PRODUCT

SOLUTIONS

- BY INDUSTRY

- B2B SaaS

- eCommerce

- E-learning

- Publishing

- BY BUSINESS SIZE

- Startup

- ScaleUp

- Enterprise

- BY BUSINESS MODEL

- Self-serve

- Sales-driven

CHARGEBEE RETENTION

Accounting and Taxes

What is Deferred Revenue?

Companies that use cash-based accounting realize their revenue as soon as payment hits the bank.

In accrual-based accounting you record the revenue only after it’s earned or recognized. Accountants use the term “revenue recognition” to identify and report how much of the deferred revenue is recognized.

GAAP accounting standards require methods and reporting techniques that show accounting conservatism. Accounting conservatism ensures the company shows a legal claim to its profit. The general method is to factor in the worst-case for the firm’s financial future. Revenue is recognized as “earned” only when service/product delivery happens as promised. Categorizing deferred revenue as earned on your income statement is aggressive accounting which will overstate your sales revenue.

SaaS businesses follow the accrual accounting method. ASC 606 / IFRS 15 are the key accounting principles that must be followed. Therefore, revenue recognition depends on the principle of the ASC 606 / IFRS 15 which state: "recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services."

How to calculate Deferred Revenue?

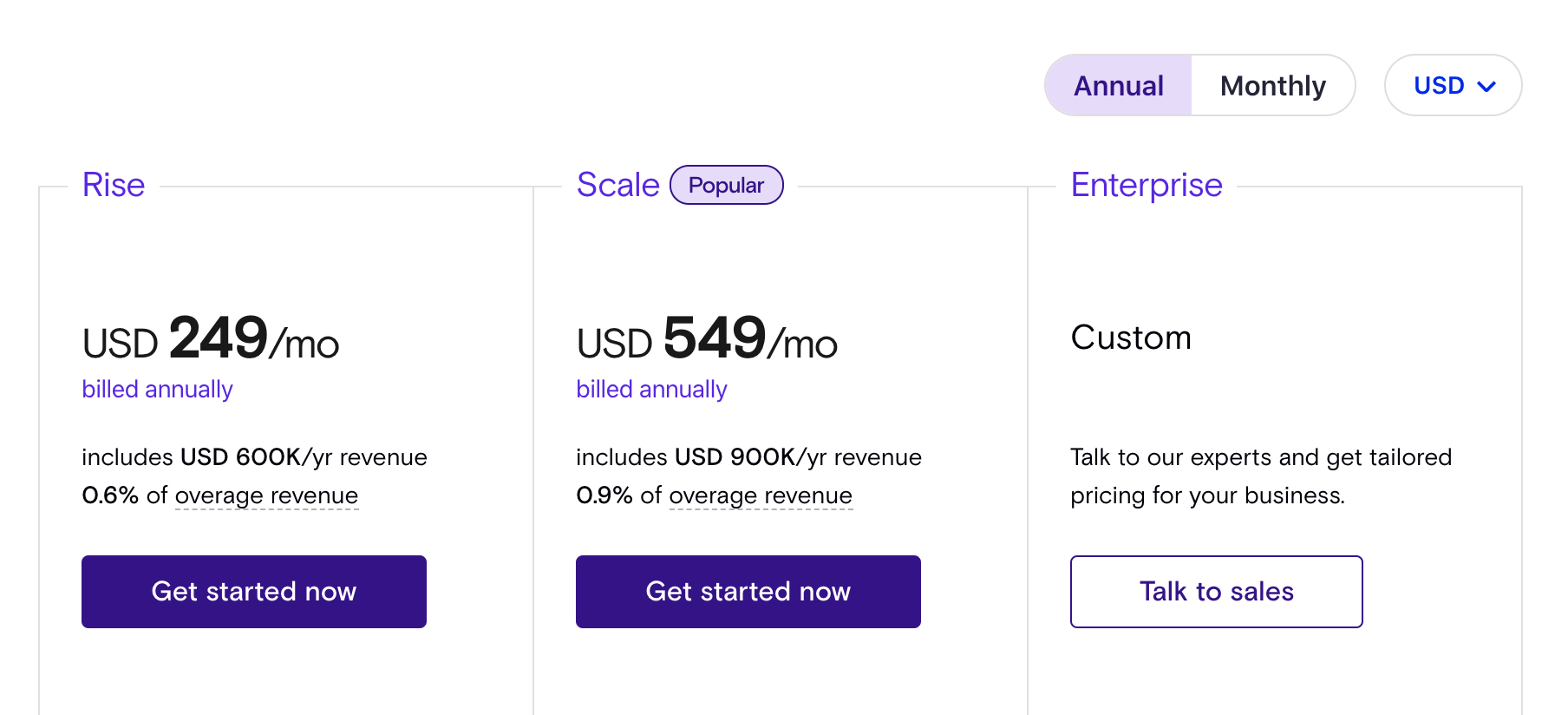

Here's an example of deferred revenue. Assume you have a similar pricing plan (for illustration purposes, we’ve explained it with Chargebee’s pricing), this how you’ll calculate your unearned income in your balance statement.

