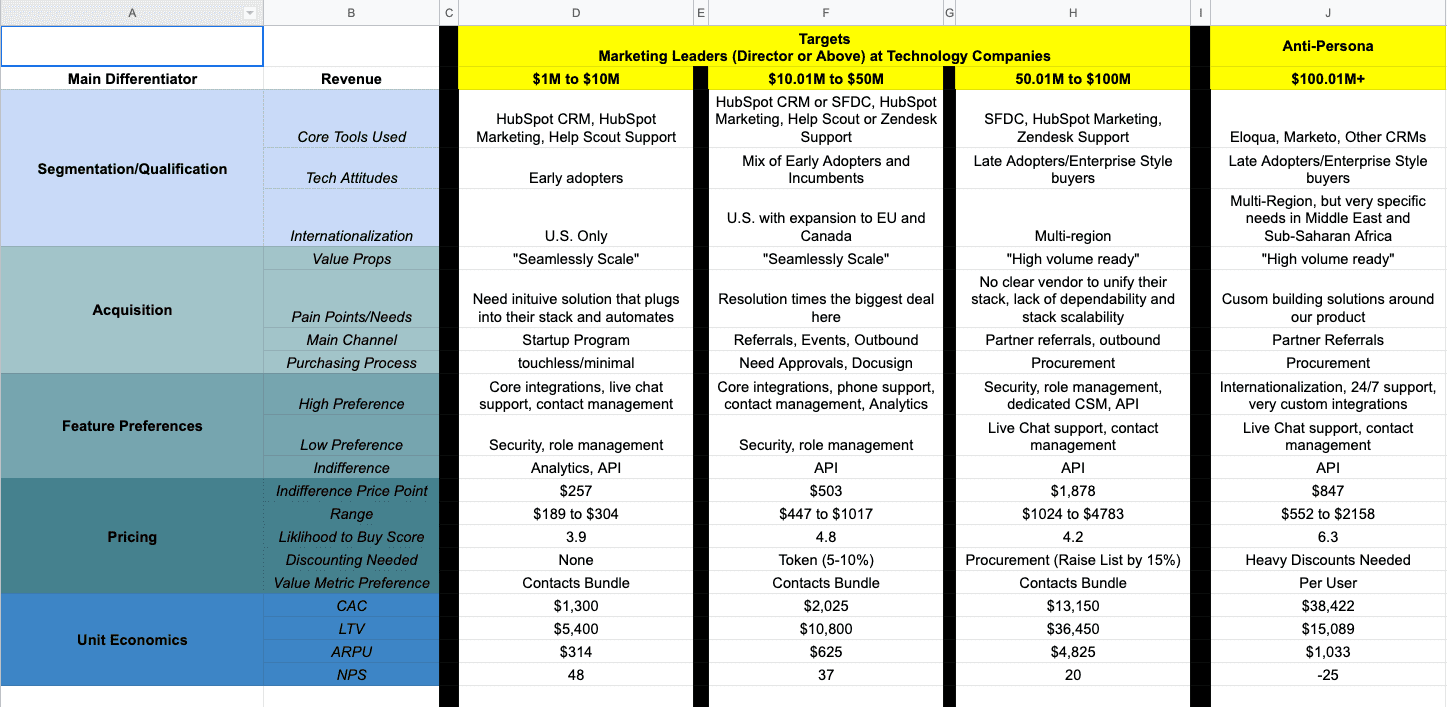

This template, for example, demonstrates how granular you need to get to understand a customer profile in relation to pricing strategies.

In particular, the data that will guide pricing strategy choice includes:

Customer Acquisition Cost (CAC), Customer Lifetime Value (LTV), and Average Revenue per User (ARPU) by customer profile/market segment

Acceptable pricing range and “indifference” price point

Compelling value props

Feature preferences

2. Assess Your Competitors’ Pricing

While you don’t want to base your product pricing entirely on competitors (unless you’re using a competition-based strategy), this information is still necessary for certain strategies.

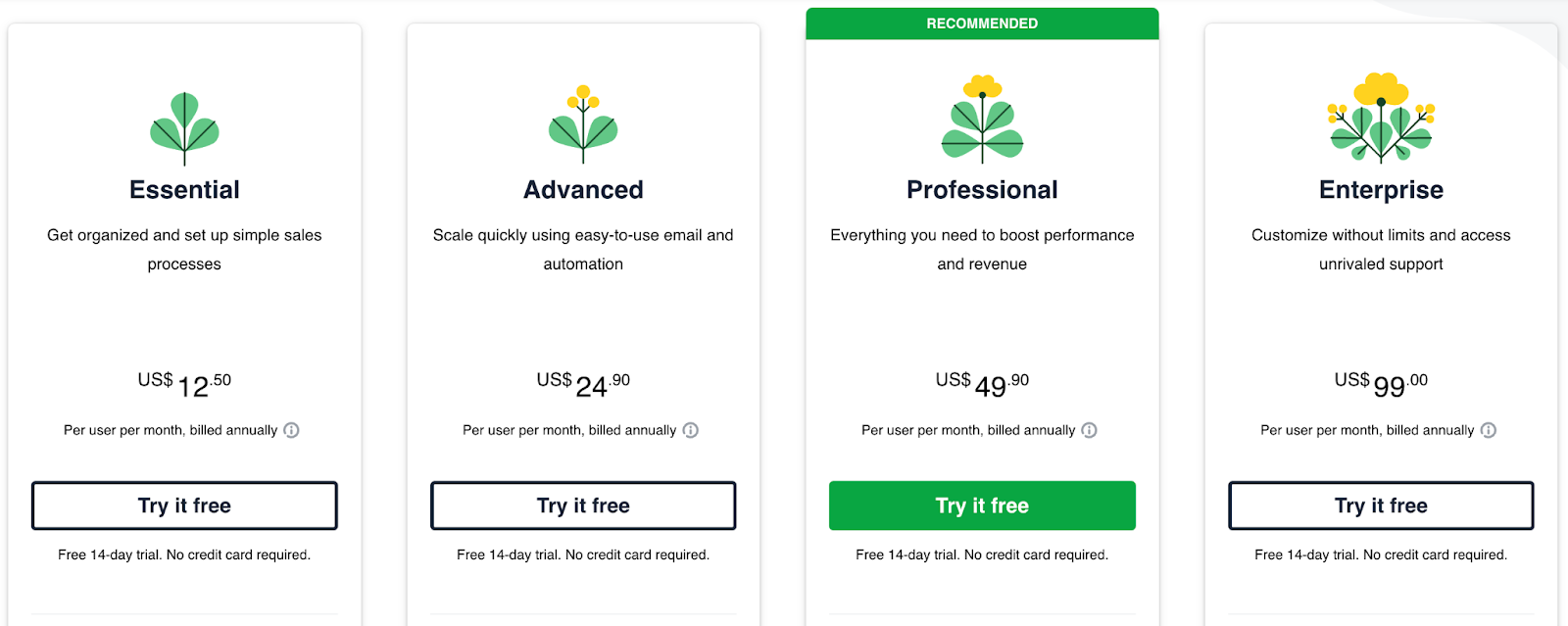

Consider Pipedrive’s pricing tiers:

And then look at those of Copper, a close competitor to Pipedrive.

