Steps to Foolproof Payment Recovery for Your Subscription Box Business

The global subscription box industry is expected to grow from $22.7 billion in 2021 to $65 billion by 2025 (at a reality-warping CAGR of 18.3%) according to research by the IMARC Group. And with good reason. Subscriptions are a healthy source of recurring revenue, subscription customers have a higher average lifetime value (LTV) than traditional eCommerce, and recurring billing takes away the pain of initiating transactions before every shipping instance.

But under what seems like a pretty straightforward business model is a labyrinth of complex revenue strategies, a plethora of API integrations and payment processes, but more importantly, a still-evolving market of service providers that help set a subscription box business up from scratch.

And you’d think that’d be the end of it. But even after your customers have set up recurring payments for their subscription box, there is always the fear that they will churn. And what is even more surprising is that most of the time, they’ll do so unknowingly.

According to analytics from Brightback (a Chargebee company) – over 53% of subscriber churn is passive or involuntary. And 20-40% of it often happens due to something as menial as failed payments from debit/credit cards.

Understand and arrest churn better, tap into contemporary strategies and take stock of your customer retention process with insights from our in-house retention experts. Get your free copy –

The Complete Guide to Customer Retention for Subscription eCommerceWhile some churn is unavoidable for any business, losing customers because of issues as trivial as mechanical payment fails or credit card expiries, is plain hurtful. Especially because they’re perfectly solvable if you optimize your payment recovery strategy.

How passive churn becomes an unprecedented nemesis to customer experience

It is one thing for a customer to churn for the lack of the right experience-solution fit, and like any product, subscription boxes will also come with their own ideal customer profile. With involuntary churn, you lose loyal customers who didn’t have the inclination to churn in the first place.

Mechanical process inefficiencies like payment gateway or credit card failures not only abruptly stop subscription billing for your customers, but they also end customer relationships without your customer ever knowing until their next order isn’t delivered.

Subscription customers who churn involuntarily also need to restart their recurring billing flow and sign up again. This unnecessary penalization fractures long-term customer relationships.

The Failed Payments Life Cycle and Common Reasons for Involuntary Churn

As an extension of eCommerce, Subscription box businesses also deal with high transaction volumes. In this case, however, transactions are online recurring payments with a higher LTV. This means subscription businesses must understand that every transaction goes through a standard set of chapters in its journey from the customer account to the receiving account. Intermediaries involving – payment gateways, payment processors, card networks, direct debit networks, or virtual wallets exchange information throughout, occasionally generating ping-backs and retries for payment recovery.

