Subscription Revenue: The Model for Long-Term (Sustainable) Revenue

Ka-ching! Ka-ching! Ka-ching!

Yup, that’s the sound of subscription revenue. You get to put your feet on the table, clasp your hands behind your head, and listen to that sweet sound on a recurring basis.

Your customers love you for the flexibility and value you provide while you’re earning predictable revenue to invest in growth. The global Software as a Service (SaaS) market size is projected to reach USD 307.3 Billion by 2026, from USD 158.2 Billion in 2020!

So let’s break down the nitty-gritty of managing a subscription business––starting from atom.

What is the Subscription Revenue Model?

With a subscription revenue model, you charge customers regularly––usually a monthly or yearly fee.

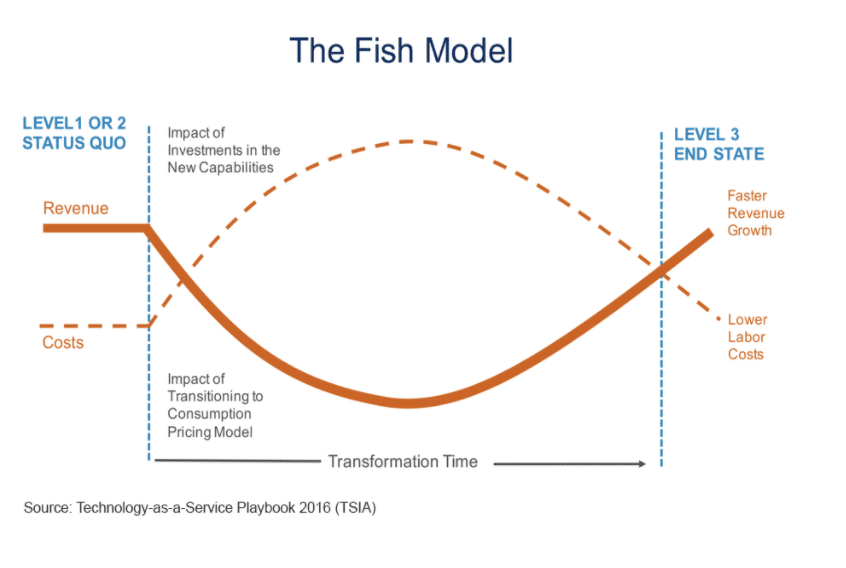

When you start and adopt a subscription revenue model, your costs will increase, and your revenue will decline (don’t worry, it’s only temporary).

You’re going to be spending all that money on acquiring customers and implementing their feedback into your solutions. You could have a great product, but customer feedback is going to make it an exceptional product. The name of the game is customer retention.

Eventually, you’ll start getting to a point where you have loyal customers. The effort you poured into customer satisfaction, and engineering starts paying dividends. You start offering your customers upgrades and cross-sells.

And before you know it: your revenue moves up.

Subscription Revenue pricing models

There are a couple of ways you could set up your recurring revenue model, but three are most common.

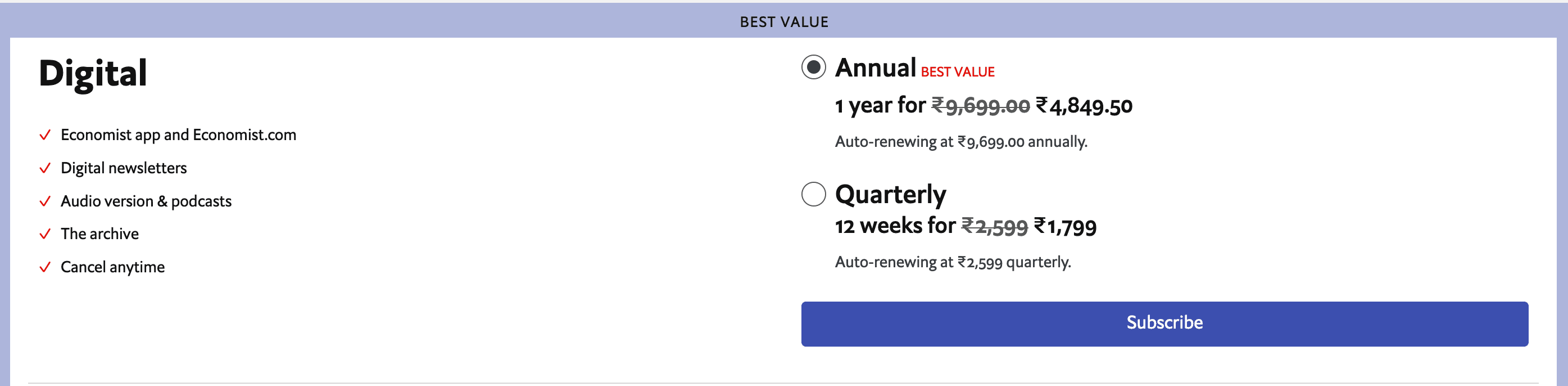

The flat-rate pricing model

It is a direct and straightforward recurring fee model. You have a product, and you price it at a flat rate for all your customers.