These two products are fairly similar as far as pricing goes. Imagine, then, that you’re in charge of pricing at ActiveCampaign, and you want to use a penetration pricing model to break into the CRM market.

You’d need to know what these two competitors are charging, so you can position your most basic product package at a much lower price point.

3. Consider Your Revenue Model

Your revenue model has a significant impact on the appropriateness of different pricing strategies.

If you’re primarily generating recurring revenue, for example, then the price skimming strategy might not be the most appropriate approach. However, it might be a suitable method for those selling high-value goods such as electronics and vehicles.

Similarly, economy pricing often isn’t the best strategy for SaaS and subscription businesses, though it’s great for many FMCG (fast-moving consumer goods) companies.

Perhaps, though, your revenue model is a partial subscription model, with the remainder of your revenue made up of services.

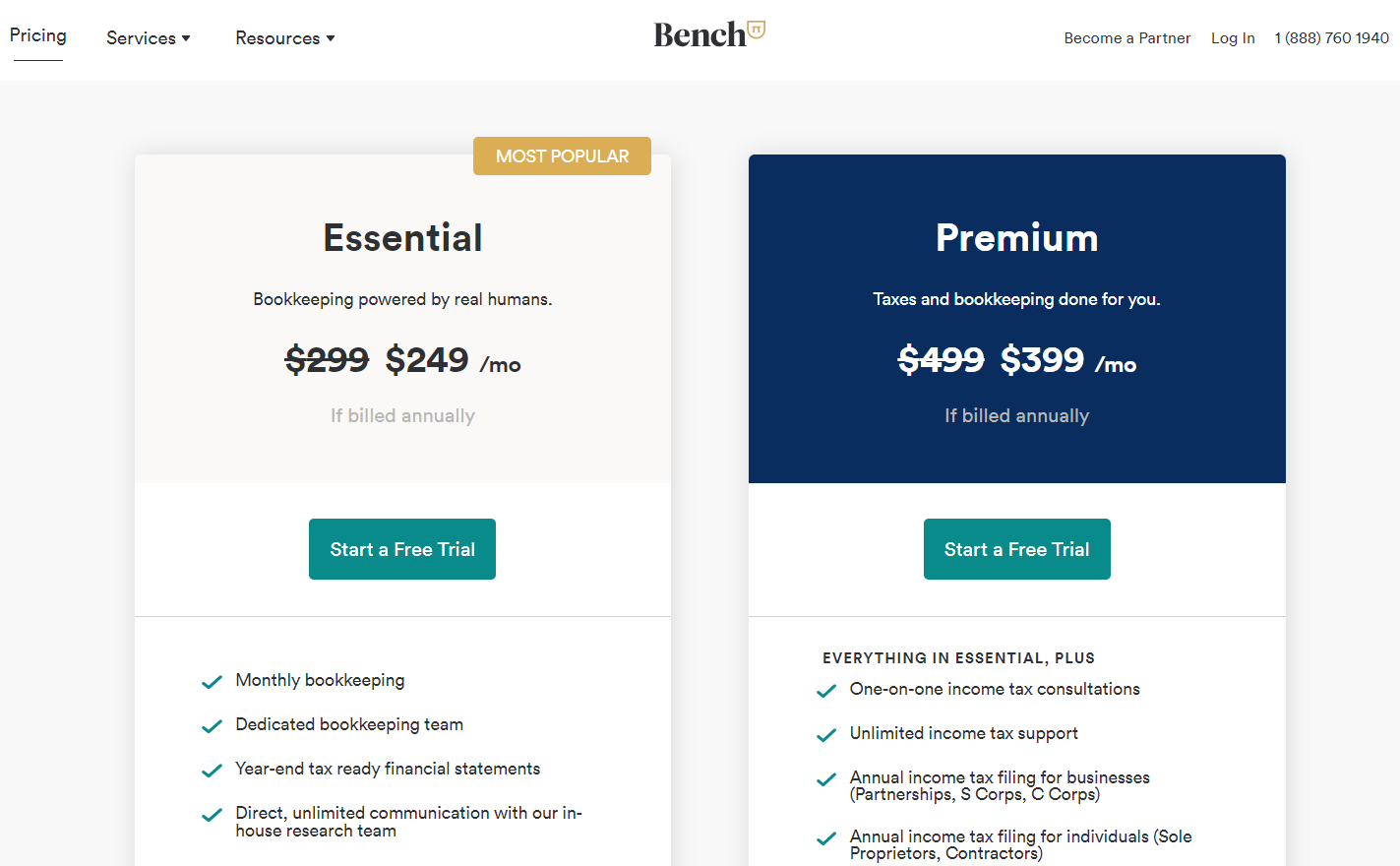

Bench, for example, uses this model.

They have a proprietary software platform and offer services over and above this.

In this instance, it may be suitable to use an economy pricing model for the platform itself (acting as a sort of loss leader to attract new clients) and generate the majority of its revenue using a value-based pricing strategy for service.

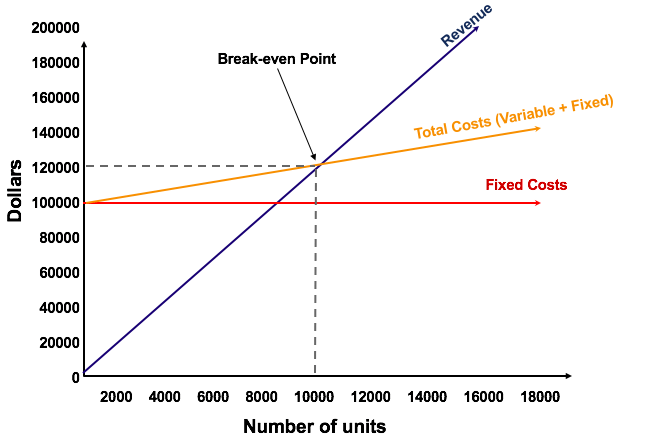

4. Get Absolute Clarity on Your Costs

Even if you aren’t going to use a cost-based strategy (such as cost-plus pricing), it’s imperative that you understand the total expense of production.

This will help you to ensure your pricing more than covers that cost and will be crucial in conducting analyses such as calculating your breakeven point.

5. Evaluate Your Company’s Strengths and Weaknesses

What is your company great at, and in what areas are you not so strong?

If, for example, you have a great marketing team with strong storytelling skills, you know you’ll be able to get more leverage out of a value-based pricing strategy.

If, on the other hand, you’re really good at cost reduction and maximizing production, an economy pricing strategy might prove appropriate.