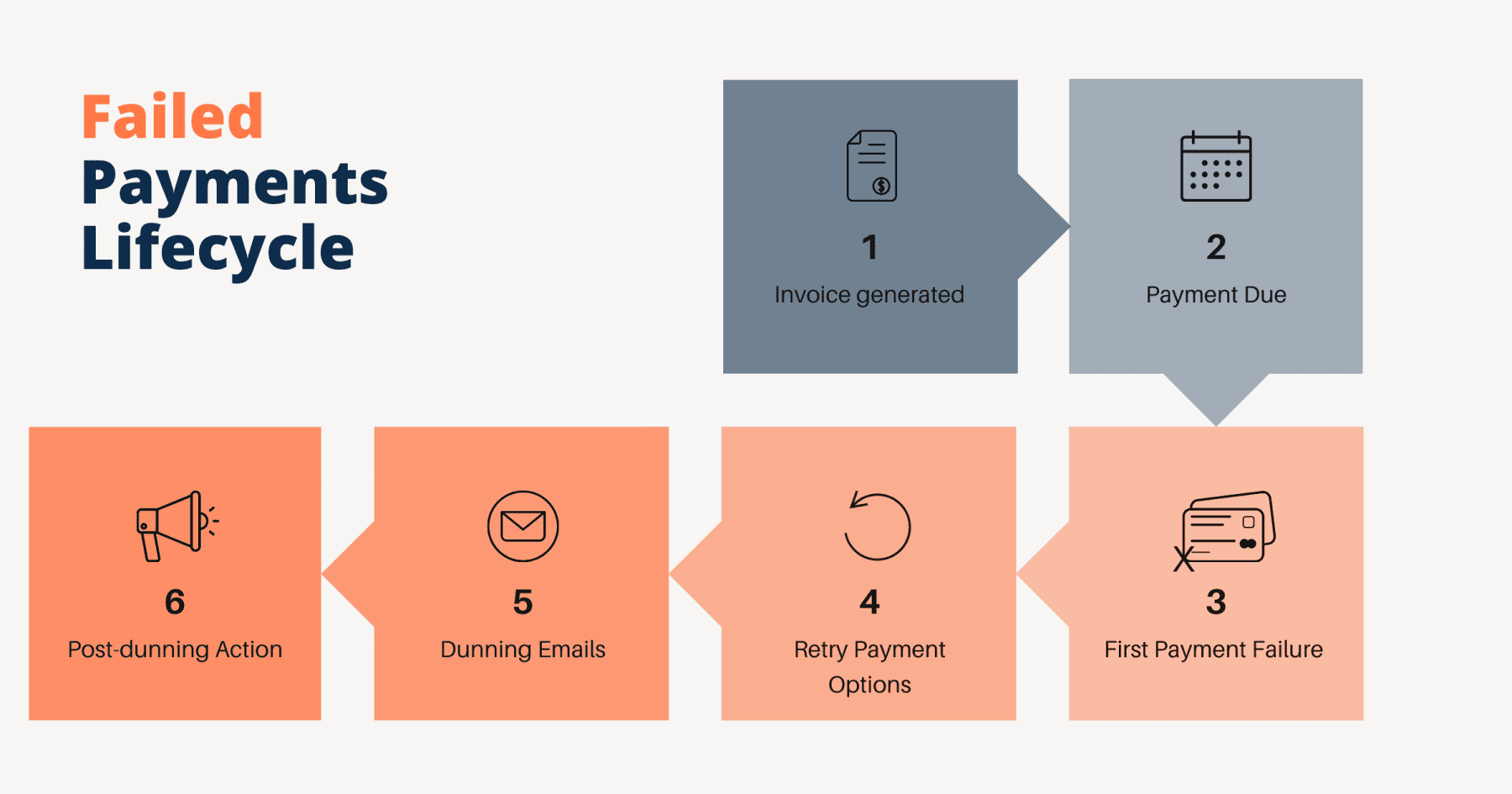

The below workflow exhibits a conventional structure and the stages that a recurring, online payment goes through when the payment fails. It is almost like a butterfly life cycle, except, it’s causing your customers to churn out.

Depending on whether you’re using invoices for each subscription billing instance or not, failed payments look a little different:

In both cases, the charge can be immediate or delayed, you can automate it (using a card or a direct debit order with the bank) or set up manual payment recovery (using cash or a cheque), and it can be recorded and filed automatically (by a subscription management system) or manually.

Common reasons for failed payments for subscription box businesses

Involuntary churn is more passive in nature and happens without the subscriber proactively canceling their subscriptions. It is when mechanical reasons cause a customer to stop paying and lose their subscription benefits as a consequence. They can happen due to any of the following reasons:

Expired credit card details

Credit card expiry is the single largest contributor to passive/involuntary churn. While all credit cards are meant to expire within a stipulated period (due to anti-fraud regulations), it is onerous to assume your subscribers will track expiry and remember to update every platform they’ve enabled automatic card payments for with their new card number, expiry date, CVV and other details.

It is also to be noted that expired credit cards can cause passive churn for even the most loyal customers of your subscription box. In fact, any customer who has stayed on your platform for over 2 years is likely to churn if you did not automate card updates in your billing platform.

