PRODUCT

SOLUTIONS

- BY INDUSTRY

- B2B SaaS

- eCommerce

- E-learning

- Publishing

- BY BUSINESS SIZE

- Startup

- ScaleUp

- Enterprise

- BY BUSINESS MODEL

- Self-serve

- Sales-driven

CHARGEBEE RETENTION

Retention

What is Involuntary Churn?

As a SaaS/subscription business, you’re probably already looking at the churn and how it affects your revenue. Customer Churn and Revenue Churn are the most commonly addressed metrics that businesses look at–day in and day out. Churn is when a customer stops paying for your product/service. However, when your subscribers churn without actually intending to stop using the service–this is termed as Involuntary Churn.

How does Involuntary Churn occur?

Involuntary churn occurs when a customer undergoes a payment failure, leading to their subscription being canceled. Not only do you lose your customers, but a part of the monthly recurring revenue is lost, too. It can happen for any of the following reasons:

Not updating their subscription billing information/credit card information (using expired cards)

Hard declines when a card is lost or stolen

Soft declines when a credit card has maxed out its limit≥

Banks can decline the card for other reasons

Voluntary Churn VS Involuntary Churn

Voluntary churn is the purposeful cancelation of a subscription. And unlike involuntary churn, voluntary churn indicates an underlying problem. Your customer experience could be subpar; your pricing strategy could be off, or maybe you’re attracting the wrong customers.

Neglecting this type of churn could push your customer acquisition cost to unreasonable levels. In comparison, retention of customers would cost you five times less.

If you’re finding it difficult to pinpoint the problems in your business: we’ve put together a comprehensive guide to analyzing churn.

How should businesses interpret Involuntary Churn?

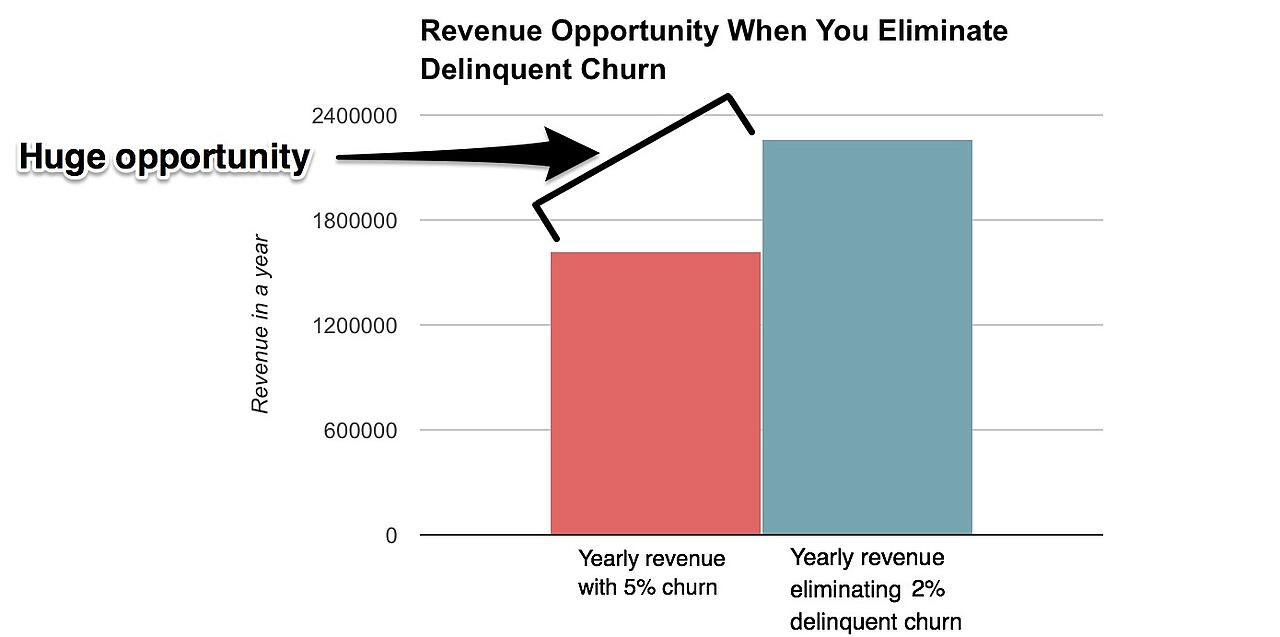

About 20-40% of churn is usually from the involuntary churn. And, the most striking truth about involuntary churn is that almost all of it is avoidable. Therefore, reducing involuntary churn is one of the easiest and most direct ways to increase customer lifetime value (LTV), leading to higher returns on your customer acquisition cost (CAC). As you can see from the image below, a mere 2% decrease in the involuntary churn rate results in a substantial revenue increase.

Beyond its negative effect on revenue, involuntary churn hurts your relationship with the customer as well, who wakes up one day to realize that their subscription got canceled, unintentionally.

But, like we said: almost all of it is avoidable.

How to reduce Involuntary Churn?

Between the issuer and acquiring bank, there’s a complex interlink of payment gateways, payment processors, and card networks––a host of things could go wrong. Taking failed recurring-payments into consideration, we’ve split its lifecycle into six stages: It makes it easier to utilize various tactics at different stages–as shown below.

If you’d like to read a step-by-step guide on reducing involuntary churn, click here.