6. Ensure Your Pricing Strategy Aligns with Your USP

What is your company’s unique selling point? Is it convenience? Financial savings? Customer revenue growth?

Your USP needs to align with the strategy you choose to determine pricing.

For example, if your value props demonstrate your ability to generate the customer thousands of dollars in new revenue, a penetration pricing model where you charge relatively little for your product probably doesn’t align.

Pricing Strategy for Different Industries

1. SaaS

In general, the most appropriate pricing strategy for SaaS and subscription businesses is the value-based pricing strategy.

This pricing strategy:

Maximizes your revenue per user

Allows you to increase pricing as the value your product offers improves

Mitigates the effect of competition that uses penetration or economy pricing models

2. Ecommerce

For ecommerce companies, the ideal pricing strategy to use depends quite heavily on the industry you’re in, the stage your company is at, and the kinds of products you’re selling.

Value-based pricing is always a good move, and competitive pricing can be a good place to start if you’re unsure about what customers are willing to pay. Both can also be valuable strategies for ecommerce companies moving over to a subscription model.

If you’re selling discount goods at volume, economy pricing can be a viable solution.

3. E-learning

E-learning companies can follow similar advice to SaaS companies (value-based being the ideal strategy), assuming they’re operating on a subscription model.

For e-learning businesses selling using a perpetual license model, penetration pricing can be a viable alternative for market newcomers looking to gain market share, though value-based will win out in the long term.

4. Publishing

Value-based and competitive pricing strategies will be best for subscription-based publishing companies, though price skimming may be suitable if you’re able to position yourself as a premium product.

5. OTT and Video

OTT and video businesses should follow suit with SaaS companies and adopt a value-based approach.

Competition should be analyzed, but given content varies significantly from platform to platform, a strictly competition-based approach shouldn’t be followed.

Difference Between Pricing Strategy and Pricing Model

Many revenue leaders confuse pricing strategies and pricing modes, and they’re often used as synonyms, despite this being incorrect.

Your pricing strategy is the theory behind your product pricing. It tells you how you set your price and what data you need to pay attention to when calculating that figure.

Your pricing model, on the other hand, is the way you display, package, and communicate your product pricing to your customer.

Examples of pricing models include seat-based or user-based pricing (common in SaaS, for example, $49 per month, per user), perpetual license (a one-off purchase), and usage-based (such as your monthly utility bills).

When determining product pricing, you’ll need to decide on both. You’ll use a pricing strategy to determine how you’ll set the price, then decide on a pricing method to determine how you’ll communicate and invoice that price.

Types of Pricing Models

So far, we’ve laid out the most common pricing strategies and discussed what distinguishes these strategies from pricing models.

Here, we’ll examine eight common pricing models, which you can combine with the overall strategy you’ve chosen for your company.

1. Freemium

Freemium is an extremely common approach to pricing and involves offering a free version of your product with the goal of converting users to a paid plan at a later point.

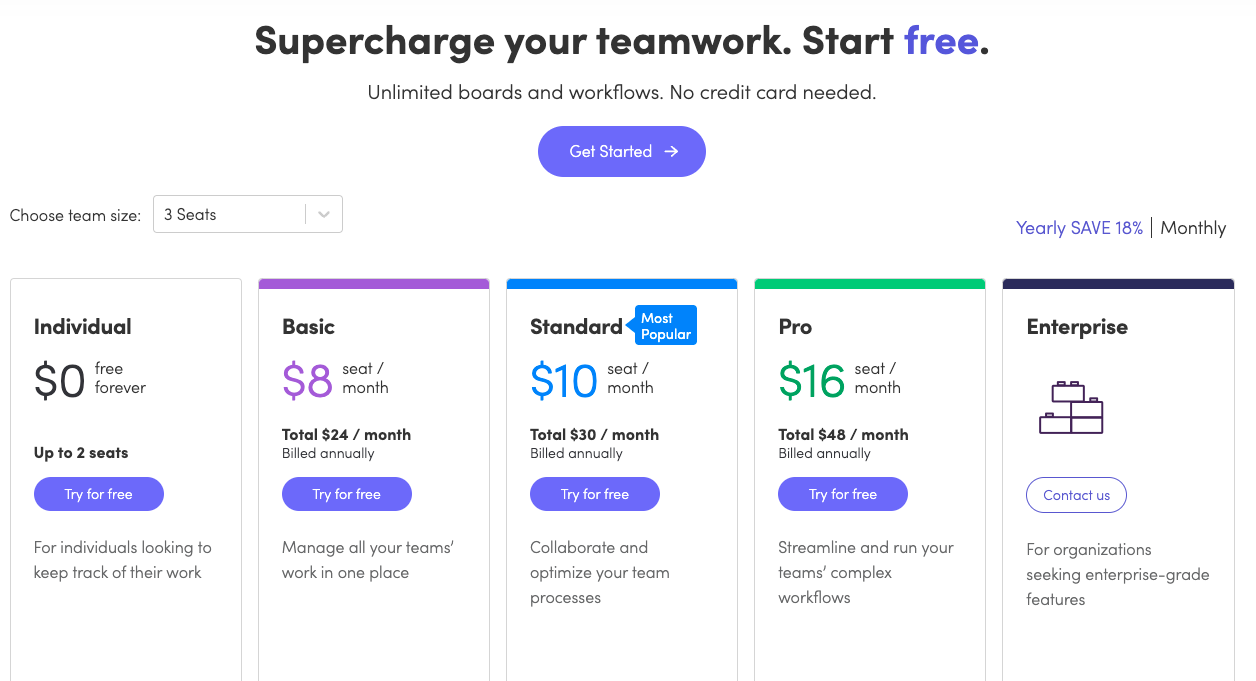

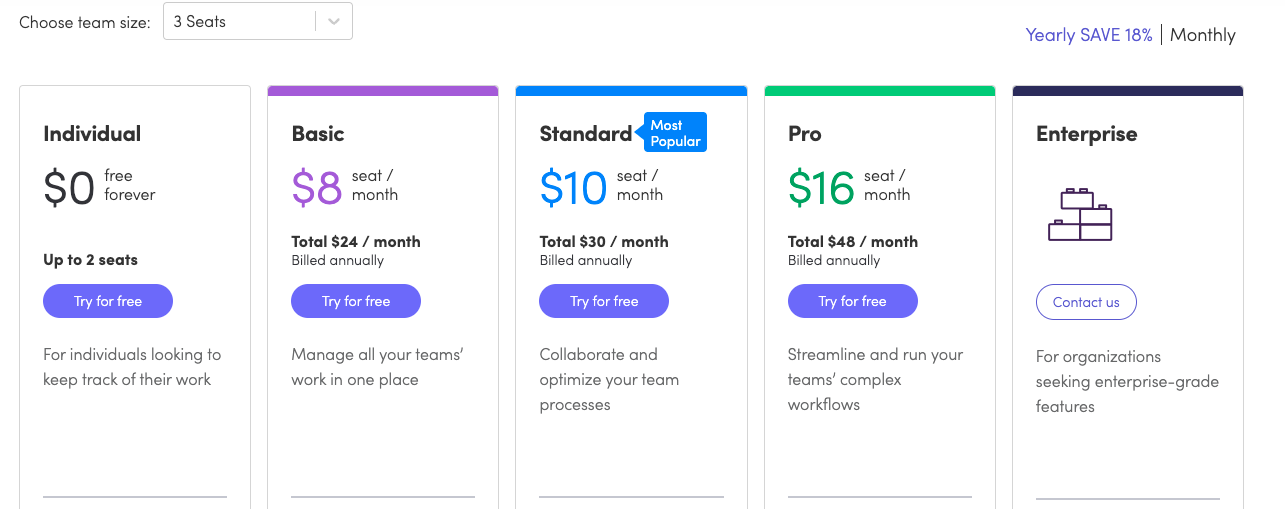

monday.com, for example, makes use of the freemium pricing model.