Soft declines

Soft declines result from a temporary problem with a payment gateway, payment processor, or tool. This is a case where there isn’t an inherent issue with the card details collected by the business and is usually resolved by simply initiating a retry on the same payment process at a later time.

Hard declines

Hard declines result from problems that are a little more permanent – no money in the bank, stolen card – problems that are a little less temporary than a glitch in the network or a gateway timeout.

Among them, the stolen card data problem is increasingly pertinent. In 2021 alone, the Federal Trade Commission reported over 2.8 million cases of credit card fraud, and as data and technology become even more democratized, organized financial fraud will also evolve with it.

Once a card is reported stolen, it is automatically blocked from being used for additional purchases. Recurring payment pings to the cardholders are also, automatically declined.

Untagged recurring payments

This often happens for eCommerce businesses following a blended revenue model. If you offer a subscription box service along with one-time transactions, errors in accurately tagging recurring payments may lead to the issuing bank identifying your consecutive auto-debits or charges as attempted fraud and are likely to decline them, for no fault of the customer.

Payment recovery workflow for your subscription box business

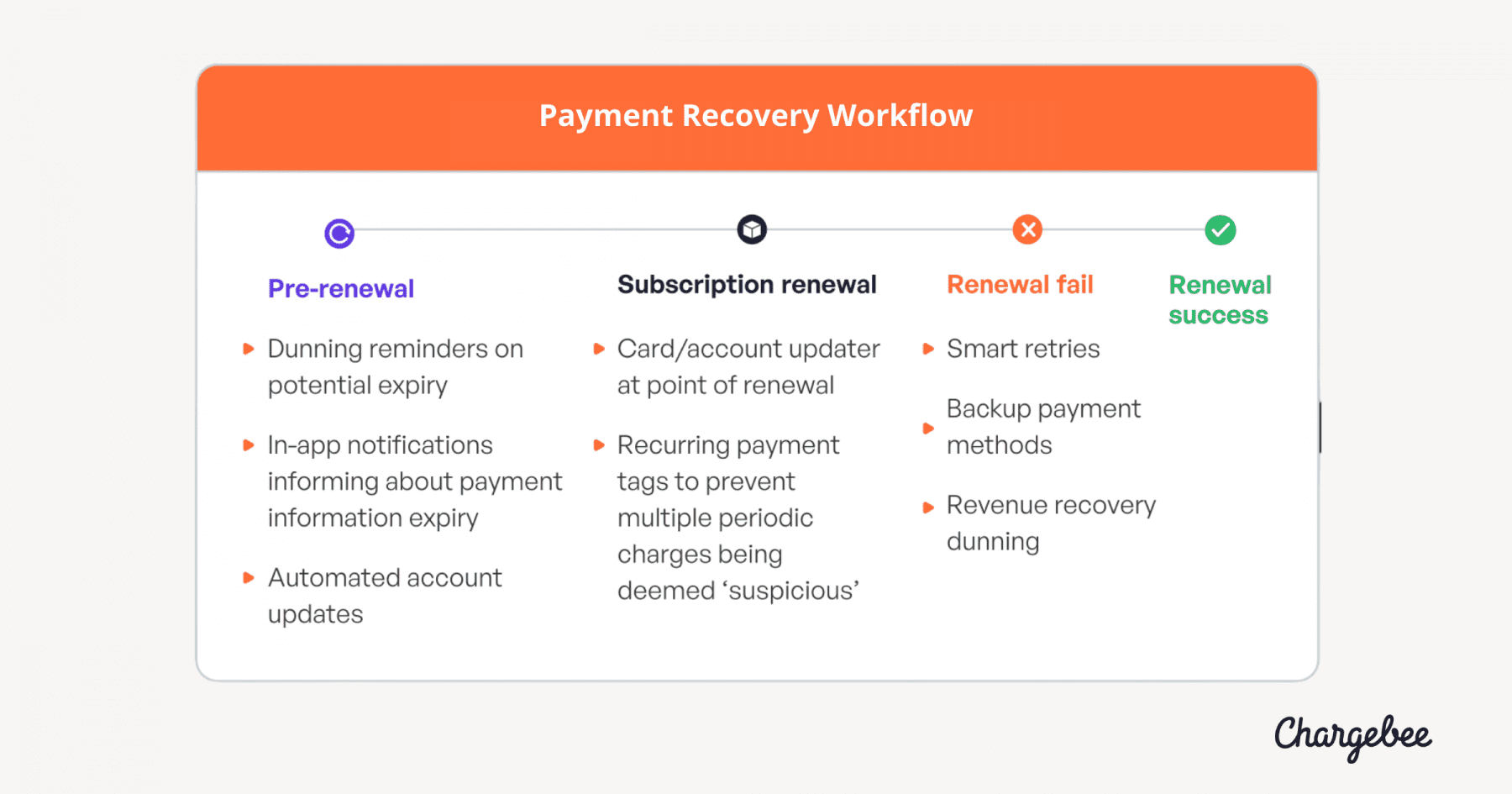

Instead of thinking of payment recovery as a reactive process, the below workflow provides a more proactive stance to not only recover failed payments but minimize the chance of failures before they even happen.

The contemporary payment recovery workflow, therefore, focuses on 3 distinct stages of intervention:

- Pre-renewal

- At Subscription Renewal

- Post Renewal Failure