You charge your customers on a weekly, monthly, quarterly, or yearly basis.

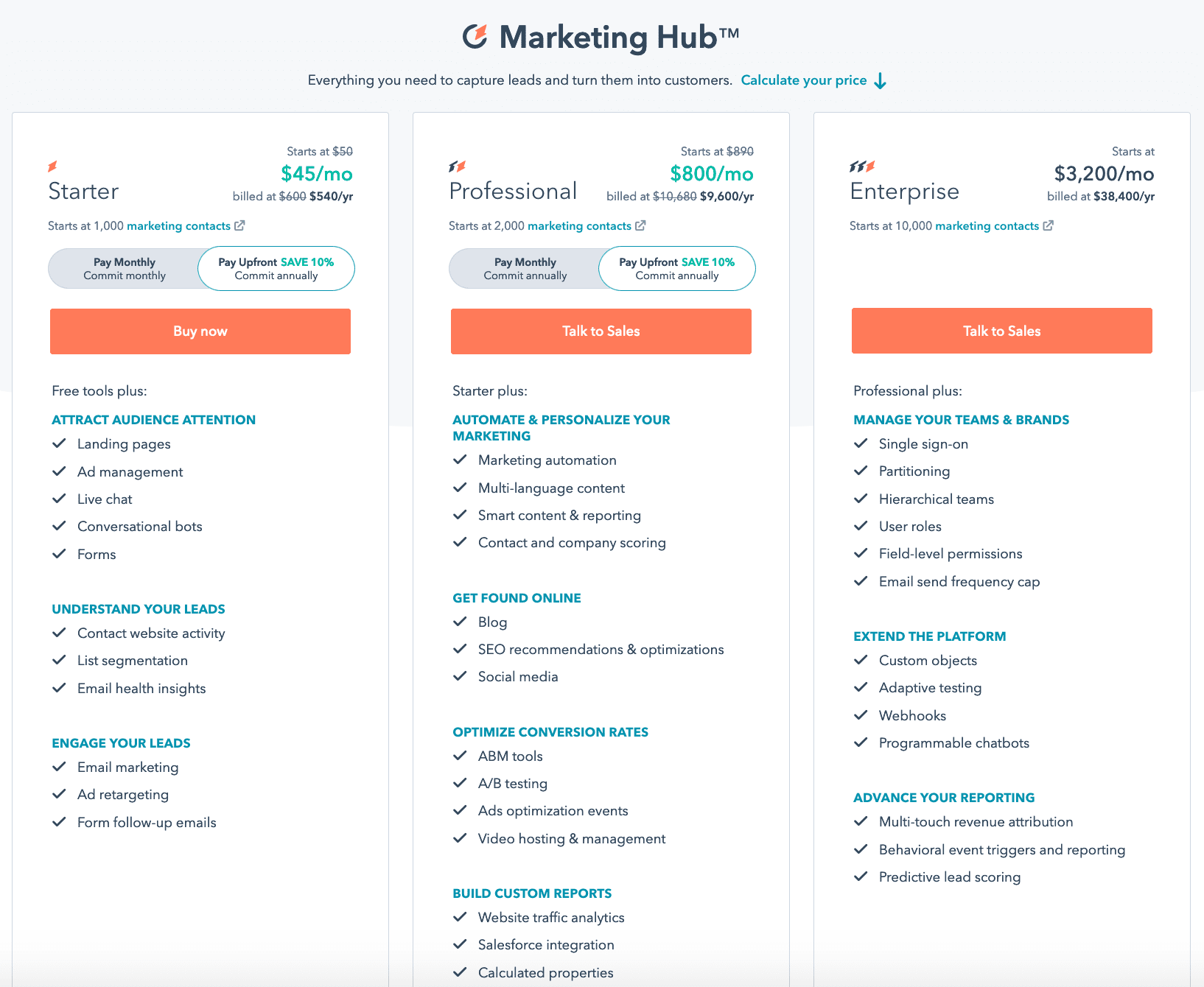

Tiered pricing model

The tiered pricing model is better suited for business pricing their solution based on features or number of users. You get to tailor your offerings to different sets of customers.