With freemium, the idea is to design a stripped-back version of your product, so you retain some leverage to bring users up to a paid plan.

It’s important, however, that you still provide enough value in the free version to make it worthwhile to the user.

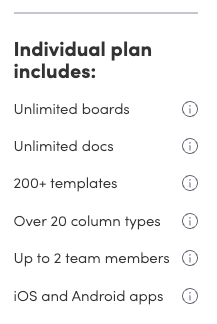

In monday.com’s case, the free plan allows for unlimited boards and access to over 200 templates to get started immediately.

However, users on the free plan are limited to just two team members, meaning monday.com has built growth right into its pricing (if the free user gets significant value out of monday.com, their team will grow beyond two members, and they’ll need to upgrade to a paid plan).

2. Per Seat

With the per-seat pricing model (also known as the per-user model), your customers pay based on the number of employees that are using the product.

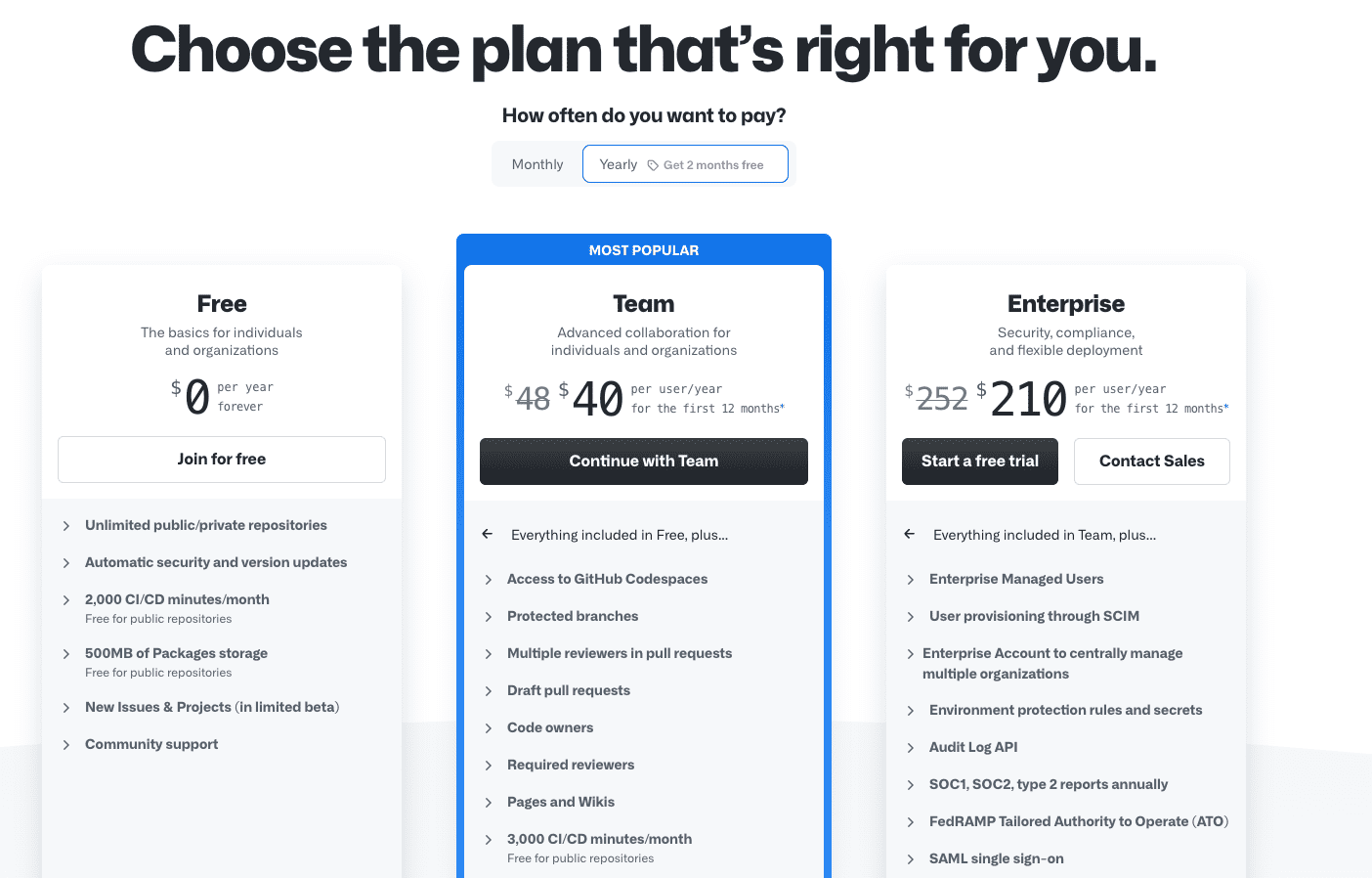

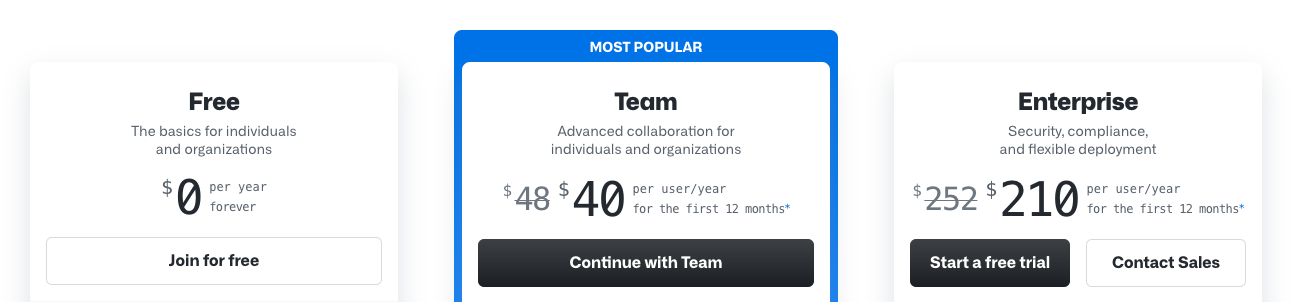

GitHub, for example, uses the per-seat pricing model:

Note, like with both GitHub and monday.com, the per-seat model can be combined with the freemium model.