As is evident, each stage comes with a specific tool and process optimization and needs specific attention in the journey. Let’s break them down!

Pre-renewal: Identify and intercept involuntary churn before it happens

Payment recovery starts way before a payment fails or a credit card declines. It starts from the moment a new customer gets their first subscription box delivered. By continuously monitoring credit card expiry dates and decline rates for payment gateways, your subscription billing or management system should be able to automatically switch your customers over to a better, functional payment option.

If that sounds too complicated, it is a good idea to optimize your payment process and select payment gateways (like Stripe, Braintree, and others) that auto-update a customer’s credit card details ahead of expiry.

Another process that can proactively arrest involuntary churn, (and requires minimal technical groundwork) is identifying upcoming renewals and sending automated emails and notifications – a process called pre-dunning – to your customers so they may update their payment information in the customer payment hub before their cards are wrongly charged.

Statutory warning – this can come at the cost of customer experiences by appearing intrusive or aggressive, and hence, a lot of it boils down to the narrative or story you craft in your message. However, if there is typically a longer delay in between two subsequent charges to your customer account, deploying pre-dunning might be a good idea.

Point of Renewal: Arrest Failed Payments at Source

As explained before, it often takes very little to see your customers churn, even when you’ve accurately filled in and updated their account details at customer acquisition. Sometimes it boils down to simple payment method failures, timeouts, or even gateway issues. (No) Thanks to soft declines!