For example, a startup would choose the most basic plan you have on offer. When they start scaling, you could upsell to these customers. Since they’ve been on their journey with you all this time, they are likely to partner with you.

The tiers are usually in the range of 2-5.

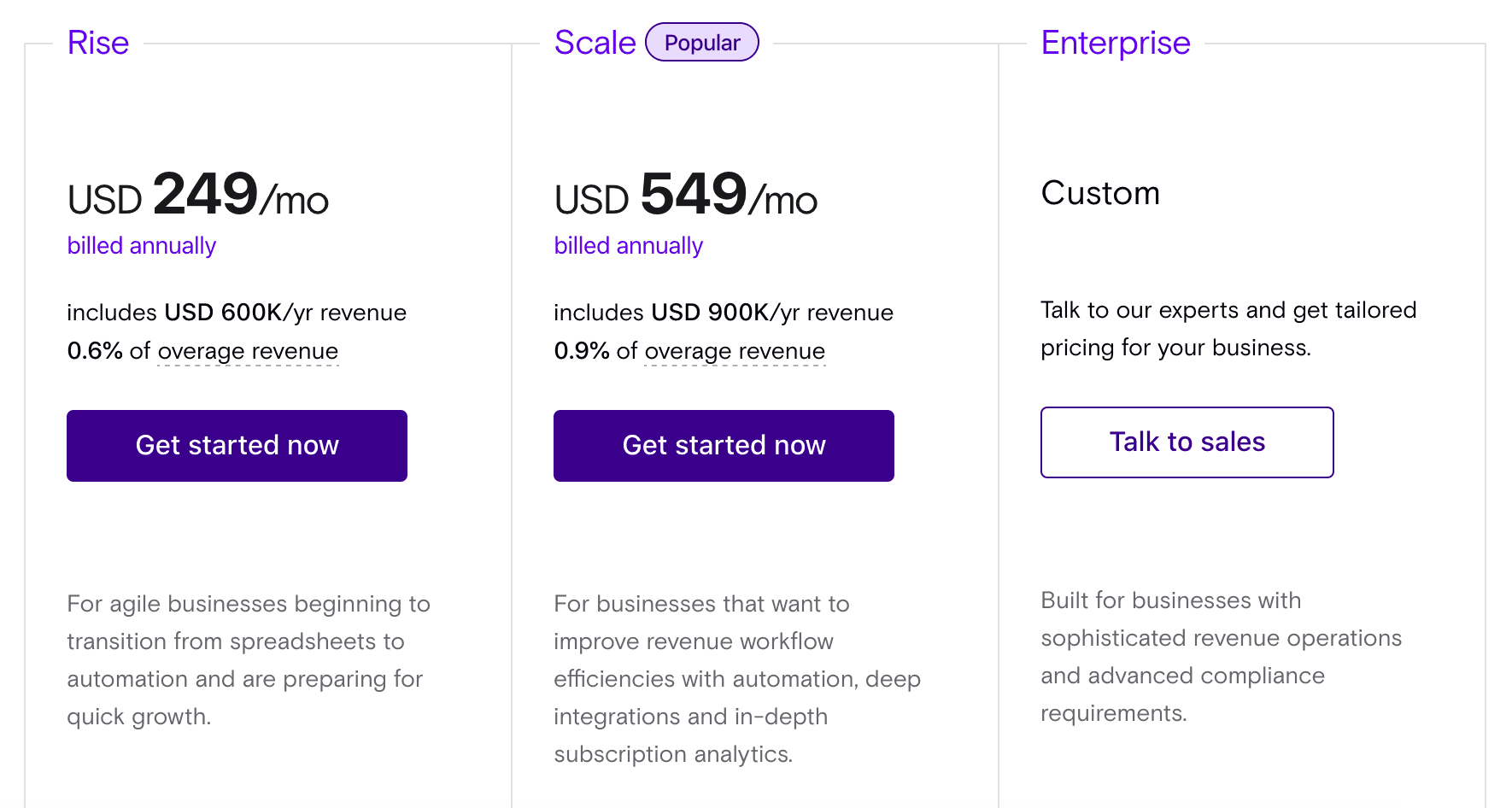

Usage-based pricing model

You can charge usage in two ways: You can have a base fee and then charge your customer according to their usage, or you can forgo the base fee and charge purely on usage. The factors on which the usage depends could include API calls, emails, transactions, etc.

If you look at the image below, Chargebee includes a base fee in each plan, and if the revenue is exceeded, there will be an overage charge. It offers a fair solution to both the customer and business.

Each of these pricing models has its advantages and disadvantages. To find something that fits your business, you can check out this guide on pricing.