The per-user model has a few important advantages:

Revenue growth is built-in — as the customer’s company grows in size, they’ll add more users (depending on the need your product serves)

Pricing is easy to digest, and customers can budget accordingly

Customers have immediate access to all features (that are included in their plans)

However, it has some drawbacks as well:

Users can often share passwords to avoid paying for extra seats

Total costs can get expensive for customers when they expand, so they can be reluctant to upgrade

Getting customers from one user to many users can be a challenge

High-usage customers can be a drain on your resources relative to the revenue you’re receiving from them

Low-usage customers may feel they aren’t getting a lot of value out of your product

3. Tiered

Most subscription businesses use the tiered approach. With a tiered pricing model, you’ll create different ‘plans’ (generally between three and five) at different pricing points.

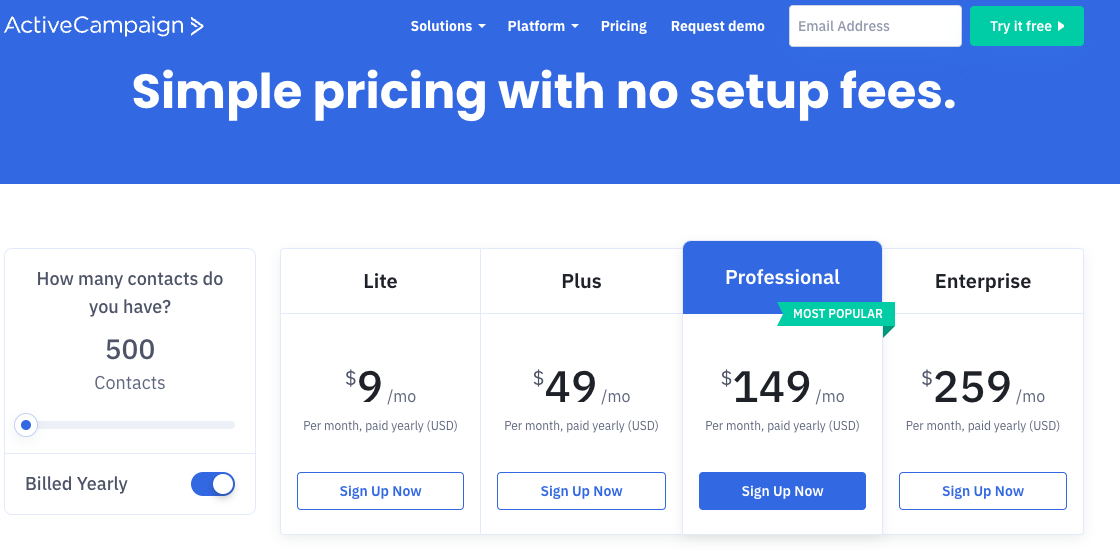

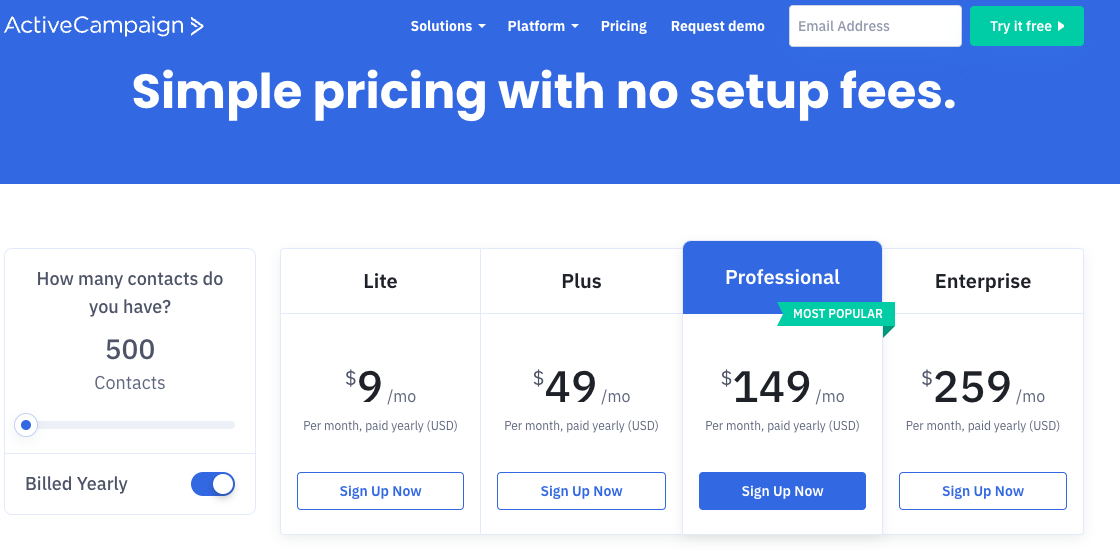

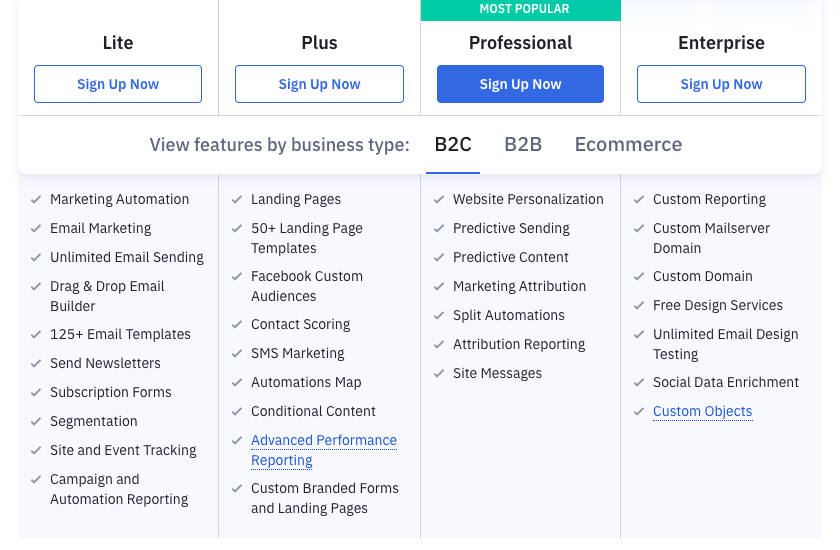

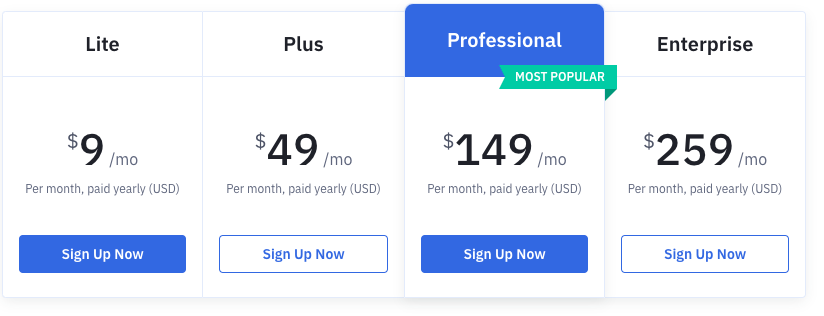

ActiveCampaign, for example, uses the tiered model:

With tiered pricing, each subsequent plan gives users access to more features or higher usage volumes.