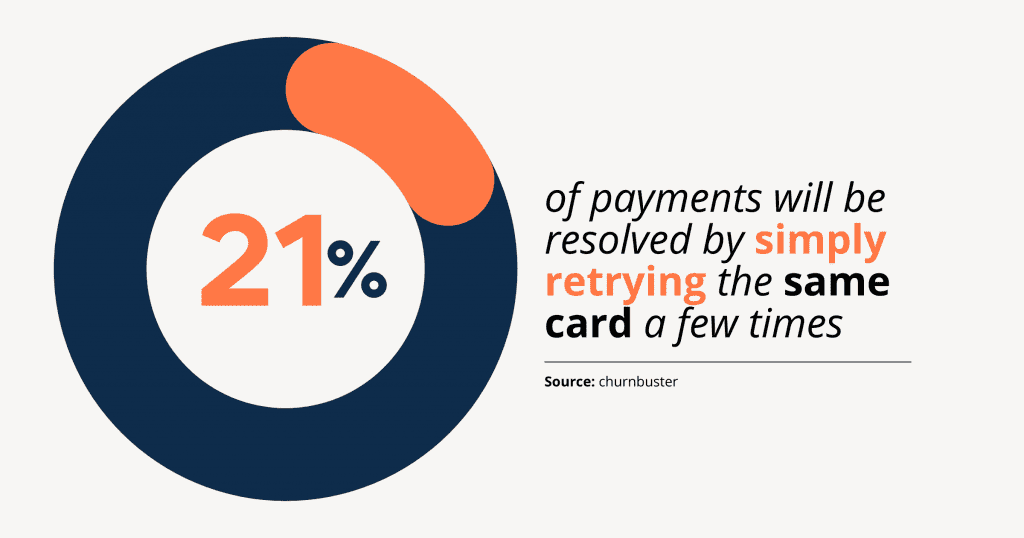

Simple problems, deserve simple solutions. Often, instead of seeking to update card details and initiating dunning, a simple retry functionality is all you’d need.

By automating retries, you effectively iron out the mechanical issues in your payment recovery workflow at the point of renewal, for no extra effort! We call that a win-win.