How to build a reliable Subscription Revenue workflow?

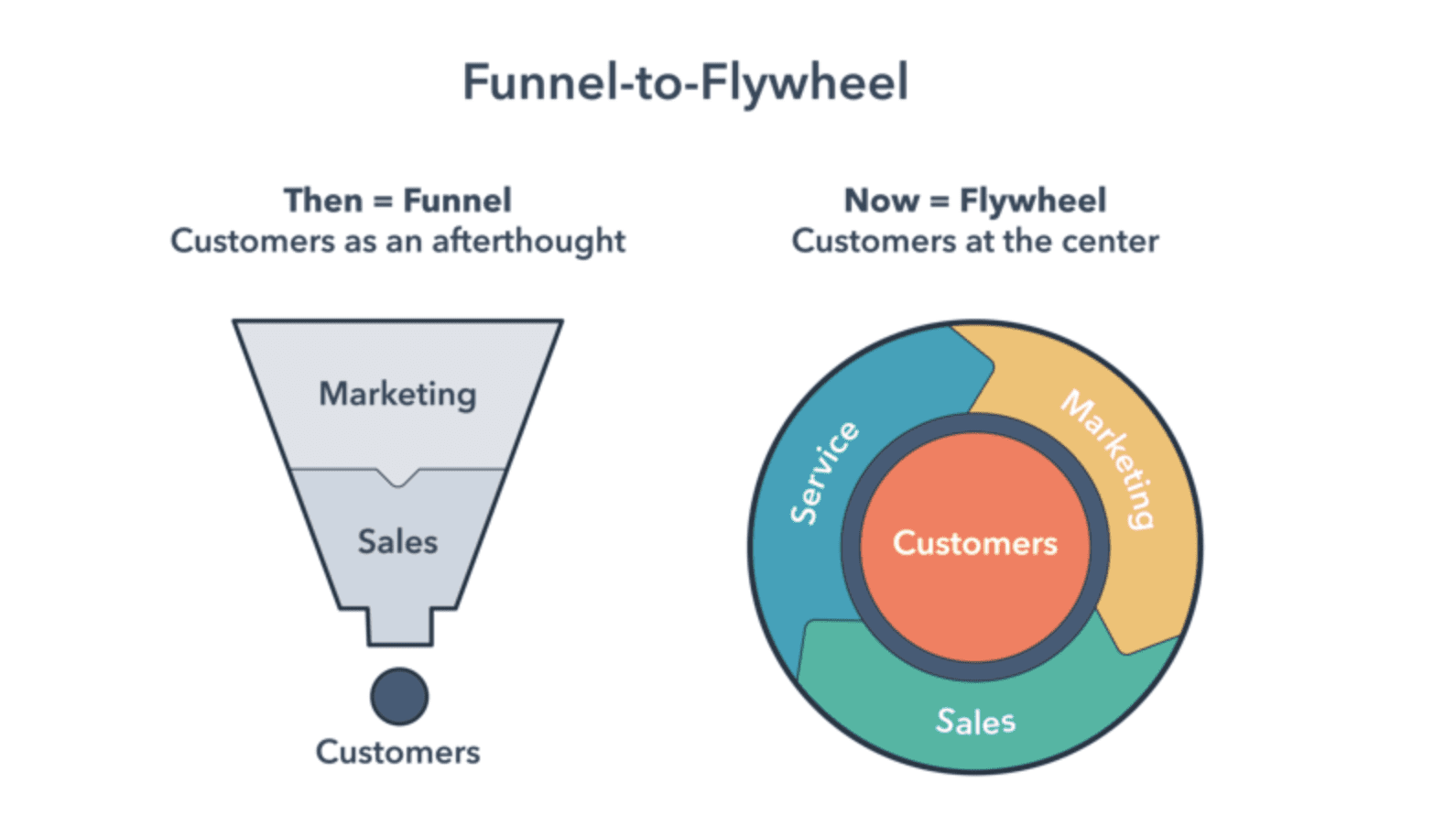

If you look at a transactional business, you’ll see that money moves in a straight line from Marketing to Sales, and then Finance. But in a subscription business, you have a little magic called RevOps.

Do you remember when we spoke about providing value to your customers? The only way to achieve that would be to engage with them throughout their life cycle. To maximize your revenue potential, you need to be solving a customer’s problems and retaining them. Acquiring new customers would cost you five times more.

And so, we change that funnel into a flywheel.