This is a powerful method for attracting revenue growth from SME customers. When new customers in this segment sign up, they’re more likely to opt for a more affordable plan.

As the company grows, you’ll continue to demonstrate value through the results your product generates, as well as any marketing and sales activities you engage in to increase your annual contract value.

It can also be an effective way to take advantage of price anchoring, a technique where the lowest and/or highest pricing tiers help to establish the middle tier as better value.

GitHub’s pricing model demonstrates price anchoring in action, where their “Team” plan appears as higher in value when compared with the much higher cost of the “Enterprise” option.

4. Flat-rate

Flat-rate pricing takes the opposite approach to the tiered pricing model.

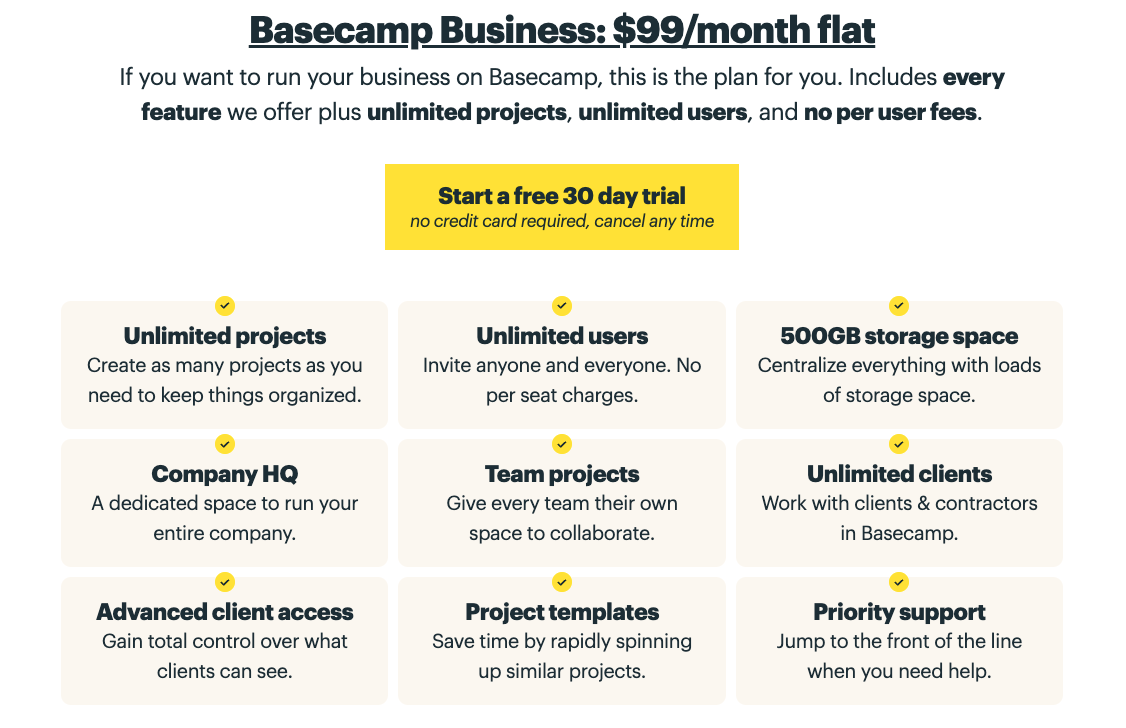

With a flat-rate pricing model, you charge one price for access to all of your product features. Basecamp, for example, uses the flat-rate pricing model, which is unusual in SaaS.

Flat-rate pricing models can be considered a form of penetration pricing, where companies compete with industry leaders who charge on a per-user model.

Consider, for example, a company with 30 users comparing Basecamp’s pricing with monday.com’s pricing.

Even at monday.com’s lowest pricing tier ($8 per month), that’s a cost of $240 per month vs. $99 at Basecamp.

The primary benefit of running a flat-rate pricing model is this competition. Plus, it makes your pricing much more digestible, as potential customers don’t need to waste time figuring out the differences between your various plans.

It does come with a major drawback though: the inability to grow revenue from existing accounts.

When you use a tiered pricing model, you’ve got revenue growth built in, as you always have the ability to upsell lower-tier accounts. And if you’re charging per user, you’ll continue adding revenue as your customers scale.

There is a workaround for this problem. Note that Basecamp’s flat-rate pricing model includes unlimited users. It’s also possible to combine the flat-rate model with a per-user pricing model, where you offer only one plan at a flat rate but charge extra per additional seat.

5. Usage-Based

Usage-based pricing is a pricing model where customers pay based on what they use in a given month.

You’ll find this model used across the majority of utility companies.

In the B2B world, usage-based pricing is often used for cloud computing and web infrastructure services. Entrepreneurs and business owners often prefer this model because of the transparency — you pay for what you get.

Amazon Web Services (AWS), for example, uses this pricing model.

Some companies use a hybrid model, where usage-based and per-seat pricing models are combined to provide a set monthly rate with usage ceilings.

Auth0, for instance, takes this approach.

It makes the most sense for high-volume plans — sending an extra invoice for each new user is not feasible.

6. Pay as You Go

The pay-as-you-go pricing model is a variation of the usage-based model in that customers pay only for what they use.

The difference, however, is that they pay in each instance they use the product rather than receiving an invoice at the beginning of the month for the last period’s total usage.

Ride-sharing apps like Uber and Lyft are good examples of the pay-as-you-go model. Customers pay based on usage (longer distances cost more) and are changed at the point of use.

Twilio is an example of a B2B SaaS company who charges using the pay-as-you-go model for certain features.

7. À La Carte

The a la carte pricing model allows customers to pick and choose features or modules, essentially building their own customized solution.

This is beneficial when you offer a large range of features and want to ensure customers are getting maximum value for their dollar. Rather than having to upgrade to a more comprehensive plan to access a single feature, they can simply add it on.

This does, however, have implications for revenue.

With a tiered approach, customers who need a more advanced feature must upgrade to a more expensive plan. With a la carte pricing, they can simply add on the new feature they need, which typically costs less than the difference between tiered plans, meaning your ability to grow revenue from upsells is limited.

Because of this risk, a la carte is less common as a SaaS pricing model, though some companies, such as Pipedrive, incorporate a la carte into their tiered approach.

8. Perpetual License

The perpetual license is, for lack of a better term, the “old” software model.