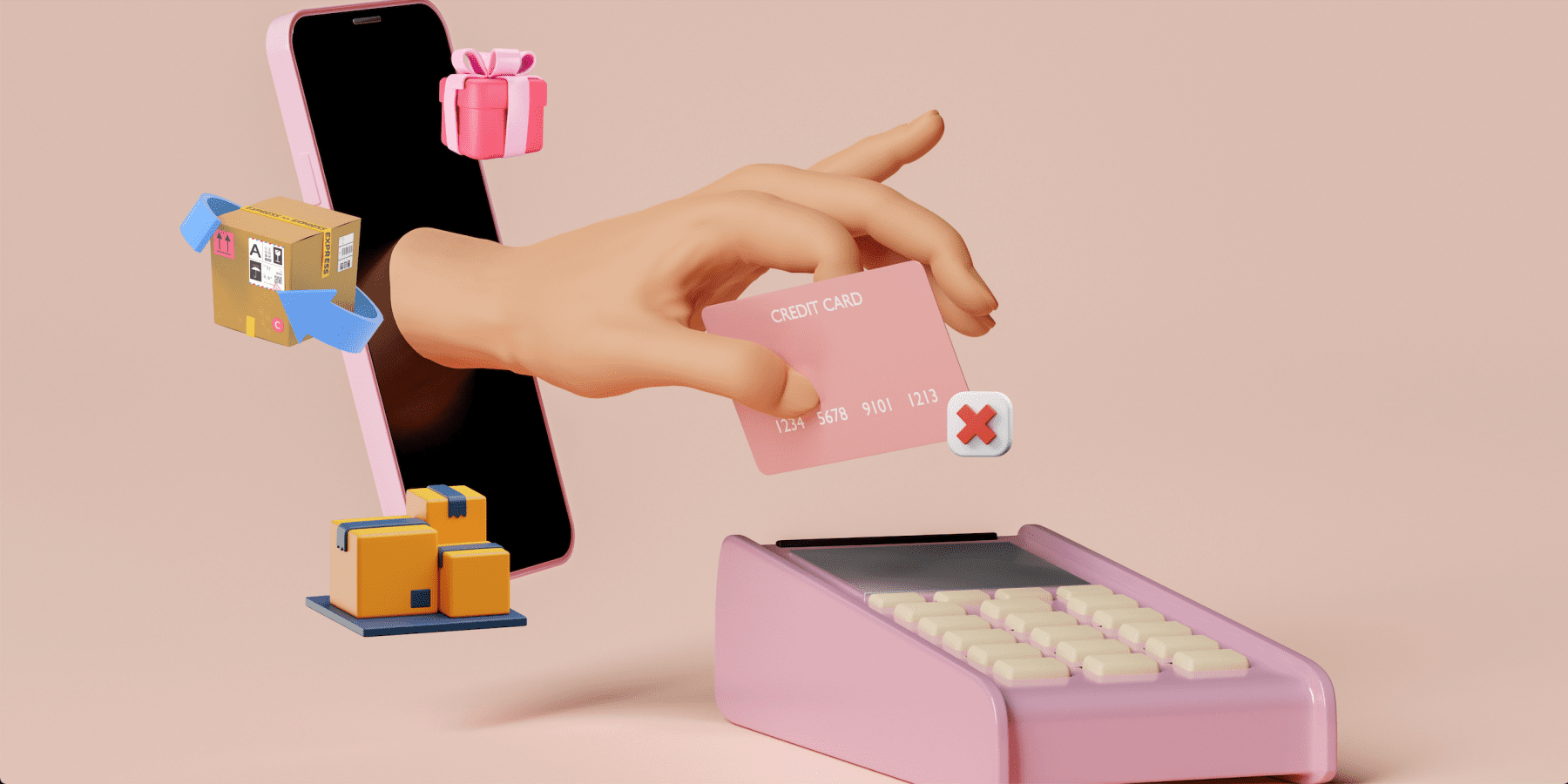

Post-failure: Firefight inertia for better recovery rates

If your transaction is declined, there is no reason to hit ‘panic’ just yet. A recurring payment hasn’t truly failed until you’ve retried to recover a couple of times, and/or tried a different payment gateway.

However, when all that is done, it becomes a different story. That’s when the ‘palms are sweaty, knees weak, and arms heavy.’ Under these circumstances, your payment recovery process has been put into overdrive, and dunning becomes your best friend.

Customer accounts that move to the post-failure stage have likely hard-declined their way in. And they are probably not getting their next subscription box without a conscious initiative to update their payment details.

A few pre-requisites to keep in mind:

- Retrying an ineffective payment gateway too many times may further impact your recovery rate

- Customers might need to be reminded to update a closed/expired card

- Customers should also be offered the choice to add alternate payment methods to mitigate a similar roadblock in the future

- Depending on the customer journey for your subscription box business, you might also choose to implement (or not) negative option billing – that’s where once a bill fails, you ship the box and issue chargebacks for the shipped orders