All the revenue-driving functions would become part of this flywheel. Apart from acquisition, the flywheel ensures three other revenue drives:

- Sustenance: Retaining the revenue brought in

- Growth strategies: Finding new revenue channels to bring in more revenue

- Customer experience: Putting the customer at the heart of your business

Check out this in-depth guide we made on how you could use RevOps to maximize your revenue potential.

How is Subscription Revenue calculated?

You’d be counting that money in 2 ways: Monthly Recurring Revenue (MRR), or Annual Recurring Revenue (ARR)

MRR

You can calculate the MRR by taking into account all the active subscriptions. It’s done in two ways:

- MRR = Sum(Monthly Recurring Charge of all paying customers)

- MRR = Average revenue per user * Number of paid customers

ARR

Apart from ARR = Sum (Yearly recurring charge of all paying customers), there’s a slight variation in the ARR formula based on the billings (you’ll learn about billings in the next sub-heading).

1) If you bill your customers monthly, you can calculate ARR as:

ARR = (Contract Value) x (12/ Duration of contract in months)

2) If you bill your customers annually, you can calculate ARR as:

ARR = (Contract Value) / (Duration of contract in years)

It would be wise to calculate both the metrics. Since ARR would give you the long term health of your business, MRR would depict the short term insights.

How does Subscription Revenue accounting work?

There are three terms to educate ourselves in the subscription revenue accounting journey: Bookings, Billings, and Revenue.

Bookings

Say your product is priced at a $500 monthly fee. You and the customers sign a contract for two years, and you bill them monthly. This contract, where there is a promise of service and payment, is called a booking–a booking of $12,000.

Bookings are a helpful indicator of future cash flow and give you insights into the sales process. And since bookings aren’t considered revenue (yet), this will help the finance team mark them as ‘committed money’ and avoid inaccurate MRR and ARR calculations.

Billings

Billings would be the invoices sent to your customers. It is where you’d collect the money on a monthly or yearly basis. Subscription billings provide insight into a subscription business’s health because it’s the money you’re owed.

Revenue

And finally, we have our revenue. Under the GAAP rules, you can only recognize the income if you’ve provided the services to the customer––and if the other conditions laid out by ASC 606 are met.

Deferred Revenue

And if you’ve collected the customer’s payment but haven’t yet provided the services, the amount will be termed as ‘deferred revenue‘.

Subscription accounting could be intimidating. And that’s exactly why we have this––extensive––SaaS revenue recognition guide for you.

What’s accelerating the adoption of the Subscription Revenue Model?

Growth

With subscriptions, companies have a predictable stream of revenue that makes forecasting easy and enables growth. For instance, if a business has an ARR of $10 million and 80% of it is recurring revenue, then you know you begin the next year with a revenue base of $ 8 million which you can build on and invest from. No wonder, SaaS-based solutions are expected to grow from $102 billion in 2019 to $ 140 billion in 2022 according to Gartner estimates. This kind of growth is no longer restricted to the software business. Ecommerce, OTT, and subscriptions to digital publications saw a significant increase in 2020 as well.

Metrics

Investors love businesses that bring in predictable revenue. Subscription businesses not only offer that but also give them a clear picture of the health of the business through various metrics such as MRR, Churn Rate, ARPU, customer acquisition cost, lifetime value. There is often a race within Investors to back a good story, and our subscription analytics tool RevenueStory helps you highlight the story you want to tell.

Customer Satisfaction

A subscription business prides itself on delighting the customers through constant engagement. A CitiBank study found 76% of businesses now look at subscription-based business models to improve customer retention and long-term customer relationships.

Challenges with Subscription Revenue

Sure, no system is perfect (just better); but a subscription model does have a few niggling problems to watch out for.

Customer management

You’ll probably have a lot of customers using your product, on-repeat. You’ll need an efficient system that can manage these customers. A subscription management solution that offers an effective way of categorizing sign-ups, activations, trials, upgrades, and downgrades will go a long way in improving your efficiency.

Invoicing

Manually invoicing thousands of customers is a chore. Think of all the time you’re going to spend on spreadsheets and communicating with different functions. Look for a solution that can send automatic invoices to customers.

Accounting and Taxes

Subscription accounting can be daunting. There’s the ever-changing tax rules, compliance requirements, and EU-VAT complications. And also the need to comply with GAAP & IFRS. Find a solution that can automate redundant manual work.

Conclusion

The subscription revenue model helps you capture the compounding value of your customer relationships. After all, the average repeat customers spend 67% more than the new customers, so focusing on customer retention and deep customer insights that provide you cross-selling opportunities will help scale your subscription revenue model seamlessly. Predictable revenue not only makes investing in your growth a far easier exercise but also makes your business more resilient, ensuring it thrives in the most challenging of times.