Before SaaS was the most common approach, customers would need to purchase the software outright (now known as a perpetual license).

With the perpetual license pricing model, customers pay a one-off fee and have access to the product in perpetuity. Depending on your structure, that might include all future updates, or they may need to pay a crossgrade/upgrade fee in the future.

Microsoft, for example, still sells Word on a perpetual license (though you’ll see that they’re trying to push customers toward a subscription model).

Making the Most of Pricing: Tips and Best Practices

Not sure how to start optimizing your prices? Here are a few tips and best practices.

1. Adopt a Localized Pricing Model

While the USD may be a pseudo-universal currency, failing to display localized pricing inevitably creates friction in the buying process.

Buyers in regions that also use the term “dollar” (Australia, New Zealand, and Singapore), for example, may misinterpret how you’re displaying prices, resulting in an unwelcome surprise when it comes time to enter their credit details (often resulting in cart abandonment).

Moreover, charging exclusively in one currency means customers incur foreign currency fees, and due to fluctuations in exchange rates, your consistent monthly cost is no longer all that consistent.

A simple way to get around this is to install a plugin on your site that detects the visitors’ region and calculates local pricing automatically. There are two drawbacks here, however:

The nature of exchange rates means that prices are displayed differently each time the customer visits. So unappealing price points ($43.67, say) limit your ability to take advantage of psychological pricing.

You’re not truly localizing pricing.

Localized pricing must reflect the demands and expectations of the geography you’re selling into, and this is not always the same as a simple exchange rate calculation.

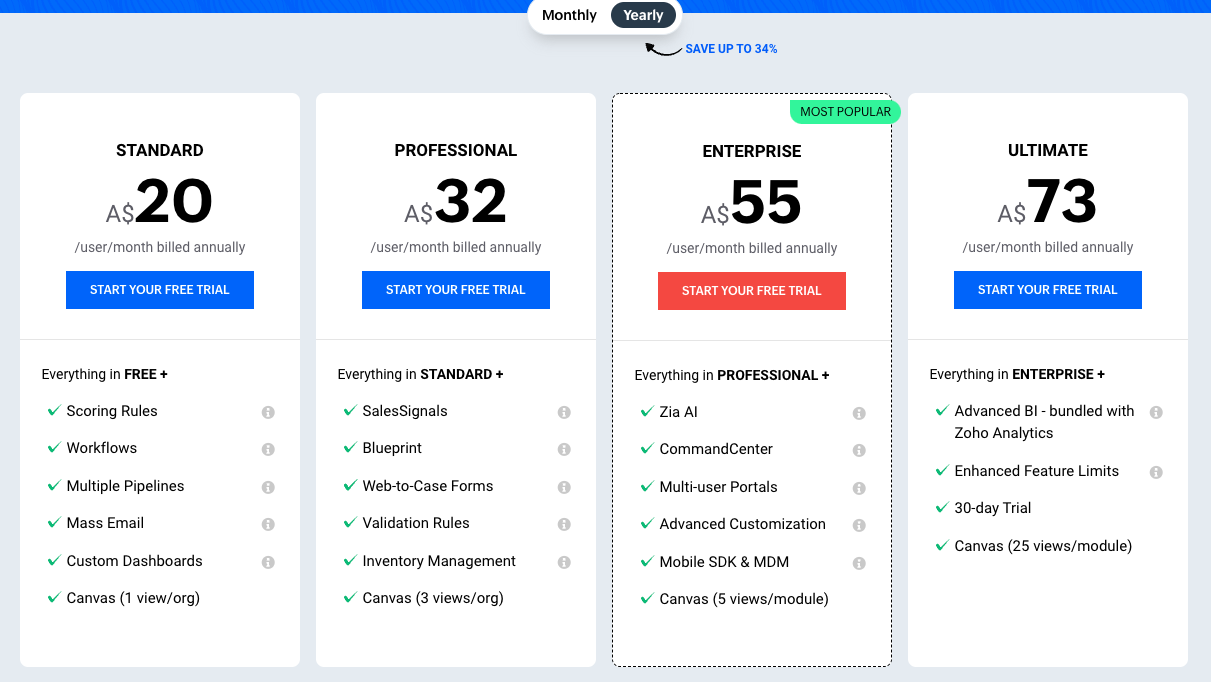

Zoho, for example, makes it clear to Australian visitors that they’re charging in AUD, and uses localized pricing to set digestible, round numbers for each of their pricing tiers. You also need to consider the buying power of your target market in each country.

2. Messaging Matters

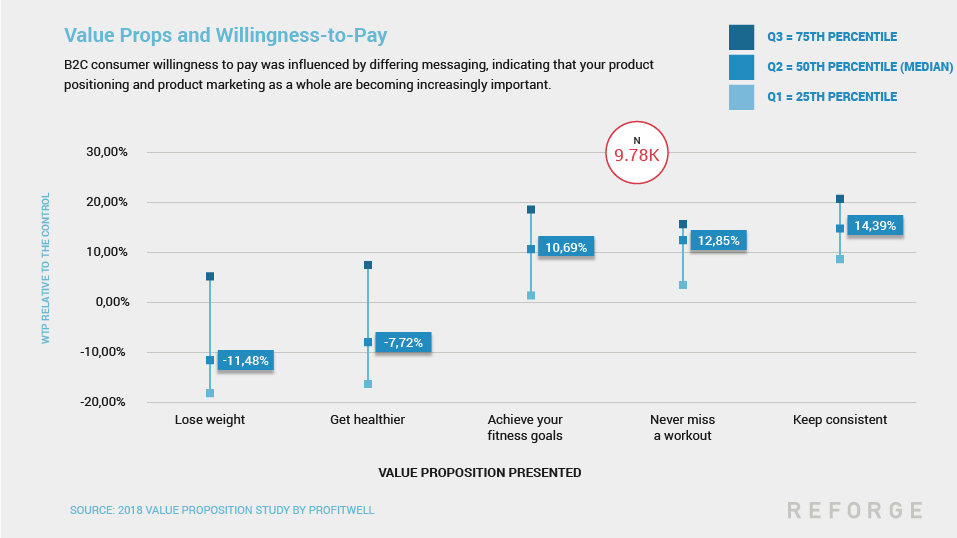

Though the price points you choose do influence how customers perceive the value your product offers, they’re far from the only lever you can pull.

The messaging around your pricing, and the value propositions you use to communicate the benefits your customers can expect to receive, can influence buyers’ willingness to pay by as much as 20%.

Testing is the best (and really only) way to nail your messaging with 100% confidence. The problem is, testing messaging on a live audience can be time consuming, and presents a risk to revenue growth, because testing ineffective messaging on real customers means you’ll convert less than you could.

To maximize impact (and minimize time spent in A/B testing in a real-life scenario where revenue is on the line), use a message testing service like Wynter to gather in-depth feedback from relevant B2B audiences.