A Shifting Momentum from Dunning to Smart Dunning

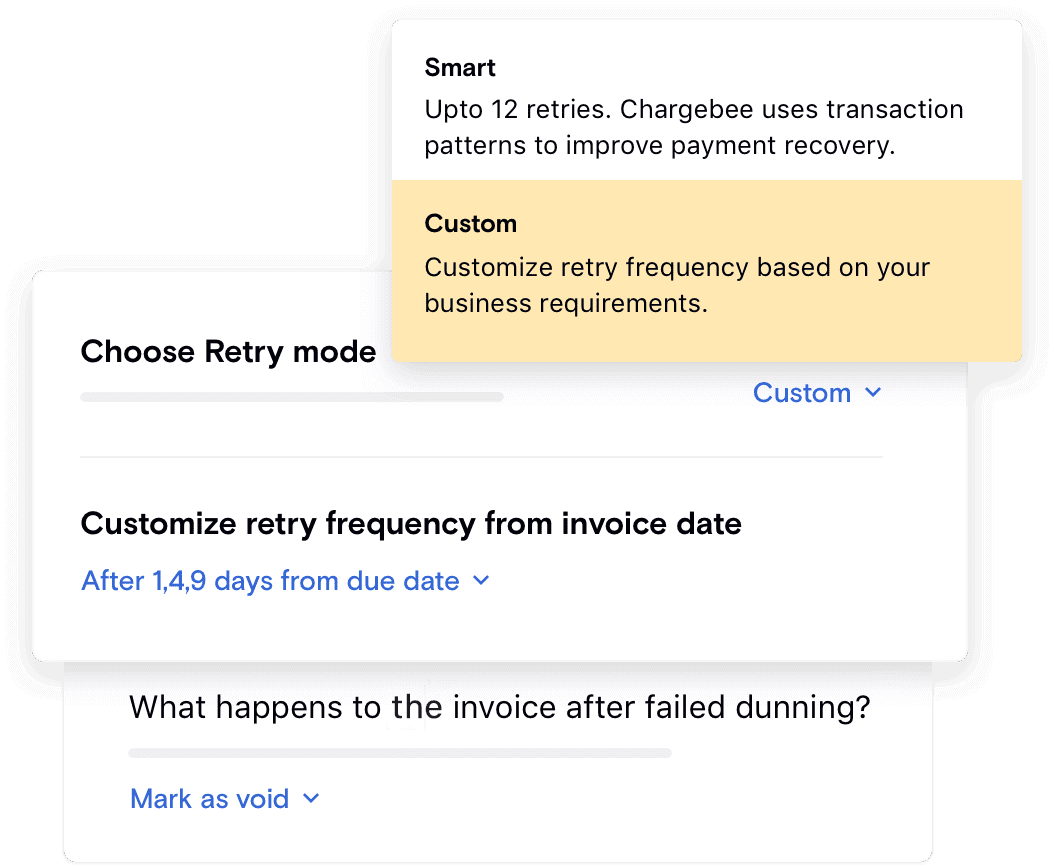

Dunning is the process of retrying payment attempts and sending payment reminders to customers when a transaction gets declined.

But as much as it is about reminding customers to pay their dues, it is also an exercise in empathy and understanding. Dunning works best when it isn’t considered intrusive. Too many notifications and you probably have an irritated (mildly begrudged) customer. Too few, and they’ll probably fail to remember you.

Hence, it is important to find the right balance between the frequency of reminders, and the messaging. To ensure that is done ensure that your subscription management platform can not automate dunning email and in-app notification frequency, but can also initiate reminders based on the reason for a failed payment.

If you are a subscription box business with a global presence, the impact of defining and charging from the right payment gateway (based on localized success rates) cannot be overstated.

By analyzing geo-specific transaction patterns, Chargebee shifts the momentum from ‘dunning’ to ‘smart dunning’ to deliver better returns on retention metrics, and reduce the turnaround time for payment recovery.

If a credit card on file resulted in a failed payment due to a hard decline, such as a card expiration, it’s pointless to try that same card again a few weeks later. The dunning capability includes ‘Smart Retry,’ a mechanism that recognizes the cause of a payment failure and adjusts the retry logic accordingly, and increases recovery rates by 25%

Chargebee’s Revenue Recovery Suite helped Whiteboard standardize and automate the vast majority of their processes when payments fail, reducing churn by 100%, and ensured smooth native and API integrations with Braintree, Stripe, and QuickBooks.

Listen, Iterate, Optimize: Data Always Delivers

For your payment recovery strategy to work, your subscription business must always have tabs on the data your tools and systems generate.

Pick up data from your gateway to find out what time during the day might be best for a retry, or let your fail rates and dropoffs determine which step in your subscription billing need to be optimized.

Group your customer base into dunning personas based on their ticket sizes, where they’re located (relative to where you are), and what kind of payment process you have in place for them (invoice-based payments vs. automated card and online wallet payments). This will give you an idea of the professional vs domestic need you are serving and will allow you to tailor your retry cycles to suit both.

Take the next step: Revolutionize Your Payment Recovery with Chargebee

In 2021, Chargebee helped subscription businesses recover over $75 million through smart dunning.

It comes with several out-of-the-box native and API integrations to help you get your subscription box started instantaneously, be it on eCommerce platforms (like Shopify, BigCommerce, and others) or as an independent in-house platform.

From checkout to retention, coupons to customer communication, billing to shipping, and taxation to accounting – get all the benefits of automation to painlessly grow your subscription box business.