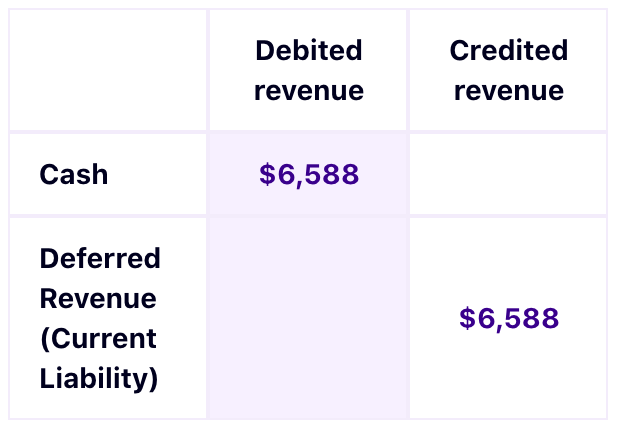

Suppose customer X signs up for the “Scale-up” annual plan on January 1st by paying $6,588. Your accountant will record the transaction in your company's journal entry as:

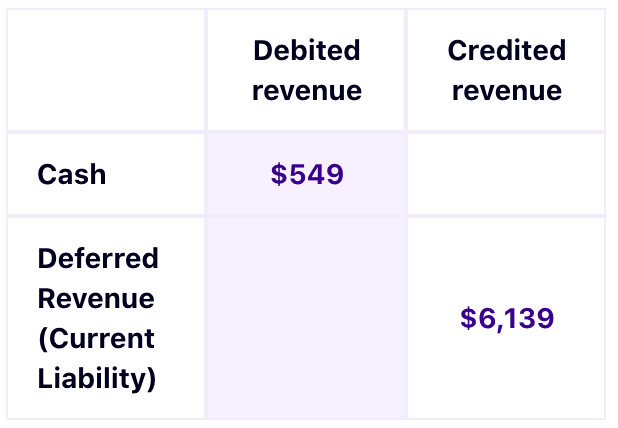

This entry has not touched your company's balance sheet yet. When closing the books for January, your accountant will be creating your monthly financial statements. At that time, the accountant will debit the deferred revenue of $549 from your credited revenue.

This reduces your deferred revenue by $549 from $6,688 to $6,139 in January’s book closing statement. This method will continue as you recognize $549 every month from your deferred revenue balance until it reaches 0.

Why should deferred revenue be seen as a liability?

Your money isn’t realized You still owe your customers the required service/goods that should be provided for the completed transaction. So it cannot be counted as revenue just because it shows in your bank records. If your customer wishes to terminate the service before the unfulfilled period of subscription, you’ll need to return the sum for that period. (example: if they terminate the subscription after 5 months, the money should be returned for the remaining 7 months)

Prevents business over-valuation It is easy to factor in growth based on the money that hits your bank before the promised service has been delivered. This clouds your company’s forecasting methods and creates a “growth illusion”. Where you think you’ve grown and start investing the unrecognized balance to keep the growth momentum. This misleads your investors to believe that you’re growing when the reality is something different.

Multiple services offered Some businesses offer multiple services along with their subscription model, like annual maintenance for two years. In this case, one part of the service you’re providing is fulfilled at purchase, whereas the other will be deferred. This will show that one part of your revenue is earned and another deferred, leading to accounting issues as there are multiple stages of delivery. Realizing these accounts can lead to false positives showing up in your cash-flow statements. Therefore, it is crucial to track your contract terms with your customers before realizing the revenue.

Conclusion

Deferred revenue in accounting is a careful exercise in accounting. Recognizing revenue before it’s earned will misinterpret your growth numbers, spiking your growth potential. It is also important to know that this un-earned cash should not be invested in your future projects until it’s earned. A conservative approach to calculate revenue will present a more realistic picture of your company’s growth.