Start by testing internally before investing in professional message testing. Perform Voice of Customer research by interviewing your current buyers and questions about the challenges they faced previously and how your product impacts their lives today.

Pull important quotes and insights from these interviews to use as fuel for your product messaging. Develop several messaging options, and ask for feedback from internal stakeholders (marketing, sales, and customer service).

Use this feedback to refine your message and draft the final landing page copy, then submit it for testing, and use the feedback from that professional process to polish, finalize, and publish.

3. Test Psychological Pricing

Psychological pricing is somewhat of a misnomer — all pricing is psychological.

The term itself, however, refers to the concept of manipulating price points at the micro level to influence buyers’ perceptions of value.

The classic example, and one which you see nearly everywhere, is ending price points with a 9 (such as $19 instead of $20, or even better, $19,99).

Ending your pricing in 9s isn’t the only method, however. While this strategy does work for lower-value products (think FMCGs like those pictured above), it tends to be coupled psychologically with discount brands.

Pricing that ends in a 0, on the other hand, can establish the opposite; an appearance of luxury or premium quality.

The most important factor here is what works for your audience. Set up multivariate testing to establish whether 9, 0, or 5 (or any other number, for that matter) appeals most to your target customer.

4. Keep Pricing Packages Simple

Many studies support the notion that offering too many choices results in something known as “analysis paralysis.” Buyers are too overwhelmed with the number of options they have and are less likely to make a decision than those given fewer options.

Limiting your selection to three to five packages tends to be the most effective approach. It is also enough space to incorporate a free plan and a custom enterprise plan on either side of the scale, like monday.com does.

Pricing presented like this is extremely easy to digest, because most customers will fall into one of three categories:

Customers who are just getting started who know they want a free platform

Customers at the enterprise level who will gravitate automatically to the Enterprise plan

Customers that are anywhere in between, who’ll then only have three options to choose from

Plus, presenting three options makes it easy to take advantage of the center stage effect, the tendency for consumers to choose the middle option when presented with a row of pricing packages.

Note also how monday.com uses a subtle design cue (the “Most Popular” icon) to further influence this decision pathway with a bit of social proof.

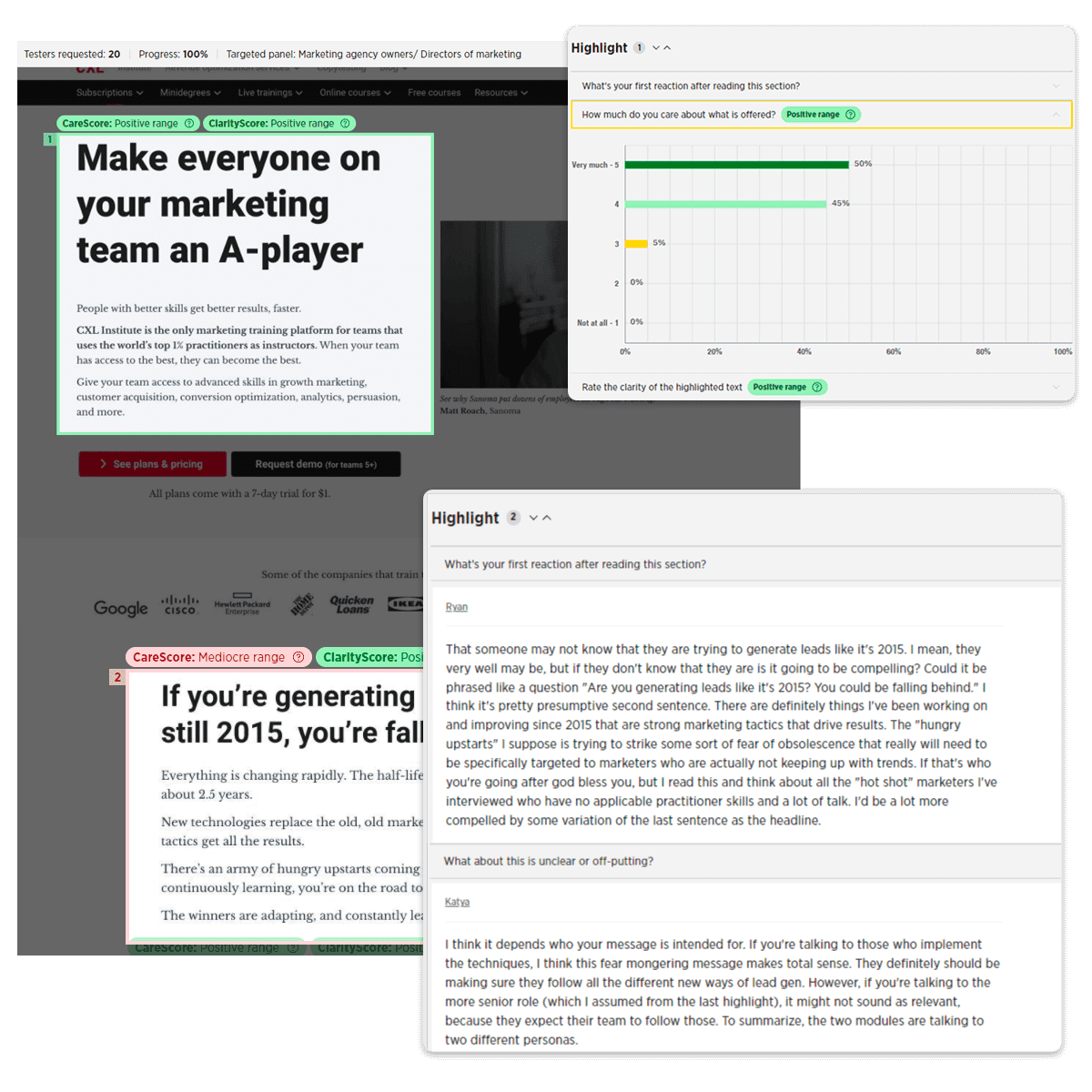

5. Use Design to Impact Purchase Decisions

The design of your pricing page (in conjunction with the price points you set and the messaging you use to sell your value props) can have a significant impact on pricing decisions.

It’s fairly well-established that buyers more readily choose the middle option when presented with a selection of products or packages.

But, if, like many SaaS brands, you want to influence customers to choose a more extensive package with a higher price point, you can use subtle design cues to make one package stand out.

ActiveCampaign, for example, uses a couple of simple yet effective design tricks to make their Professional plan stand out, as well as a subtle “Most Popular” banner to influence choice based on social proof.

Conclusion

Your pricing strategy is one of the most crucial growth levers you have.

It helps you establish a price point that serves market expectations, and if you choose the appropriate strategy for your industry and company type, can build revenue growth right into your price tags.

Of course, determining pricing is just one small step on a very large journey towards revenue optimization. On the other side of that journey is a need to manage, influence, and grow subscription revenue, which is where a platform like Chargebee comes in.

Chargebee is a dedicated revenue management and subscription billing platform designed to help you streamline revenue operations and consistently improve profitability.